Providing full comfort for being always compliant with financial crime regulations through efficient operations.

Financial Crime

Our experience with a vast range of financial institutions in the CEE region and globally as well as governmental and supervisory bodies (Central Banks, FIUs, UNODC, IMF) allow us to solve problems related to financial crime. The Financial Crime Advisory practice has developed an ecosystem that endeavours to provide an integrated Financial Crime Risk Management set of services and products in various financial crime domains (AML and Sanctions, Fraud).

Financial Crime Compliance

Financial Crime Compliance is the classics of Financial Crime Advisory. The financial services industry continues to face significant scrutiny from global regulators over AML and Sanctions processes, systems and controls. We have created multiple service offerings which cover all the main needs of financial institutions in this area.

Financial Crime Technology and Analytics

Financial Crime Technology and Analytics practice is aimed at advising clients on the range of technology-related topics appearing in the Financial Crime space. We start from vendor selection processes to providing clients with high-end PwC proprietary applications and process accelerators. Our service offering consists of the following categories:

Selected solutions

- Financial Crime Assessment and Optimisation Enablers

- Sanctions testing

- Sanctions efficiency optimisation

- Sanctions screening

- Customer risk rating optimisation

Financial Crime Assessment and Optimisation Enablers

An analytics-driven solution built to improve the performance of AML transaction monitoring systems.

Outputs:

- Maturity assessment including comparison to peer institutions

- Suggestions to increase risk coverage

- Behavioural segmentation to boost scenario tuning

- Scenario tuning to decrease the number of false alerts

- Predictive model for scoring alerts

- Technical specification (link to https://appdev.pwc.com/case-study/financial-crime-suite)

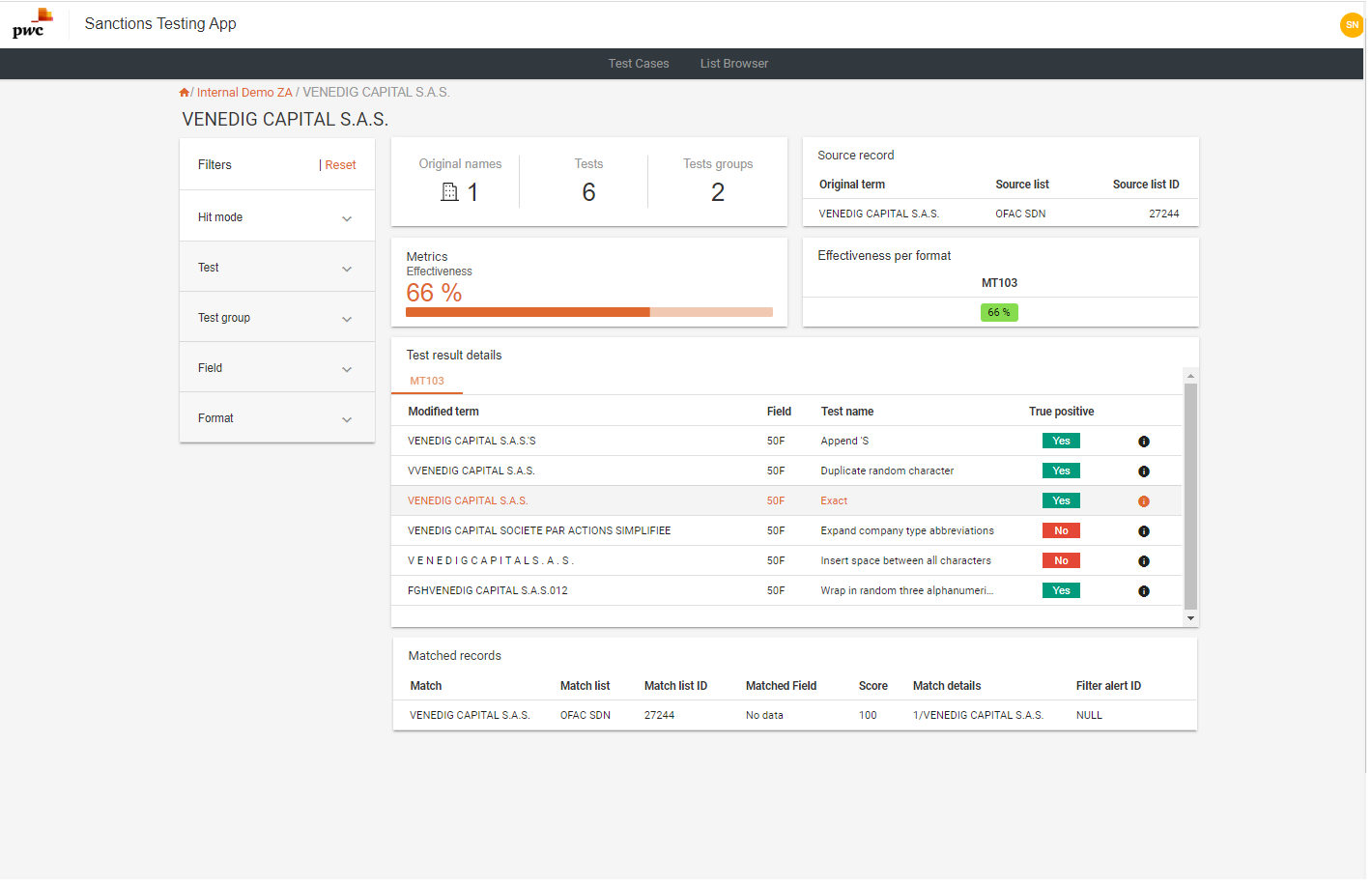

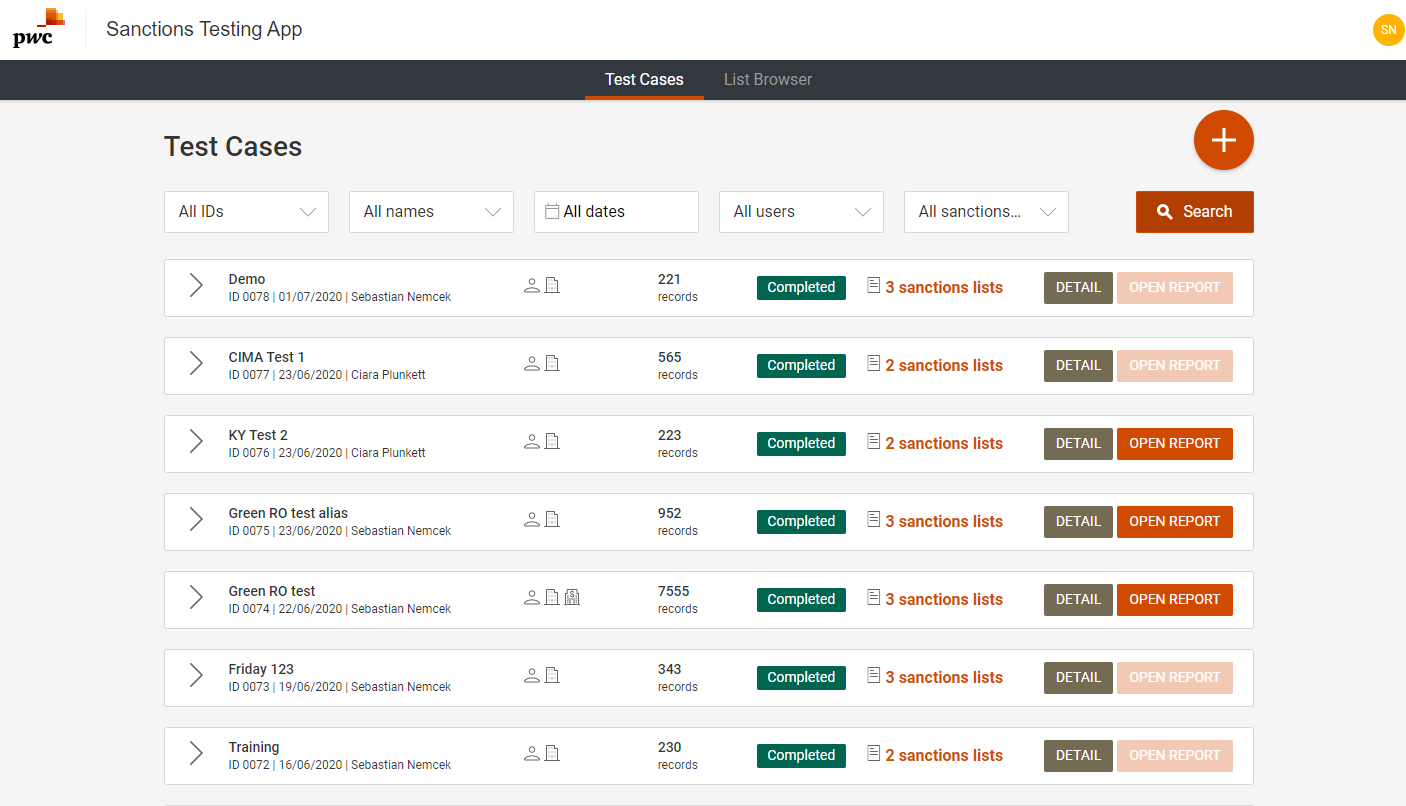

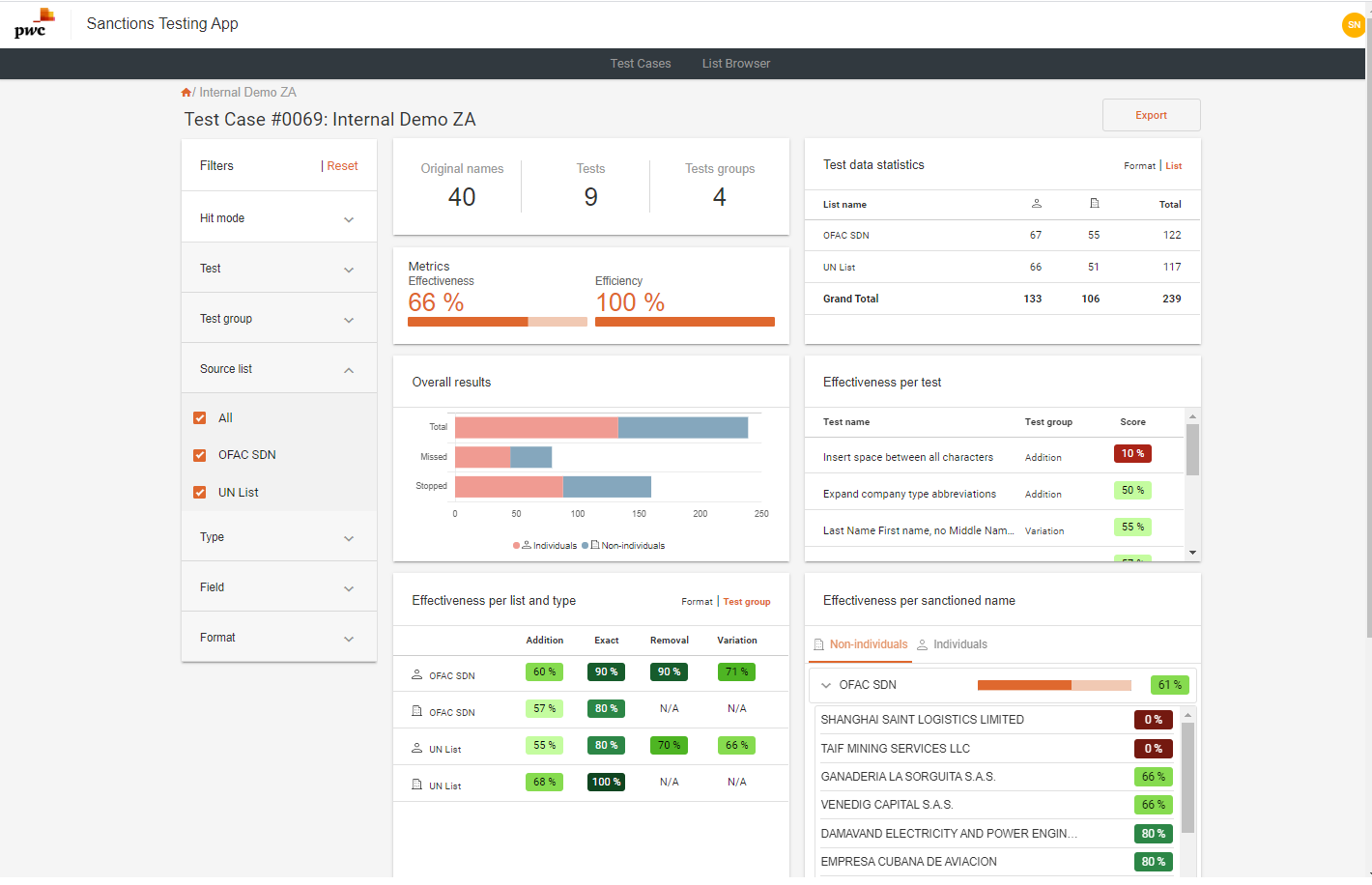

Sanctions testing

Do you trust your sanctions filter?

Our Sanctions testing application will provide you with the comfort of understanding your screening filter's ability to stop real sanctioned names and variations thereof. You can use these results to adjust the screening configuration, implement better controls and also perform a retest every time you update your screening configuration.

With Sanctions testing application, you will:

- Be able to create customized transaction and reference data test files in your own custom format

- Have the ability to identify and measure your screening system effectiveness

- Easily identify the missed names and common false negative patterns

- Always use the latest sanctioned records to test your screening system

Sanctions efficiency optimisation

Using our Sanctions efficiency optimisation tool, we are able to perform data-driven analysis of your historical false positive alerts and identify the key drivers behind them. With our tool you will be able to understand:

- The contribution of each sanctions list and even sanctioned name to the overall number of alerts

- The contribution of each screened format, MT type, and field to the alerts created

- The most common combinations of screened name and sanctioned name that create the false positives

- The steps that you need to take (new business rules, screening exceptions, list updates,...) to improve your efficiency and their impact

Sanctions screening

Having on the fly clarity and confidence on the sanctions imposed on your counterparts is crucial to help you timely highlight the related risks. Our dedicated forensic team has all the necessary data sources and tools for conducting sanctions’ and watch lists’ screening across multiple jurisdictions. Right here and right now. No need to spend your time on hectic checks through numerous sanction lists and chasing their continuous updates.

Customer risk rating optimisation

PwC's Financial Crime Talks

The Fraud Risk Management Puzzle

PwC Discussion Series 1

PwC Discussion Series 2

PwC Discussion Series 3

PwC Discussion Series 4

PwC Discussion Series 5

PwC Discussion Series 6

PwC Discussion Series 7

PwC Discussion Series 8

PwC Discussion Series 9

PwC Discussion Series 10

You might be interested in

Contacts

You are looking for an expert to help you; you want to request our services; or simply ask something? Let us know about yourself and we will get back to you as soon as possible.