Optimising Route-to-Market Strategy In APAC

Client: Global Consumer Healthcare Business

Our Role: PwC helped the client optimise its Route to Market strategy for its consumer healthcare business in Singapore, Malaysia, and Indonesia with an objective of driving cost saving and growth.

Industry: Consumer Healthcare

Services: Operations, Benchmarking, Technology

Solution: Route-to-Market Strategy

Client Challenge:

The main problem the client faced was that it lacked a clear route to market (RTM) strategy for its consumer healthcare business in Asia markets.

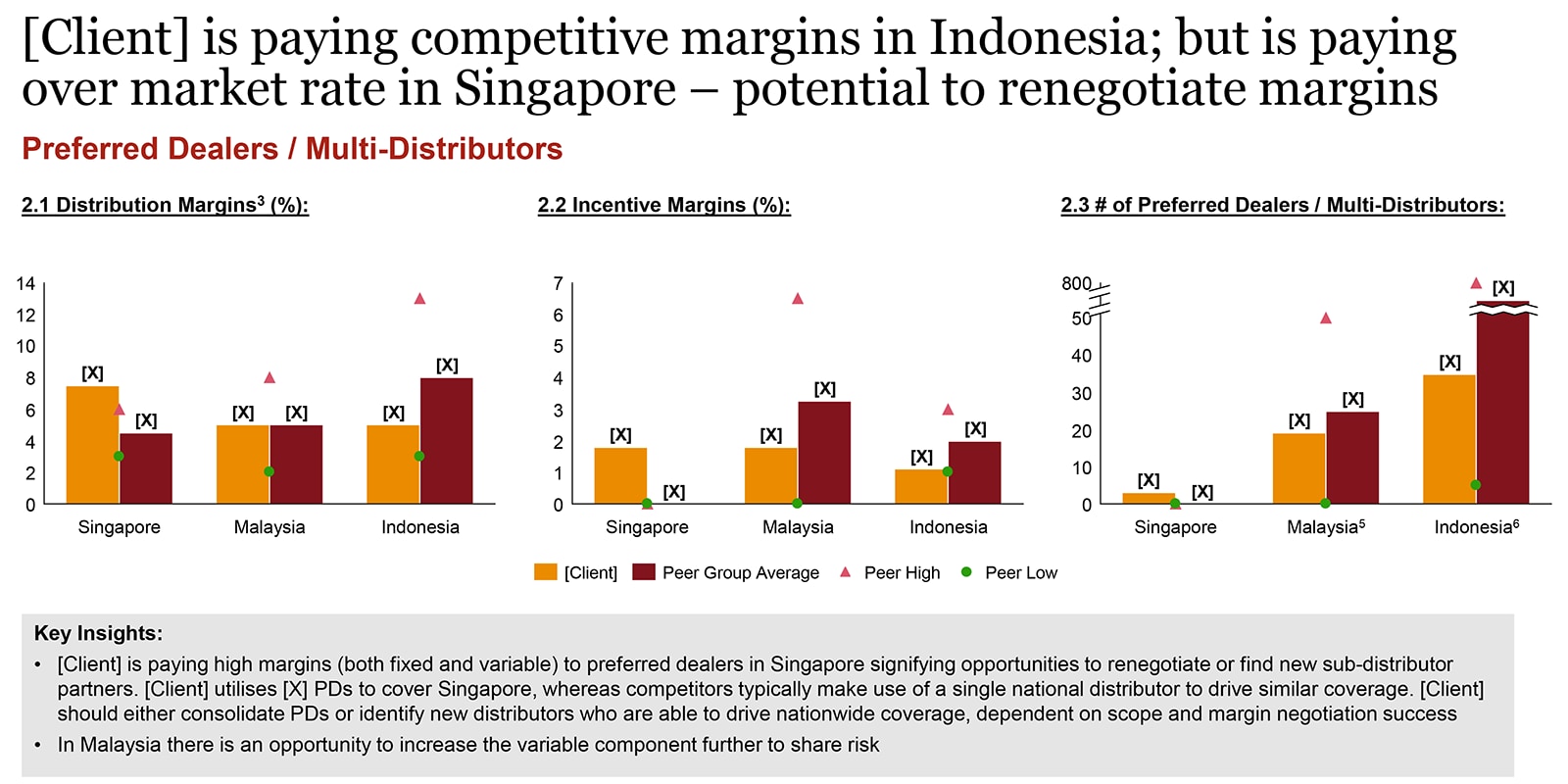

The legacy RTM models in place were often multi-layered, slowing progress of product to market, and involved multiple distribution partners, complicating effective performance management. Furthermore, the client had limited transparency of its cost base, such as inability to segment RTM costs by value chain/region/channel/partner/customer/product/etc. This hindered its ability to manage costs (e.g. paying less competitive margins to some distributors) and strategically tailor service levels for customers. Finally, supply chains were not optimised for efficiency, locking in working capital that could otherwise have been deployed to other initiatives, unlocking greater value for the client.

Approach:

The client approached PwC to help it assess its three prioritised APAC markets which included Malaysia, Singapore, and Indonesia. The objective of the project were:

- To evaluate client’s RTM models and to redesign as required

- To gain visibility of client’s RTM costs (in particular, warehousing distribution, ordering & sales)

- To identify initiatives to optimise costs and drive growth, detailing and prioritising opportunities

- To quantify the Size of the Prize and develop a high level investment case and implementation roadmap

Given the complexity of the client’s distribution network and service model, we first had to formulate an accurate and comprehensive understanding of the RTM models that were used by the client at that point in time. To achieve this, the team conducted a thorough internal analysis of the client’s existing RTM model (e.g. distribution partners, stock flows), and looked into its revenue, cost and ROI using PwC’s cost and value “cube” methodology.

The team also conducted an extensive external analysis of industry best practices and benchmarking on key metrics

Using client data, PwC worked closely with the client to create dynamic dashboards for ‘value’ and ‘cost cubes’ - providing visibility of P&L revenue and costs allocated to different RTM dimensions (e.g. product, channel, geography) based on associated drivers (e.g. number of pallets, % of sell out value). This allowed the client to flexibly drill-down value/cost-to-serve, which assists informed decision making on RTM optimisation.

The insights and findings obtained were then used to identify strategic and tactical RTM optimisation opportunities across the client’s business based on strategic and tactical levers in line with PwC Strategy&’s FFG framework. Experts were then interviewed to test and validate these opportunities, which are then assessed and prioritised based on impact and feasibility. After several rounds of detailed analysis and discussions, the team was able to produce a detailed list of prioritised opportunities, quantified size of the prize (e.g. cost savings, profit uplift, avoided capital cost) and developed high-level investment case.

Impact:

The client now has a detailed understanding of the various realisable RTM optimisation initiatives such as delayering of RTM network model, reduction of SLOB inventory, restructuring of margin across fixed and variable components, consolidation and optimisation of sub-distributors to drive performance, optimisation of salesforce performance, and increased outlet coverage.

Once fully acted upon, the client can expect a 8% reduction against the addressable cost base in annualised cost savings, equating to multi million USD impact, profit uplift in excess of 1M USD and working capital reduction of over 2.5M USD.

Contact us

Consumer and Industrial Products Leader, South East Asia Consulting, PwC Singapore

Tel: +65 8223 1503