Authors

Is your organisation ready to be onboard e-Compliance? In our previous blog, we shared that the evolution from e-Invoicing to e-Reporting and eventually e-Auditing is not far off on the horizon, and organisations should have game plans to embark on an e-Compliance journey. In this blog, we will share the global trends on e-Compliance and some insights on how to strengthen your foundation to be ready for take off in the e-Compliance space.

Global trends on digitalisation transformation

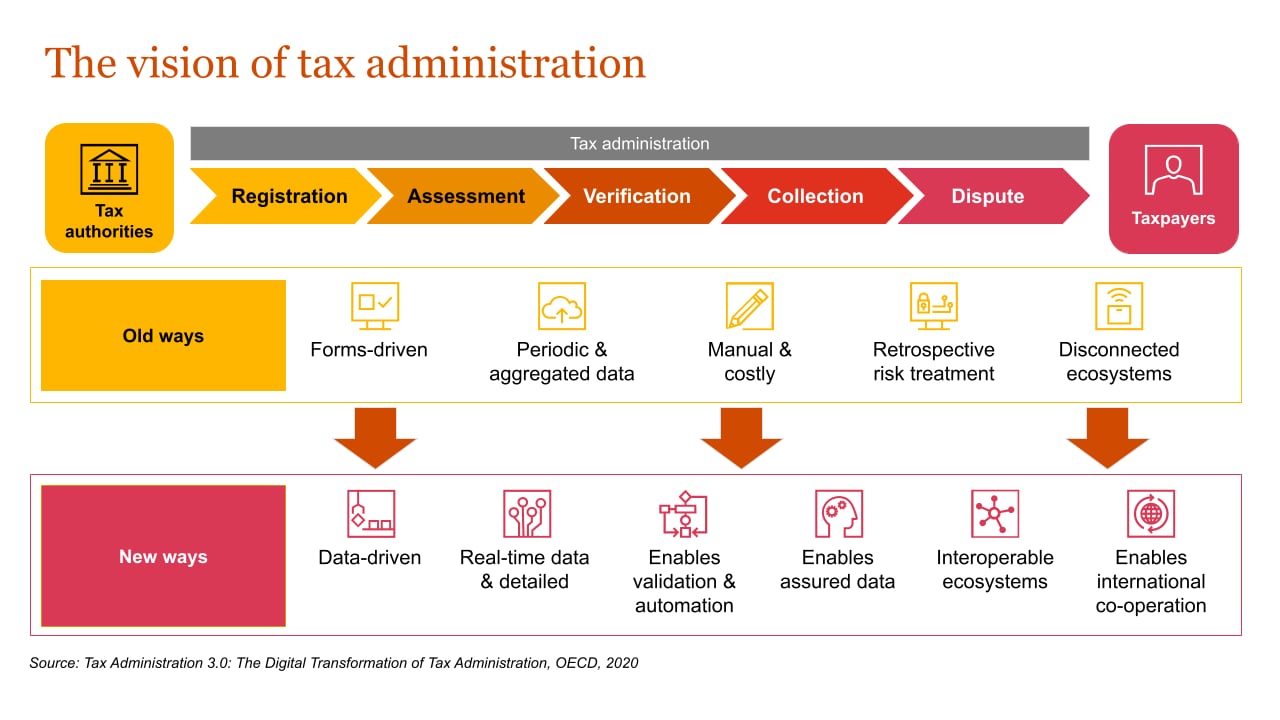

To better understand global trends, it is worth understanding the vision for tax administration by the Organisation for Economic Co-operation and Development (OECD) as they seek opportunities to harmonise the interoperability of systems between jurisdictions to promote adoption of digitalisation.

As part of digital transformation to achieve this vision for tax administration, here are the core elements of the transformation:

1) Taxpayer touchpoints - How the taxpayers engage with tax administration and governments

2) Embedded within the taxpayer natural system - Taxpayers will have a more seamless experience over time through more integrated networks/systems, where there will no longer be a single point of data processing and tax assessment

3) Building blocks - Includes Digital Identity, Data Management and Standards, Tax Rule Management and Application, New Skill Sets and Governance Frameworks to create an interoperable ecosystem to enable validation and automation of data and data flows

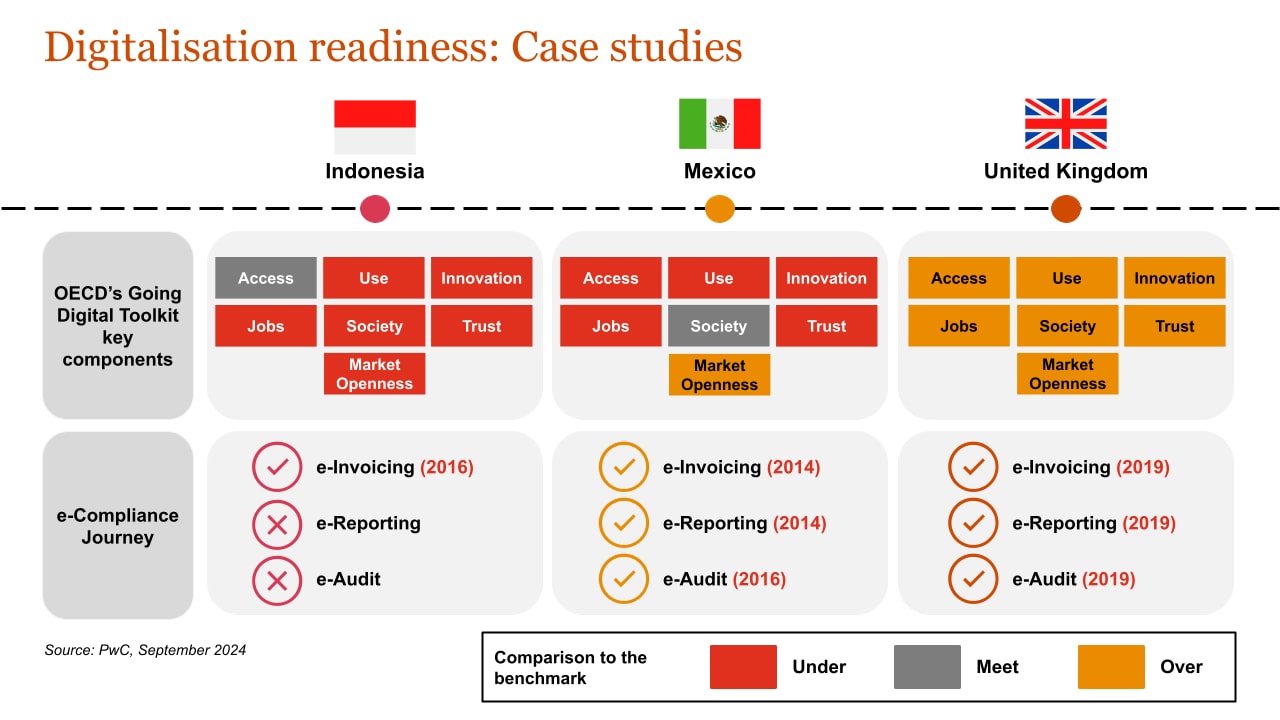

Items 1) and 2) will be looking at readiness of the countries’ infrastructure and networks available to foster the transformation. Item 3) will be focusing more on the structure and framework of the various organisations’ perspectives to further bring 1) and 2) to life. However, as one size cannot fit all and OECD does acknowledge that the burning platform has limitations in terms of differences in digital footprints by country and by region. In response, the OECD has developed a Going Digital Toolkit to help countries assess their state of digital development and formulate policies in response around the 7 dimensions (see below for details):

Access to communications infrastructures, services and data

Effective use of digital technologies and data

Data-driven and digital innovation

Good jobs for all

Social prosperity and inclusion

Trust in the digital age

Market openness in digital business environments

Malaysia is currently not listed in the Going Digital Toolkit. To study the digital readiness of a cross section of economies from different parts of the world, we made a comparison between the following three countries (Indonesia - our neighbour, Mexico - a model country for e-Invoicing and United Kingdom - a country with a higher score compared to the benchmark):

Based on the above study, it is worth noting that digital transformation readiness in several economies may not be on par with the OECD’s benchmark, but the adoption of e-Invoicing, e-Reporting and e-Audit by tax authorities is gaining momentum worldwide. This shift is driven by the need for increased transparency, reduced tax evasion, and streamlined tax administration processes.

An example that can be used as reference, the CFDI (Comprobante Fiscal Digital por Internet, Mexico e-Invoicing) has been a success, where the CFDI system led to improved tax collection, reduced tax evasion and streamlined business operations. The real-time access to transaction data allows tax authorities to scrutinise tax collection which leads to more frequent audits and tax inspections. The CFDI continues to evolve to collect more information (the sale price for mergers and acquisitions transactions for instance) via enhanced functionality for a comprehensive and detailed view of economic transactions.

Strengthening the foundation

Many organisations have gone through a robust transformation to meet the e-Invoicing requirements. While companies have put in some measures to meet the short timeline, however, these are not for the longer term. Organisations have to think outside the box, and plan for the longer term to sustain themselves through this new way of tax compliance and in meeting the e-Reporting/e-Audit requirements. The Vision of Tax Administration 3.0 is focusing on data driven innovation, embedded in natural systems, meaning tax authorities no longer rely on one source - your statutory account or tax return to determine your tax liability. There are more accesses to different data points going forward for them to reassess your tax liability. Therefore, as a good start, organisations need to reassess their strategy. The diagram below demonstrates how taxpayers could get ready to be aligned with the Inland Revenue Board Malaysia (IRBM)'s Corporate Plan on Tax Administration.

How far is Malaysia from the e-Compliance space?

There is no single definition of what e-Compliance is currently. We anticipate that Malaysia may follow in the footsteps of other countries that have implemented e-Compliance processes like e-Auditing and e-Reporting. It's essential to look towards a 5 - 10 year horizon in rethinking the tax function's value proposition, to get ready for this evolution.

We can reimagine the impending journey ahead in a digitalisation process of tax compliance, which consists of the four dimensions below:

Based on our research, we noted that 66.67% of countries in the world have already implemented e-Invoicing and 15.38% is on Peppol, a network or framework used for the secure transfer and retrieval of electronic business documents, now mainly used in e-Invoicing. 13.85% of the countries have embarked on e-Reporting, which is typically a complementary process of e-Invoicing, where tax related data enables tax authorities to auto-calculate simple corporate tax returns or to be used more frequently in VAT/GST tax returns. 9.74% of countries have implemented e-Audit, using the Standard Audit File for Tax Purposes (SAFT-T). It is an international standard for electronic exchange of reliable accounting data from an organisation to tax authorities or external auditors. This standard is now increasingly adopted within European countries as a means to file tax returns electronically.

Looking at the bigger picture, countries around the globe have implemented e-Reporting or e-Auditing in various forms. Some countries combine the two. e-Reporting in France requires taxpayers’ declaration of information on transactions not included in the electronic invoice, which is not limited to domestic B2C (Business to Consumer) transactions and international B2B (Business to Business) transactions, but also payment information for specific transactions. There is a greater expectation on the digitalisation of tax administration to create more opportunities to make tax compliance simpler and less burdensome for taxpayers, resulting in less errors and more accurate tax collections for tax authorities.

A research effort by TA Securities projects that tax collection from e-Invoicing can reach RM260 billion or more in 2025 based on the assumption of 8% growth from 2024. Preparation is key for greater levels of digital transformation from the Malaysian tax administration in the next few years.

There are expectations for the Malaysian government to reintroduce the goods and services tax (GST), which will easily integrate the process with e-Invoicing. The process of generating the e-Invoice under Tax Reporting after the potential reintroduction of GST may look like this:

Getting ready to venture into the e-Compliance space

Both the OECD Tax Administration 3.0 and IRBM’s Corporate Plan 2021-2025 clearly demonstrate that we are not too far from e-Compliance. We can see ongoing efforts to move towards e-Compliance, where tax authorities are looking to integrate the business process with tax processes and move taxation closer to taxable events. Clearly this demonstrates the importance of embedding the Tax agenda into the enterprise-wide strategy and operation to make this happen. As you prepare for the future of e-Compliance, consider the following:

Does the organisation have a game plan to enhance and integrate their current business and tax strategy to keep up with the IRBM's pace of transformation?

How does your organisation manage the risks of multiple touch points of digital data? What are the tax controls available in terms of tax rules applied on tax treatments?

Have you upskilled your tax/finance personnel with new skills, including environmental, social and governance (ESG) issues, tax risk management frameworks and internal tax controls?

Does your organisation have short and long term investment plans for systems and digital tools for integration or to meet the requirements of e-Compliance?

The future of tax compliance is digital. Tax functions cannot remain status quo amid expectations to stay relevant. Reassessing your tax function’s value proposition for the next 5-10 years is very important. Are you ready for what’s next?

Let's chat

Contact us