{{item.title}}

{{item.text}}

{{item.text}}

November 2020

By Mohd Haizam Abdul Aziz, Tax Director, and Tay Boon Hwee, Senior Manager, PwC Malaysia

The evolution of the Tax department from a back-office function to a valuable business partner - to deliver insights in real time and likely remotely in the current landscape - means that we first need to evaluate whether the current Tax reporting set-up has the ability to support the new needs of the business. In our earlier blog in this ‘Driving agile tax functions’ series, we shared some key questions to help guide you in your evaluation.

Change is also being driven and objectively measured by the following key performance indicators (“KPIs”):

Enhancing your existing operating model to meet the needs of the business could involve changes to the ecosystem your Tax function is housed within, which includes tools, processes, and resources.

The tax lifecycle does not only revolve around preparing and submitting tax returns to the Tax Office by the due date once a year. We see an opportunity for Tax functions to play a strategic role in the organisation as tax considerations should be evaluated with every strategic decision undertaken by the company’s top executives.

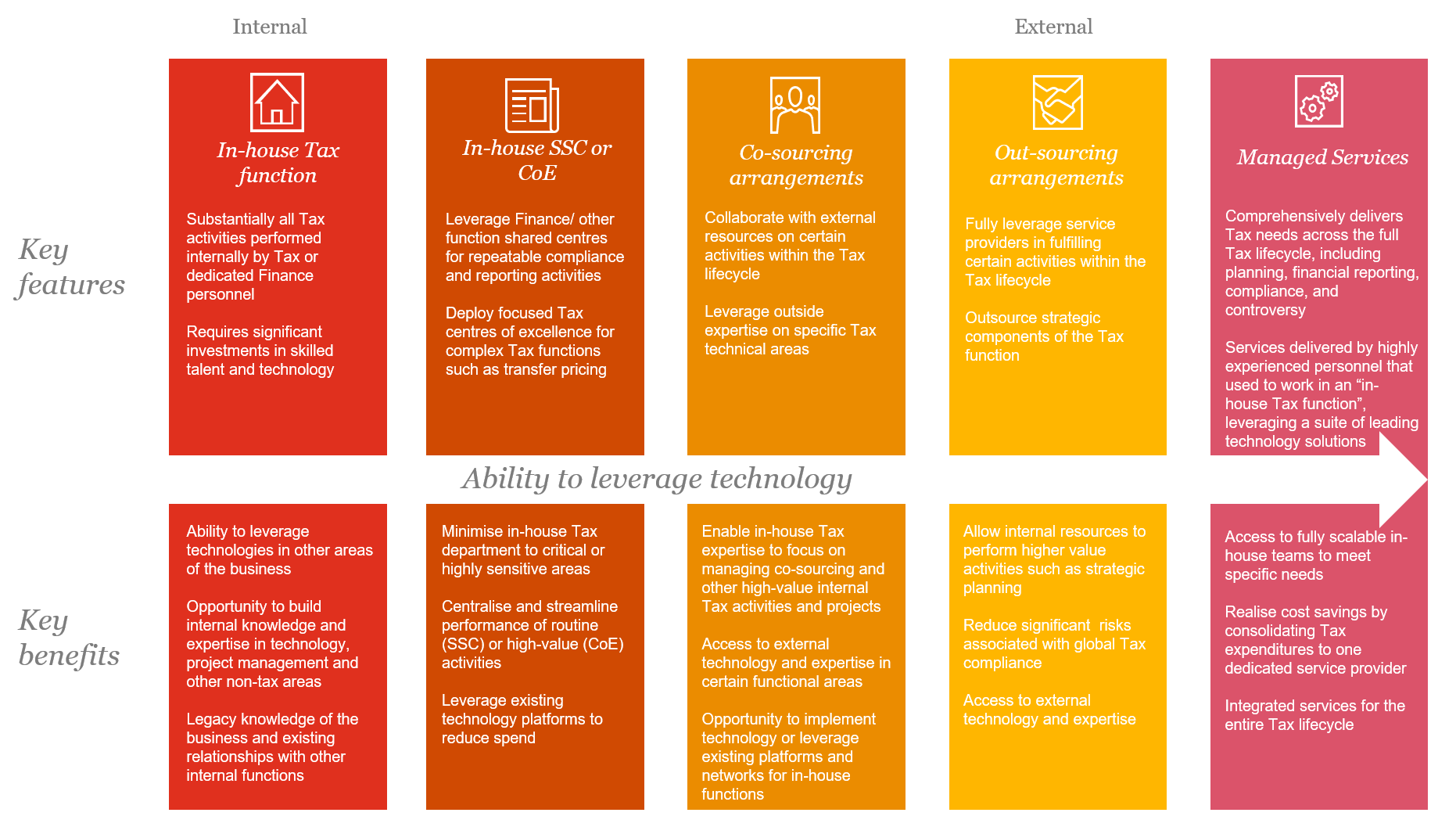

We find that different Tax functions’ operating models range on a spectrum, from completely in-house to engaging a third-party service provider for comprehensive delivery on every aspect of the tax lifecycle. Companies are deploying one or more of these sourcing arrangements (illustrated below) depending on the requirements of each Tax functional area, fulfilling their respective compliance and strategic roles whilst leveraging technology.

Each of the above models has its benefits and drawbacks. For example, in-house Tax functions, operating amidst growing complexity (both regulatory and business arrangements) and pressure to reduce spend, must be strategic in evaluating their core competencies and ability to deliver in certain areas.

In the shared service centre (SSC)/centre of excellence (COE) model, could Tax benefit from shifting certain activities to an SSC so that time is available to pursue other value-added activities? Tax organisations may leverage the infrastructure of an SSC for repetitive, indirect and direct compliance, and reporting-related activities. However, as technologies evolve, will the value of SSCs be eclipsed by a digital labour force with the advent of robotic process automation (“RPA”) utilities?

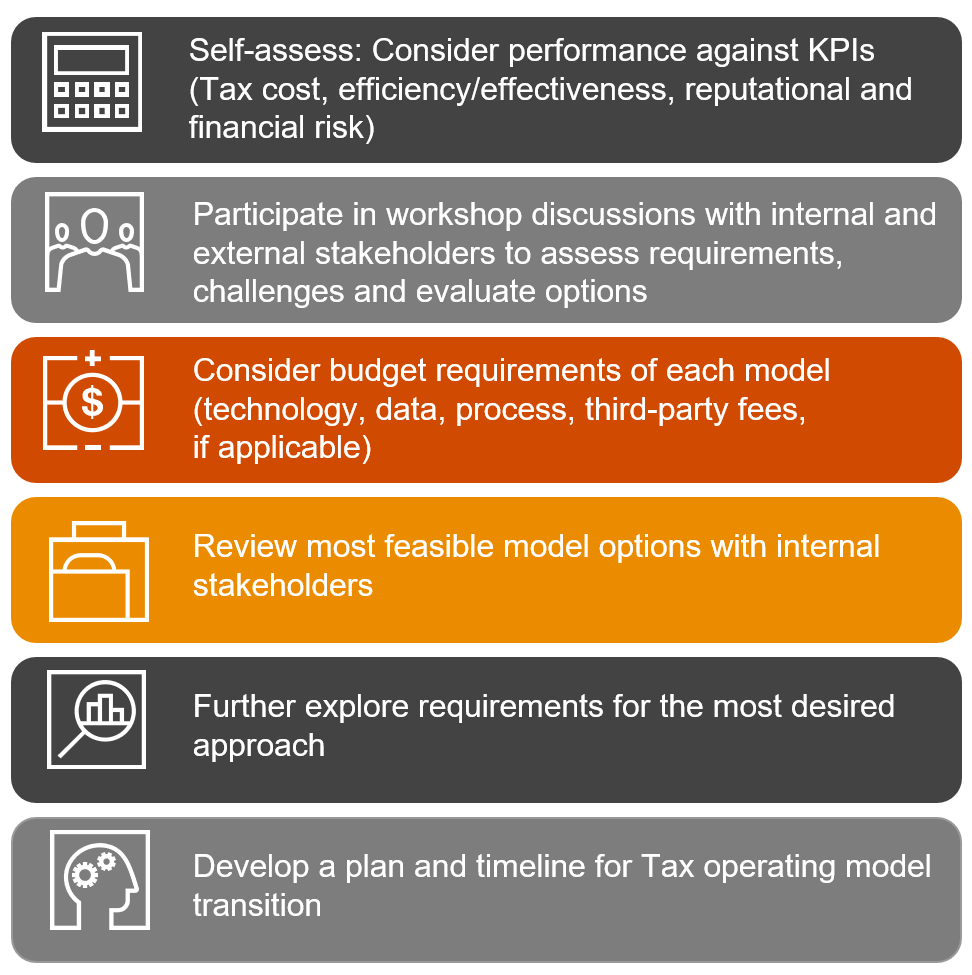

There are many considerations in selecting the appropriate operating model for Tax to achieve its goals. One of the most important is the first step in the process – an assessment of the function’s performance, requirements and ability to adapt to change.

Is Tax meeting its objectives that are measured by established KPIs?

Does Tax have the capability, in light of regulatory and legislative changes, and increasing global complexity, to close performance gaps related to technology, people/talent, process, and data?

What are the expectations of Tax in meeting and supporting the requirements of the business?

The final step may be equally significant – effective planning and coordination. Without close attention to the execution of the transition, the new approach may fail to deliver an improvement in Tax’s performance. In order to assess and prioritise your requirements, we suggest the following considerations:

The short answer is – everywhere. Technology is the thread that runs through the entire tax lifecycle. We will discuss how technology can be used as an enabler in our next blog.

Our ‘Driving agile tax functions’ blog series will help provide insights on how to transform and meet the new requirements of Tax functions.

Technology in tax: Disrupter or enabler? (upcoming)

Driving agile Tax functions: Pulling the components together

Get in touch if you would like to delve deeper into any of the aspects covered in this blog post.

{{item.text}}

{{item.text}}

{{item.text}}

{{item.text}}