Public Finance

By Kamesh Mohadeb, Senior Manager, Advisory

Browse through the sections

Forecasted deficit trend

This year’s budget and forecast to 2024/25 predict an improvement across all major deficits.

Last year’s Budget v latest estimate 2022/23

According to the latest estimate of 2022/23, the Government is either close or likely to outperform its main economic targets.

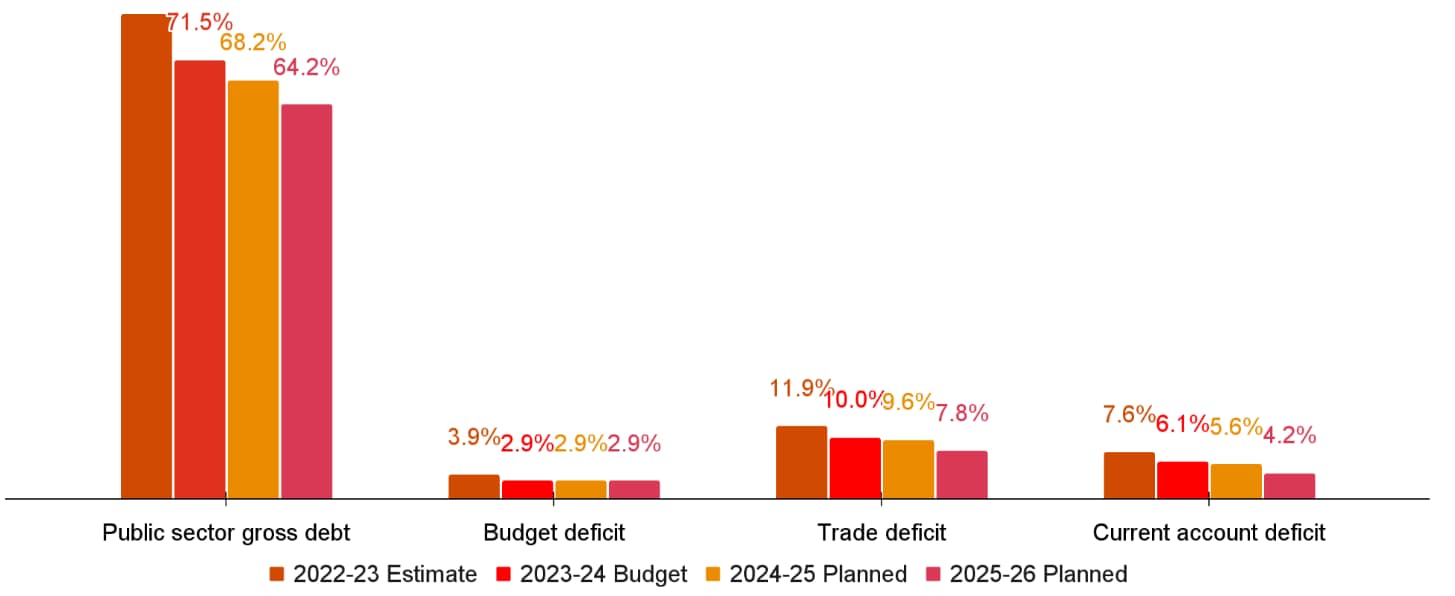

Deficit as a % of GDP trend

The Government intend to improve on the target Budget deficit as a % of GDP from 3.9% to 2.9% for the next 3 years

Budget composition

2023/24 Budget Deficit: Rs21bn

Metro Express - Rs6.8bn;

Construction of new runway project project at Plaine Corail Airport - Rs7.7bn.

We note that the balance of the Special and other extra budgetary funds is to be reduced from MUR31bn to MUR12bn.

The MUR21bn deficit will be funded via a mix of domestic debts (issue of government securities) and foreign debts (support loans from International Bank for Reconstruction & Development and Agence Francaise de Developpement).

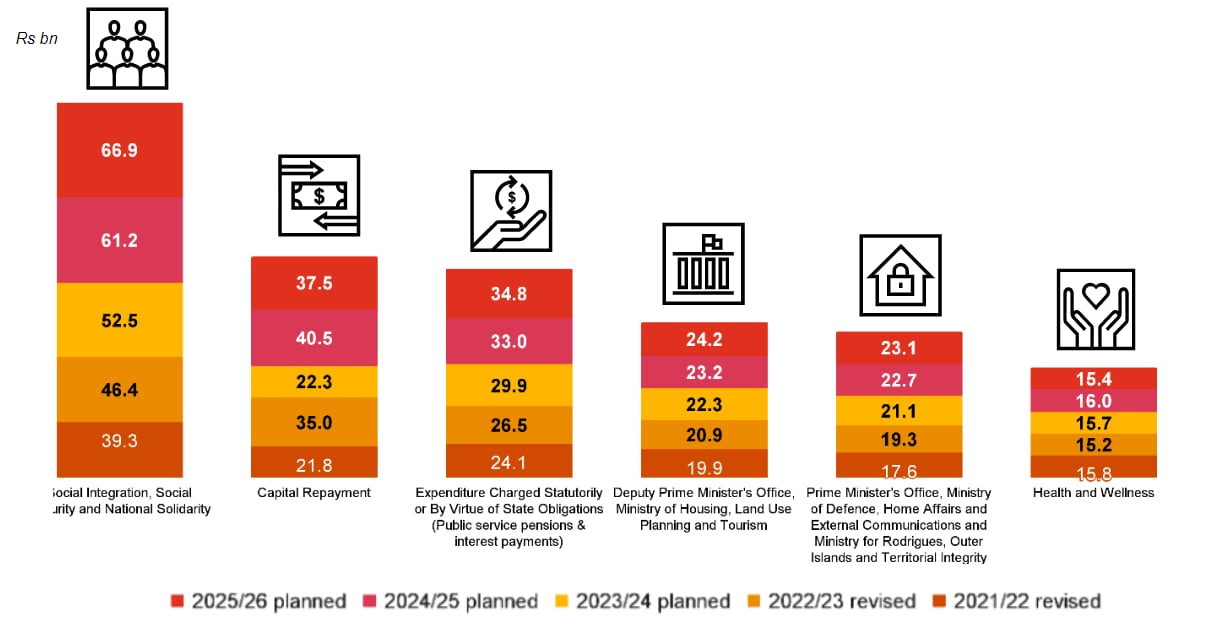

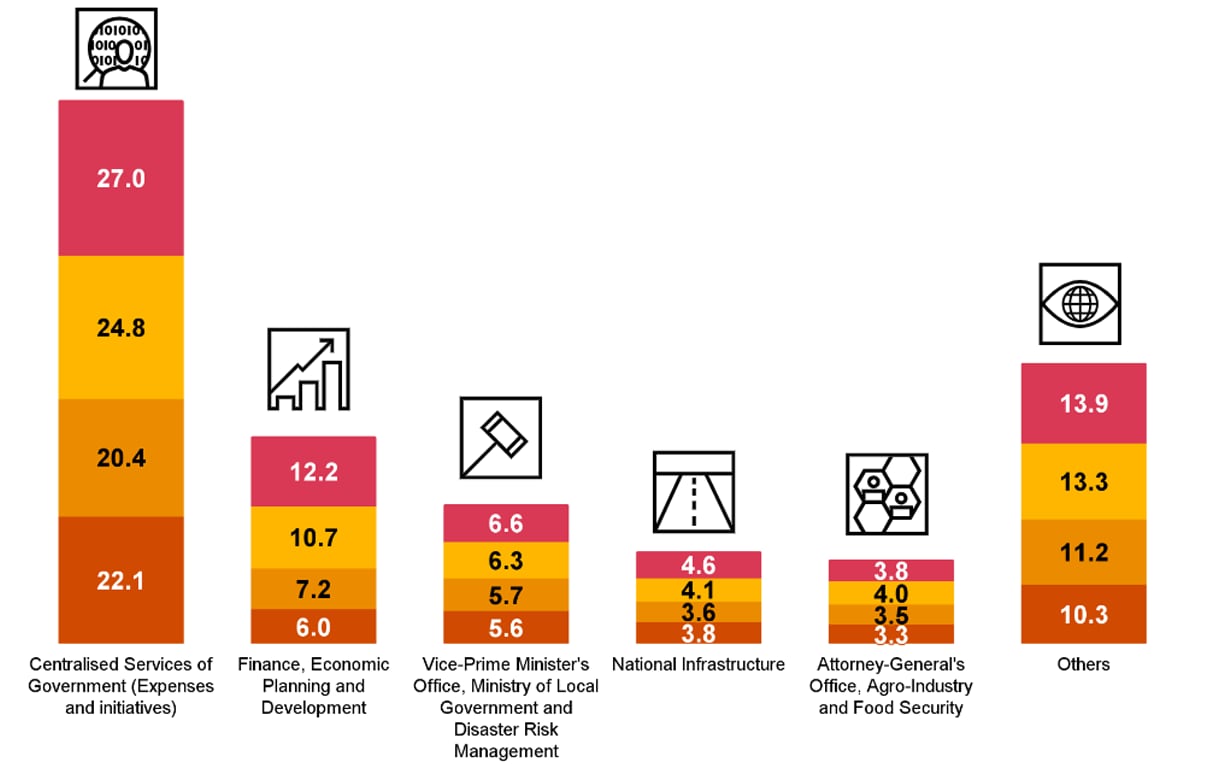

The Budget has been allocated to each ministry and department identified in the Budget as follows:

Currency depreciation v value of imports

The Mauritian Rupee has depreciated vis-a-vis the USD and EUR at a compounded annual growth rate (CAGR) of 1.5% and 1.1% respectively each quarter since Q1 2019 to Q1 2023.

This has contributed to a quarterly CAGR of 2.8% for the same period on the value of imports.

Gross Domestic Product v public sector debt

The Government has set an ambitious target to reach a gross debt as a percentage of GDP of 71.5% for 2023/24.

Although the debt to GDP ratio is on the decreasing trend since 2020/21, the sustainability of the public debt level should remain a priority.

Download our Budget Brief 2023 - 2024 to read all of PwC's analysis.

Click here

Experience PwC's #Metabudget universe

Discover PwC's #Metabudget

Our Metaverse is live now!

Susbcribe to receive PwC's Budget Brief 2023 - 2024

Contact us

Anthony Leung Shing, ACA, CTA

EMA Deputy Regional Senior Partner, Country Senior Partner, PwC Mauritius

Tel: +230 404 5071