{{item.title}}

{{item.text}}

{{item.text}}

To build trust, raise capital and drive sustainable growth today, some companies are starting to think more holistically about their strategies, activities, values and behaviours.

This more integrated thinking will help organisations communicate better with their stakeholders, provide a better picture of the organisation's worth and improve risk awareness as well as risk management.

And to achieve this, companies need to look beyond the current reporting model that’s rooted in past financial performance to give stakeholders a clearer, more forward-looking perspective on the business.

To build trust, raise capital and drive sustainable growth today, some companies are starting to think more holistically about their strategies, activities, values and behaviours.

This more integrated thinking will help organisations communicate better with their stakeholders, provide a better picture of the organisation's worth and improve risk awareness as well as risk management. And to achieve this, companies need to look beyond the current reporting model that’s rooted in past financial performance to give stakeholders a clearer, more forward-looking perspective on the business.

To build trust, raise capital and drive sustainable growth today, some companies are starting to think more holistically about their strategies, activities, values and behaviours.

This more integrated thinking will help organisations communicate better with their stakeholders, provide a better picture of the organisation's worth and improve risk awareness as well as risk management. And to achieve this, companies need to look beyond the current reporting model that’s rooted in past financial performance to give stakeholders a clearer, more forward-looking perspective on the business.

Check out this video to learn more about the growing awareness of integrated reporting among companies in Malaysia through the eyes of PwC Malaysia’s Managing Partner Sridharan Nair and Assurance Partner Pauline Ho.

Watch now.

The International Integrated Reporting Council’s (IIRC) Integrated Reporting Framework is a positive step that provides an opportunity for companies to start to assess and address connectivity across their business and to communicate more relevant information more clearly, without spin.

Designed around six capitals, it focuses on getting companies to describe their value creation in the short, medium and long term.

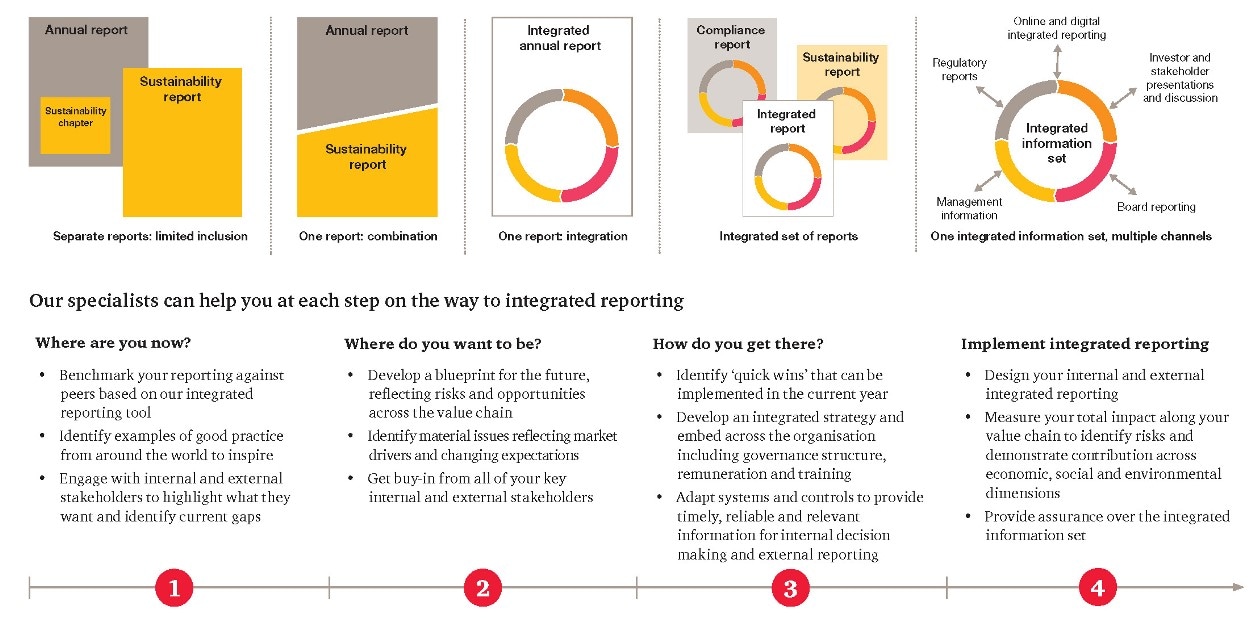

The framework allows companies to assess where they stand today, and what improvements they need to make going forward – a catalyst for integrated thinking and integrated internal and external reporting.

Challenges and questions remain. The Integrated Reporting Framework is a useful starting point, but companies also need to generate relevant and reliable information in the first place, and have an objective way of measuring their progress towards more integrated reporting.

Ask yourself…

{{item.text}}

{{item.text}}