Welcome to the 11th edition of the Doing Business Guide in Viet Nam - an annual publication prepared by PwC Viet Nam and VCCI. The purpose of this publication is to provide insights into the overall economic outlook and act as a helpful start for any business plans in Viet Nam.

2022 is truly a “new normal” and the beginning of a new period. The pandemic has been kept under control, and the nation is now focused on recovery amidst turbulent global headwinds. However, despite a challenging global outlook, Viet Nam’s growth at 8.02% bucks the trend.

While there are uncertainties in the coming times, the vision ahead remains the same. The country is determined to maintain a strong and sustainable economy, grow the manufacturing and digital economy, to become a developed economy by 2045 and have a net-zero carbon economy by 2050.

These ambitious goals are supported by multiple policies and continuous reforms. The government has also laid out plans for a greener economy to help achieve Viet Nam’s commitment to tackling climate change.

The path towards a sustainable future will be a long journey. Viet Nam will not embark on this journey alone and will require the support of partners domestically and internationally. The country welcomes collaboration in both technical and financial aspects to achieve national goals and become a vital member of the international community.

Viet Nam’s resilience has been proven in 2021 and 2022 through all uncertainties and disruptions. The country shall thrive and prosper in moving forward.

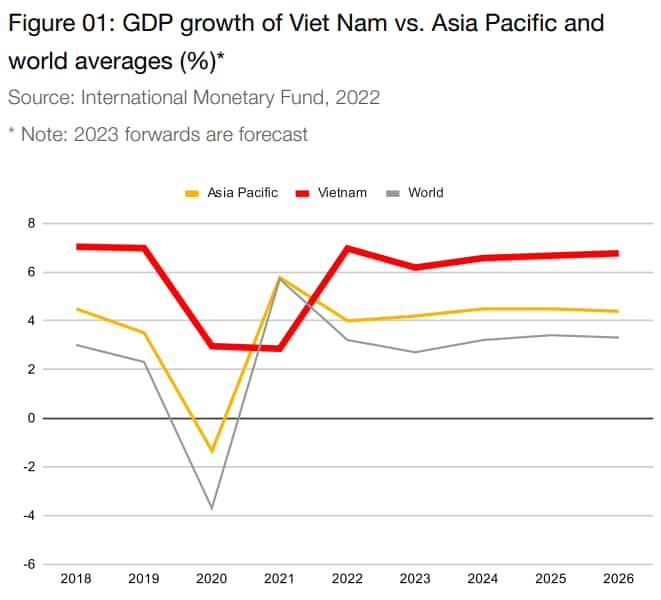

Viet Nam’s GDP for 2022 growth, as reported by the GSO, is 8.02%. This is still much higher than the initial government targets of 6.5% as well as the global and regional growth projections. The key drivers to achieve this growth are the momentum of economic recovery in the key sectors post lockdown, plus the continuing economic support and reforms made to achieve development goals.

Looking into 2023, Viet Nam has set its GDP growth target at 6.5%. Meanwhile, the other international financial institutions such as ADB, UOB, Standard Chartered15, IMF, etc., provide forecasts for Viet Nam’s GDP growth ranging from 6.3% up to 7.2%.

Sectoral growth highlights the strength of Viet Nam’s industrial sector and the recovery of the services sector. Industry and construction output grew 7.8%, and services grew 10%, contributing 38.2% and 56.6%, respectively, to the growth rate of the economy.

Explore more insights about:

The identified five growth pillars for Viet Nam are a strong framework for the country to develop the path to a resilient future.

This publication will highlight the key developments of two of these areas: the digital transformation and the net-zero journey.

Digital transformation is the national priority

Although it poses a tough challenge to the economy, the pandemic has been serving as a good catalyst for digital transformation in the past year. The government has set the long-term goals in digital transformation and innovation. Several policies, guidelines and initiatives in order achieve these goals have been rolled out. There are also numbers of key developments in Digital economy, Cyber security, e-Government and Innovation ecosystem.

Toward the NetZero and sustainable future

Tackling climate change is imperative for Viet Nam’s economic future. At the 2021 United Nations Climate Change Conference (COP26), the Prime Minister of Viet Nam, announced a series of climate action commitments. These commitments were once again reaffirmed by Viet Nam at the recent COP27 in November 2022. They will have a significant impact on the transition to carbon neutrality and will require a rewiring of the entire economy. Viet Nam is seeking to put these agreed commitments and mechanisms into practice and move forward in green, digital and energy transformation with the help of local stakeholder and international partners.

Get in touch

Johnathan Ooi Siew Loke

Partner, Deals and Consulting Services Leader, PwC Vietnam

Tel: +84 28 3823 0796