{{item.title}}

{{item.text}}

{{item.text}}

The asset and wealth management industry is shifting towards integrating environmental, social, and governance (ESG) factors for long-term value creation. ESG is now seen as a crucial driver of financial performance and positive societal impact.

With rising risks posed by global temperatures affecting our environment and communities, asset managers are more committed than ever to directing capital toward sustainable investments and embedding ESG principles into their corporate strategies.

ESG integration in your organisation demonstrates how you can leverage your expertise, resources, and capital to address some of the most pressing issues facing our planet today.

We realise that the call for action to integrate ESG has also resulted in significant challenges for asset managers with increasing uncertainty regarding how to respond to them including:

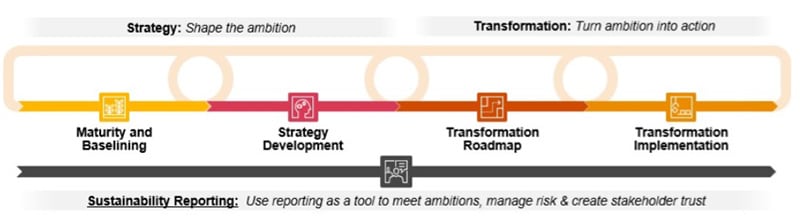

Amidst this backdrop of a constantly evolving ESG landscape, our committed team of ESG asset and wealth management specialists help clients put in place the right capabilities, skills and processes required to translate ESG strategy into execution.

We do not believe in a one size fits all approach for ESG and provide tailored services that suit the exact needs and business of our clients.

As sustainability and climate consequences emerge, companies are looking for ways to mitigate climate risk and build more resilient businesses. To thrive, asset managers need to deliver in the near-term while building long-term sustainable investment strategies. By understanding climate risks better, leaders can safeguard their business and identify opportunities to compete in a decarbonising world.

PwC has the right capabilities and services to support asset managers to mitigate risk while building business strategy that is equipped for the future.

As the world adapts and responds to an era marked by unprecedented environmental challenges, a global push towards decarbonisation has emerged as an imperative for businesses, governments, and companies. With its vast influence over global capital allocation and corresponding voting power, the asset management industry is uniquely positioned to play a pivotal role in facilitating the transition to a low-carbon economy. By integrating decarbonisation strategies into their investment processes, an asset manager can contribute not only to environmental sustainability, but also protect and enhance long-term shareholder value.

We offer bespoke services tailored to our clients' unique needs and business objectives.

With the global push towards Net Zero and increasing regulatory changes, the focus on an organisation’s ESG journey has increased. Stakeholders, especially investors, now expect robust ESG approaches. PwC’s 2022 survey revealed that three-quarters of institutional investors see ESG as part of their fiduciary duty, with 72% setting ESG-related goals for asset managers.

How well is your business adapting to a changing world? Whether your business should be sustainably minded is no longer a question, the challenge is how to get there effectively.

For many asset managers, hiring a full-time sustainability manager or team may not be feasible or cost-effective to meet ESG priorities and regulatory requirements. As a standalone support service, Sustainability Office as a Service (SOaaS) offers a flexible, tailored approach to sustainability that suits an organisation’s evolving needs.

In-depth analysis of and comparison against peers to identify ESG best practices and provide tailored recommendations.

Identification of material ESG risks and opportunities, including validation with key stakeholders and alignment with core business.

Articulation of high level ambition, including quick wins, aligned with the organisational purpose and prioritised ESG focus areas.

Identification of ESG data sources for own due diligence as well as monitoring and assessing the data relating to portfolio companies.

Monitoring of defined and measurable targets aligned with the business purpose.

Review existing ESG strategy and initiatives and provide recommendations for the future based on market landscaping and industry trends coupled with PwC expertise.

Review existing governance structures, including any ESG-related board KPIs and annual reporting to the board on sustainability matters.

Training and upskilling for board and senior management, as well as relevant teams to enhance understanding and knowledge of ESG risks and opportunities.

Review of sustainable investing policies and use of relevant checklists and tools, as well as integration of corporate sustainability strategy into potential revisions.

Conduct gap analysis of sustainability practices against sustainability reporting standards, frameworks and regulations to assess readiness or suggest enhancements to existing reporting.

Annual monitoring of portfolio companies and development of sector-specific guidance for high risk sectors.

Providing periodic updates to investors on material sustainability developments, as well as required ESG compliance.

{{item.text}}

{{item.text}}

Sustainability and Climate Change Practice Leader, PwC Singapore

Tel: +65 9817 8213