The future of finance: Leveraging automation to deliver undiscovered value

Access to real time financial data is critical for effective decision making. However, traditional financial processes in most organisations mean that finance functions require significant turnaround time on generating reports for management that are historical-focused and unable to deliver predictive insights.

Finance functions are also experiencing significant accounting changes due to new standards, and requiring more detailed disclosures, complex calculations and valuations. This has created the need for tailored solutions such as bespoke systems or robotic process automation (RPA) tools to increase the efficiency and accuracy in reporting.

Group reporting and consolidation

We support you in speeding up your financial consolidation process and to seamlessly manage complex consolidation challenges from end-to-end:

- Automated statutory and management consolidation

- Multi GAAP management

- Foreign currency conversions

- Workflow set up to manage and monitor the group reporting and consolidation process.

Group reporting and consolidation

Last mile of reporting

Reporting comes in many shapes and forms. We are here to help you improve your processes and technology enablement related to financial, management and risk reporting. PwC combines our know-how around reporting with technology to increase collaboration, standardisation and deliver efficiencies:

- Automation of repetitive tasks surrounding account reconciliations and monthly closing

- Simplification and creation of transparent reporting for financial statements, management and sustainability reports

- Combining data from various sources and working collaborative with dynamic number and narratives across the reporting.

Last mile reporting

Financial budgeting and planning

We enable you to evolve your analytics capabilities from descriptive to predictive insights by aligning objectives with enterprise strategy, enabling a data-driven culture, and implementing the right technology:

- Integrated planning across departments

- Automation of rolling forecasts and further cash analysis

- Simulations and what-if analysis

- Predictive analytics.

Financial planning and analysis

Business Information and analysis

Analyse business performance and identify patterns and key trends to present business insights in interactive visualisation:

- Smart dashboards for performance management and reporting

- Business forecasts for the estimation of credit losses (e.g. IFRS 9), budgeting and management reporting, treasure related forecast e.g. FX expose, cash flows, commodity prices and climate risk scenarios.

How can we help

The world is changing and we enable you to capitalise on these changes. With our in-depth knowledge and established credentials in finance, accounting and reporting advisory, we are well-positioned to support you in the automation of your reporting requirements.

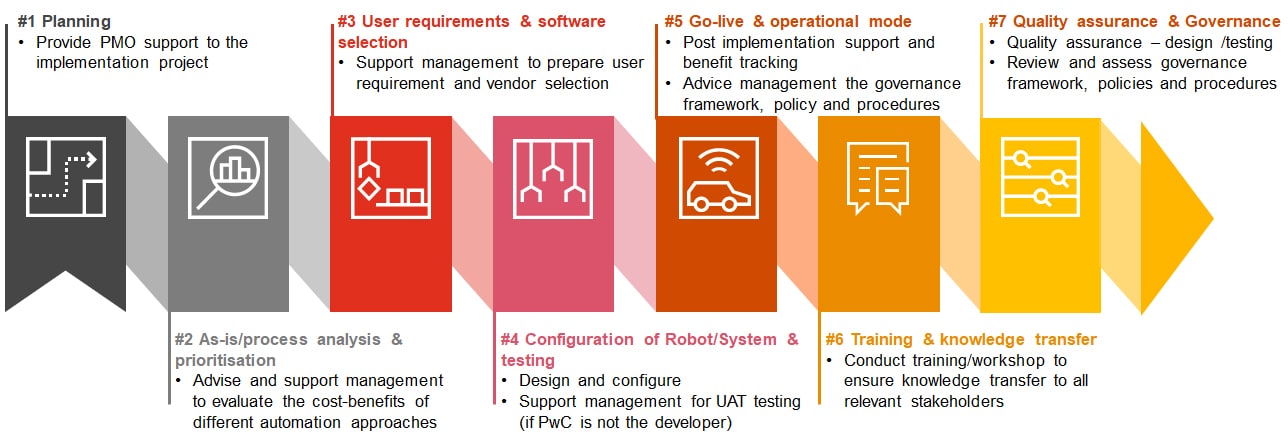

We support you “from strategy through execution” to shape a future-ready finance function on your reporting automation journey through:

- Standardisation and automation of the process and harmonising your data, evaluation of where and when to invest with a focus on the cost-benefit ratio

- Planning your technology roadmap

- Integration of strategic, non-financial value drivers and information in financial and management reporting