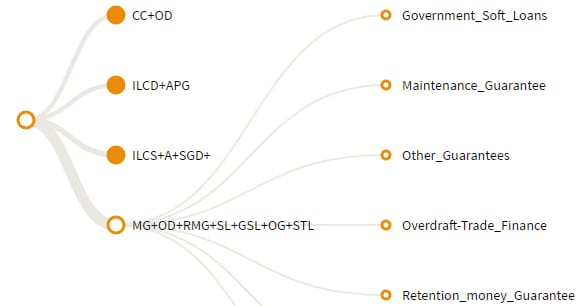

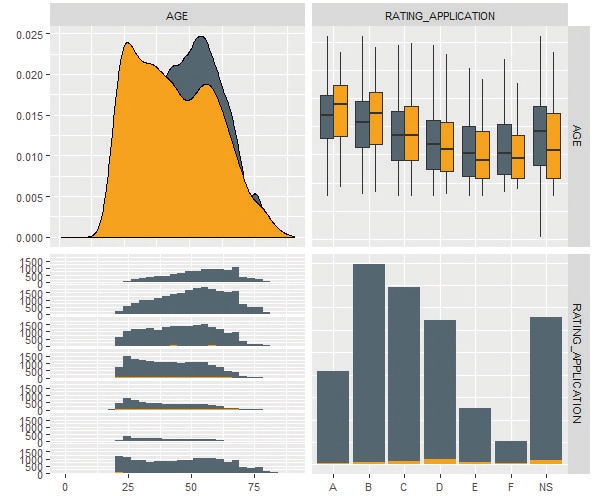

In CRMS you can analyse the historical behaviour and trends observed in various segments of your portfolio. In this step, multiple segmentations can be created for further use during modelling.

Read more >

The future of model development automation

CRMS automates the credit loss modelling under various frameworks (IFRS 9 / CECL / IRB)

The PwC Credit Risk Modelling Suite (CRMS) showcases the possibilities of automation and standardization in credit risk modelling. With methodology adjustable to your needs it covers all stages of model development from modelling of individual components to final impact analysis.

Integration of modelling steps (exploration, estimation, evaluation) within a single interactive tool enables rapid model development.

Integrated modelling suite assures integrity and consistency of all developed models with defined modelling methodology.

Apart from regular model development, the tool is also suitable for quick ad-hoc analyses needed for impact studies, scenario analyses, etc.

Within the general workflow the particular modelling approach can be adapted to provided modelling guideline.

Read more >

Read more >

Read more >

| 1 | Leverage comprehensive data model | Underlying SQL database allows you to store multiple versions of models for each risk component. Changing the assumption and comparison with previous model is just few clicks away. |

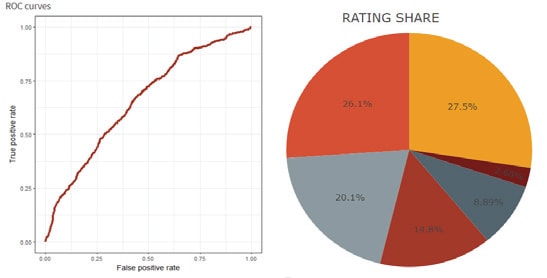

| 2 | Develop the application or current rating | The rating simulation component employs Logistic regression or Random forest ML algorithm to develop scoring model and automatic WoE binning method ensures meaningful rating grades definition. |

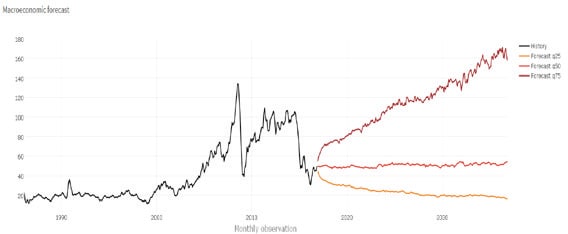

| 3 | Model forward-looking risk measures | CRMS comprises time-series analysis and simulation component, which can be used to forecast macro-economic factors impacting the probability of default. |

| 4 | Make the most of scenario analysis | Thousands of forward looking scenarios are generated by Monte-Carlo method and used to determine representative scenarios and their weights for the final loss calculation. |

| 5 | Apply robust segment-tailored PD models | Combine historical information with predictions of macroeconomic development using Cox hazard model, or transition matrices with Vasicek/Merton z-shift to estimate PD at account level. |

| 6 | Anticipate exposure and loss | EAD depends on repayment schedules and CCF estimates. LGD reflects expected collateralization and unsecured recovery rates estimated by Kaplan-Meier method. |

| 7 | Benefit from complex stage classification | The IFRS 9 staging algorithm uses both qualitative and quantitative criteria as well as a comparison of current and origination PD curves. |

| 8 | Gain insight into expected credit loss | In the final calculation stage any combination of prepared model components and related segmentations can be selected and evaluated. |

| 9 | Test your assumptions and see their effects | Computation, visualisation and comparison of the results help quickly assess the impacts of assumptions behind the credit loss calculation. |

You are looking for an expert to help you; you want to request our services; or simply ask something? Let us know about yourself and we will get back to you as soon as possible.