Introduction

Banks and financial institutions (FIs) are expected to conduct periodic reviews and refresh their customer information especially as regulatory scrutiny in relation to periodic reviews is increasing. At the same time Know-Your-Customer (KYC) periodic reviews are manual, time-consuming, voluminous and expensive.

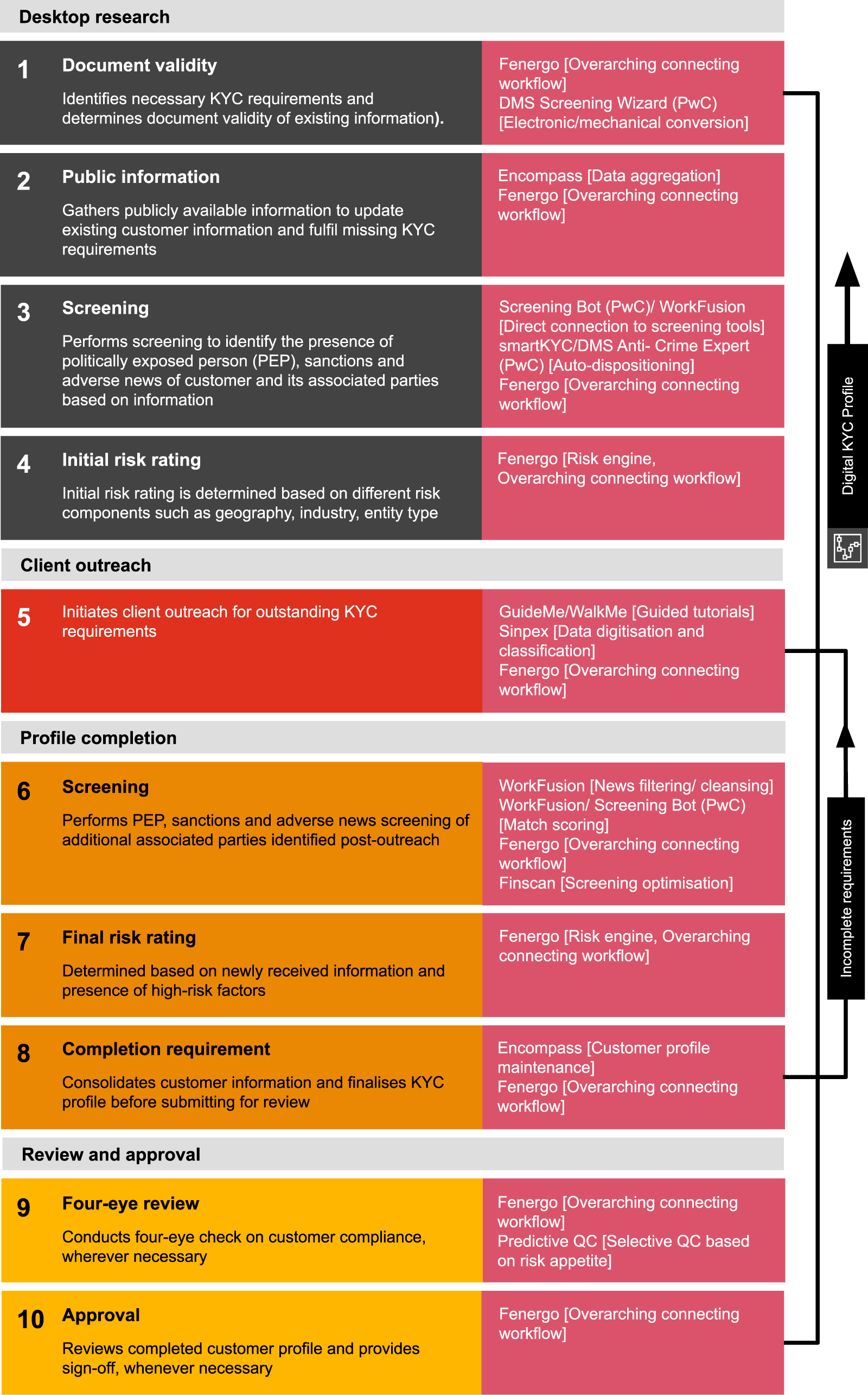

Powered by technology, the Perpetual Know-Your-Customer (P-KYC) approach enables automation across all end-to-end periodic KYC review process steps, leaving only a small subset of the more complex cases that require some degree of human intervention.