We seldom see private markets and retail investors sharing the same swim lanes, but this is about to change.

Historically, the illiquid, chunky and riskier nature of private asset classes has created a high ‘barrier of entry’ or access for the average retail investor. Although asset and wealth managers have provided retail investors with some form of access via select products, the adoption has not been widespread for various reasons.

However, the rise of the mass-affluent1 globally, especially in Southeast Asia, has become a demographic that cannot be ignored in the private asset investment landscape. With increasing disposable income, conditions are ripe for the affluent middle class to reallocate more funds from savings and real estate, into other investment opportunities, catching up with the allocation profile of their western counterparts.

Bottom line, we’re now seeing a new generation of sophisticated investors in this region, and their search for yield and diversification is not limited to traditional asset classes nor traditional investment platforms.

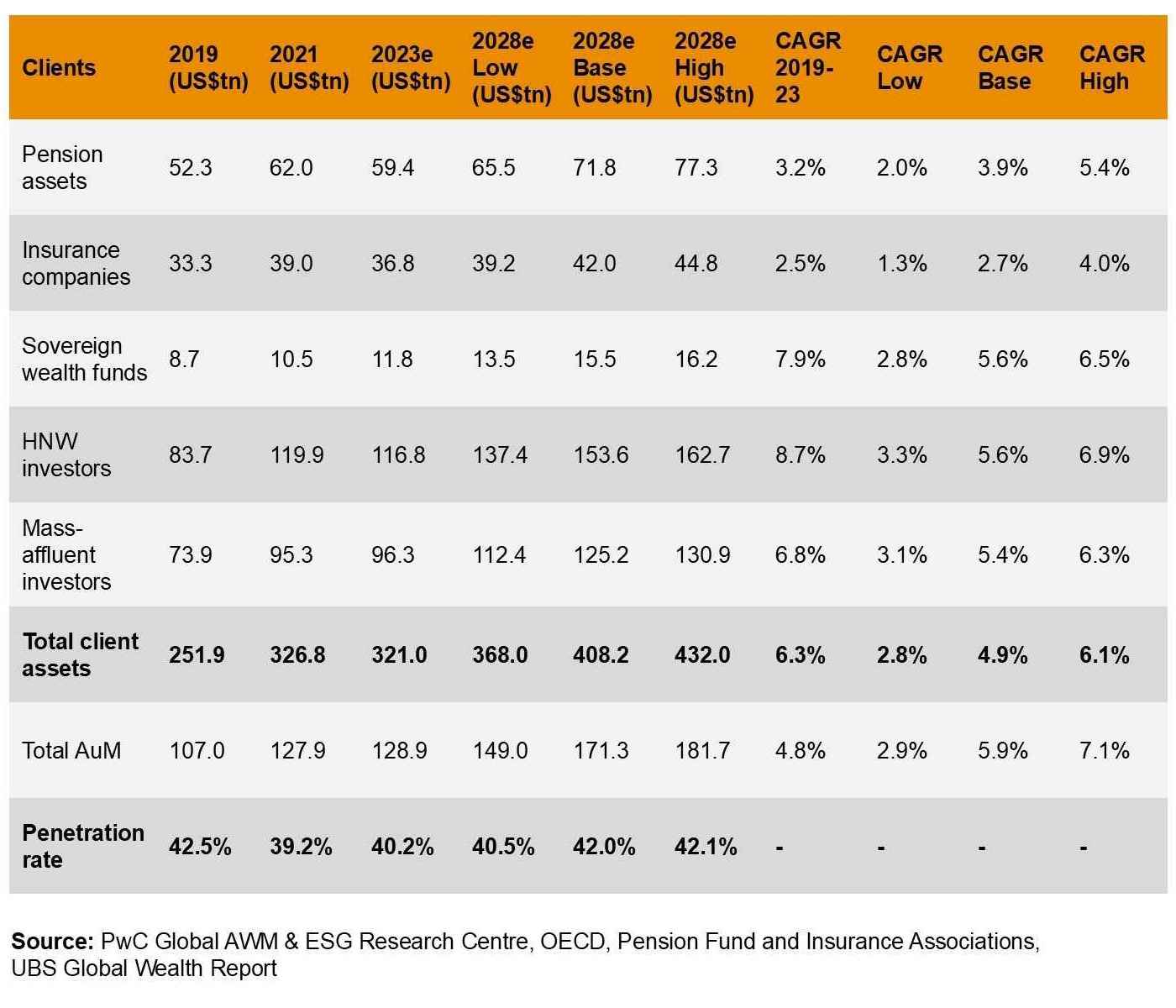

Mass-affluent investors are a a fast-growing market segment, as client assets are poised to surpass $408 trillion by 2028

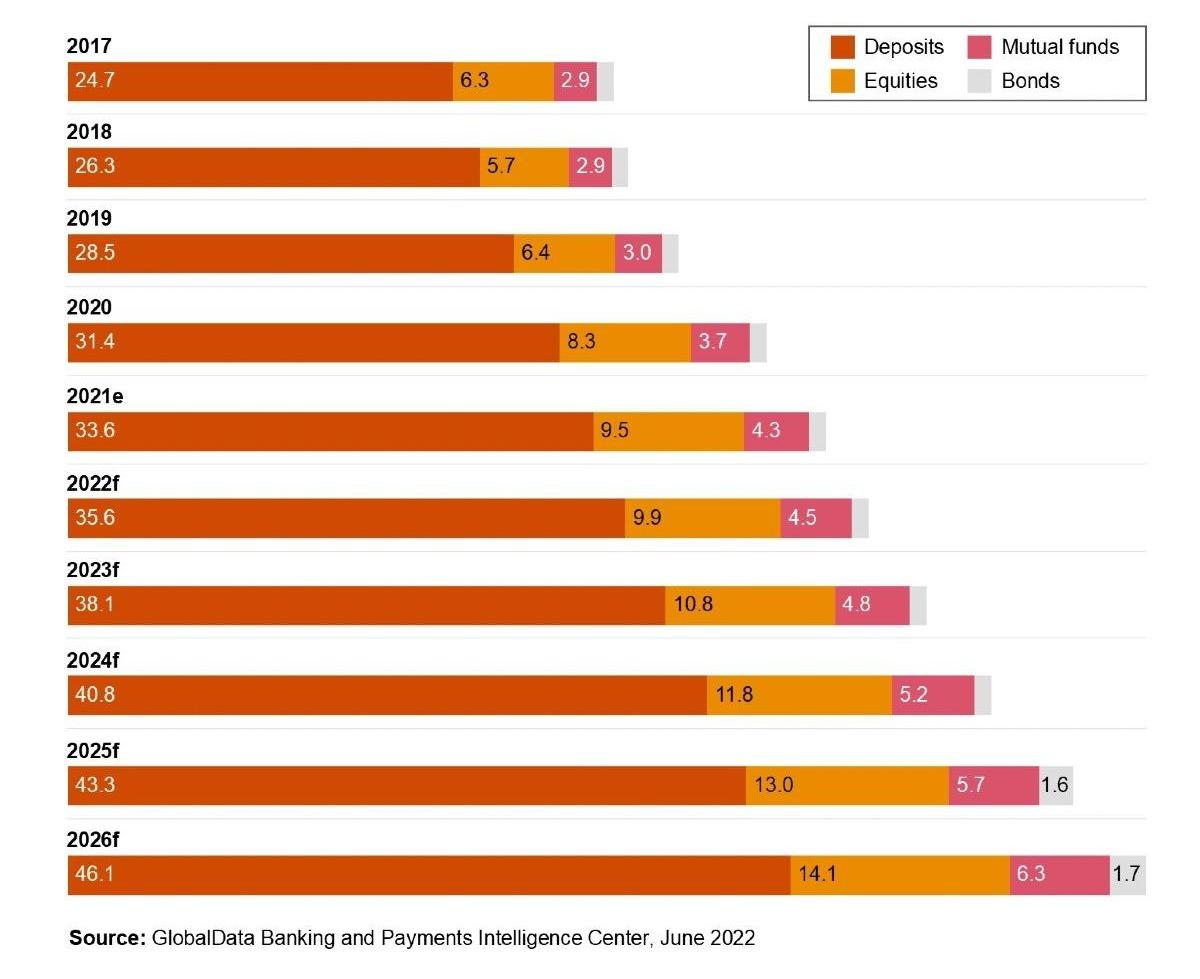

APAC: Retail savings and investments by asset class (2017-26f, $ trillion)

Time for asset and wealth managers to rethink the channels of access and distribution?

While mass-affluent investors may not have the assets of high-net-worth individuals (HNWIs), they can be financially sophisticated and better positioned than mass-retail investors, desiring access to products offered to higher investor segments but also finding themselves either ineligible or deterred by the fees. It is also timely that in Singapore, the Monetary Authority of Singapore recently issued a consultation paper to seek feedback on a proposed long-term investment fund (LIF) framework that provides retail investors access to private market investment funds2, signalling both the interest and the potential of this market.

With today’s technology - from AI and GenAI tools to advanced analytics, Regtech and cloud computing solutions, to name a few - fractionalising investments and building bespoke investments offerings tailored to this investor demographic are increasingly possible.

But before taking the ‘leap,’ I strongly encourage asset and wealth managers to understand the mass-affluent population and consider how your offerings can meaningfully connect with them. This understanding is key to unlocking new opportunities. As food for thought, I’ll leave you with some interesting figures about the mass affluent from research findings by UBS, Syfe, as well as the PwC Market Intelligence and Insights team:

- Over the past two decades, the mass-affluent population in the Asia Pacific region (APAC) has grown by approximately 200%, increasing from around 100 million to over 292 million adults

- 80% of mass-affluent investors in APAC would consider advisory services via digital channels

- 78% of mass-affluent investors surveyed said ease of use would influence their choice of service and 56% cited low fees as a factor in their decision as well

- 74% of mass-affluent investors would increase their investments slightly or significantly if products were tailored to their income range, and 71% would do the same if more comprehensive investment information were provided

- 66% of mass-affluent investors felt traditional financial institutions do not provide adequate products

1 Mass-affluent individuals generally have an annual household income above US$75,000 and hold between US$100,000 and US$1 million in liquid assets.

2 Consultation Paper on Providing Retail Access to Private Market Investment Funds, March 2025, the Monetary Authority of Singapore

For more insights on what else is re-shaping up the asset and wealth landscape

Check out our Asset and Wealth Management Revolution Survey

Contact us

Justin Ong

Paul Pak

Patrick Yeo

Eric Yeo

Yuneswaran Keraishnasamy

Christina Mason

Mabel Ang