Derivation

Employment income is regarded as derived from Malaysia and subject to Malaysian tax where the employee:

exercises an employment in Malaysia,

is on paid leave which is attributable to the exercise of an employment in Malaysia,

performs duties outside Malaysia which are incidental to the exercise of an employment in Malaysia,

is a director of a company resident in Malaysia, or

is employed to work on board an aircraft or ship operated by a person who is resident in Malaysia.

Exemption (short-term employees)

Income of a non-resident from an employment in Malaysia is exempt:

if the aggregate of the period(s) of employment in Malaysia does not exceed 60 days in a calendar year, or

where the total period of employment which overlaps two calendar years does not exceed 60 days.

Employees of regional operations

Non-Malaysian citizens who are based in Malaysia and working either in an Operational Headquarter, Regional Office, International Procurement Centre, Regional Distribution Centre or Treasury Management Centre status company would be taxable on employment income attributable to the number of days they exercise employment in Malaysia.

Types of employment income

| Type of employment income | Taxable Value |

| Cash remuneration, e.g. salary, bonus, allowances / perquisites | Total amount paid by employer. Certain allowances / perquisites are exempted from tax. Refer to “Perquisites” below |

| Benefits-in-kind, e.g. motorcar and petrol, driver, gardener, etc | Based on formula or prescribed value method. Certain benefits are exempted from tax. Refer to “Benefits-in-kind” below |

| Housing accommodation (unfurnished) | |

employee or service director |

Lower of 30% of cash remuneration* or defined value of accommodation |

directors of controlled companies |

Defined value of accommodation |

| Hotel accommodation for employee or service director | 3% of cash remuneration* |

| Withdrawal from unapproved pension fund | Employer’s contribution |

| Compensation for loss of employment | Total amount paid by employer. Exemption is available under specified conditions |

* Cash remuneration does not include equity-based income

Perquisites

Below are examples of taxable perquisites:

| Perquisites | Taxable Value |

| Petrol card / petrol or travel allowances and toll rates | Total amount paid by employer. Exemption available up to RM6,000 per annum if the allowances / perquisites are for official duties* |

| Care subsidies / allowances for children, parents and grandparents | Total amount paid by employer. Exemption available up to RM3,000 per annum* |

| Parking fees / allowances | Fully exempted* |

| Meal allowances | Fully exempted* |

| Interest on loan subsidies | Loans totalling RM300,000 for housing / passenger motor vehicles and education* |

| Income tax borne by employer | Total amount paid by employer |

| Award | Total amount paid by employer. Exemption available up to RM2,000 per annum for the following types of award:*

|

* Exemptions are not extended to directors of controlled companies, sole proprietors and partnerships

Benefits-in-kind (BIK)

The value of BIK provided for an employee may be determined by either of the following methods:

formula method, or

prescribed value method

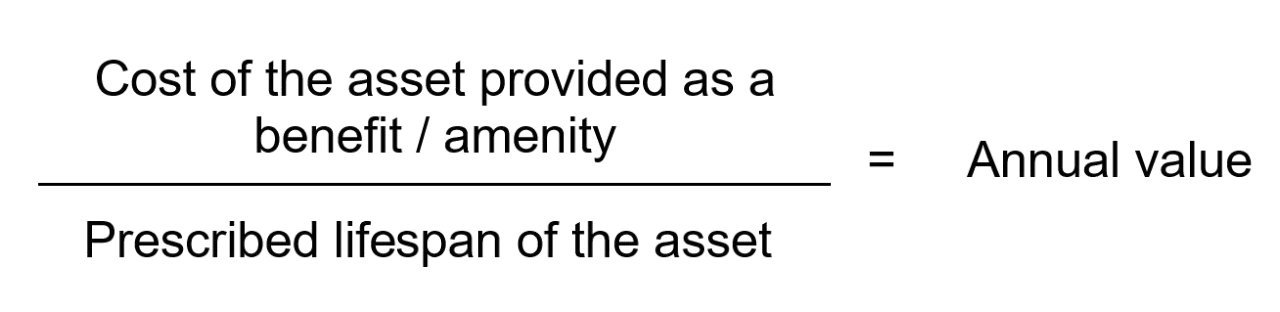

Under the formula method, the annual value of BIK provided to an employee is computed using the following formula:

The prescribed lifespan for various benefits are as follows:

| Benefits-in-kind | Prescribed average lifespan (Years) |

| Motorcar | 8 |

| Furnishings: | |

Air-conditioner |

8 |

Curtains and carpets |

5 |

Furniture |

15 |

Refrigerator |

10 |

Sewing machine |

15 |

Kitchen utensils / equipment |

6 |

| Entertainment and recreation: | |

Organ |

10 |

Piano |

20 |

Stereo set, TV, video recorder, CD / DVD player |

7 |

Swimming pool (detachable), sauna |

15 |

Miscellaneous |

5 |

Under the prescribed value method, the following are some prescribed values of BIK:

Benefits-in-kind |

Value per year |

| Household furnishings, apparatus & appliances: | |

Semi-furnished with furniture in the lounge, dining room and bedroom |

RM840 |

Semi-furnished as above and with air-conditioners or carpets or curtains |

RM1,680 |

Fully furnished |

RM3,360 |

Service charges and other bills (e.g. water, electricity) |

Charges and bills paid by employer |

| Prescribed value of other benefits: | |

Driver |

RM7,200 per driver |

Domestic servants |

RM4,800 per servant |

Gardeners |

RM3,600 per gardener |

Corporate recreational club membership |

Membership subscription paid by employer |

The following are some exemptions for certain BIK:

| Benefits-in-kind | Exemption |

Leave passages

|

|

| Employer’s goods provided free or at a discount* | Exemption up to RM1,000 per annum. |

| Employer’s own services provided free or at a discount* | Fully exempted |

| Maternity expenses & traditional medicines* | Fully exempted |

| Telephone (including gift of a mobile telephone), telephone bills, pager, personal data assistant and broadband subscription* | Fully exempted, limited to one unit for each asset |

| Smart phones, personal computer, and tablets* | Exemption up to RM5,000 |

* Exemptions are not extended to directors of controlled companies, sole proprietors and partnerships.

Standard rates for motorcar and fuel provided:

| Cost of car (when new) (RM) | Annual prescribed benefit | |

| Motorcar (RM) | Fuel* (RM) | |

| Up to 50,000 | 1,200 | 600 |

| 50,001 – 75,000 | 2,400 | 900 |

| 75,001 – 100,000 | 3,600 | 1,200 |

| 100,001 – 150,000 | 5,000 | 1,500 |

| 150,001 – 200,000 | 7,000 | 1,800 |

| 200,001 – 250,000 | 9,000 | 2,100 |

| 250,001 – 350,000 | 15,000 | 2,400 |

350,001 – 500,000

|

21,250 | 2,700 |

| 500,001 and above | 25,000 | 3,000 |

* Employee is given a choice to determine fuel benefit based on annual prescribed rates or exemption available for petrol usage

Collection of tax

Taxes are collected from employees through compulsory monthly deductions from remuneration by the 15th of the following month under the Monthly Tax Deduction (MTD) system.

Total remuneration including BIK and value of accommodation provided to employees is subject to MTD.

Individuals receiving non-employment income are required to pay by compulsory bi-monthly instalments.