The tool tracks, documents and monitors the lifecycle of the risk model for you.

Supervise your models with Model Risk Manager

The PwC Model Risk Manager serves your institution as a control framework around the management of models. With this application, your financial institution can organise, evaluate and monitor all the models used across the organisation in a user-friendly environment.

All-in-one box

The MRM platform combines the Model Inventory, Model Workflow and Reporting functionalities all-in-one box.

Easily accessible

The user connects to the MRM through an interactive web application.

Efficient

The MRM saves you time and resources by automating the governance processes surrounding your models.

Compliant

The MRM tool complies with regulatory requirements, follows market practices, and the information stored in the tool has an auditable track.

All-in-one box

1. Model Inventory

The Model Inventory serves as a structured and powerful database of your models with more than 200 attributes in the off-theshelf version and the possibility of customisation per your specific needs. Its main purpose is to assist banks, insurance companies and other financial institutions in storing, supervising and documenting their models using a user-friendly dashboard.

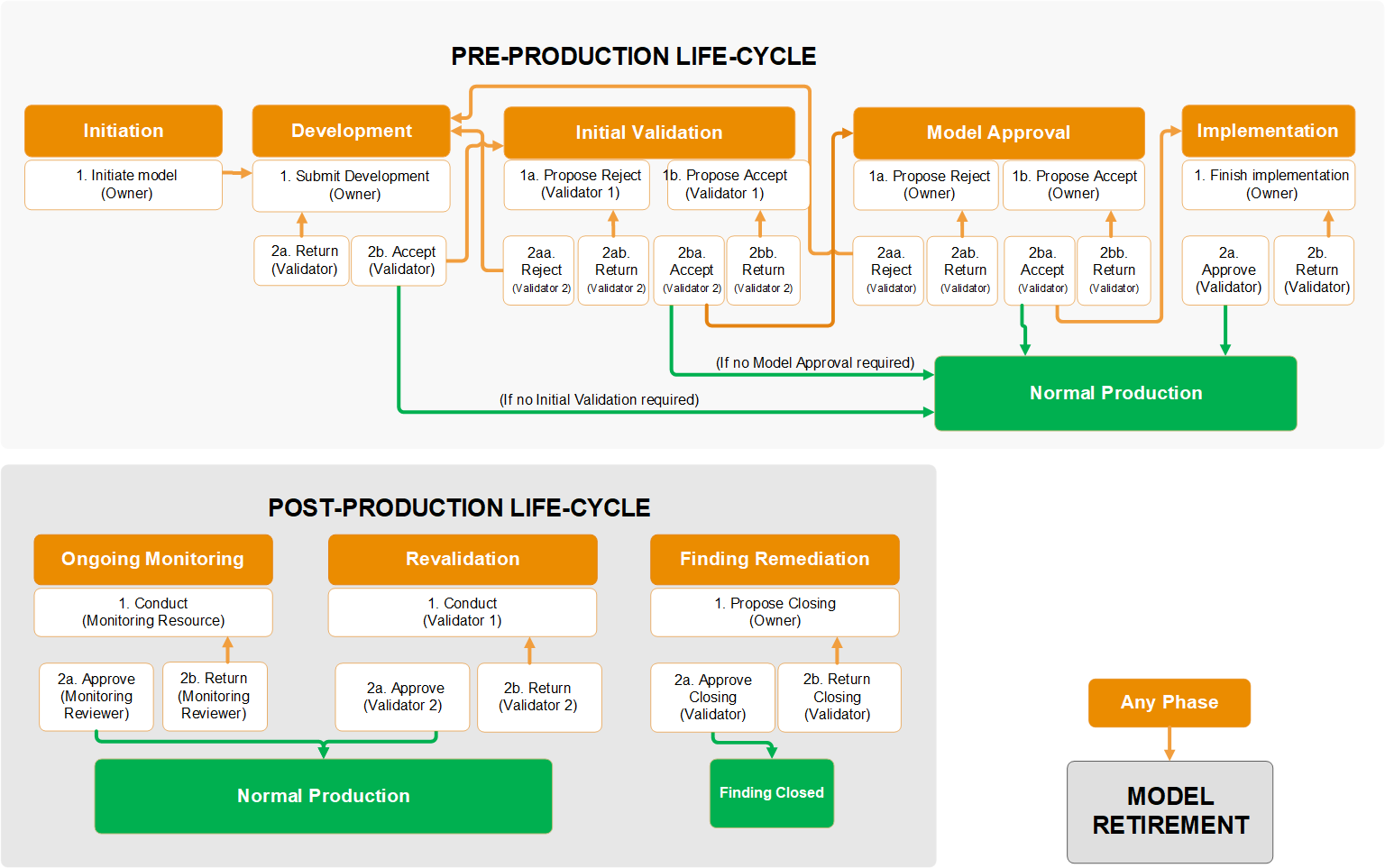

2. Model Workflow

The Model Workflow provides the key functionality to support the whole model lifecycle, including the flexibility to be adjusted per individual models. Workflow enables multiple user roles to be set up and supports a four-eyes principle.

3. Reporting

The MRM tool visualises the distribution of attributes across a bank’s portfolio of models either in the form of build-in reporting functionality, customisable reports or usage of third-party reporting platforms.

Model Risk Manager tool

Main functionalities

- Model Inventory

- Model Workflow

- Reporting

Model Inventory

Model Typology

- A structured database of all models available in your institution

- Stores key model information with regard to model risk management

User Roles

- For each model, the inventory supports multiple roles such as model owners, developers and validators

Finding Tracker

- List of key findings and resolutions from audits and validations

Auditability

- All relevant actions performed on models are stored

Model Workflow

- Essential logic of the model lifecycle is enforced through core phases in predefined relationships

- Possibility to set up a simpler workflow by omitting certain phases in the tool’s standard settings

- Automatic notifications and a four-eyes principle (key actions reviewed by particular independent users)

Reporting

- The tool provides management with a standardised report on the aggregated level

- Summary of predefined subsets of models

- High-level information regarding model risk and model lifecycle phase

- For custom reporting, the tool is linkable with third-party reporting tools such as PowerBI or Tableau

You are looking for an expert to help you; you want to request our services; or simply ask something? Let us know about yourself and we will get back to you as soon as possible.