Tourism tax

Preparing for a new frontier

June 2017

By Sukania Prem Kumar

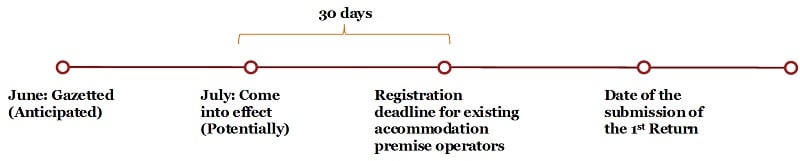

The Tourism Tax Bill 2017 was passed in the Senate on 27 April 2017. It is anticipated that the Bill will be gazetted in June 2017 and would potentially come into effect in July 2017. Once the law comes into effect, affected businesses will have 30 days to register for the tourism tax with the Royal Malaysian Customs Department (“RMCD”). When registered, a business would be expected to commence charging the tax. The tax will be administered by the RMCD, who also administers the GST.

The estimated revenue to be raised from this tourism tax is RM654.62 million, assuming 60% occupancy rate of the 11 million ‘room nights’ available in Malaysia. This tax will be imposed in addition to GST on both local and foreign tourists staying at any accommodation premises. The responsibility for collecting the tax will be borne by the operators of the accommodation premises.

Operators must file a return every three months to account for the tourism tax (“TTX”) received. However, if the operator is GST registered, the operator must file a tourism tax return in the same taxable period in which the operator files his/her GST returns (i.e. monthly or quarterly). Submission of both the tourism tax and GST returns in the same taxable period would help reduce compliance costs for operators.

During the parliamentary session in the Senate, the Minister of Tourism stated that tiered rates would be imposed at the following rates:

While this could be subject to change, the relatively high rates have started raising questions in respect of exemptions. At present, exemptions have been publicly stated to include homestays and kampungstays registered under the Ministry of Tourism and Culture. Accommodation premises run by educational and religious institutions for non-commercial purposes will also be exempted from the tax.

Under the former service tax regime, only accommodation premises with 25 rooms or more would have been considered a taxable person. There is a possibility that the tourism tax regime will have a similar threshold or will introduce long-term stay exceptions to minimise the impact of the tax on the tourism industry. However, to date, there have not been any such announcements.

While we recognise that there are more questions than answers at this stage, we have examined some practical considerations that need to be taken into account by tourism industry players to minimise the impact of the tax on their operations.

System enhancement

The amount of tourism tax will need to be shown separately on a tax invoice. This would mean that point of sales systems will need to be modified to compute and display the tax. New tax codes would be required and system reports and working papers will need to be enhanced to compute and evidence the tax collected.

Time to account for Tourism Tax

When must the tax be accounted for? This is a crucial question for operators when dealing with deposits, agents and online booking platforms. Presently, it is not clear at which point the tax is imposed when third parties are involved. However, as a starting point, businesses should review existing documentation with third party booking partners to determine if they are based on an agency model or a reseller model. It is likely that these two models are treated differently for the purposes of tourism tax.

Customers

Websites and signages must be updated to inform customers about the new tax. In addition, it is never too early to start thinking of ways to mitigate the increased cost of hotel stays by exploring options such as reducing the price of rooms or shifting the focus to promote non-stay events such as one day conferences. Of course, a cost-benefit approach should be taken when exploring these options.

There is still uncertainty as to how the tax will be applied in relation to pre-existing state tourist fees charged in Penang, Malacca and Langkawi. We understand that Customs will be discussing the issue of double charge with the state parties in due course.

Strategy revision

Marketing and business strategies may need to be revised to incorporate the new tax.

It is unclear as to how the tax will be applied to marketing strategies such as free rooms and ‘3 for 2’ promotions since the tax is based on a per room/night charge.

Accommodation premises with plans to increase their premises ratings may need to reposition their business model until more information regarding the tax is available.

Sukania Prem Kumar is an Associate Consultant of the Indirect Tax Advisory Group at PwC Malaysia.