Exceptional input tax credit claim

June 2017

By Naufa Murad

Goods and Services Tax (“GST”) is a tax on the consumption of goods and services in Malaysia and is levied on the value added at each stage of the supply chain. One of the key elements under the GST regime is the recoverability of GST incurred on business expenses by a taxable person (i.e. input tax credit (“ITC”)) in the course or furtherance of his business. The input tax credit mechanism ensures that GST is chargeable only on the value added by a business. Without ITC, GST would be charged on gross sales by every business throughout the supply chain leading to a tax on tax, or tax cascading.

In the normal course of business the entitlement to claim ITC would generally arise at the point when a GST registered business / person incurs the GST. However many businesses incur significant GST expenses prior to the effective date of their GST registration, with these acquisition to be used in the course or furtherance of business. As such, shouldn’t the GST cost incurred for these expenses be claimable?

The exception to the normal rule

The GST legislation provides a special concession allowing a taxable person to claim GST incurred on business expenses prior to their effective date of GST registration.

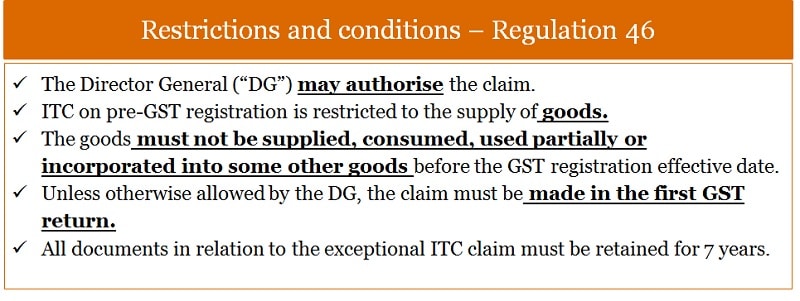

As this is an exception to the normal rule, there are of course conditions and restrictions attached to the pre-GST registration ITC claim.

Seeking authorisation

Customs have prescribed in the RMCD Guide on Input Tax Credit as at 4 January 2017 (“the Guide”) that an official application is to be made to claim exceptional ITC. However the guide does not state how that application is to be submitted:

- Letter?

- Application form?

- Information to be included?

Situations in which you may be able to claim exceptional ITC

The following case is used to illustrate the application of exceptional ITC and practical issues that may arise with respect to exceptional ITC. The case below is loosely based on actual events that occurred prior to the amendments to the Guide noted above.

Case study ...

A company incorporated in Malaysia constructed a plant that would be used to manufacture widgets. The construction took two years and during this time the Company has not made any taxable supplies.

Subsequent to the completion of the manufacturing plant, the Company is ready to begin the production of widgets, projected its’ total turnover of taxable supplies in the first 12 months of trading to exceed RM500,000.

On this basis the Company applied for GST registration under the GST Act 2014 and also requested that the GST registration effective date be the same as its first day of trading. The Company had incurred pre-GST registration expenditure on raw materials and capital goods in addition to the cost of construction of the plant.

Key issue to consider: Construction cost of plants and capital goods expenditure that includes supplies of both goods and services.

- Would the ITC be claimable where the service element cannot be distinguished or separated from the construction cost of the plant?

- Would the ITC be claimable where the cost of a standalone service incurred in obtaining the capital goods is capitalised under the standard accounting principle in Malaysia?

In the month in which the Company’s first GST return was due, the Company submitted a written application to the DG seeking approval to claim the pre-GST registration ITC.

However, at the point the written application was submitted, the first GST return was also due to be submitted – the Company submitted its first GST return which includes the exceptional ITC claim without obtaining a response or approval from the DG in accordance with regulation 46 of the GST regulations 2014.

Key issues to consider: Timing factors

- How long would it take for the DG to respond and authorise the claim?

- Could a Company submit an official application of intention to claim and submit the claim in the GST return before receiving authorisation from the DG?

- Would the DG allow the exceptional ITC to be claimed in the next return, if no request was made to claim the exceptional ITC in subsequent return?

The Company was in a refundable position, due to the exceptional ITC claim. The Company received a request to provide supporting documentation in order for Customs to verify the Company’s refund position. Once the review by Customs was completed, the ITC amount was refunded in its entirety which include the exceptional ITC claim.

Key issue to consider: Amount of exceptional ITC allowable

- Would the Company be required to amend the first GST return submitted if the amount claimed differed from the amount approved by the DG?

- Could a taxable person appeal the decision made by the DG to disallow the exceptional ITC claim? Or if the amount allowable is restricted?

- Would the Company be penalised for claiming exceptional ITC without authorisation from the DG or where the authorisation came subsequent the first GST-03 return being submitted?

Note:

- The Customs guide on input tax credit as at 4 January 2017 states that “a registered person MUST obtain an approval from the DG before an exceptional ITC claim can be made.”

- Regulation 46 of the GST Regulations 2014 states that “a DG may authorise exceptional ITC claim.”

Conclusion

While the update of the Customs guide to incorporate this issue has provided some clarity, there are still many issues which need to be addressed.

For business starting up and / or businesses that are expanding this concession could assist in reducing the cost incurred prior to the point at which the business is required to register for GST. As the exceptional ITC is restricted to goods only, businesses that requires significant capital goods investment may benefit significantly from this concession.

Where a business is more reliant on services it acquires, the primary focus should be towards accelerating the GST registration.

It is important to note, that the exceptional ITC is subject to the approval of the DG. In any event, it will generally be in the interest of the business to register for GST as soon as possible in order to maximise the ITC claimable on start-up costs.

Naufa Murad is a Consultant of the Indirect Tax Advisory Group at PwC Malaysia.