To better identify compliance, financial tax, fraud and reputation risks

Intelligent Risk Monitoring

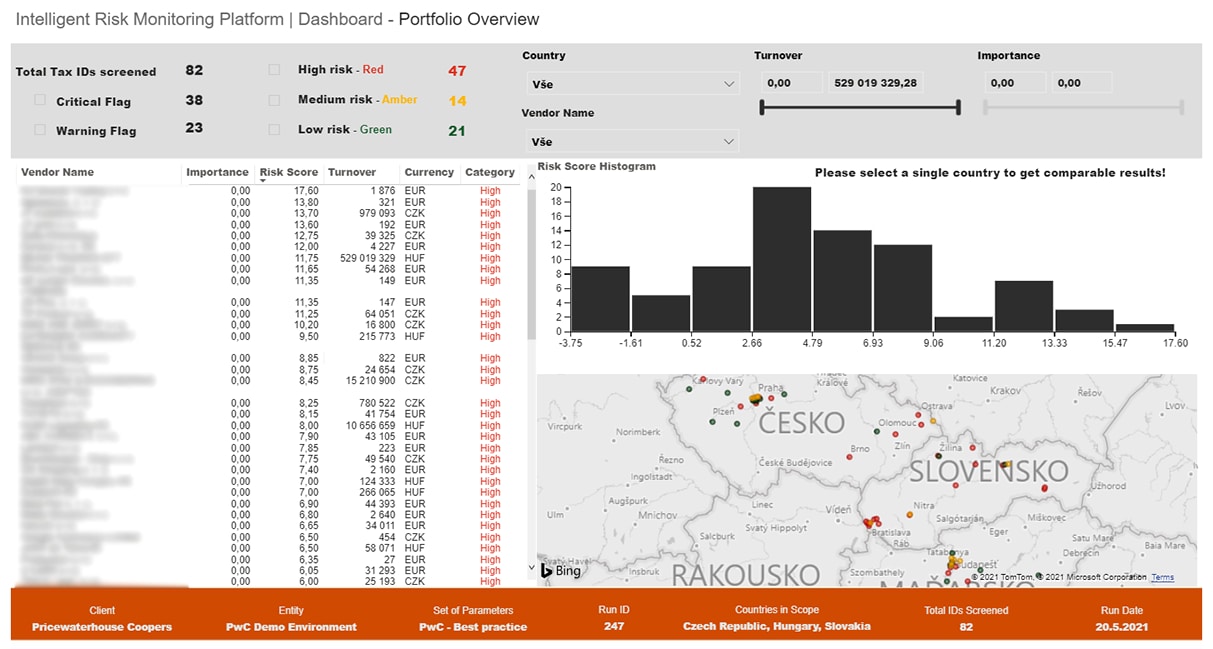

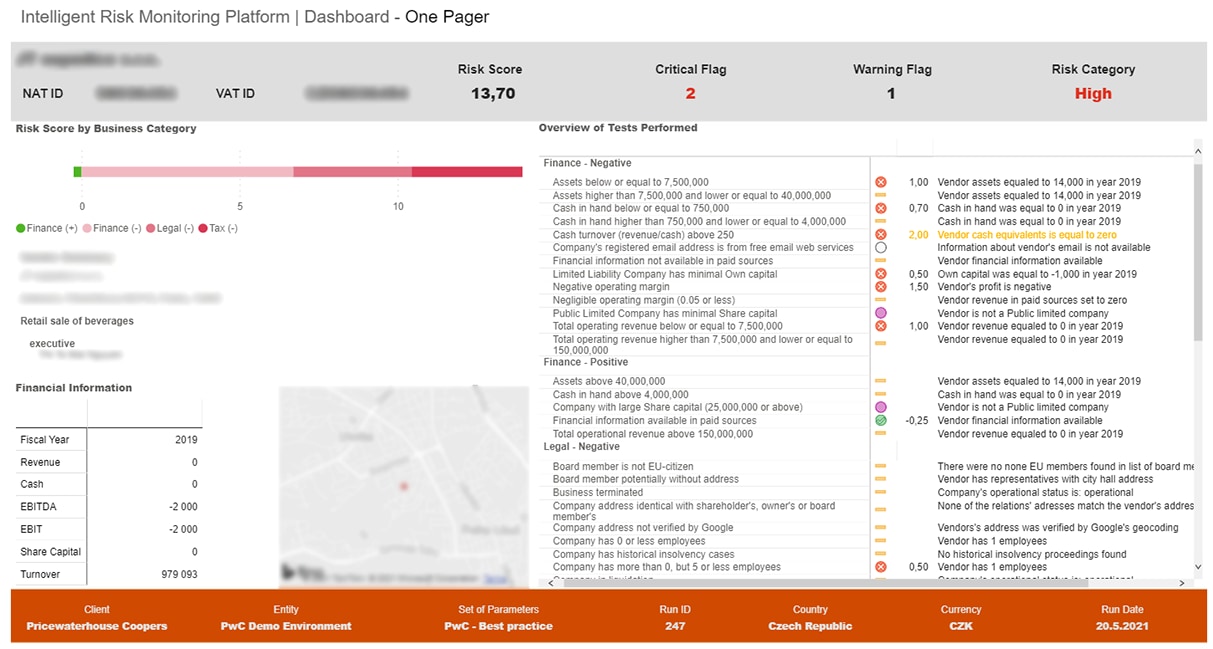

Intelligent Risk Monitoring is an automated solution that allows screening large volumes of third parties and identification of financial, tax, fraud, compliance and other risks.

Our solution automatically collects large amounts of data: registration, financial, geographical and other from multiple sources. In a next step it performs a series of tests to assess the overall riskiness for each tested entity.

Intelligent Risk Monitoring

- 2019 Czech Crisis Survey

Third party screening is a natural process for starting and continuing cooperation with third parties, which is intended to protect the companies from various risks, such as:

- Fraud risk

- VAT fraud risk

- Inconsistent risk monitoring in a holding / group of companies

- Sanction lists

- Conflicts of interest

- Reputational risks

Fraud risk

Monitor changes in business partners and compare exposure to suppliers / customers with tax, financial and legal risk indicators, such as insolvency cases or tax issues

- Your company may be used as "smokescreen" in VAT carousel fraud schemes. You may have fake suppliers in your portfolio. By monitoring your partners you may receive early warnings about potential fraud.

- Periodic and up to date monitoring of third parties is needed to mitigate risks of dealing with fraudulent third parties, companies in insolvency, shell companies or companies with possible reputational risks.

VAT fraud risk

Detection and ongoing protection against VAT carousel schemes and support during tax authorities reviews

- In many jurisdictions, tax authorities require certain supplier due diligence. They may reject VAT deduction if tax fraud is suspected. Tax authorities may demand VAT for payments to companies on tax blacklists.

- Our tool checks for risks related to VAT frauds and documents the portfolio checks, so that due care can be shown to the regulator.

Inconsistent risk monitoring in a holding / group of companies

Control supplier portfolio consistently across the whole group and manage risks from a single place

- In larger holdings, you need to apply the same metrics and methodology for evaluating your business partners throughout your whole group.

- CEE is considered a slightly more risky region compared to western Europe, therefore it helps to adopt a proven automated platform to monitor third party risks in CEE, such as Intelligent Risk Monitoring.

Sanction lists

Check if your business partner is on any sanction list

- To avoid fines and other prosecution for dealing with companies on sanction lists, you can periodically screen your business partners.

Conflicts of interest

Identify links between employees and business partners

- Key employees may be linked to your suppliers or customers, which poses a conflict of interest. Connection between employees and your business partners can be automatically detected from trade registries.

- Detect clusters of suppliers and/or tender participants to make sure the competition within a tender is genuine.

Reputational risks

Identify companies with no business history, dormant shell companies, ready-made companies, companies on blacklists, debtors

Some companies may present a reputational risk - for example during Covid crisis, there were many cases when "dormant" ready-made companies suddenly woke up to offer large supplies of medical goods to public entities under stress. They either delivered poor quality, overpriced goods or no goods at all. This led to negative media coverage and public scrutiny. Such situations could be easily avoided, had the suppliers been screened in publicly available sources.

Functionalities

What are the outputs?

Interactive dashboards

Interactive dashboards clearly summarising screening outputs and allowing to drill down to individual test result details.

Regional coverage

The solution is currently covering following territories:

| Czech Republic | Slovakia |

| Hungary | Poland |

Partial coverage

| Romania | Ukraine |

| Slovenia | Croatia |

We are currently expanding the coverage to other CEE regions. Please contact us if you would like to prioritise a specific territory.

Benefits

Identifying suppliers heavily reliant on your business

Intelligent Risk Monitoring verifies the third parties’ reliance on cooperation with you, using financial data from external sources and data associated with the business partners provided by you.

Automation of the supplier and customer screening process

Comprehensive risk analysis of cooperation with business partners is a complex process and requires the use of diverse sources of information. Automation of the business partners screening and assessment by Intelligent Risk Monitoring will save you time and increase process efficiency.

Automatic analysis of warning signals

Intelligent Risk Monitoring performs a series of tests and risk assessments of third parties in a fully automated manner, which increases the cost-effectiveness of this solution and ensures short response time.

Identification of risks arising from geographical location

Intelligent Risk Monitoring verifies the risks arising from the geographical location of third parties, including having addresses in virtual offices.

Automatic acquisition of registration data

Intelligent Risk Monitoring automatically fetches and fills in registry, financial and other data available through API (Application Programming Interface), which allows for a flexible approach to the scope of performed analyses and significantly reduces its time.

Identification of unreliable customers and distributors

Intelligent Risk Monitoring reviews counterparty financial metrics in the liquidity/solvency area and incorporates them into its risk assessment.

You are looking for an expert to help you; you want to request our services; or simply ask something? Let us know about yourself and we will get back to you as soon as possible.