The legacy of GST: Closure audits

The reintroduction of the Sales and Services Tax (SST) has kept corporates across Malaysia busy for the last three months or so.

November 2018

By Pauline Lum, Tax Executive Director, PwC Malaysia

Organisations are innovating to remain relevant in a digital and borderless space. This results in greater demands for more support from their internal functions, including Tax, to be strategic partners of the business in light of increased transparency and exchange of information by regulatory bodies. Tax authorities have also been levelling up by harnessing technology and transforming the way they regulate and collect taxes. As a result, there is increased scrutiny in how tax risk is managed by more stakeholders.

Our last series of blogs focused on identifying the maturity level of your tax function, as a starting point for you to design a blueprint to level up. In this series, we will examine the foundations and building blocks necessary for a sustainable tax function to meet tax reporting requirements of the future.

Building your dream house starts with a strong base and design to ensure that it weathers the ever-changing environmental conditions. Before any work begins, you need to take stock of the house to assess what has to be replaced or enhanced.

Levelling up a tax function is no different. Identifying the level of maturity helps define the journey and changes required in the building blocks (outlined below). Clarity and alignment with the organisation’s overall strategy and vision is important to ensure that everyone is moving in the same direction. Leveraging enablers such as Technology and Performance Metrics allow a sustainable blueprint to be designed and executed.

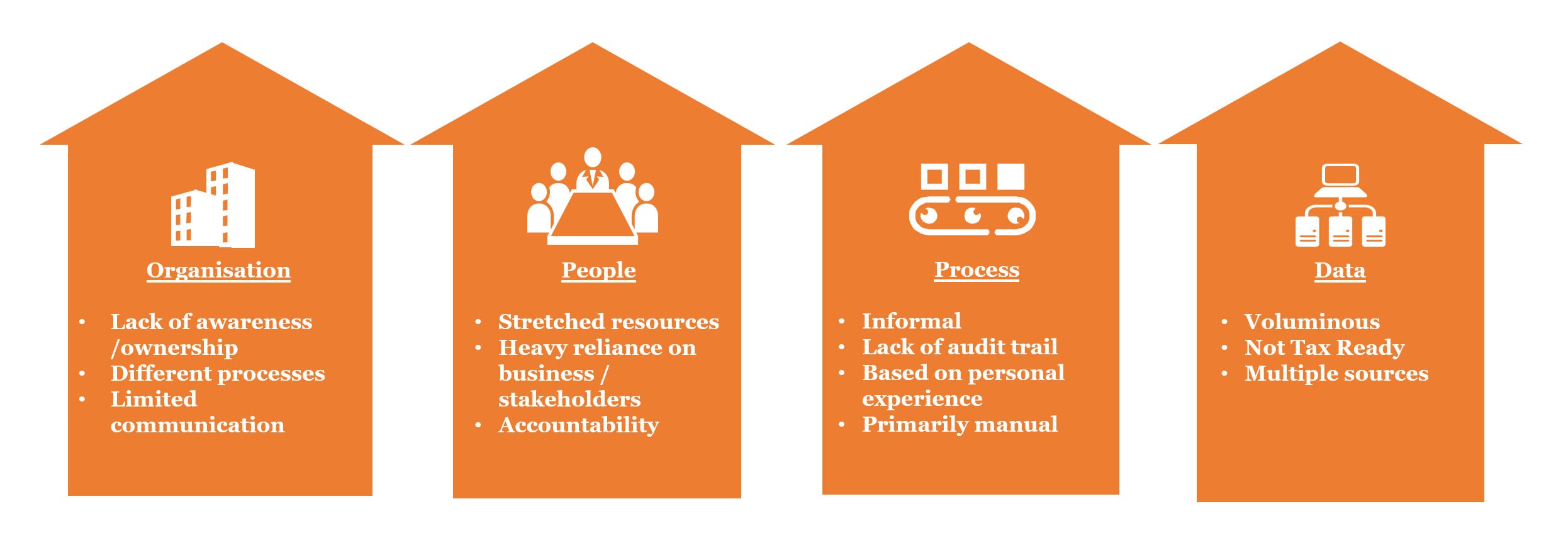

Changes made in isolation are less effective due to lack of awareness and alignment of processes to meet the needs of all parties involved. Common challenges faced by organisations may include the following:

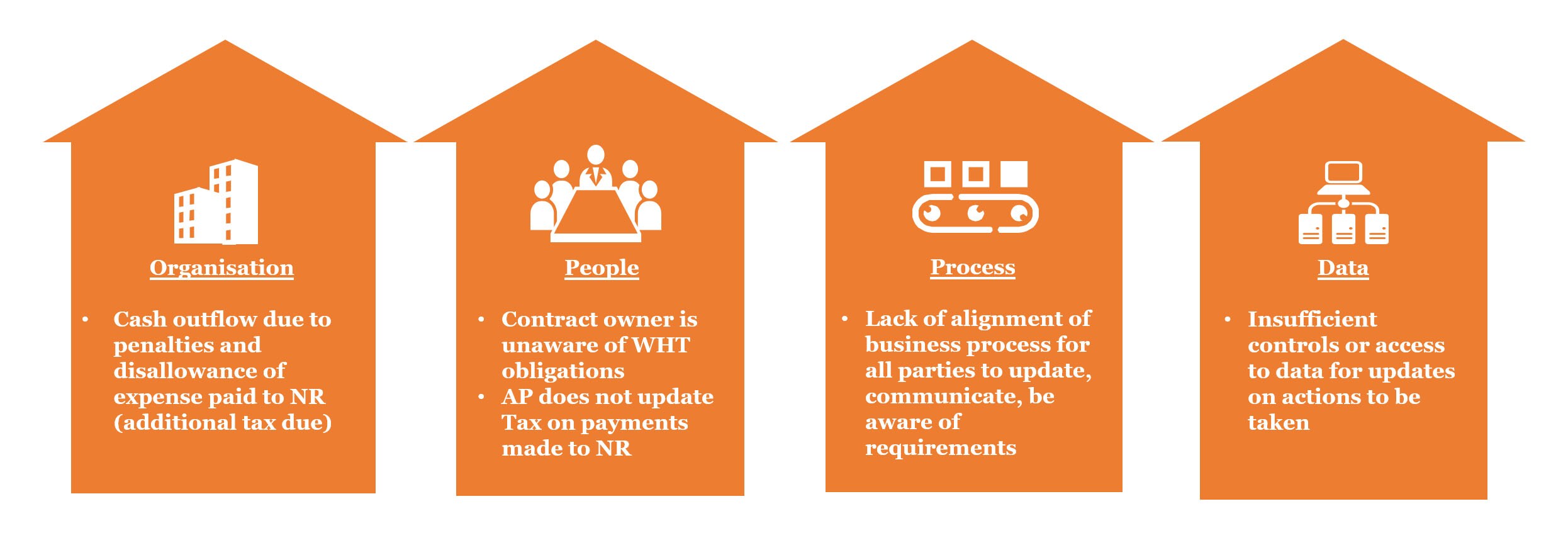

For example, unnecessary cash outflow due to non-compliance of Withholding Tax (WHT) obligations through penalties as well as a disallowance of expense paid (in Malaysia) to the Non Resident (NR) are common. This is often due to the lack of alignment of processes and communication by all parties (i.e. contract owners, accounts payable (AP) and tax personnel) involved in WHT management.

If so, then it is time to take a step back to reassess, redefine and then redeploy your tax approach. Much like building or renovating a house, you need to establish what the current framework and foundation is to establish what needs to be done. In our next two blogs, we will delve deeper into the building blocks (i.e. Organisation, People, Process and Data) and enablers (i.e. Technology, Performance Metrics) for a strong foundation capable of weathering the conditions.

Taking the first step to dealing with your tax challenges of tomorrow, starts today - Let’s chat.