Greater quality growth

The first pillar in our four year strategy is to achieve Greater Quality Growth throughout our business. Our plan is two fold: digitilise our business and leverage on technology to be more efficient; and grow non-audit services across all Line of Services.

1. Create efficiency and agility internally by digitilising our business

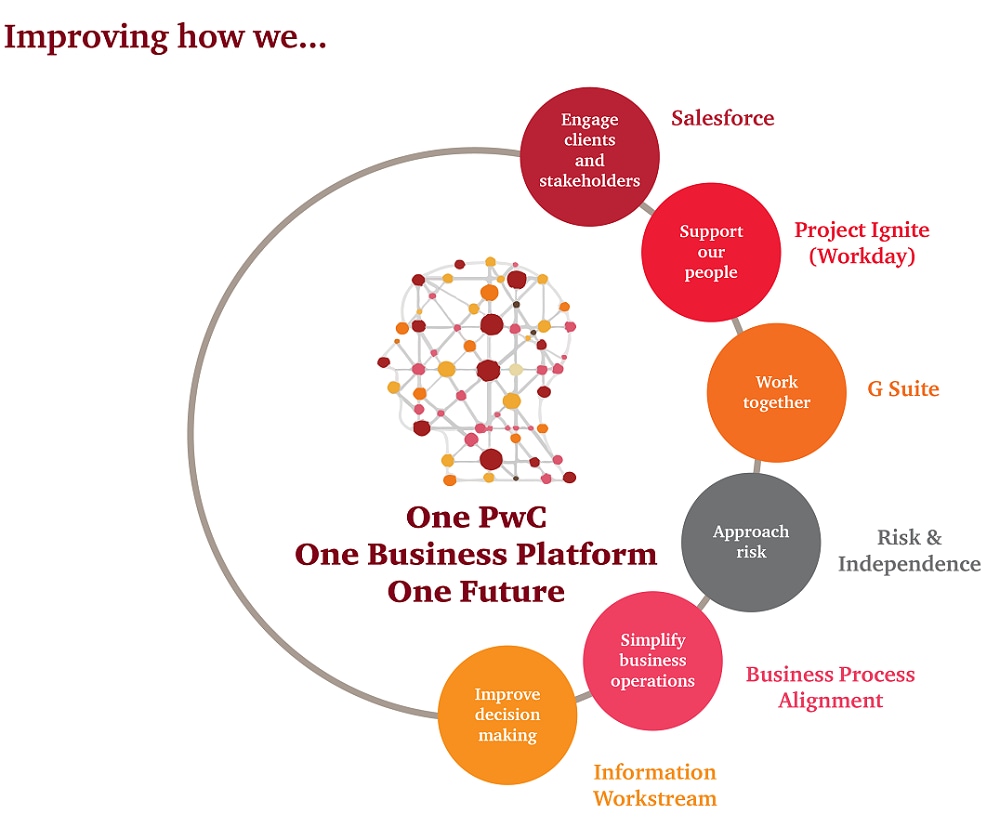

Globally, PwC has embarked on a journey to create the capabilities we need to work as ‘One PwC’ and make it easier to work with each other and our clients. This will be achieved by aligning and standardising our business operations processes and technologies, across the 158 territories in the PwC network.

PwC's Business Operations Solutions Programme (BOS) will enable us to change how we support our people and work together through these cloud solutions : Salesforce, Workday, G Suite and Business Process Alignment.

The outcomes we want from this change are:

- An improvement to our people and client experience. Our people and clients want to have access to the best thinking and tools to be more effective, mobile and agile.

- The ability to operate faster in an increasingly globalised world. Both our clients and our people expect PwC to operate seamlessly with one another and without borders.

- A transformation of our digital capabilities. Process and technology standardisation will allow us to be ready for change and adapt to any innovation or disruption that comes our way.

PwC Malaysia aims to deploy G Suite and Workday in 2018. We are currently implementing significant ground work for go-live in the second half of 2018. The other BOS components will be implemented at a later stage in Malaysia.

Apart from efforts to digitilise our business, we have also made an investment network-wide to establish a secure environment given increasing cyber threats around the world.

2. Grow our non-audit services across all Lines of Services

We offered several new services in 2017 in response to changes in the marketplace contributed by global megatrends such as digitisation. Explore the tabs below for more info.

Rising cybersecurity threats continue to disrupt the operations of many organisations. As cyberattacks become the ‘new normal’, companies will need to look at more effective ways to address these risks in order to stay “cyber resilient”. The rapid adoption of emerging technology such as artificial intelligence (AI) and machine learning in business has also seen companies recognising the need for a cyber risk management programme that is future proof - targeting threats from the increased adoption of these technologies.

Our cybersecurity professionals have assisted many of our clients to conduct a wide range of technical and non-technical assessments aimed at understanding the security posture of the organisation and formulating effective strategies to strengthen the organisation’s resilience towards cyberattacks. “Stress-testing” as a cybersecurity defence, using threat intelligence and scenario-based testing garnered the interest of financial institutions amidst growing threats in the market and increased regulatory demand. We are currently conducting these activities on a regular basis using the talents of our in-house certified ethical hackers.

Industries are starting to realise the need for a proper cyber response strategy championed by key decision makers of the company. They recognise that cybersecurity is not merely an IT issue.

Over the years, we have successfully helped many of our clients, including government agencies to develop, improve and test their cyber response plan through a series of cyber war games. This includes raising awareness of cybersecurity at the senior management level using our in-house interactive experiential learning platform – Game of Threats™

Contact us