{{item.title}}

{{item.text}}

{{item.text}}

December 2020

By Pauline Lum, Director, Tax, PwC Malaysia

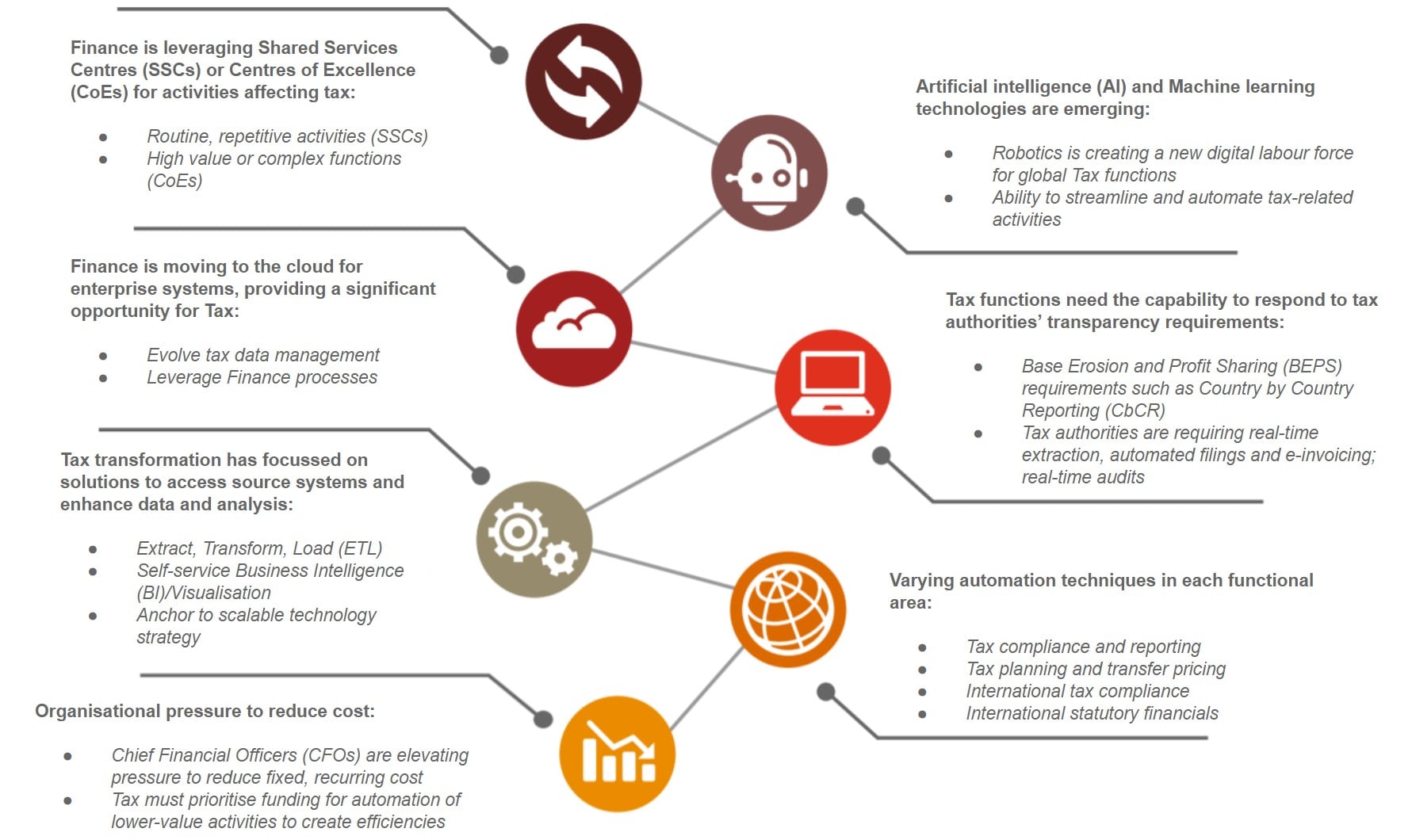

The role played by Tax functions is becoming increasingly important in today’s volatile landscape. Navigating regulations and country-specific obligations in a borderless marketplace, while pushing for innovation in business arrangements/models and managing risk cannot be done manually or in silos.

The integration of technology within organisations has increased to enable efficiencies and unlock value in almost all aspects of the business. This is no different for Tax functions. If harnessed effectively, technology will be able to enhance how Tax operates and collaborates with the rest of the business. With a push for more to be done with less and in real time, the adoption of technology by companies presents unique opportunities and challenges. These arise due to the different requirements (i.e. internal and external stakeholders), existing conditions and corporate cultures.

Tax operating model + Enablers = Agile Tax Function

The COVID-19 pandemic has accelerated the adoption and need for technology to glean insights, meet compliance and fulfil other daily obligations. Working remotely has become an integral part of the “new normal”, which continues to be redefined as new developments in the pandemic landscape unfold. However, it is important to ensure that you assess what is currently available (i.e. data points, tools in use, strategies or ongoing initiatives in place) and what is required (i.e. change in business requirements and/or infrastructure), when crafting your roadmap and immediate action plan.

As discussed in our earlier blog, it is important for any changes to an operating model to be aligned to the requirements of the business. After which, you should be able to identify the tools needed to meet these requirements, to further support and deliver the desired outcomes. In order to optimise sourcing decisions regarding tools, the following considerations should be made.

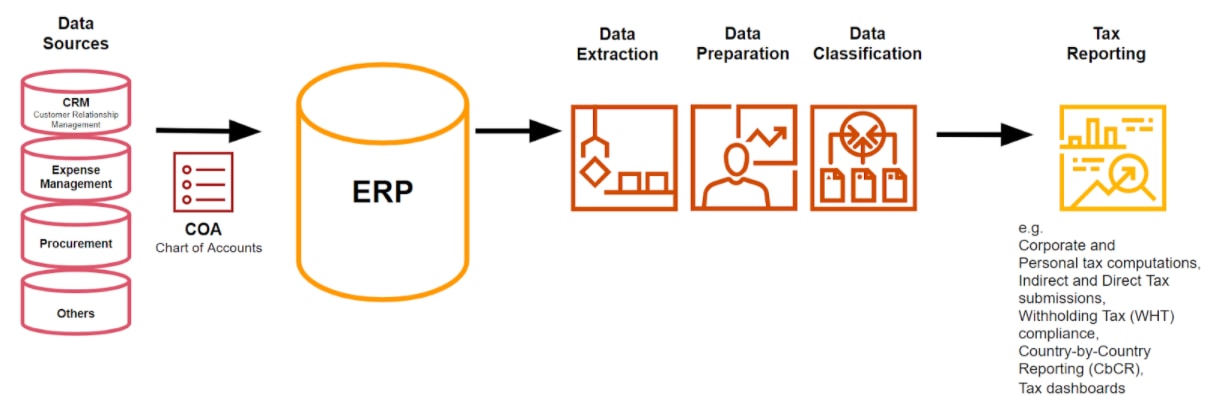

Data is the lifeblood of a company. Tax, like every other internal function of an organisation, relies heavily on the quality, accuracy, timeliness and availability of data for reporting.

When was the last time you assessed the lifecycle of your data? This is critical to help you understand the dependencies of data points and to see how to capture data that is fit for purpose. This assessment will help you determine and prioritise the tools required to enable operational and reporting efficiencies. Generally, at the onset of a business transaction (when all information is available), only details that are required for financial reporting are captured. Typically, this will not be sufficient for tax reporting, which results in time spent on “workarounds”, which are often manual.

The adoption of new tools has to be supported with effective changes made to processes that govern their use, coupled with effective change management (driven by key performance indicators). Most people fear the unknown, and combined with “transformation/initiative fatigue”, these are aspects of the change process which could be disruptive and hamper the sustainability of the adoption. Hence, it would be beneficial to leverage other enterprise-wide initiatives, to optimise activities, key messaging on changes to be adopted and time spent by parties involved.

In a cost conscious environment, and with the sun setting on support for certain enterprise resource planning (ERP) software by 2025, companies are having to decide on an upgrade or migration of their ERPs. It is important for companies to consider all user requirements as part of that journey and for internal functions to align their digital strategies/roadmaps enterprise-wide. This presents an interesting opportunity for Tax to leverage off activities, to enrich the quality of data for Tax reporting whilst optimising investments in their ERP.

In evaluating your Tax function requirements, ask the following questions:

What other requirements does the business have?

Is your digital strategy aligned across the enterprise, and does it consider tools for Tax reporting?

In our next blog, we will share case studies to explore what companies can do to get ready for ERP migration and discuss these components in totality (i.e. operating models, technology) to illustrate how you can drive agile tax functions.

Our ‘Driving agile tax functions’ blog series will help provide insights on how to transform and meet the new requirements of Tax functions.

Why it’s time for tax functions to move from compliance to strategy

Driving agile Tax functions: Pulling the components together (upcoming)

Get in touch if you would like to delve deeper into any of the aspects covered in this blog post.

{{item.text}}

{{item.text}}

{{item.text}}

{{item.text}}