Digital Banking: Malaysian banks at a crossroads

The release of Bank Negara Malaysia (BNM)’s Exposure Draft on Licensing Framework for Digital Banks will set the scene for one of the biggest disruptions to the financial services market in decades.

“Two years of digital transformation in two months” - this quote from Satya Nadella, CEO of Microsoft on the speed of change experienced in his company sums up the accelerated pace of digital adoption as a result of the global pandemic. Ideas considered unthinkable even a short 6 months ago are now normal. For financial services organisations held back by regulations and legacy technologies, this is a wake-up call and an opportunity to deliver end-to-end online customer and employee experience. It is also timely to reinforce banking’s wider societal purpose of improving lives through financial inclusion.

In the last few years, banks have stepped up their investments in digital capabilities in response to increasing customer demand for online access and the availability of new technical capabilities such as data analytics, cloud and Artificial Intelligence, and a more open regulatory environment. But have these investments transformed the banking experience? Are banks on the right path in changing how they operate and deliver value to their customers?

Research has shown that the majority of digital transformations have not delivered the level of desired outcomes. An IDC analysis estimates that 70% of all digital transformation initiatives do not reach their goals. Of the $1.3 trillion that was spent on digital transformation in 2018, IDC estimated that more than $900 billion went to waste.

In my experience leading major digital transformation initiatives for over 10 years, the following three reasons are major contributors.

Failure to automate end-to-end business processes (such as customer onboarding, account opening) resulting in fragmented solutions

Inability to build organisational capabilities and talent to sustain continuous development beyond initial Proof Of Concepts

Banks are now staring at the massive challenge of continuing their digital investments in a cost constrained environment. Getting their workforce ready to develop the technologies, while continuing to deliver value to their customers is another issue. At the same time, they are competing with new digital banks that will undoubtedly come in with newer technology built on modern architecture without the legacy debt.

However, there are industry players that may have cracked the code to successful digitalisation. I know of incumbent banks as well as digital banks developing world-class digital capabilities at lower costs, while training their people to make full use of their new digital investments. Recently the finance function of a leading global universal bank adopted a “citizen-led” digital transformation, training 300+ “citizen” developers who identified 200+ new use cases resulting in an annual run rate cost reduction of $15 million. This case study highlights the importance of engaging and upskilling your workforce while contributing to bottom line benefits.

Over the last two decades, technology by itself has evolved and now has the ability to transform whole businesses in the financial services sector, similar to its impact on other industries such as retail and media. Traditionally, for banks, technology was a support function enabling product and customer strategies.

However, as the case study illustrates, a bank that has invested in superior technology capabilities, can deliver great customer and employee experiences and offer simpler products backed by data insights at high speed and lower cost. This is a fundamental shift which puts technology at the heart of banking, serving to benefit the wider population including the B40 (the bottom 40% income group in Malaysia) and the Micro, Small and Medium Enterprises (MSME) segments, where banking is most needed.

The following three key trends demonstrate the emergence of new technology practices and operating models to enable a new world of banking.

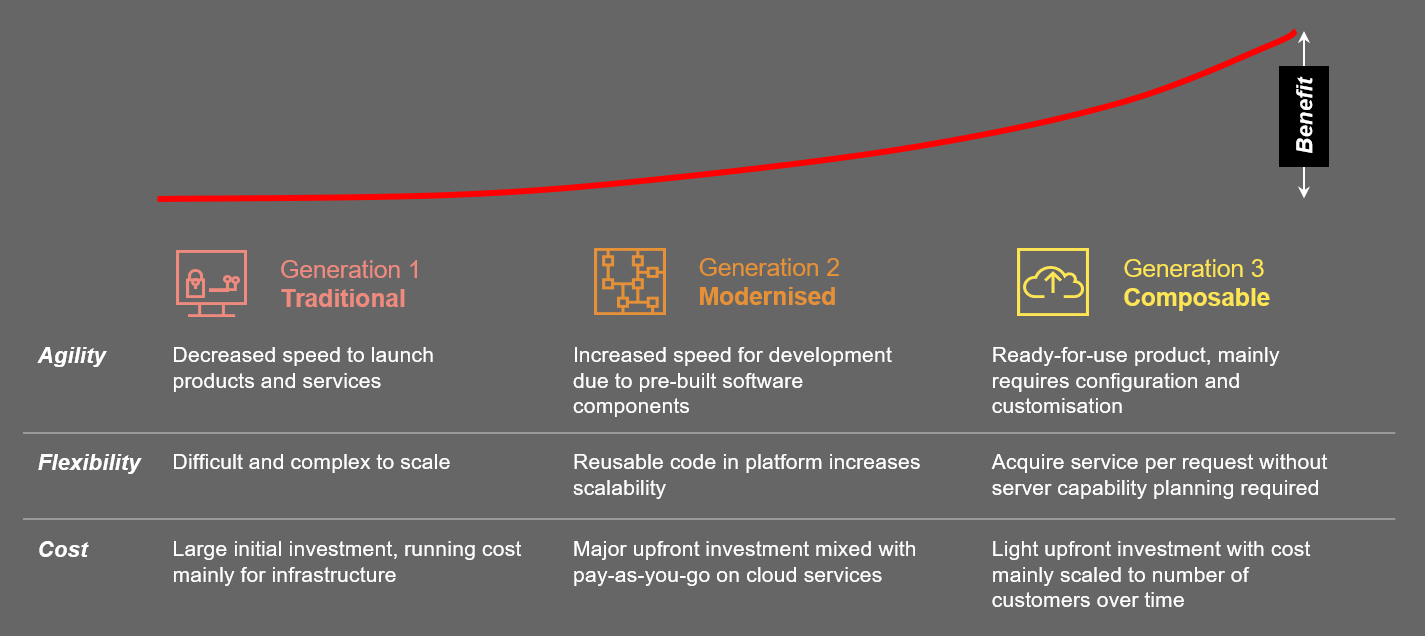

Locally and globally, banks are at different stages of maturity. Traditional banking technology architectures (Generation 1) are monolithic and are notoriously expensive, slow and risky to modernise and scale. Many banks have embarked on modernising their architectures (Generation 2), by retaining the core, but adding capabilities such as reusable components and cloud-based services to increase speed. However, the cost of change and the risk factors remain with the core systems.

In recent years, new architectures (Generation 3) have emerged which are cloud native products with ready-for-use functionalities that can be configured to meet the bank’s requirements. Generation 3 architectures offer banks exceptional flexibility to launch new products and customer journeys, with light upfront investments. As banks move towards Generation 3 architectures, they will reap significantly higher benefits with lower initial costs.

The convergence of digital, data and AI-driven automation have meant that banks can deliver personalised customer and employee experience at scale at relatively low costs. Among banks in Malaysia, as well as globally, their initial forays into digital were focused on User Experience (UX) design, data analytics based on historical analysis and Intelligent Automation for cost and risk reduction. Banks are now realising that the power and capabilities of these technologies are best deployed through a unified approach. When deployed together, data insights are delivered to customers through a rich UX while automation will ensure that the fulfilment is seamless.

New technologies and capabilities have allowed banks the opportunity to re-imagine organisational structures, talent management and employee engagement. Traditionally, organisation and operating models at banks have been built around products with sales and operations teams supporting them alongside functional areas such as finance, HR, IT and Marketing. With digitalisation, banks can rebuild operating models along customer journeys. This new operating model is automation-led with the digital workforce managing rules-based and basic cognitive tasks (such as simple credit decisioning and basic reconciliations). Employees can be upskilled to provide high touch customer advice, design new digital capabilities and manage exceptions which automation cannot handle.

To summarise, banks in Malaysia have made some progress on digital transformation but some of these initiatives have faced significant challenges and have not delivered on their initial promise. However, the current pandemic and the customer demand and acceptance for digital capabilities presents a significant opportunity for incumbent banks as well as digital banks to disrupt traditional banking by adopting new and emerging technologies including AI-driven automation to manage costs and mitigate risks. Banks may have hit the pause button along the way due to changing priorities, but it’s timely to reboot the digitalisation journey they started, with the resurgence in demand for digital services.

Building an organisational culture that engages and incentivises transformation is the first step to empowering their employees and transformation teams as change agents in championing digital transformation internally and in their customer delivery. Indeed, banks have an important role to play in enhancing trust in the financial system by making strategic investments in technology and ensuring that their products and services reach the underserved and unbanked through efficiency and scale. It is after all a journey enabled by technology and powered by humans.

The release of Bank Negara Malaysia (BNM)’s Exposure Draft on Licensing Framework for Digital Banks will set the scene for one of the biggest disruptions to the financial services market in decades.

2020 looks to be the year of virtual banking in Malaysia, on the heels of the highly anticipated release of Bank Negara Malaysia’s virtual banking licensing framework in December 2019.

Asia Pacific Sustainability, Strategy & Transformation Partner, PwC Malaysia

Tel: +60 (3) 2173 0348