{{item.title}}

{{item.text}}

{{item.text}}

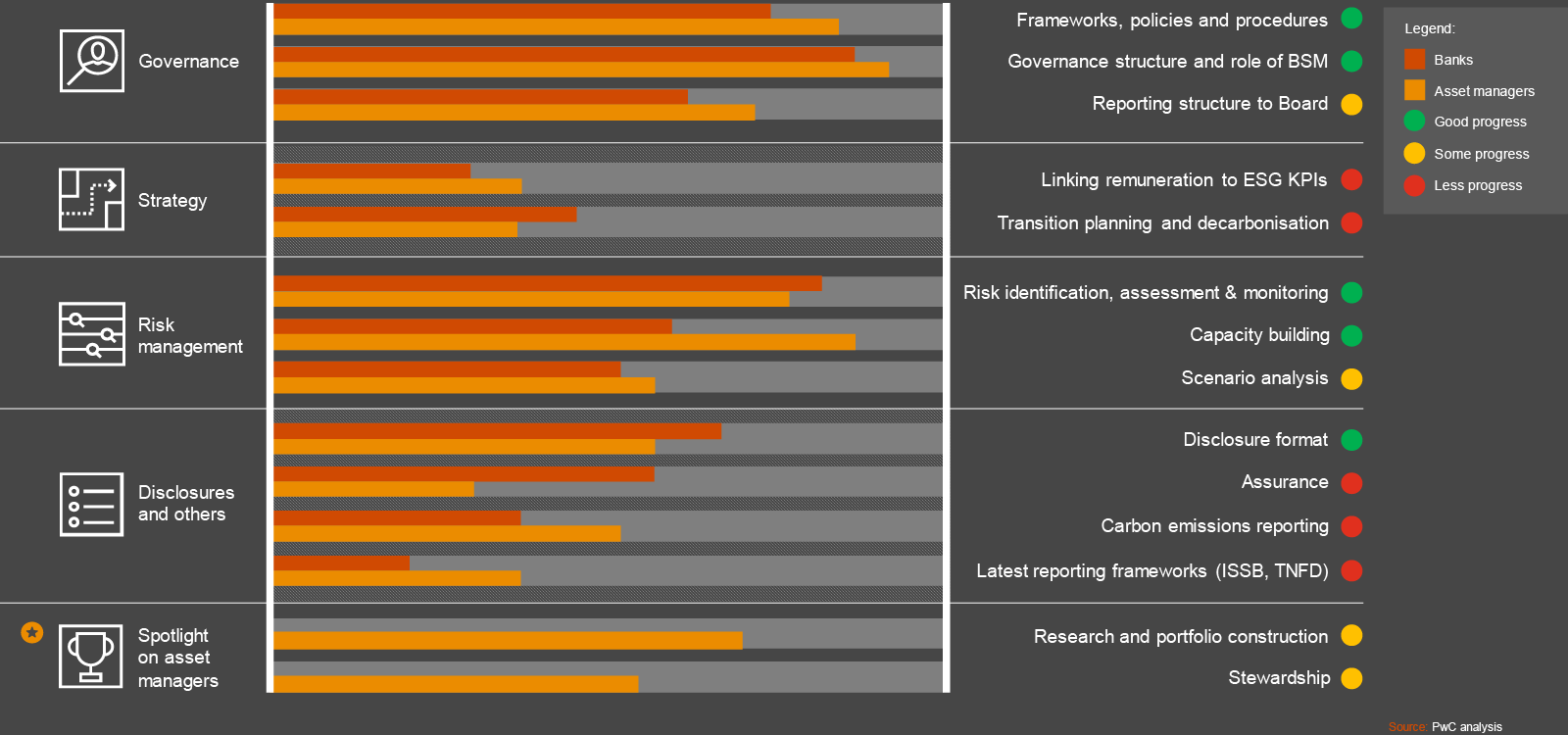

In the third quarter of 2023, PwC Singapore conducted a survey across 50 financial institutions with operations in Singapore, comprising 26 asset managers and 24 banks of various sizes and profiles, to reflect on the industry's progress in operationalising the MAS Environmental Risk Management (ENRM) Guidelines since they came into effect in June 2022. Overall, good progress has been made across the board and while many observations are consistent with those highlighted in the Monetary Authority of Singapore (MAS) information papers published in May 2022, this study further explores nuances amongst smaller financial institutions, including foreign-headquartered banks and asset managers placing reliance on group policies and capabilities, and shines a spotlight on upcoming topical areas such as transition planning, International Sustainability Standards Board (ISSB) and Taskforce on Nature-related Financial Disclosures (TNFD).

Implementation maturity by banks and asset managers in Singapore:

In Q3 2023, PwC Singapore conducted an industry survey across the banking and asset management sectors. The survey reflects on where our local financial institutions are at in terms of operationalising the MAS Environmental Risk Management (ENRM) Guidelines and assesses plans for upcoming topical areas including transition planning, Task Force Nature-Related Finance Disclosures (TNFD) and International Sustainability Standards Board (ISSB) for the banking and asset management sectors.

The survey was conducted across 50 financial institutions (FIs) with operations in Singapore. The 50 respondents were split between 26 asset managers and 24 banks.

PwC Singapore held a closed-door discussion where we shared key insights and results from the recent industry survey and around the topic of transition planning for financial institutions. Followed by an industry group roundtable to discuss key environmental, social and governance (ESG) topics impacting asset managers and banks.

{{item.text}}

{{item.text}}

Bing Yi Lee

Christina Mason

gsap_scrolltrigger