Authors

TCG is an essential component of cooperative compliance, which has benefits for both taxpayers and the Malaysian Inland Revenue Board (MIRB). Cooperative compliance depends on trust and transparent communication between tax authorities and taxpayers. To build this trust, openly sharing viewpoints and having accessible data and documentation to support claims are essential. Strong tax data collection fosters confidence in tax disclosures and drives the need for enhanced transparency and good tax corporate governance within organisations, helping to create a connected tax ecosystem (TCG, as outlined in our earlier blog) within organisations, helping to create a connected tax ecosystem. This blog explains how e-Invoicing boosts taxpayer-authority cooperation and highlights TCG's role in ensuring confidence in the collected tax data.

Data-driven, technology-supported cooperative compliance

With technology advances and business models growing more complex, real-time communication with stakeholders, including tax authorities, is essential. Tax authorities are enhancing taxpayer services using data-driven and technology-supported strategies. In 2020, the Organisation for Economic Cooperation and Development (OECD) Forum on Tax Administration explored the digitalisation of tax systems, through three stages:

Tax Administration 1.0 - Traditional, paper-based with basic digital tools.

Tax Administration 2.0 - Leveraging technology with improved data handling.

Tax Administration 3.0 - Cutting-edge technology for comprehensive data management and enhanced taxpayer services, reducing compliance burdens.

As jurisdictions move at their own pace toward real-time insights and efficient tax administration, ensuring data accuracy and quality is critical. Embedding tax into natural business processes and enterprise risk controls will be essential for a seamless transition to Tax Administration 3.0.

Rise in tax data collection and reporting

Countries are rolling out e-Invoicing and tax governance programmes to enhance cooperative compliance and transparency. This mutual openness fosters trust, paving the way for Tax Administration 3.0, where tax processes will be able to naturally integrate into daily business activities, making compliance smoother and more seamless.

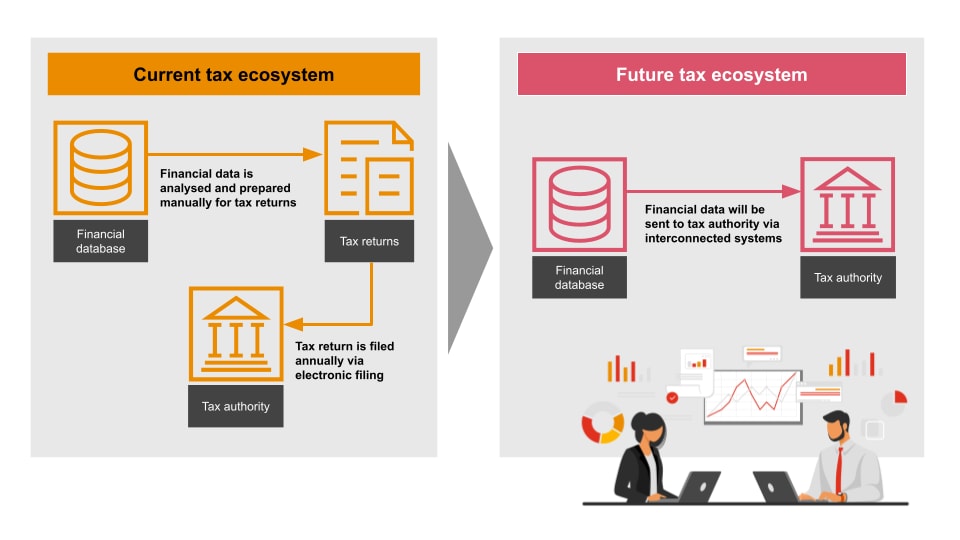

Most tax ecosystems leverage checks and balances being carried out (often manually) by taxpayers before being submitted electronically (example of Tax Administration 2.0). However, aspirations to move to an ecosystem where tax data can be sent to the tax authorities via interconnected systems (example of Tax Administration 3.0), are dependent on data quality. These instances are illustrated below:

An example of a country moving in this direction is Singapore, in which the No-Filing Service (NFS) was introduced by the Inland Revenue Authority of Singapore (IRAS) in 2021. Through this scheme, individual taxpayers are only required to verify the accuracy of the pre-populated figures, without having to file any tax returns on their end.

Malaysia is embarking on real time tax data transmissions electronically through e-Invoicing and the upcoming Malaysian Income Tax Reporting System (MITRS) from the year of assessment 2025 (beyond electronic filing).

All roads lead to data, and hence clear data handling rules and connected tax ecosystems are necessary for a comprehensive and complete set of data, which in turn increases the confidence and levels of comfort in making tax disclosures. This is where we note more companies leveraging activities such as e-Invoicing, finance or digital transformations to embed more tax controls into natural systems in an organisation.

Connecting the dots - Tax data collection (e.g. e-Invoicing) and TCG

On 1 August 2024, many large companies based in Malaysia (with revenue of RM100 million and above) transitioned to e-Invoicing, whilst handling Transfer Pricing Documentation and Pillar 2 compliance. This journey involved understanding data requirements, locating e-Invoice data, and ensuring real-time validation by the MIRB. Consequently, companies have enhanced core systems and adjusted Accounts Payable (AP) and Accounts Receivable (AR) processes to capture accurate data. This is an example of how to embed tax into natural systems in an organisation. Such changes facilitate a smoother transition for ‘going digital,’ whilst improving efficiency and transparency in tax reporting.

Leveraging e-Invoicing activities to embed tax controls

Based on our observations from supporting Wave 1 taxpayers for the 1 August 2024 e-Invoicing transition in Malaysia, it was clear that embedding tax requirements into everyday processes helps organisations gain real-time visibility over transactions, reduce manual intervention and ensure compliance with tax regulations. By addressing these areas, taxpayers can ensure a smooth and compliant transition to the e-Invoicing environment as well as other tax reporting obligations:

Data accuracy: Ensuring transmitted financial data is precise and compliant.

Timely reporting: Meeting deadlines to avoid penalties.

System integration: Seamlessly linking e-Invoicing with existing accounting systems.

Data security: Protecting sensitive information during transmission.

For instance, common scenarios where tax controls could be embedded by taxpayers to enhance data transmission:

| Scenario | Considerations to enhance tax controls |

Advance payment / deposits |

|

Timing of data transmission |

|

| Business model of consignment/drop shipment |

|

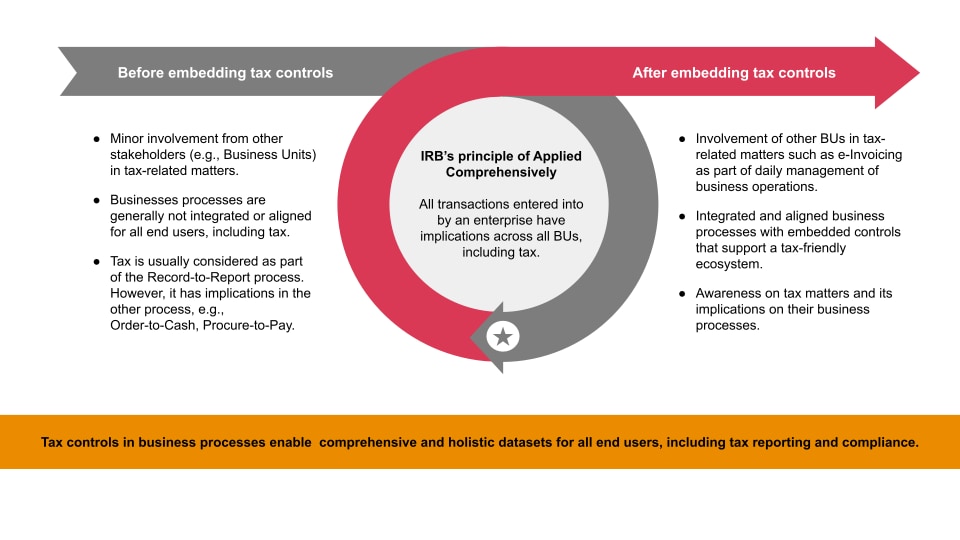

These tax controls involve coordination among various stakeholders and across the full range of an organisation’s activities, aligning with the ‘Aligned Comprehensively’ principle of the TCG framework. Under this principle, the IRB expects that tax controls are embedded within and integrated into business processes. Further details of how this principle will be able to enhance TCG in your organisation are outlined in the diagram below (discussed in our earlier blog).

This principle is one of the six key TCG principles and with adequate tax controls, taxpayers will be able to enhance their tax reporting ecosystem and subsequently, build levels of comfort in making tax disclosures. This is a result of having adequate data to support the disclosures made.

Leveraging other initiatives and activities to embed tax controls

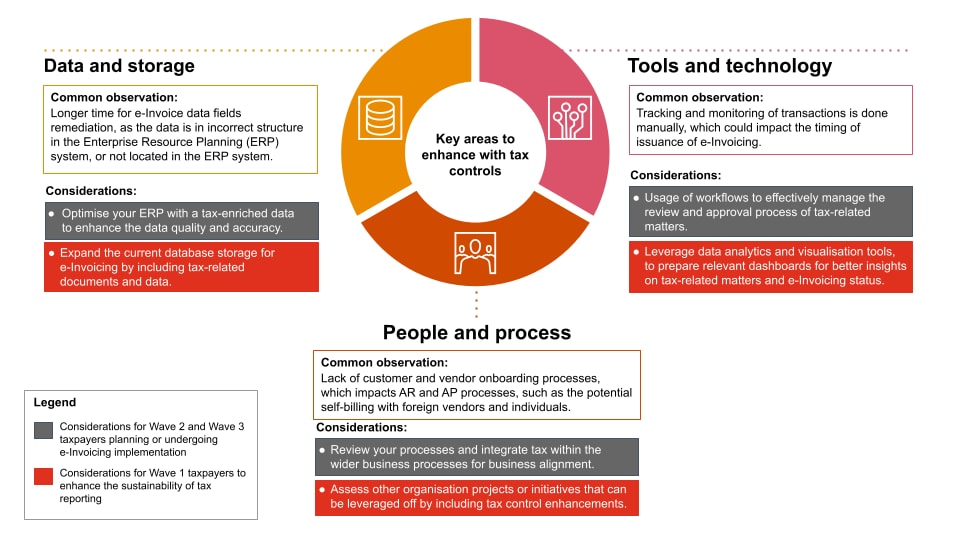

The demand to do more with less is a challenge for finance and tax professionals, who are facing expanding responsibilities, tighter resources and growing compliance requirements. In this environment, it is crucial to find opportunities to collaborate and leverage existing initiatives, such as enterprise wide transformation, enterprise resource planning (ERP) transformation, compliance and risk reviews, amongst others. All these activities already consider the data requirements, tools in use, process and people to ensure it is successfully rolled out, making it easier to embed tax controls without adding significant strain on resources.

Based on our observations, the following are some of the key areas and considerations for taxpayers to enhance their tax controls and tax data management.

Conclusion

Robust tax controls and the TCG programme ensure data excellence, which is key to confident tax reporting. With global trends increasingly leaning towards e-Invoicing (e.g. Australia, Malaysia, Vietnam and others coming on board like Singapore), we can observe that accurate tax-enriched data builds trust and transparency with tax authorities and stakeholders.

For Malaysia, we can expect further refinements and updates to e-Invoicing ahead of the full implementation by 1 July 2025. Whilst there are concessions provided to taxpayers for e-Invoicing compliance, this is the right opportunity to embed any tax controls and optimise the system prior to the end of the concession period. This is to ensure a smooth and seamless experience for your e-Invoicing journey.

Previously from Budget 2024, there were tax deductions given for activities relating to e-Invoicing and the TCG programme. Ahead of Budget 2025, you may want to consider these elements within your annual budgeting as part of enhancing your tax functions and organisations. In addition, it will be beneficial to anticipate any reporting obligations or wider sustainability initiatives that may be applicable to you and prepare accordingly by considering the following:

Is your data tax-enriched and friendly for tax reporting purposes?

Do you need further refinements to your processes and infrastructure once the concession period ends?

Is your ERP scalable and can it be optimised to enhance effectiveness for tax purposes?

Let’s connect to assess your readiness for a data-led, technology-enabled taxpayer-authority cooperation.

Contact us