Work your working capital

March 2019

By Ganesh Gunaratnam, Working Capital Management Leader, PwC Malaysia; and Krishna Chaitanya Seela, Deals Associate Director, PwC Malaysia

As disruption continues to turn industries on their heads, it is no surprise that companies are looking at various ways to raise additional capital for their business. Servicing debts and day-to-day operations can put a lot of strain on a company’s cash flow.

Methods of raising capital could include relying on loans or funds from investors. But are companies making the right calls and thinking long term? Or are they actually making quick fixes that may prove counter-productive in the long run?

It’s also worth pointing out that getting access to external sources of funding may not always be so straightforward. We believe there’s no better time than now for companies to start looking inwards to raise or free up cash.

Managing working capital efficiently for improved cash flow

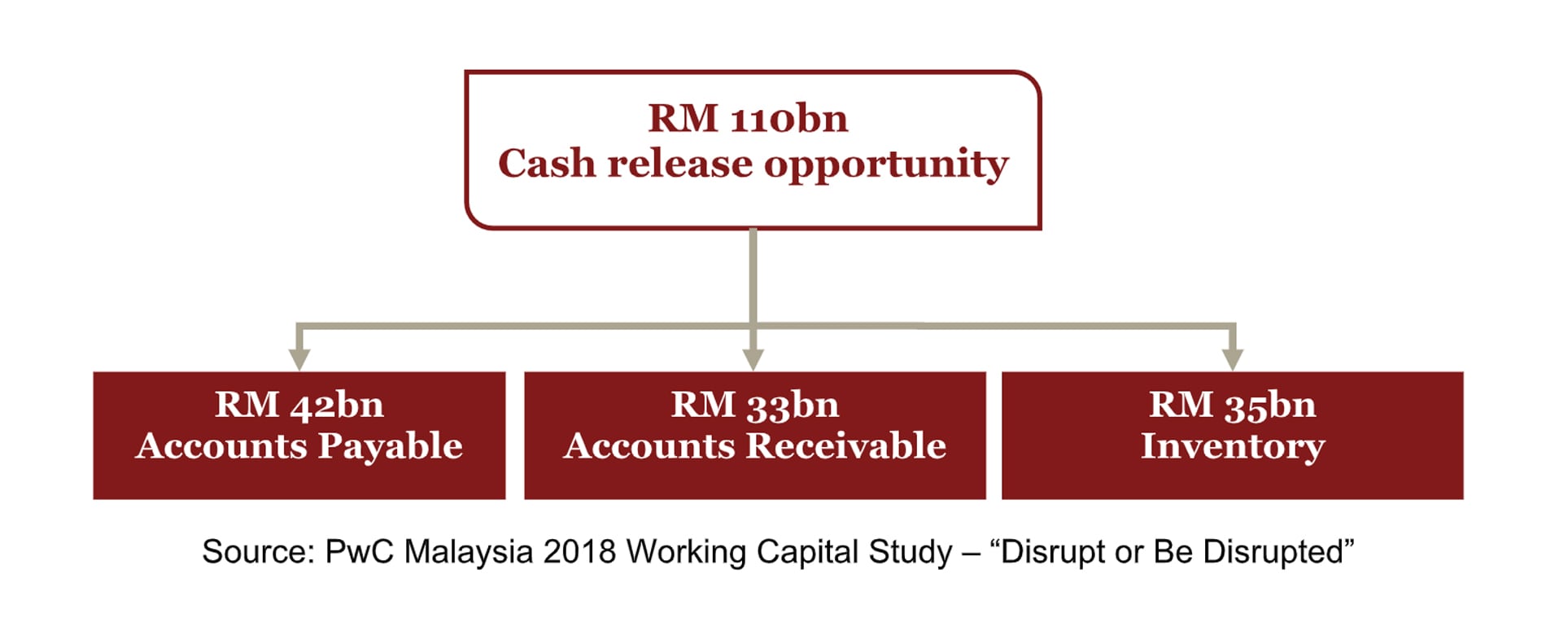

PwC’s 2018 Malaysia Working Capital Study, which analysed over 400 companies across 14 sectors listed on Bursa Malaysia, reveals some interesting findings. Malaysian companies have a total of RM110bn of cash trapped on their balance sheets, resulting in the loss of significant opportunities. Thankfully, there are solutions to free up this cash.

By focusing on their internal operations, companies can tap into the cheapest source of cash available - working capital. It’s critical for working capital to be managed holistically, or companies may risk losing out on opportunities for cost savings or face potential cash-flow issues.

So how well are Malaysian companies managing their working capital?

Our report highlights that the struggle is real for Malaysian companies when it comes to improving their working capital performance. Their net working capital (NWC) days1 remain at a 4-year high of 56 days.

The good news is that the deterioration of NWC days has levelled off after three continuous years of poor performance. This can be attributed mainly to the significant improvement in inventory management. Twelve out of the fourteen sectors studied experienced an improvement in their Days Inventory Outstanding (DIO) levels. Engineering and Media & Telco were the only sectors where DIO levels increased. This indicates that most companies are managing their inventory well, helping them release cash from their working capital to some extent.

The bad news – Malaysian companies seem to make short-term decisions when it comes to managing their working capital and cash flows. Of all the three working capital components (i.e. accounts receivables, accounts payables and inventory), most companies would choose to stretch their payables. In fact, this trend has been consistent since 2016, with about 60% of the companies studied doing so.

While stretching payables may seem like the easiest way to improve working capital, what many fail to realise is that it rarely delivers long-term gains.

The fact is that stretching payables could potentially threaten the supply chain, notably resulting in the possibility of suppliers failing due to cash flow issues. The unpredictability of today’s business environment only accentuates this risk.

Our report found that Malaysian companies are also not managing their accounts receivables as effectively as they should, with their receivable days recording a 4-year high of 59 days in 2017.

What’s alarming, is that 70% of the companies studied had higher receivable days compared to payable days (i.e. they pay faster than they collect). This tells us that in order to unlock cash flow, a more efficient management of billing and collecting payments is needed.

Getting on the road towards long term gains

We recommend several approaches to help you free up cash from your balance sheet, which will prove advantageous to you in the long run.

- Leveraging on Supply Chain Finance

Adopting innovations such as Supply Chain Finance (SCF) can help you manage your accounts payable in a much more sustainable way. Also known as ‘reverse factoring’, SCF allows businesses to lengthen their payment terms to their suppliers, while giving their suppliers the option to get paid well ahead of the invoice due date. In most instances, no collateral from suppliers/buyers is needed, as SCF relies on the buyer’s credit rating instead. This would help improve not only your working capital, but also the relationship with your suppliers and the overall stability of the supply chain.

- Improving the ‘Source to Pay’ process

Our report found that of the RM110bn cash release opportunity, RM42bn comes from better accounts payable management. That should be reason enough for companies to seriously look into how they can improve their ‘Source to Pay’ process. From our experience, implementing niche procurement solutions, Robotic Process Automation (RPA) or Strategic Cost Reduction programmes have often delivered great results, improving a company’s operational efficiencies. This would ultimately help reduce cost and increase profitability.

- Optimising the management of your accounts receivables (AR)

Equal attention should be placed on improving a company’s receivables process. We’ve found that carrying out system-driven process interventions, defining roles and responsibilities, and setting up a central AR governance structure will enable companies to reduce their ‘Days sales outstanding’ (DSO), leading to a sustainable improvement to the overall process. Companies should also revisit their contractual terms & collection strategies, and set up a strong credit risk appraisal process with pre-defined credit limits. This ensures a timely collection of payments, and prevents cash outflow from exceeding cash inflow.

- Embracing Industry 4.0

While the companies analysed fared better in their inventory management, there could be opportunities for further improvement with the help of Industry 4.0. For example, by digitising processes through the implementation of machine learning, companies would be able to gain valuable insights and visibility on their inventory. This real-time visibility and dynamic demand forecasting can help optimise the safety stock requirements and ensure excessive cash is not locked up as inventory.

Don’t leave cash on the table

We’ve seen several successful global companies – especially those in the retail industry – already reaping the benefits of utilising technology and a well-managed ‘Source to Pay’ process to manage their operations and working capital. It has allowed them to react quickly to market trends, while enabling them to add innovative products to their portfolio, giving them an edge over their competitors.

In a nutshell, companies in Malaysia should start adopting a more holistic approach to address their cash flow issues. While there may be some teething issues in the beginning, the journey will be worth it as it moves companies away from being dependent solely on investors or loans for capital. Because the cash is there. It’s just a matter of ensuring it’s accessible when you need it.

The last thing you’d want is to leave RM110bn on the table.

1 The time it takes companies to convert working capital to cash

Did you find this blog helpful? Yes | No

Keep up-to-date with the latest blog posts via RSS

Contact us

Krishna Chaitanya

Deals Senior Manager, Working Capital Management, PwC Malaysia

Tel: +60 (3) 2173 5399