{{item.title}}

{{item.text}}

{{item.text}}

Singapore Exchange (SGX) announced the new SPAC listing rules on its Mainboard, effective 3 September 2021. It follows the public consultation paper released in March 2021 that received feedback from over 80 respondents, which according to SGX is possibly the highest response rate to any of its consultations in recent years.

The new listing framework enhances the reputation of SGX as one of the most progressive bourse in the Asia Pacific region and is expected to add the much needed vibrancy to Singapore’s capital markets. Being an early adopter of this alternative capital raising route within the Asian time zone provides SGX with the necessary ingredients to act as a platform for fast growing Asian companies.

| Market capitalisation | Minimum of S$150 million |

| Timeframe for de-SPAC |

Within 24 months of SPAC IPO, with extension of 12 months subject to prescribed conditions |

| Moratorium | Moratorium on sponsors’ shares from IPO to de-SPAC, a 6-month moratorium after de-SPAC and for applicable resulting issuers, a further 6-month moratorium thereafter on 50% of shareholding |

| Minimum equity participation by sponsors | Sponsors must subscribe to at least 2.5% to 3.5% of the SPAC’s IPO shares depending on the SPAC’s market capitalisation, with aggregate shareholding not exceeding 20% of the SPAC’s issued share capital at IPO |

| Approval of de-SPAC | De-SPAC can proceed if more than 50% of the SPAC independent directors approve the transaction and more than 50% of the shareholders vote in support of the transaction |

| Warrants |

Warrants issued to shareholders will be detachable. Maximum percentage dilution to shareholders arising from the conversion of warrants issued at IPO is capped at 50% |

| Redemption rights | All independent shareholders are entitled to redemption rights |

Source: SGX News Releases, SGX introduces SPAC listing framework, 2 Sep 2021

Key highlights of certain guidance relating to suitability assessment factors of SPACs under SGX Mainboard Listing Rules Practice Note 6.4 include:

Key criteria to be met prior to completion of de-SPAC:

| Fair market value of target |

At least 80% of the amount in the SPAC’s escrow account at the time of entry into the binding agreement for the business combination. |

| Identifiable core business |

Business combination must result in the resulting issuer having an identifiable core business of which it has a majority ownership and/or management control. SGX may consider a business combination involving an acquisition of a minority stake in a business(es) or asset(s), where the resulting issuer can demonstrate that it has management control of such business(es) or asset(s). |

| Financial adviser (FA) | Issuer must appoint a FA, who is an issue manager, to advise on the business combination. |

| Independent valuer | Issuer must appoint a competent and independent valuer to value the business(es) or asset(s) to be acquired under the business combination where (A) a placement or subscription for the issuer’s equity securities by institutional and/or accredited investors, is not conducted in contemporaneous with the business combination; or (B) the business(es) or asset(s) to be acquired under the business combination involves a mineral, oil and gas company, or property investment/development company. A summary valuation report must be included in the shareholders’ circular in relation to the business combination. |

| Shareholder circular | Shareholders’ circular seeking approval for the business combination must comply with the prospectus disclosure requirements. |

SPACs are:

Startups may consider an acquisition or merger with a SPAC instead of taking the traditional IPO route directly for a number of reasons. They can retain an agreed equity stake in the business, raise funds and have the flexibility to negotiate favourable deal terms such as valuation and additional investment with the SPAC sponsor (currently not available for the traditional IPO route). It also enables startups to expedite the time required to go public as well as reduce fund raising costs, aside from gaining access to experienced management teams of the SPAC sponsor.

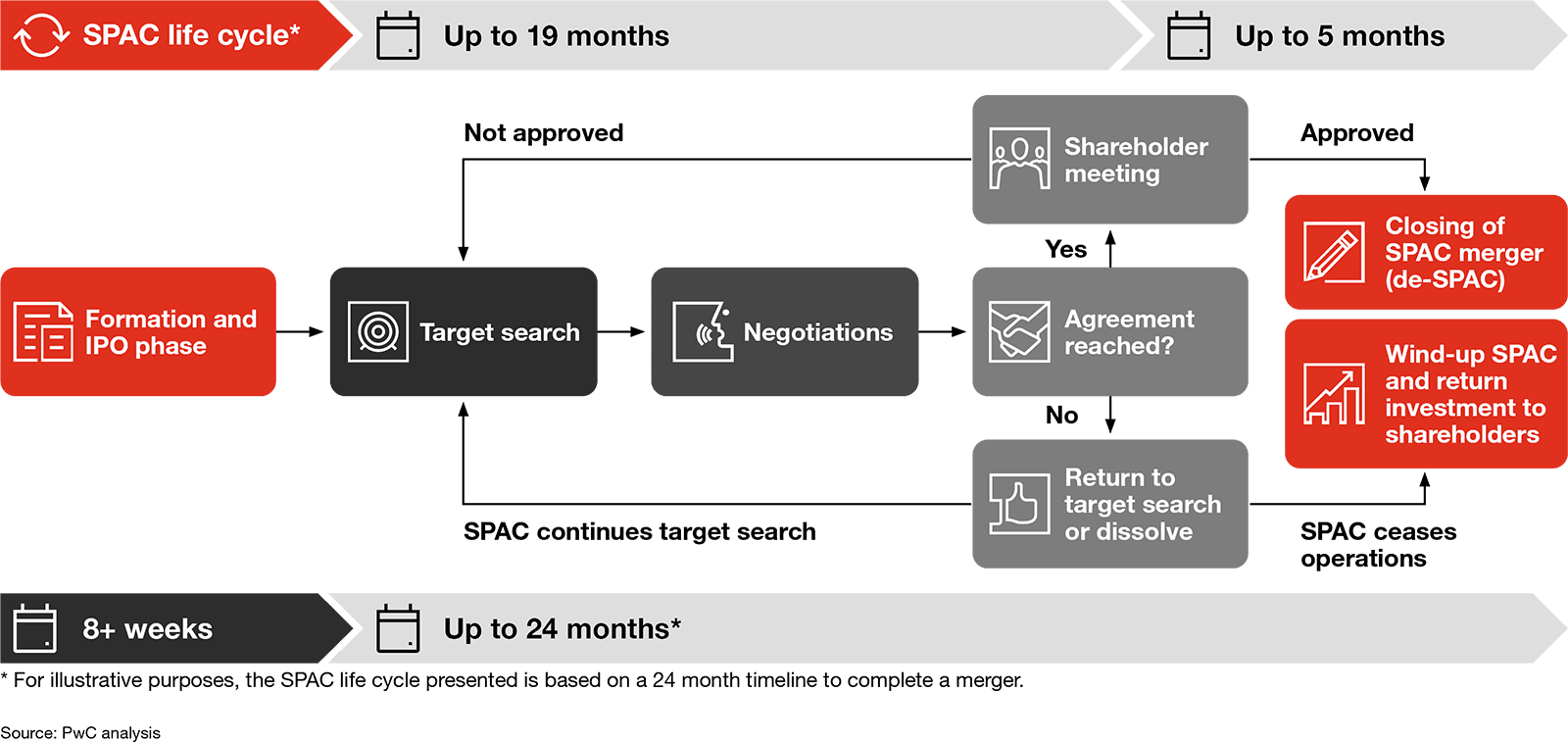

The compressed timeline to complete the de-SPAC transaction remains a key challenge for target company to get ready to operate as a public company. Although listing via a SPAC route pose an appealing fund raising alternative to traditional IPOs, it is important for target companies to understand the criterias and risks and assess their state of readiness to operate as a public company, just as they would do if they were to consider the traditional IPO route, and prepare themselves to navigate across these challenges.

{{item.text}}

{{item.text}}

Tham Tuck Seng

Rebekah Khan

Alex Toh

Jimmy Seet

Patrick Yeo

Maxime Blein