Authors

It's no small task for companies to collate customer or vendor data for e-Invoicing reporting. Many businesses may find it challenging to maintain 'business as usual' during the full e-Invoicing implementation, especially with tax audit looming on the horizon. To ease this transition, the Malaysian Inland Revenue Board (IRB) granted a 6-month soft landing for the first wave of e-Invoicing implementation. These companies, with a turnover over 100 million, are now embarking on their e-Invoicing journey and taking advantage of the six-month flexibility to prepare for the full implementation. We have seen many companies initiating operational changes and improving management of tax risks as they implement e-Invoicing. In this blog, we will share some insights for businesses to get their house in order and to have better or more controls to ensure readiness for an ‘e-Invoicing tax audit.’

The clock is ticking

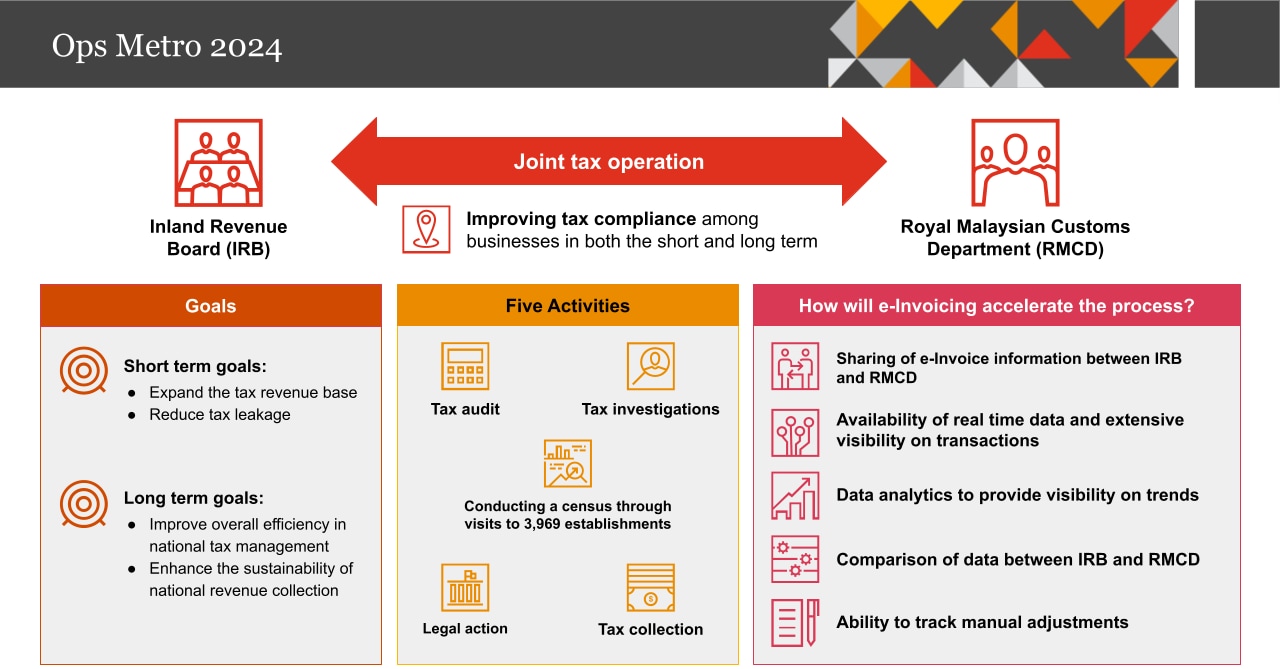

On 19 August 2024, over a thousand officers from the IRB and the Royal Malaysian Customs Department (RMCD) launched large scale operations to ensure tax compliance as part of Ops Metro 2024. E-invoicing, a key data collection initiative enforced by Section 138(4)(aa) of the Income Tax Act 1967, now provides real-time data access to both the IRB and RMCD. This will accelerate the audit investigation process, as summarised below:

From the above, the coverage of the taxes for the tax operation will not be limited to direct taxes, but also indirect tax. Have you tried one of the IRB’s dashboards which is available to the public? The current income tax dashboard provide you some insights:

What proportion of income taxes come from individuals?

How does the taxpayer compare to other taxpayers in Malaysia

How many people pay tax each year (groupings in solo, joint and fillings with no tax paid)?

And for a bit of fun, how do you compare to the other taxpayers in Malaysia?

The dashboard meets the government’s agenda to promote transparency and digitalisation; it wouldn’t be surprising if the government or tax authorities expedite their dashboard with treasured data from the e-Invoicing collection exercise. We foresee the government will soon follow the path of many other countries to roll out e-reporting and e-audit, which we will share more in the next blog.

Reconciliation: Do your numbers match?

The IRB has taken further steps to make it mandatory, under Section 82C of the Income Tax Act, 1967, to use validated e-invoices as proof of income. The proof of expenses may come into force when the e-invoicing becomes mandatory for all taxpayers on 1 July 2025 (with six months of flexibility), as outlined below:

From the above, it clearly illustrates the timing when companies are required to reconcile for the year end reporting. For example, as a start, your annual turnover should reconcile with your reported proof of income transactions, or your income disclosure in your income tax return matches to your Sales and Service Tax (SST) returns. If you further deep dive into the non-reconciling items and reasons for non-reconciliation, it is a mission impossible if your data has not been sorted in a proper manner.

e-Invoice data provides powerful insights, whether the current sales, sales trends (linking back to external factors), comparison between the disclosure in income tax returns and indirect tax returns, identify discrepancy or abnormality, among others. Any non-reconciling items/transactions or inconsistency in reporting, will be reflected as red traffic lights to tax authorities on any potential non-compliance.

e-Invoicing implementation is just the beginning. Taxpayers should start planning a robust internal defence to ensure ongoing tax compliance and readiness for audits.

Does internal defence play an important role to ensure compliance?

Many organisations already leverage their internal audit teams as the first internal defence, assessing and improving risk management, internal controls and governance processes related to e-Invoicing compliance. But as e-Invoicing implementation progresses, organisations should include in their plans to strengthen their internal defences as part of their overall strategy.

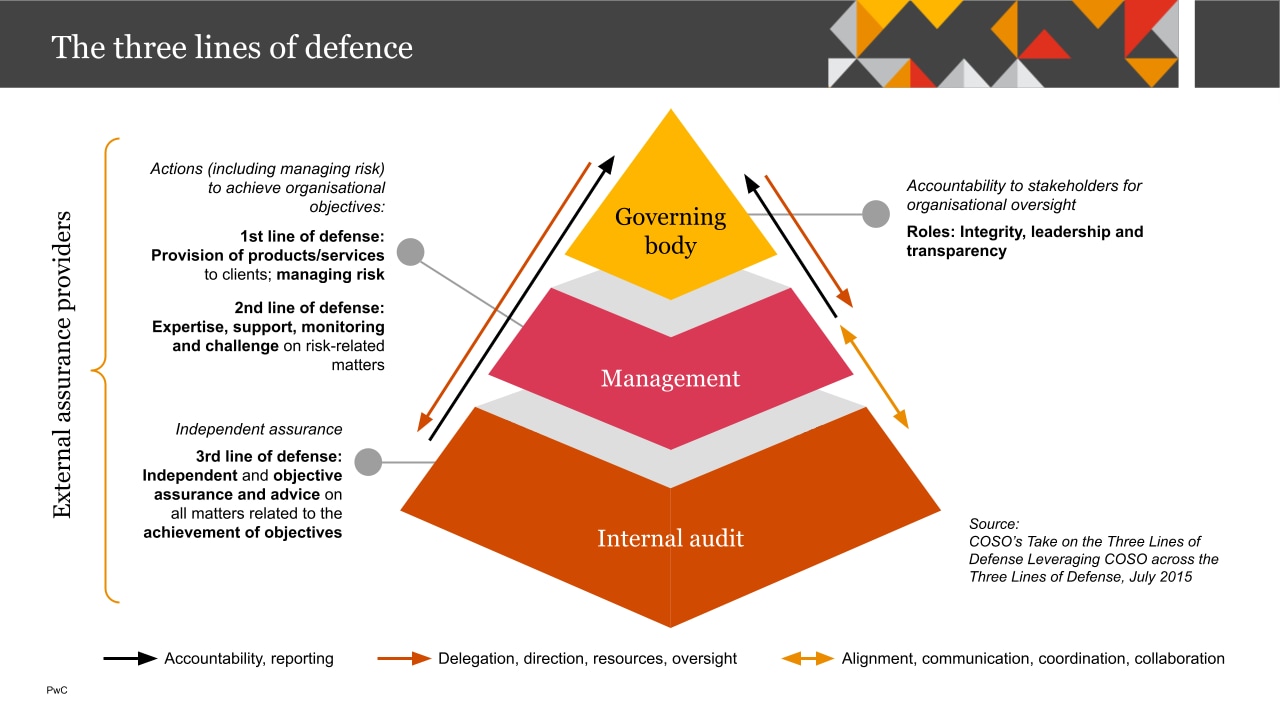

The Committee of Sponsoring Organisations (COSO) is a widely accepted and developed internal control framework in response to senior executives’ need for effective ways to better control/manage their enterprises’ risks and to help ensure that organisational objectives related to operations, reporting and compliance are achieved.

The framework can be summarised into the following three lines of defence:

Business Operations/Procurement (First Line): Ensuring that all relevant e-Invoice data is collated at point of engagement with clients or business. Company policies and standard clauses are included to support the data collation process and align with the e-Invoicing requirements.

Specialised back office support (Second Line): Ensuring that all e-Invoice data is accurate, complete and submitted on time. Therefore, it is very important that your Accounts Receivable, Accounts Payable and Finance teams are fully up to speed with the latest e-Invoicing guidelines.

Internal Audit (Third Line): Integrating e-Invoicing into your Internal Audit plans, ensuring that all processes are audit-ready at all times.

The model above demonstrates how specific duties related to risk and control could be assigned and coordinated within an organisation, regardless of its size or complexity. Therefore, as part of the change management for the e-Invoicing implementation, it is very important to upskill both the front and back office functions. The upskilling will help the stakeholders in the organisation to understand the critical differences in their roles and responsibilities to ensure the e-Invoicing compliance as below:

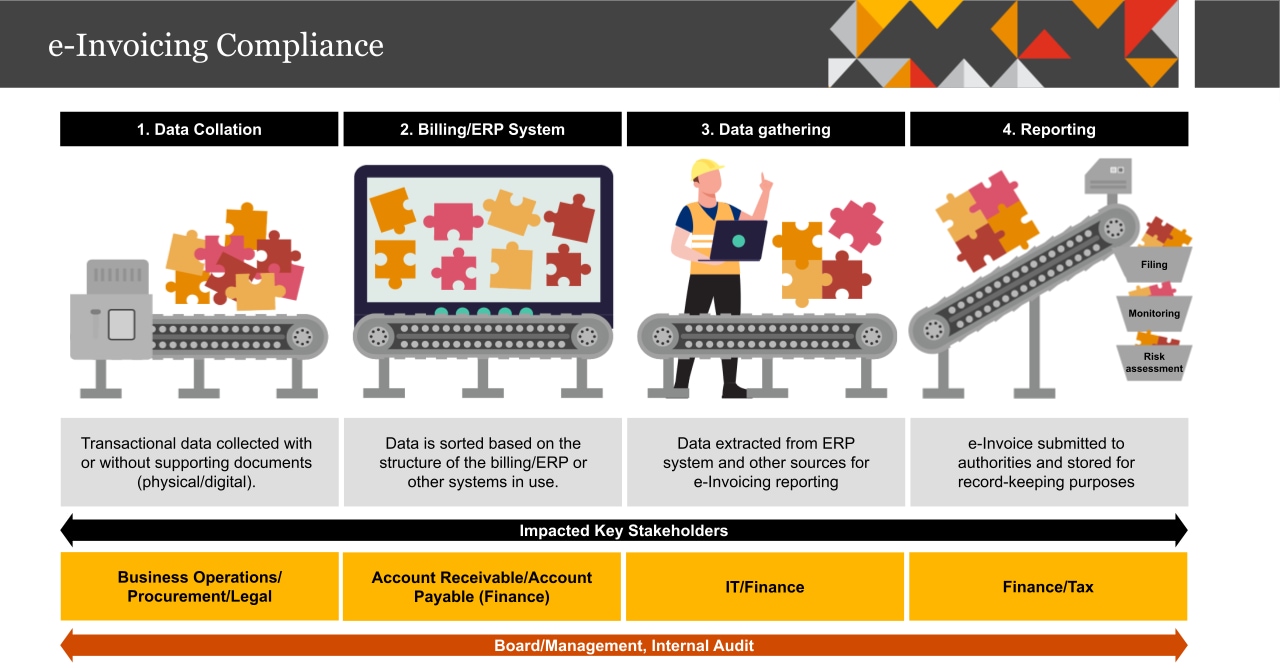

e-Invoicing will transform the way companies work going forward, extra controls have to be exercised in each step to manage and mitigate the risk of potential non-compliance, which can be summarised as below:

| Stakeholders | Mitigating the risk of e-Invoicing non-compliance |

| First Line | |

| Customer Relationship/ Procurement/Legal | What is their role in ensuring data completeness and accuracy? |

| Second Line | |

| Account Receivable/ Account Payable/ Finance | Are they fully up to speed with updates or changes from the e-Invoicing guidelines/FAQ perspective?

Are they aware of the key checks to ensure accurate submission via the MyInvois Portal?

Do they know what action they need to take for data that is incomplete or incorrect? |

| IT/Finance | What remedial actions are in place in the event the API/MyInvois portal goes down?

How can they assist when there is an error in submission?

What is the Business Continuity Plan if the accounting system is down? |

| Finance/Tax | Who is responsible for the reconciliation between the validated e-Invoice and income statement/tax return?

What measures are in place for tax to ensure that all income and all expenses meet the proof of income and expenses requirements? |

| Third Line | |

| Internal Audit | Have your internal auditors included e-Invoicing in their internal audit assessment?

Do your internal auditors know what are the key risk areas and controls for e-Invoicing? |

| Overall | |

| Board/Management | What is the Board/Management’s risk appetite?

Does the Board/Management understand the importance of e-Invoicing compliance and the consequences of non-compliance? |

Venturing into the new era of ‘e-Compliance’: What’s next

As we look ahead, the evolution from e-Invoicing to e-reporting and eventually e-auditing is not just a distant prospect; it’s an inevitability. Artificial intelligence and data analytics are set to be linchpins in your organisation’s tax defence strategy. As you prepare for the future of e-compliance, consider the following:

Are all of your stakeholders fully equipped to ensure e-Invoicing compliance within your organisation?

Have you incorporated e-Invoicing as part of your internal audit review?

Does your organisation have game plans to embark on an e-compliance journey after e-Invoicing?

Is your Board aware of the potential upcoming tax digitalisation tools or trends to plant the seeds for the future plan?

Has your organisation considered technology analytics or tools to ease the pain of reconciliation?

The future of tax compliance is digital, and the challenge isn’t merely to adapt, but to stay one step ahead. Are you ready for what’s next?

Let’s chat

Contact us