{{item.title}}

{{item.text}}

{{item.text}}

January 2021

By Pauline Lum, Tax Director and Jeannie Shee, Tax Managing Consultant, PwC Malaysia

Without exception, Tax functions have been working towards operational resilience to address the challenges of working virtually, which puts a strain on daily activities. In our earlier blogs, we discussed the importance of:

Assessing your tax operating requirements (present and mid-to-longer term),

What is available in terms of operating model, tools, ongoing initiatives, and

Developing a roadmap of action steps to manage outcome, cost, expectations and resources.

These components are critical in building and implementing sustainable strategies to optimise operational and cost effectiveness. The extent of adoption of each component depends on the company’s evaluation of its current versus desired state. In the following case studies, we share critical success factors, triggers and learning points from recent journeys which we have supported.

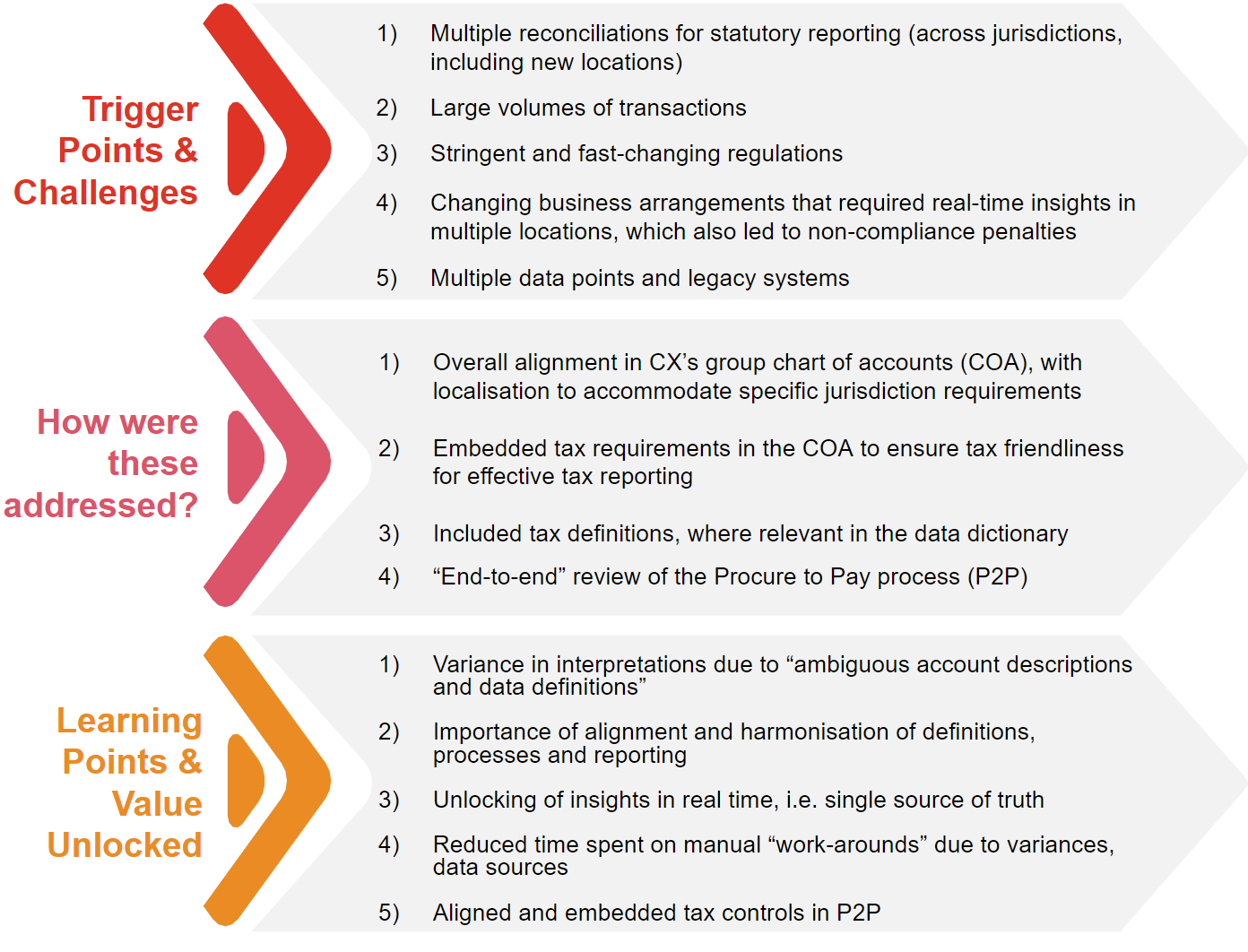

With rapid expansion in the region, Company X and its subsidiaries (CX) decided to upgrade their enterprise resource planning (ERP) system to S4HANA (greenfield and an early adopter). Their journey was driven by a digital agenda, without a review of the operational needs and challenges faced (current and future) by Tax.

During the “assess and design phase” of their ERP journey, CX realised the interdependencies between Finance and Tax processes and people. CX took a closer look to see how Tax controls and obligations could be integrated to optimise output from the ERP. This resulted in changes to their current processes and engagement with the rest of the business and other internal functions. Details of CX's journey are outlined in Diagram A.

CX paved the way for other companies to learn from their journey, which continues today.

Diagram A

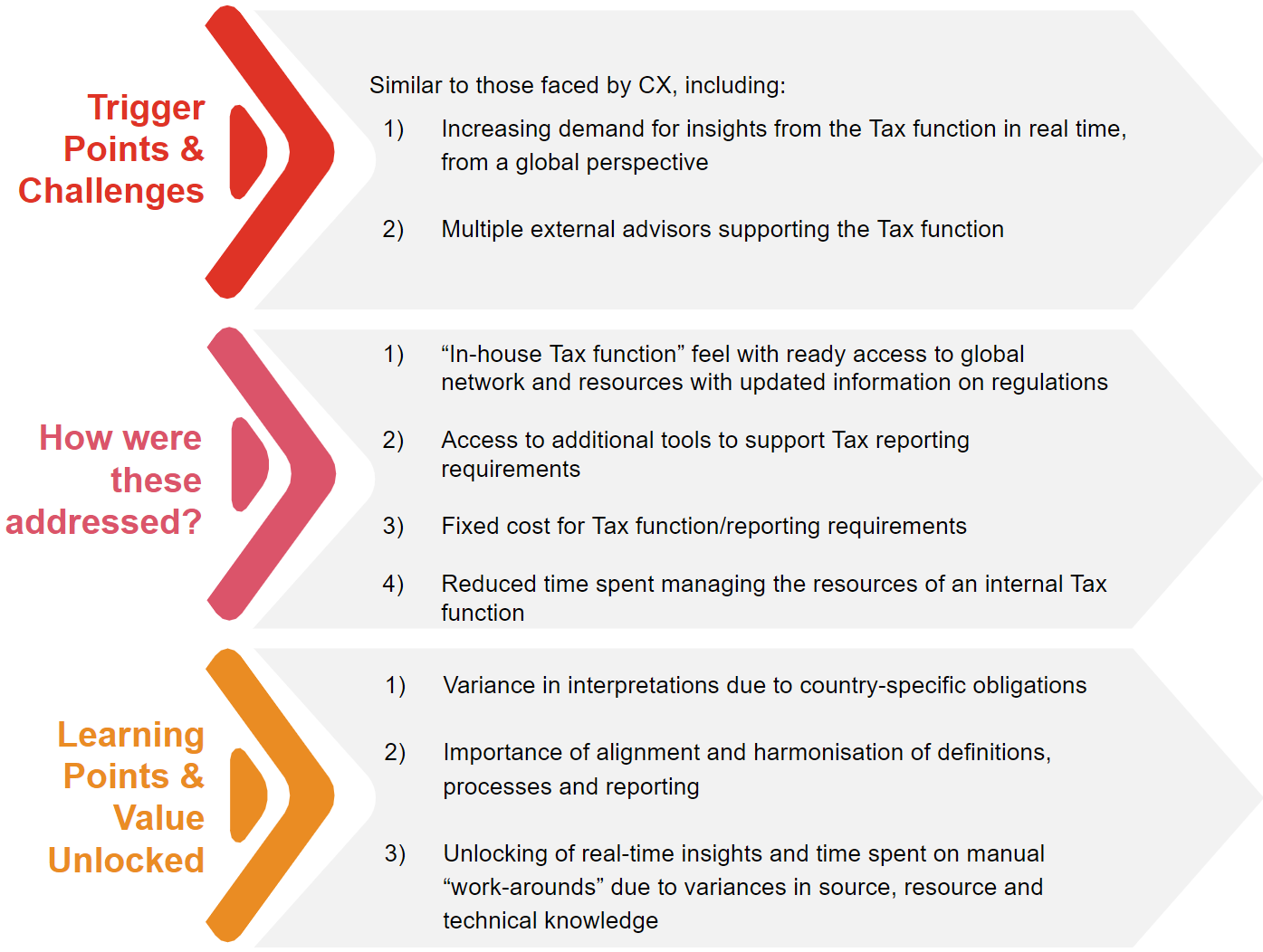

Faced with increasing pressure to “do more with less”, Company Y and its subsidiaries (CY) had to take a critical look at their functional and operational efficiencies. Their journey was driven by an enterprise-wide adoption of cost-cutting measures, which resulted in a decision to move into an outsourcing model for their Tax function.

CY has a global footprint and is supported by a “best in class” Tax function. So it was critical to manage people, processes and tools for seamless integration and migration to the new outsourced vendor. This resulted in changes to their reporting process and operations (with both internal and external stakeholders).

Subsequent to this bold outsourcing decision by CY, we have seen other organisations also reassess their needs and operating models. The impact of the COVID-19 pandemic has also accelerated the need to reduce cost, whilst maintaining (if not increasing) operational efficiencies. CY has paved the way for other companies to learn from their journey (details outlined in Diagram B) which continues today.

Diagram B

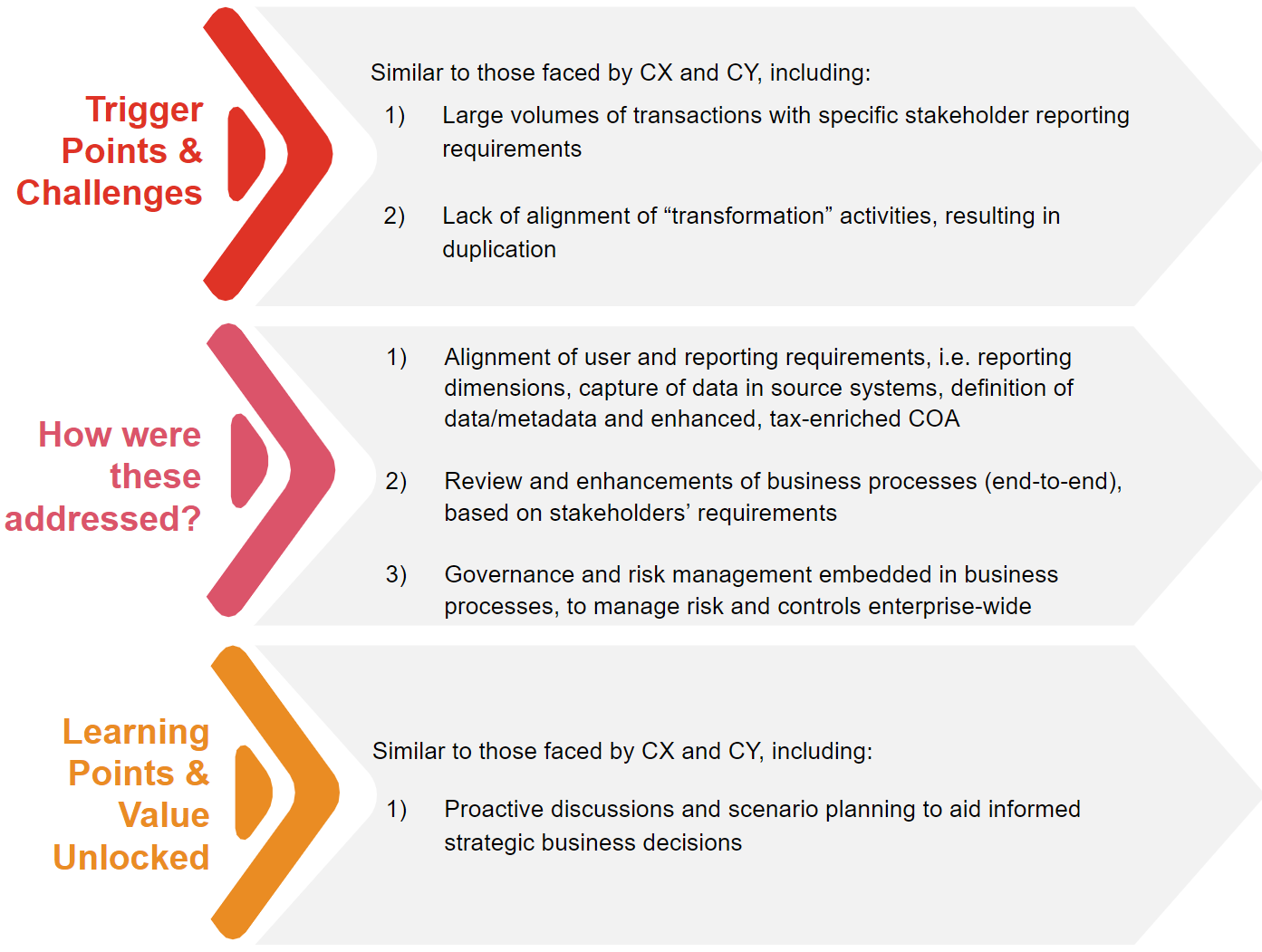

With the sun setting on technical support for Company Z and its subsidiaries’ (CZ) existing ERP, the group decided to migrate to a new ERP. This triggered a “digital transformation” journey for the whole group. However, each internal function had to decide what that journey would mean for them. This resulted in several initiatives being run in tandem, with duplication of activities involving similar stakeholders. Due to the interdependencies of the functions and lack of integration between initiatives, not all journeys were effectively implemented.

CZ decided to reassess and align (where possible) initiatives and activities. This enabled a more holistic enterprise-wide approach, where Tax was able to leverage controls, process enhancements and data capture for Tax risk management and compliance. CZ continues on their transformation journey. Their learning points (outlined in Diagram C) encompass 3 critical success factors for driving agile Tax functions, which are:

timing for involvement,

alignment of stakeholders/requirements/definitions, and

ensuring that the process, tools and people dimensions are always considered to sustain and evolve the initiatives implemented.

Diagram C

We hope that our ‘Driving agile tax functions’ blog series has helped to provide insights on how to transform and meet the new requirements of Tax functions.

Why it’s time for tax functions to move from compliance to strategy

Driving an agile Tax function: Pulling the components together (final blog of the series)

Get in touch if you would like to delve deeper into any of the aspects covered in any of these blogs or for a complimentary diagnostic assessment.

{{item.text}}

{{item.text}}

{{item.text}}

{{item.text}}