What was the impact of COVID-19 on sales?

Pre-COVID

55% Sales growth

55% Sales reduction

COVID Impact

55% Sales growth

55% Sales reduction

The world is changing, and so is the winning formula for enduring family business success. The unprecedented events and disruptive impact of the pandemic have compelled family business leaders to respond with agility and embrace new approaches to sustaining their legacy. In fact, Asia Pacific family businesses have shown significant resilience and are optimistic about growth through 2022.

In PwC’s Family Business Survey 2021, we learned about the current thinking and future outlook of 2801 family business leaders across 87 territories worldwide, of which over 800 were from the Asia Pacific. Our findings indicate that family business leaders can no longer rely solely on their values and legacies to propel their business forward. Asia Pacific’s family businesses of tomorrow need a new game-changing approach to achieve lasting success—one based on accelerated digital transformation, prioritisation of sustainability goals and family continuity plans.

The time to act is now if family businesses want to keep their legacy for future generations. Watch an overview of the key findings from the Family Business Survey 2021.

Filter the data by territory and compare it to the APAC average.

55% Sales growth

55% Sales reduction

55% Sales growth

55% Sales reduction

55% Expansion and/or diversification

55% Digital, innovation, technology

55% Evolving/new thinking

55% Sustainability and/or local community

55% Strong, no longer a priority

55% Strong and still a priority

55% Not strong but is a priority

55% Not strong and not a priority

55% We want to lead the way

55% We are unlikely to lead, but we will play our part when required

55% We need to lead the way

55% It is the role of the government to lead the way

55% Shareholders’ agreement

55% Dividend policy

55% Testament/last will

55% Family constitution or protocol

55% Family employment policy

| Questions and Answers | Asia Pacific | Australia | Mainland China | Bangladesh | Hong Kong | India | Indonesia | Japan | Malaysia | Papua New Guinea | Singapore | Taiwan | Thailand | Vietnam | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Q10. Looking back over the last financial year BEFORE THE COVID-19 PANDEMIC would you say your sales have been | |||||||||||||||||||

| Sales growth | 51% | 63% | 65% | 52% | 50% | 60% | 51% | 38% | 47% | 38% | 49% | 43% | 39% | 33% | |||||

| Sales reduction | 21% | 16% | 19% | 17% | 15% | 18% | 25% | 23% | 29% | 35% | 21% | 22% | 31% | 24% | |||||

| Q11. And what do you think the impact of the COVID-19 pandemic will be on your sales? | |||||||||||||||||||

| Sales growth | 26% | 42% | 32% | 43% | 14% | 32% | 15% | 18% | 24% | 12% | 23% | 38% | 11% | 24% | |||||

| Sales reduction | 48% | 32% | 38% | 31% | 56% | 40% | 60% | 62% | 53% | 65% | 56% | 41% | 61% | 42% | |||||

| Q21. Which, if any, of the following are the company's TOP FIVE priorities for the next two years? | |||||||||||||||||||

| NET: Expansion/Diversification | 82% | 83% | 84% | 78% | 73% | 85% | 80% | 87% | 86% | 68% | 91% | 86% | 86% | 79% | |||||

| NET: Digital, innovation, technology | 77% | 76% | 73% | 67% | 74% | 87% | 71% | 78% | 90% | 59% | 84% | 70% | 83% | 82% | |||||

| NET: Evolving/new thinking | 66% | 58% | 54% | 59% | 58% | 76% | 71% | 57% | 69% | 76% | 84% | 70% | 72% | 67% | |||||

| NET: Sustainability/local community | 30% | 34% | 37% | 35% | 26% | 33% | 19% | 20% | 27% | 41% | 25% | 35% | 33% | 21% | |||||

| Q28.SUM. We have strong digital capabilities | |||||||||||||||||||

| Digital strong and no longer a priority | 18% | 24% | 21% | 7% | 20% | 15% | 17% | 28% | 8% | 32% | 13% | 11% | 17% | 9% | |||||

| Digital strong and still a priority | 16% | 21% | 14% | 31% | 14% | 11% | 8% | 13% | 16% | 6% | 16% | 16% | 11% | 21% | |||||

| Digital not strong but a priority | 31% | 28% | 32% | 19% | 24% | 46% | 32% | 28% | 43% | 26% | 38% | 24% | 31% | 21% | |||||

| Digital not strong and not a priority | 35% | 28% | 33% | 43% | 42% | 27% | 43% | 30% | 33% | 35% | 34% | 49% | 42% | 48% | |||||

| Q33a. Which of the statements below best describes the way you feel about the role of your family business today? | |||||||||||||||||||

| There is an opportunity for family businesses like ours to lead the way in sustainable business practices | 52% | 36% | 65% | 67% | 35% | 68% | 59% | 60% | 49% | 53% | 46% | 46% | 56% | 45% | |||||

| Family businesses like ours are unlikely to lead, but we will play our part when required | 38% | 54% | 29% | 26% | 52% | 29% | 33% | 13% | 43% | 38% | 48% | 41% | 39% | 45% | |||||

| Q33c. Which of the statements below best describes the way you feel about the role of your family business today? | |||||||||||||||||||

| In order to succeed going forward, our business is going to need to deliver greater benefits for the planet and human society | 52% | 33% | 71% | 54% | 41% | 68% | 60% | 62% | 57% | 44% | 55% | 49% | 53% | 30% | |||||

| We will play our part, but it is the role of government not businesses like ours to deliver greater benefits for the planet and human society | 31% | 42% | 13% | 31% | 30% | 24% | 31% | 12% | 33% | 44% | 33% | 43% | 31% | 55% | |||||

| Q15. Which of the following policies and procedures, if any, do you have in place? | |||||||||||||||||||

| Shareholders’ agreement | 39% | 41% | 56% | 31% | 50% | 32% | 48% | 27% | 37% | 41% | 35% | 43% | 25% | 39% | |||||

| Dividend policy | 30% | 28% | 57% | 17% | 36% | 30% | 29% | 15% | 27% | 21% | 28% | 57% | 33% | 18% | |||||

| Testament/last will | 22% | 58% | 6% | 7% | 24% | 17% | 12% | 20% | 18% | 53% | 13% | 5% | 8% | 6% | |||||

| Family constitution or protocol | 16% | 18% | 3% | 17% | 8% | 27% | 17% | 7% | 20% | 26% | 13% | 11% | 17% | 21% | |||||

| Family employment policy | 11% | 9% | 5% | 13% | 6% | 13% | 16% | 5% | 12% | 32% | 8% | 8% | 17% | 12% | |||||

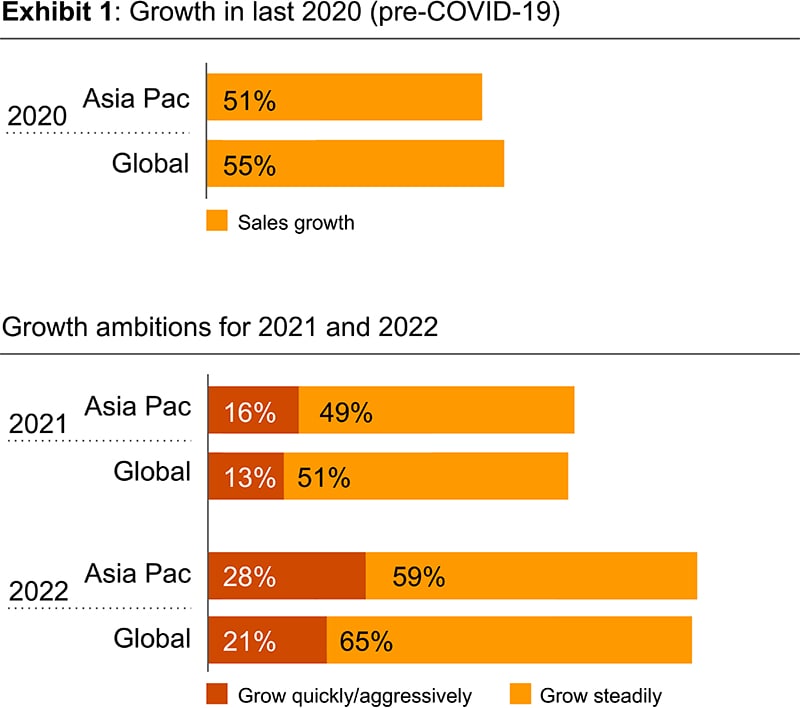

Asia Pacific family businesses have seen a mixed performance over the last financial year (pre-COVID-19), with 51% experiencing growth and 21% seeing reduction in sales. This is slightly less positive than the global scene where the majority of family businesses experienced higher growth (55%).

However, growth aims in Asia Pacific are ambitious for 2022, with 87% expecting growth to surge in 2022 (Exhibit 1). The outlook for 2021 is albeit cautious as 65% of Asia Pacific family businesses expect to see growth, much in line with family businesses worldwide.

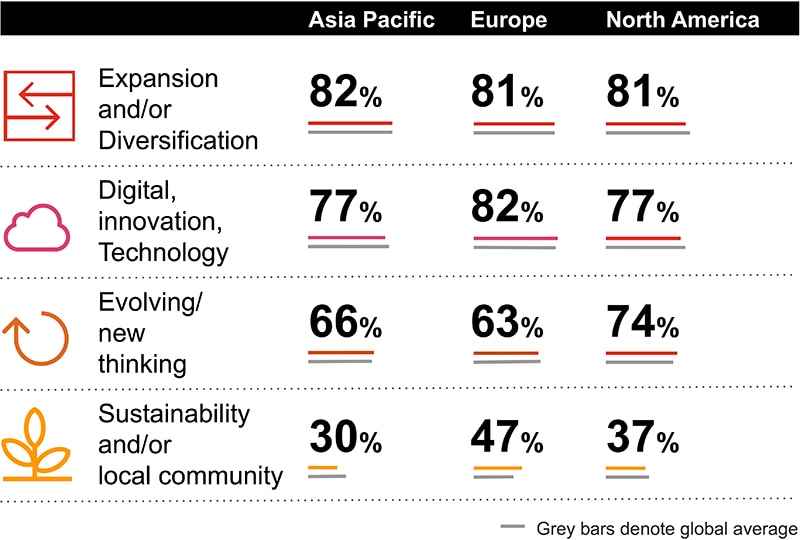

When asked to name their top priorities for the next two years, family businesses in Asia Pacific listed expansion and/or diversification (82%) as their top priority, followed by digital, innovation, technology (77%) and improving evolving/new thinking (66%).

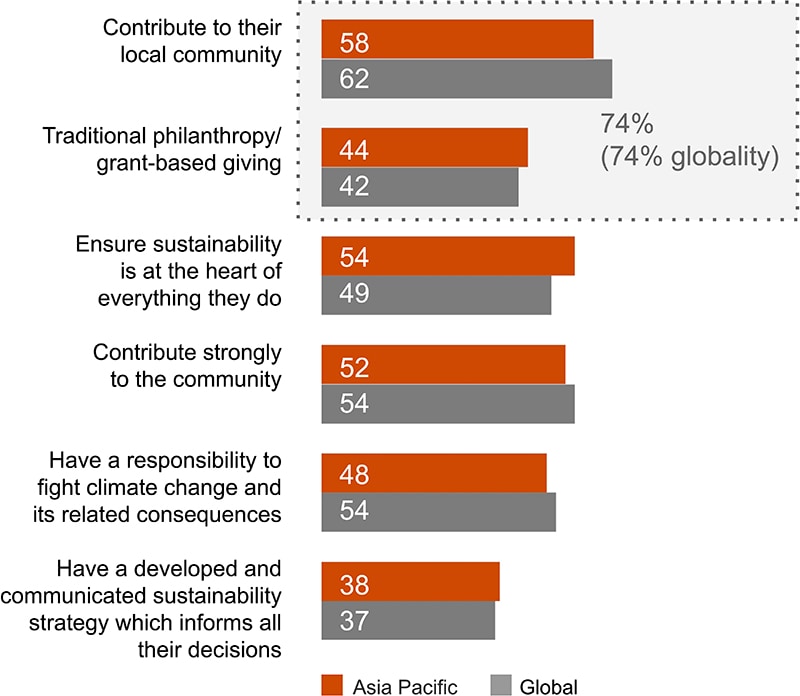

The priorities of the Asia Pacific family business leaders resonate with business priorities of their global counterparts. However, issues related to sustainability (Exhibit 2) remain at the bottom of the priority list of Asia Pacific family businesses (30%). This is considerably lower compared to Europe (47%) and North America (37%).

Exhibit 2: Key priorities over the next two years

Digitalisation has been on the agenda in recent years. Now, the pandemic has made digitised services a norm overnight. However, Asia Pacific family businesses are still lagging with only 33% (globally 38%) acknowledging that their digital capabilities are strong.

This is despite their adaptability and agility consciousness, as the majority of them believe they have strong leadership teams (64%), clear and flat governance structure (58%), with clear roles and responsibilities for those involved in running the business (66%) (Exhibit 3).

Exhibit 3: Agility and adaptability of Asia Pacific family businesses

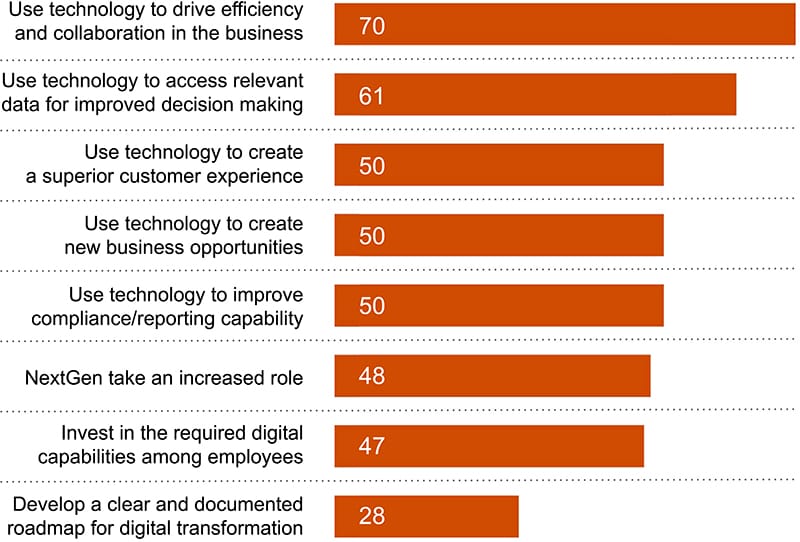

So what are Asia Pacific family businesses doing about it? 70% say they use technology to drive efficiency and collaboration while 61% leverage on technology to access relevant data for improved decision-making. However, there’s still room for improvement, as only 47% invest in upskilling their employees. And less than one-third (28%) have developed a clear and documented roadmap for digital transformation.

Exhibit 4: A majority of family businesses are investing in digital capabilities

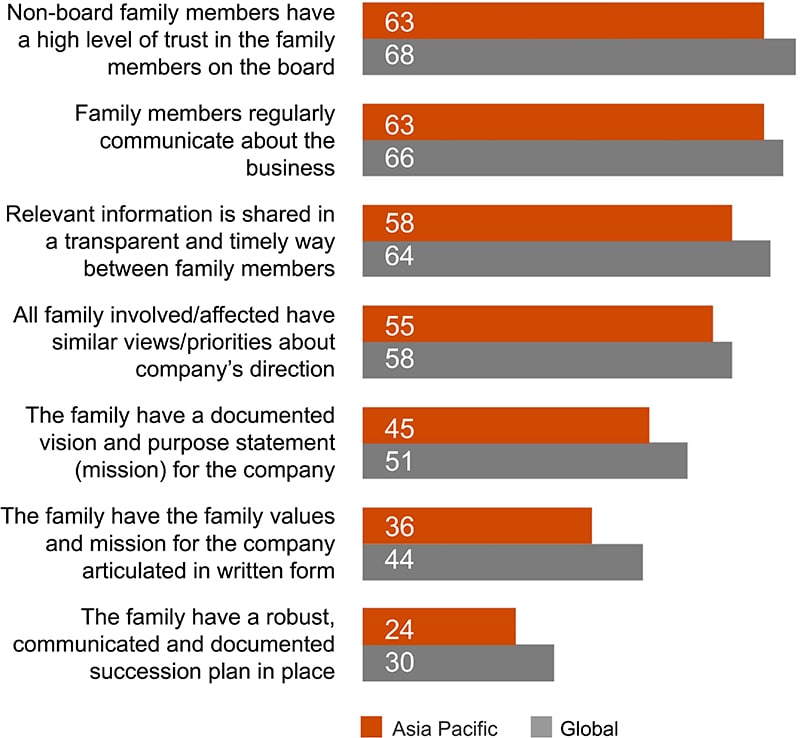

The unprecedented events of the past year have made it clear that all businesses should have a near-term business continuity plan and a long-term succession plan, as circumstances can change rapidly and in ways that are beyond a family’s control. Yet, only 36% have their values and company mission articulated in written form and only a quarter of Asia Pacific family businesses have a robust, documented and communicated succession plan in place.

Today, having a family governance structure is a business imperative. A professional governance structure and a clear process for conflict resolution, preferably involving an independent party, removes emotional and personal bias, a common stumbling block for many business families.

Exhibit 5: Family businesses have high levels of trust, communication and transperancy but many do not have a documented successsion plan yet

Commanding a high level of trust, family businesses are well positioned to lead on sustainability practices. However, they are not making it a part of their core operations. Closing this gap between family values and demonstrating their commitment to ESG is critical to their long term success. Only 38% (Exhibit 6) of Asia Pacific family businesses have an articulated sustainability strategy, and overall, just half (54%) said sustainability was at the heart of everything they do.

Exhibit 6: A minority of Asia Pacific family businesses engage in social responsibility activities, only 38% have a developed and communicated sustainability strategy

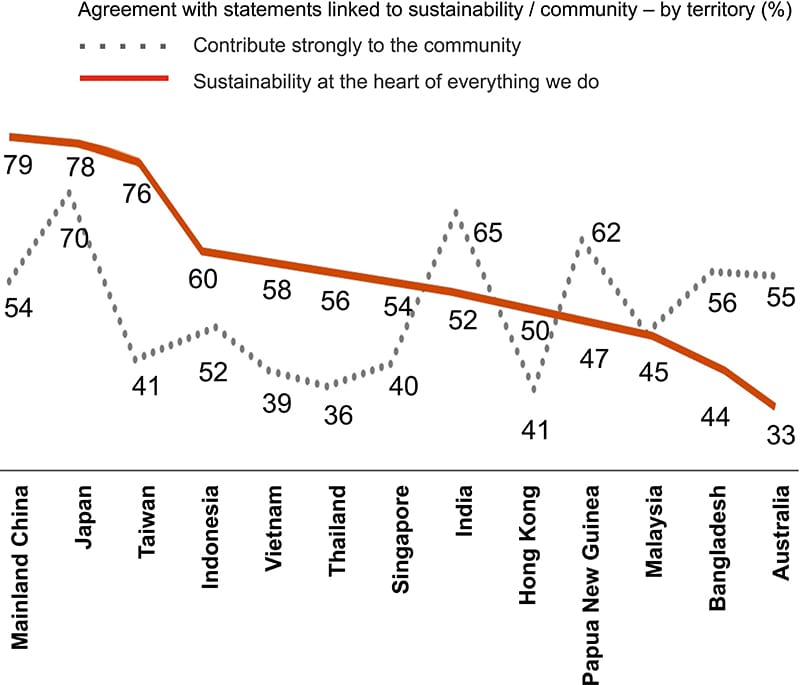

These findings vary across Asia Pacific. In China, Japan and Taiwan, the ESG message appears to have resonated, with more than 75% of family businesses saying that sustainability is at the heart of everything they do. However, less than 50% feel the same way in Malaysia, Bangladesh and Australia. In order to maintain their high trust levels and secure long-term stability, family businesses must step up their efforts and incorporate ESG as part of their business operations and decision making process.

Exhibit 7: The ESG message resonates differently across Asia Pacific countries

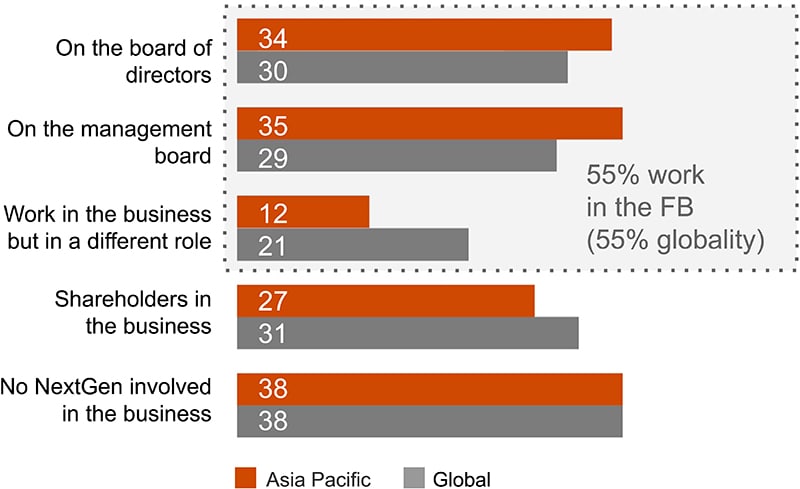

NextGen leaders will be a key driving force behind the transformational journey to propel family businesses forward. Unsurprisingly, the desire for passing on legacies among Asia Pacific family businesses is evident — 55% already have NextGens working in the business. Most likely they will become majority shareholders within the next five years.

PwC’s Global NextGen survey 2019 revealed that younger family members saw technology as one of the top drivers of change for the business, and 64% felt that this was the area they could add value. It is time for the current generation of leaders to actively involve their NextGens in driving digital change, transforming to more sustainable business practices and revisiting governance structures.

Exhibit 8: Slightly more than half of Asia Pacific businesses have next generation family members working in the business

Ng Siew Quan

Asia Pacific Leader, Entrepreneurial and Private Business, PwC Singapore

Tel: +65 9726 9880