Subscribe to receive our next publication

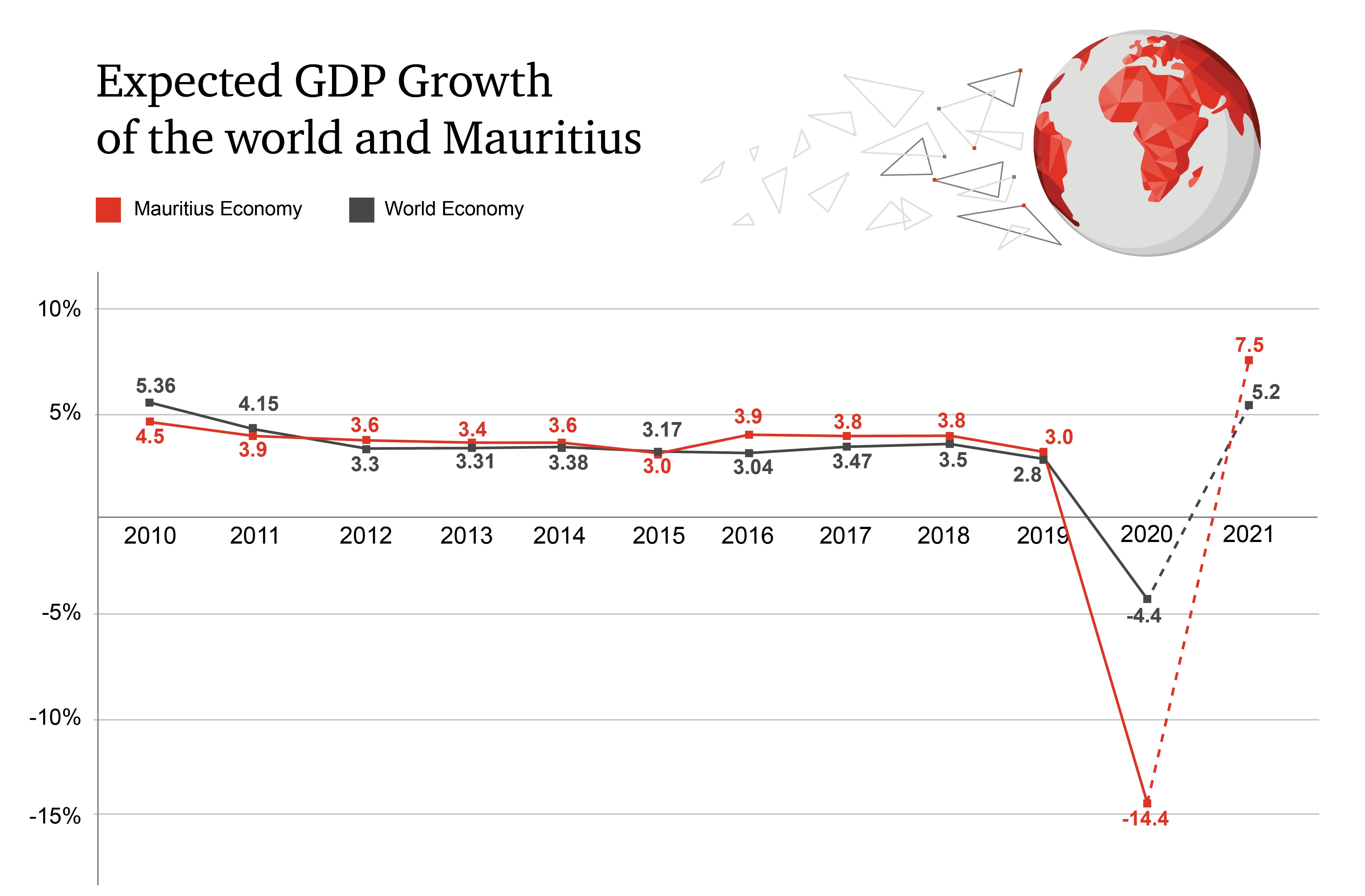

Globally, the IMF warned in its latest economic outlook report, that the world economy is still in deep recession and that 2021 is likely to witness a slow, long and uneven recovery. Whilst we expect a bounce back next year (with global growth estimated at 5.2%), different patterns of economic revival will take shape in advanced, emerging, European, Asian or US markets.

As an open and globally integrated economy, Mauritius simply bears the brunt of global effects. If we look at historical growth patterns for Mauritius over the last decade, the country’s economic performance has simply more or less mirrored global trends. 2021 will be no different! According to Government’s forecast, the country is expected to contract by 14.2% in 2020, followed by a V(accine) shape recovery of 7.5% growth in 2021. However, things will get worse before they get better…

Whilst the outlook for 2021 is more positive, it will take time for the vaccines to be deployed globally and for the crisis to subside. Despite an improvement next year, the economy will remain below 2019 levels and we will not return to pre-virus GDP levels for another two years. In addition, given the uneven pace of recovery in our primary export or target markets, different sectors of our local economy may follow different recovery trajectories.

It will take more than a vaccine to cure our hospitality industry. Global passenger travel is expected to take up to 4 years to return to 2019 levels and the sector has been on drip support with the wage assistance scheme. Whilst employment has been the priority of the Government, there is an urgent need to re-assess our border controls policy, financial viability and playbook in this post COVID-19 era.

The Government is paying around Rs500m per month to the sector. Such support represents less than 30% of the operational cost of a hotel and the sector cannot live indefinitely only on wage support.

New ideas such as the premium travel visa for long stays are welcome, but the speed to market as well as the lack of clarity of the applicable rules are hindering take up. Restoring traveller confidence, revisiting our local tourism ecosystem, reassessing traveller preferences, upskilling and retraining are critical elements needed, and there is still a long way to go in order to build a more resilient and sustainable tourism industry in these uncertain times.

Another challenge in 2021 remains the country’s ability to get out of the EU blacklist. Dark clouds are hanging over our heads and there will be far reaching consequences the longer we stay on that list.

So far, the commitment and actions taken by the authorities to tackle the issue have provided comfort to foreign investors and, although there has been a general slowdown, we have not witnessed major exodus of companies out of Mauritius.

Looking ahead, it is encouraging as significant progress has been made to remedy the five areas of deficiencies identified under the FATF Action Plan and, if matters stay on course, Mauritius is likely to be removed from the list by mid-2021. Let’s hope that the EU does not make it a moving goal post!

A brighter spot in 2021 is the completion of major infrastructure projects, with the Government having allocated Rs6bn for public sector investment works.

The pandemic has caused some delays but the Pont-Fer - Jumbo - Dowlut roundabouts, A1-M1 Coromandel Soreze link road, Phase 2 Metro Express Quatre-Bornes Rose-Hill, amongst others, are all due to become operational in 2021. So far, 1.9m passengers have used the Metro Express and there is on average 10,000 users per day.

These new transport facilities will help to further alleviate traffic congestion and improve the quality of life of our nation. However, it will be important to monitor any cost overruns as well as the ongoing running cost of such infrastructure facilities to ensure that public interest is preserved.

Looking at the broader macroeconomic fundamentals, the country will face price pressures, although headline inflation should remain moderate at 2.6% in 2021 (as per official statistics) arising from muted international commodity and oil prices. However, inflation will feel much higher given the hike in prices; Covid-19 has shifted spending patterns and this sudden change can introduce bias in the consumer price index.

The local purchasing power will also be affected by a further depreciating Mauritius Rupee in 2021. With lower inflows arising from tourism, manufacturing or real estate sales, there is likely to be pressure for foreign currencies. The Central Bank will continue to use its foreign currency reserves to support demand, but those reserves are not limitless.

At the beginning of the pandemic, an estimated 100,000 people were forecast to become unemployed by the end of 2020 and, as per the recent Rapid Continuous Multi-Purpose Household Survey, the number of unemployed stood at 57,300 (unemployment rate at 10.3%) at July 2020.

The labour market continues to face difficulties to absorb young workers, with youth unemployment increasing to 31%. The labour market support schemes provided by the Government have helped contained the effect of COVID-19 on unemployment, but we are likely to see more redundancies in 2021 once those labour support mechanisms and restrictions soften.

One consequence of the economic contraction is worsening inequality, loss of purchasing power, and setback in living standards. Higher earners and skilled employees have adapted better to this new COVID-19 workplace than low-income, low-skilled workers. The pandemic has disproportionately affected workers at the different end of the spectrum and the differential inflation rate experienced by low- and high-income households is a concern.

The COVID-19 pandemic is also changing the patterns of consumption by forcing households to buy more essential food and spending less on transportation or recreational activities. Rising unemployment and inflation are putting a tight squeeze on low-income families’ living standards and we need to ensure that this does not turn into a social crisis.

There will be unfortunately little choice in 2021 but to continue with the social aid, unemployment support, etc to ensure that the population has access to the basic elements of food, health and security. As the recovery takes hold, the groundwork for providing a more favourable business environment and nurturing private investments will be important to rebuild a stronger, more resilient, and more inclusive economy.

Government interventionist measures will continue to dominate in 2021. The Mauritius Investment Corporation Ltd, with a war chest of Rs80bn, is expected to provide further support to companies in distress but the process and governance should be made more transparent and accelerated.

The future of Air Mauritius also remains unclear and this will be important in helping to reboot the domestic economy. The latest statistics on public finance showed that government expenditure for the 3 months period to 31 July 2020 reached Rs56bn (up by 87%) compared to Rs30bn for the same period of last year, with significant increases in grants and subsidies due to the wage assistance scheme and other social support measures. For the same period, a fall in tax revenue collection arising from lower consumption led to a corresponding drop in government revenues by 16% from Rs32bn to Rs27bn.

The budget deficit will continue to deteriorate in 2021 and this gap is expected to widen further. Bigger deficits mean a growing public debt and gross public sector debt has now escalated to over 80% of GDP.

The Government can shoulder this heavier debt burden due to the low interest rates, but the debt level is unsustainable, and its size will limit the Government’s ability to continue its interventionist measures. The growing role of the Government also has ramifications for monetary policy and the high debt levels will force the Central Bank to ensure favourable refinancing conditions.

In the immediate crisis aftermath, the country will continue to face significant challenges in 2021 and the economic conditions may further deteriorate before it gets better. However, it may not necessarily be all "doom and gloom" as there is likely to be signs of recovery in late 2021 and fewer reasons to believe that the pandemic will weigh down on the economy for too long.

Nonetheless, the road to recovery will be slow and uneven as different sectors of the economy adjust at different speed. The COVID-19 legacy will be found in the pushback against globalisation, higher debt levels, new ways of working, and greater government intervention in free markets.

There is a need to rethink of our economic model to develop more integrated value chains, green investments and productive capabilities locally. As a small island, we will need to prioritise the sustainable use of our resources as well as seek ways for more regional integration to tackle global disruptions. Despite a potential bounce back in 2021, there are real questions which remain over the country’s competitiveness, resilience and attractiveness.

We need the Government and businesses to work together in a multi-stakeholder approach in order to tackle the emerging challenges ahead. It is a shame that the dialogue between private and public sector seems to have broken down and it is critical that the differences are resolved.

A strong public-private sector partnership and collaboration has underpinned our economic success in the past and this should continue to help shape a modern Mauritius.