Vietnam ESG Readiness Report 2022

From ambition to impact

ESG creates winners among businesses, governments and society. Those who address sustainability and climate change today stand as leaders of tomorrow.

Environmental, social and governance (ESG) has become mainstream and is widely recognised as business critical. It is no wonder that ESG remains top of mind for Management Boards today.

When done correctly, ESG enables businesses to tackle the biggest challenges of today – and capture the best opportunities of tomorrow. However, ESG takes on different meanings for each organisation given its broad spectrum of topics. And so, to fully realise its potential, the ESG concept must be aligned with an organisation’s strategy and help advance its’ business model.

It is against this backdrop that both PwC Vietnam and the Vietnam Institute of Directors (VIOD) jointly conducted a survey between May and August 2022 to find out how businesses in Vietnam are (in reality) approaching and handling ESG matters. Where are these companies on the ESG journey? What are they thinking and feeling about ESG and the imperative for green growth? What support is needed to move the needle on ESG? This is what we explore in our inaugural Vietnam ESG Readiness report 2022.

Making sense of ESG

ESG is a set of environmental, social and governance standards* for company operations. It serves as a guide for stakeholders to understand how an organisation manages risks and opportunities across the three dimensions.

*ESG terminology as per Global Reporting Initiative

Download the reportEnvironment

The energy your company takes in and the waste it discharges or the natural resources needed to keep your business operational.

Social

The relationships and the reputation fostered through your business dealings across the communities where you do business.

Governance

The oversight mechanism of controls, procedures and practices needed to govern and make effective decisions for the wider good of the company.

ESG in Vietnam

ESG has gained prominence in Vietnam over the past few years. This is largely driven by the Government's efforts to promote ESG-related practices, and investors' growing demand for sustainable investment.

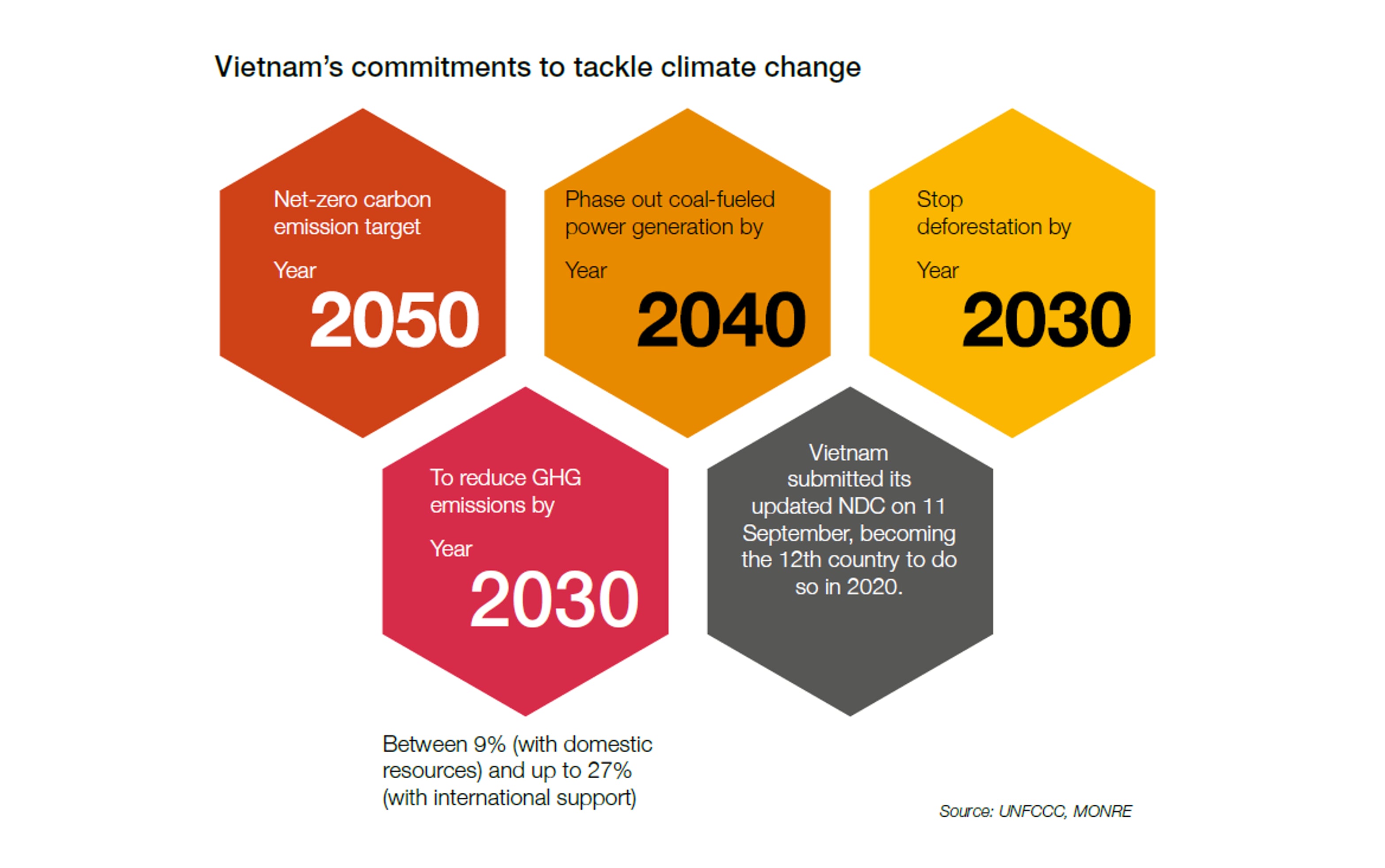

At the 2021 United Nations Climate Change Conference (COP26), Vietnam made a big splash when the Prime Minister announced a series of climate-action commitments. These will have a significant impact on the transition to carbon neutrality and will require a rewiring of the entire economy.

But that’s not all. As illustrated, efforts by the Vietnamese government cover all three dimensions of ESG. In taking the lead to provide the relevant ESG policies and regulations, the Vietnamese government can help galvanise businesses into playing a greater role in achieving the national commitments related to ESG objectives.

Part 1

ESG commitment levels are high

- 80% have made ESG commitments or plans to do so soon.

- This is primarily driven by demands of consumers, employees and investors.

- Governance is ranked as most important to the ESG strategy for Vietnamese companies.

Explore the findingsPart 2

The ESG action gap: More to do

- There is value in an implemented ESG programme.

- Without strong a governance structure, companies may fall short in achieving their ESG goals.

- Fully leverage on senior leadership to drive ESG commitments.

- Regulators play a critical role in providing clarity on ESG reporting.

- Vietnamese companies lag behind global counterparts in seeking independent assurance on ESG disclosures.

Explore the findingsPart 3

Moving ahead on the ESG path

- 61% of companies yet to commit cite lack of knowledge as the key barrier.

- 67% rank absence of transparent regulations as key challenge.

- 29% of respondents who said that there are board involvement in ESG are confident in their Board’s capabilities on ESG matters

Explore the findingsFour paths to fulfilling the ESG ambition for businesses

Beginner

Are you just beginning on your ESG journey? Do you view ESG as a compliance issue? Does your company have limited or no public reporting?

Pragmatist

Are you predominantly focused on the ESG risk aspects? Do you provide some public reporting without science based targets? Are your ESG activities and reporting segregated?

Organisations operating in Vietnam differ greatly when it comes to shaping the pace and direction on how they approach ESG.

Our recommendations on what’s next is based on the organisations' maturity and ambition which sets out some concrete actions businesses can take today.

Strategist

Do you see both opportunities and risks in ESG? Do you provide non-financial disclosure and reporting with science based targets? Is ESG integrated with business and finance?

Champion

Is ESG core to the purpose, strategy and services/products of your organisation? Are you reporting financial and non-financial ESG aligned metrics? Is ESG integrated across the organisation?