Corridor Budgeting

An introduction to Corridor Budgeting

We may not always realise it, but we intuitively think and plan our future on the basis of ranges. We expect our next salary increase to be between 5% and 10%; our newly acquired property to achieve an average annual return of 4% to 7%; or our next family holiday to cost no more than one to two months’ salary.

"People generally understand that the future cannot be projected in exact forecasts," says Dominic Chegne, PwC Advisory Services Malaysia Executive Director who focuses on strategic planning and risk management. “Many of these uncertainties fade as time goes by.”

“It’s not only in our private plans that we associate with uncertainty," adds Tobias Flath, PwC Advisory Services Malaysia Associate Director, citing the fact that the further away a particular day is, the more unreliable the weather forecast would be. Conversely, the forecasts would be more precise – and the uncertainty narrower – the closer in time the event is.

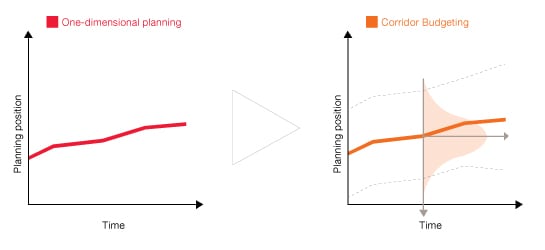

Many companies however, ignore uncertainties in their planning and come up with one-dimensional projections – e.g. “Next year, we expect sales growth of 3.5%”. The uncertainty is simply ignored – or at least until the planned and actual values are compared for the first time. “Then, all of a sudden, everyone’s surprised," notes Dominic.

The overall financial situation of a company or its business units can be quantified by taking into account the uncertainties in business planning. That’s why Dominic and Tobias believe "It’s time to shift gears from the forecasting of individual values to forecasting in the context of ranges. Decision makers need to learn to deal with uncertainty in planning."

Tobias urges companies to rethink how they conduct their planning, encouraging them to put existing data on uncertainties to good use.

A majority of companies are already looking at risks, yet, the information gathered from risk management is rarely integrated in business planning. But the advantages are obvious.

He points to current methods for integrating business planning and risk management, and the fact that future-oriented instruments are central to both. Ultimately, with the integration of business planning and risk management, the future will no longer be projected in fixed values, but in terms of ranges or “corridors”.

Minimum and maximum possible values form a corridor.

Experience has shown that actual values often deviate from the determined, forecasted values, especially in uncertain times. Deviations from forecasted values may be positive or negative. “We developed Corridor Budgeting to account for these fluctuations, in that it not only establishes an individual forecasted value, but also identifies possible deviations in both directions.

These upper and lower possible values form the corridor from which the concept’s name is derived", says Tobias, explaining the methodology.

“To make forecasts as accurate as possible, the company's uncertainties about future developments in various planning positions are compiled. The individual corridors are then synthesised in a visualisation of all possible scenarios using special software that takes into account mutual dependencies," says Tobias. Typically in Corridor Budgeting, the corridor becomes narrower as the target date approaches.”

“Corridor Budgeting produces a graphical representation whereby the corridor limits move further apart the more distant the observed time is. The graph line that runs in the corridor represents the initial management forecast. If this line lies in the middle of the corridor, management has been successful in coming up with a realistic forecast of next year’s revenues,” adds Dominic, as an example.

For the first time, management has access not only to a planned value with a measure of its precise probability, but also to information about the range and probability of all possible deviations and the related consequences.

Overall risk situations can be thoroughly quantified.

By accounting for uncertainties in business planning, a company’s overall risk situation and its individual business units can be quantified. This information provides answers to questions such as:

- Where is the uncertainty coming from?

- Which indicators should I monitor to recognise a downturn before it hits me?

- How much risk have I already exposed myself to, and how much risk can I actually take?

- How much latitude do I have before my credit rating or credit line is at risk?

- How would a strategic action affect the uncertainty?

- What is the best strategic option under uncertainty?

- Does a particular business unit get an adequate return given the risks and opportunities associated with it?

“For Corridor Budgeting to reach its full potential, however, there has to be a rethink on the part of all people involved. It’s time to shift gears from the forecasting of individual values to forecasting in the context of corridors. In order to make optimal decisions, decision makers need to learn to deal with uncertainty in planning. Everything else is just a game of chance," say Dominic and Tobias.