The global healthcare landscape is evolving, with COVD-19 as an accelerator

While the healthcare industry has been witnessing evolution in all aspects over the past 10 to 20 years, the emergence of technology and digitalisation within the sector, as well as two years of an unprecedented epidemic, have accelerated disruption in the industry. Several recent trends – increasing consumerism in healthcare (e.g., a stronger preference for convenience and simplicity in using healthcare services), inpatient care shifting to outpatient services, technological innovations, increasing complications, higher incidence of certain diseases due to more sedentary lifestyles, and longer life expectancies – are together shaping a global shift in the healthcare landscape, disrupting the sector, and pushing stakeholders to innovate and take action.

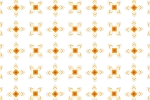

Globally, PwC has identified six emerging trends in healthcare (Figure 1).

Figure 1: Global emerging trends in healthcare

Six emerging trends in healthcare

These trends have been impacting the healthcare industry in a number of ways:

Changes in demographics

Changing demographics drive healthcare reforms. A new paradigm of public and private sector collaboration is developing to transform healthcare financing and delivery. Partnerships with new market participants from the retail, technology (e.g., artificial intelligence, robotic, teleconsultation, analytics), wellness, and fitness sectors (i.e., non-healthcare/ non-traditional healthcare sectors) are expanding and reshaping the health system.

Depleting resources

In the face of a shortage of skilled labour, technology has become a potential solution to healthcare’s resource problems. For example, remote monitoring, telemedicine, and mobile devices will help doctors/medical staff to save physical consultation time and communication time with patients, make decisions faster with the support of improved analytics, etc. With the ability to bring innovation, improved efficiency, and unique solutions, the private sector has become an appealing potential health partner for governments. One form is the public-private partnership, with which the government can reform healthcare and mitigate their depleting resource issues at the same time.

The empowered consumers

Consumers (patients) are becoming more informed and involved in the care process. Informed consumers demand increased accountability, integrity, and transparency from their health providers and overall health system. This is leading a shift away from fragmented care to integrated models: requiring organisations, communities, and social care providers to coordinate their services, and with patients becoming active partners in their health across the continuum of care.

Chronic diseases and conditions

Lifestyle changes are driving up incidences of chronic diseases (diabetes, heart-related, cancers, etc.), increasing demand for chronic care. This is more costly and demands new models and considerations for delivery of care. Advancements in precise, early detection and diagnosis of disease will serve to minimise treatment costs. For this reason, the sector is placing greater emphasis on preventive health solutions. This opens the door for non-healthcare/non-traditional healthcare industries to bring innovative solutions to chronic disease prevention and management challenges.

The distrustful consumer

Consumers are demonstrating a lack of trust in traditional health systems, due to several long-lasting and unsettled issues (e.g., overloading, long-time queuing, administrative issues, mistrust of medicine/inputs/quality of care, etc.); they are increasingly willing to entrust their health services to non-health sectors. New and ubiquitous technology is giving them the tools to do this with greater ease. With the entrance of non- traditional healthcare players (e.g., retail clinics*, wellness centres), traditional players (i.e., hospitals and clinics) will have to decide against whom to compete and with whom to partner.

*A retail clinic is a walk-in clinic located at retail outlets such as grocery stores, department stores, malls, and supermarkets that treat uncomplicated minor illnesses and provide preventative healthcare services. This model is popular in the U.S.

mHealth*

Mobile helps to make healthcare more accessible, via virtual channels in addition to traditional physical visits; faster, by saving travel and queuing time; and cheaper, partly by enabling patients to obtain information about their health conditions more easily and to have more control over the care process.

*mHealth is defined as the provision of healthcare or health-related information using mobile devices (typically mobile phones, but also other specialised medical mobile devices, like wireless monitors). Mobile applications and services can include, among other things, remote patient monitors, video conferencing, online consultations, personal healthcare devices, wireless access to patient records and prescriptions.

Where is Vietnam in this quantum leap?

An ageing population, an emerging middle and affluent class, and an increasing burden of chronic diseases reflect demographic shifts and societal changes in Vietnam relevant to the healthcare sector. These trends are driving up the demand for long-term care. Additionally, access to middle-class comforts is both fueling increasing demand for more health options and resulting in more sedentary lifestyles that will inevitably lead to greater incidences of obesity, diabetes, and other costly, chronic health conditions.

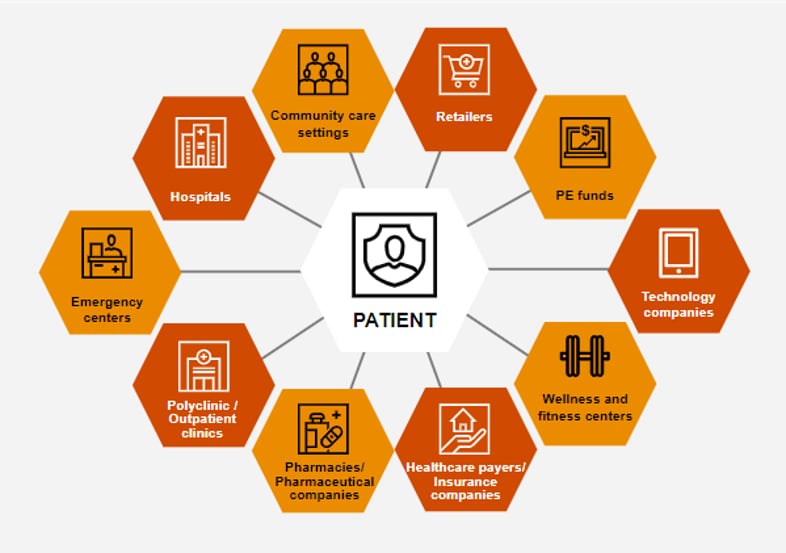

These wealthier income groups typically demand a higher quality of healthcare examination and treatment, as well as more sophisticated, convenient, transparent, affordable, and personalised services. These groups also have access to much wider care options, i.e., in hospitals and alternative sites of care (e.g., fitness centres, retail clinics, the workplace, alternative clinics, or home), either domestically or abroad, via offline or virtual channels, etc. This is opening the door for new entrants from other industries, which are together creating a larger health ecosystem in addition to traditional settings (i.e., hospitals and doctor clinics), with patients at the core (Figure 2). The global shift away from fragmented care to integrated models in which organisations, communities and social care providers coordinate their services, with patients as active partners in their health across the continuum, is also occurring in Vietnam.

Figure 2: Players in the healthcare ecosystem

Given evolving care models, both partnership and collaboration have shifted from optional to imperative. There are various forms of collaboration for Vietnam’s healthcare stakeholders to consider

Partnership and collaboration between stakeholders in the healthcare ecosystem are keys for them to stay tuned in the fast-evolving healthcare industry, and to continue to stay relevant and successful within the wider ecosystem. In a broader context, collaboration to create a more connected healthcare ecosystem for all stakeholders will help to ensure success and sustainability throughout the industry.

Hospitals’ targeting of organic growth and horizontal integration

As patients are looking for a more integrated care model, hospitals with a traditional acute care focus can consider diversifying their range and mode of services. This move could enable hospitals to acquire patients earlier in the care continuum, and to increase patient retention by enabling them to manage the care process more comprehensively. Hospitals may choose to expand organically, or via acquisition or strategic partnerships, especially in the areas that are traditionally not covered by hospitals such as teleconsultation and mHealth, wellness services, home care, and palliative care.

Hospitals, technology companies and the government may collaborate to transform care delivery

Artificial intelligence, telehealth, virtual reality, and other health technologies are more commonplace in developed markets, though they are in a development stage within Vietnam. Virtual care, telemedicine, virtual surgery, AI-assisted test analysis, connected care teams, robot-assisted surgery, data-driven and evidence-based care are all reforming the future of care delivery.

Local hospitals (both public and private) can consider partnering with foreign hospitals

Local hospitals (both public and private) can consider partnering with foreign hospitals with well-established brands, to collectively deliver consumer-centred healthcare. While the former can take advantage of the latter’s reputation and expertise, especially in the specialties in which is looking to expand; the foreign hospital can benefit by leveraging the local hospital’s network and local patient pool. The local hospital can also leverage the foreign hospital’s brand to gain and improve patients’ trust.

Get in touch

Pham Anh Duy

Senior Manager, Capital Projects and Infrastructure, PwC Vietnam

Tel: +84 918 484 843