{{item.title}}

{{item.text}}

{{item.text}}

05 February, 2020

Like it or not, tax audits are one of life’s necessities and comprise a key part of the tax authorities' enforcement program. To deal effectively with the tax authorities during a tax inspection or examination, companies need to have a thorough understanding of the prevailing tax regulations and practice, especially as these might well have changed markedly during the period under audit. It is also critical to understand the rules regarding the conduct of tax audits, and the rights & obligations of taxpayer and tax authority alike.

Companies need to have a clear picture of their compliance status, and any risk areas, with supporting documentation at the ready.

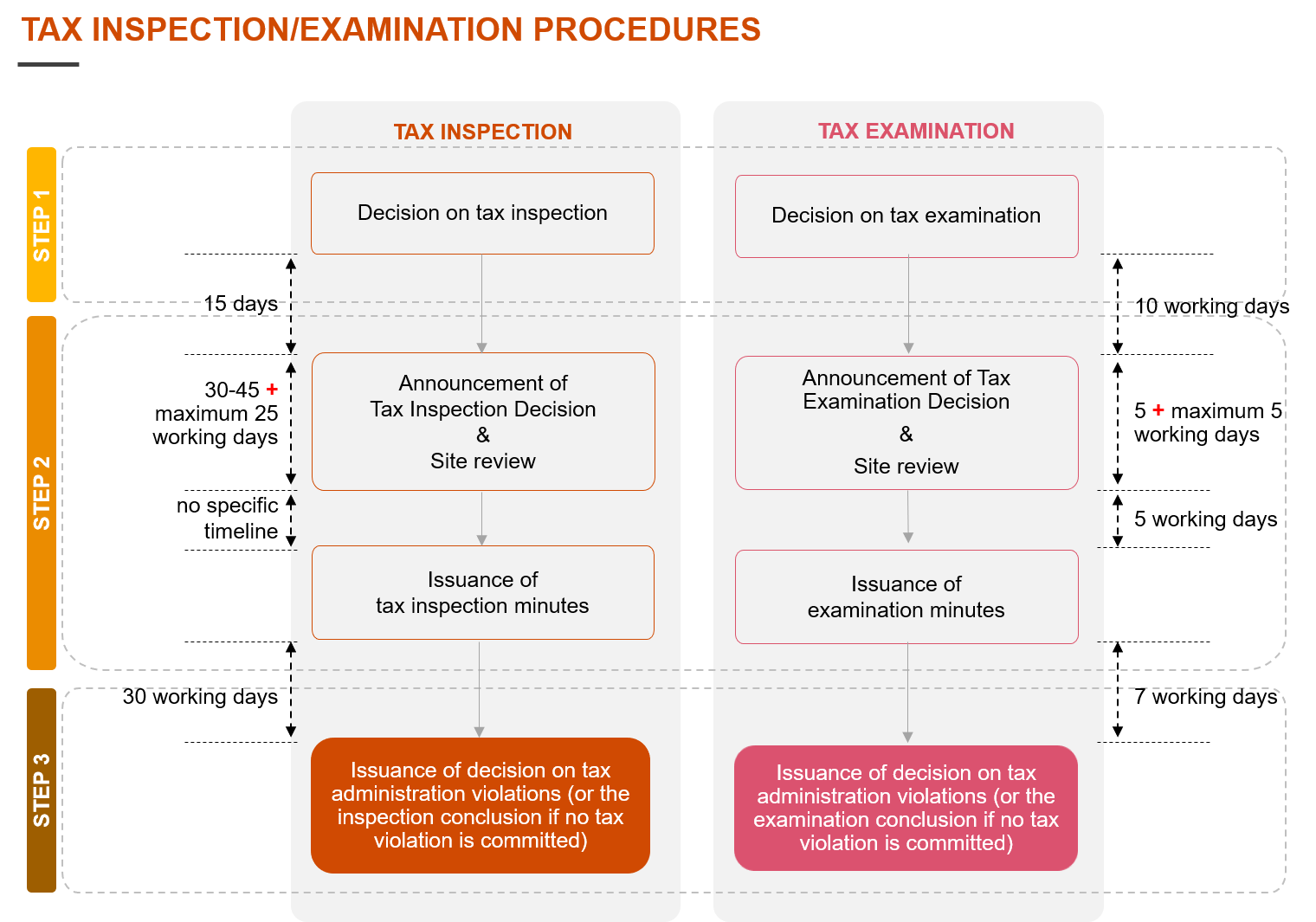

As a refresher, we have summarized the tax inspection and tax examination procedures below. In brief, tax inspections are more detailed and are a more arduous process for taxpayers.

{{item.text}}

{{item.text}}

{{item.text}}

{{item.text}}

{{item.text}}

{{item.text}}