Reducing Forecast Error Through Improvements In Operating Model

Client: Leading global luxury brand

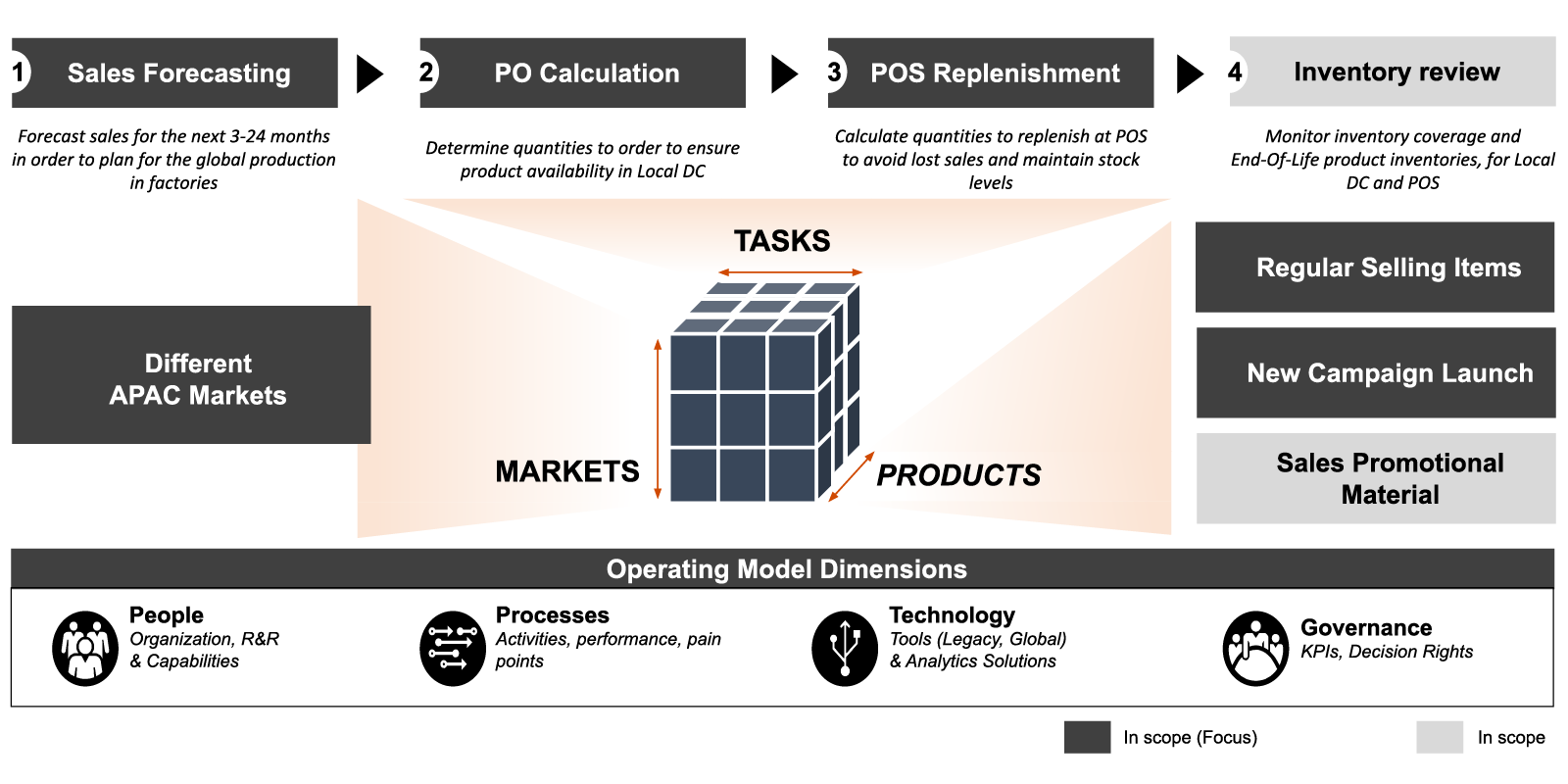

Our Role: PwC helped the client revamp its forecasting, purchasing, and replenishment processes across all operating model dimensions for its APAC operations to ensure that the right inventory is available where and when it is needed.

Industry: Fragrance & Beauty Products

Services: Operations, Benchmarking, Technology

Solution: Connected Supply Chain

Client Challenge:

The main problem the client faced was an outdated and fragmented forecasting process that struggled to keep up with the rapidly expanding market needs and the unique requirements of its growing e-commerce business. As a leading global luxury fashion brand, our client produces all of its products in Europe, which are then ordered by and shipped to its various markets around the globe, including those in the APAC region. In the APAC markets, these products are then distributed via an assortment of channels, including retail boutiques, wholesale, consignment, e-commerce and travel retail. However, to effectively run this complex operation requires accurate sales forecasting, which is inhibited by the absence of an integrated operating model that facilitates communications and information sharing.

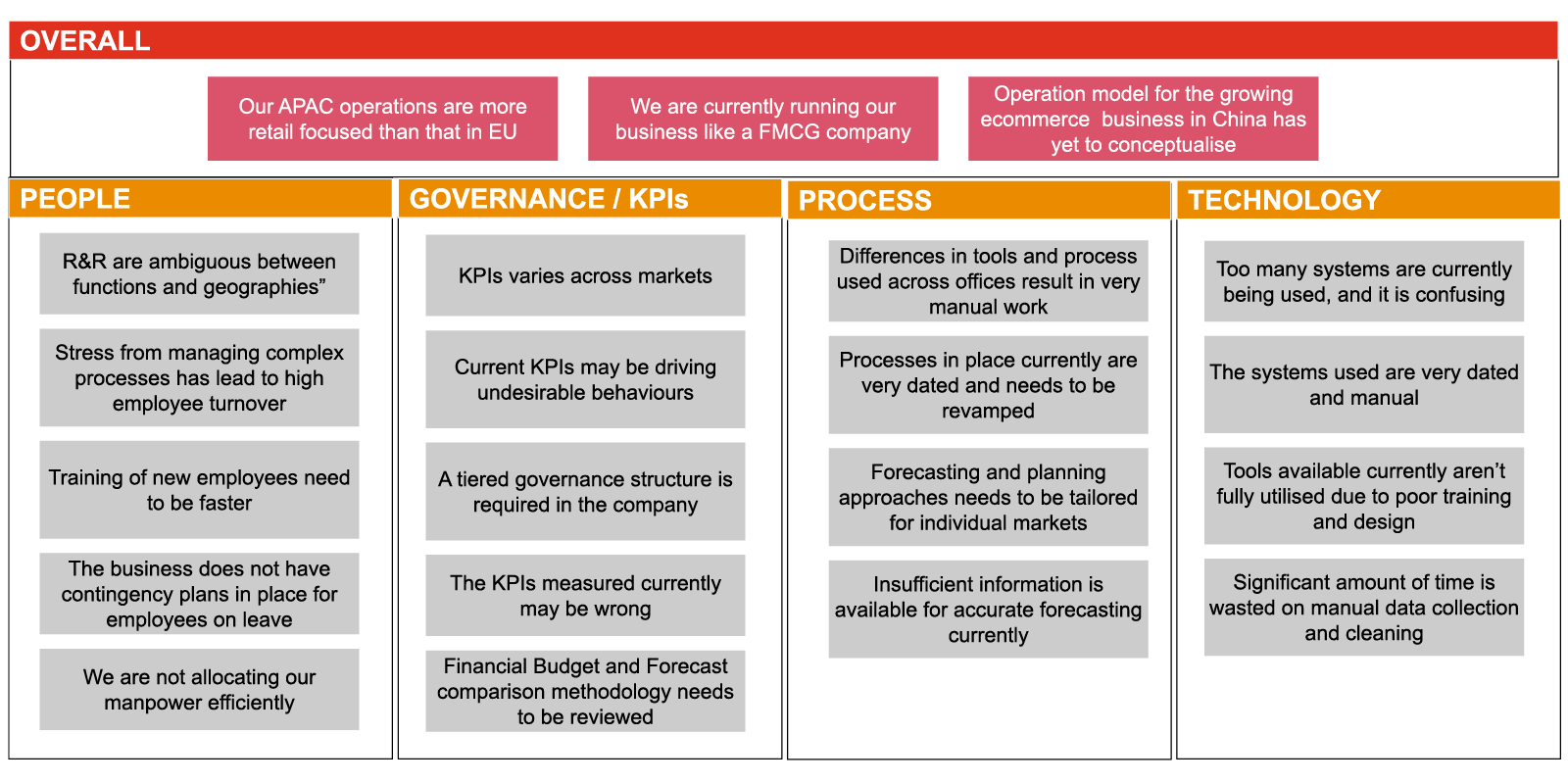

As a result, our client found itself with a highly fragmented and inconsistent network of governance policies, operational processes and technologies, leading to a large degree of operational inefficiencies, overwhelming staffs with avoidable manual tasks. This translated to low forecasting accuracy of ~55% (industry average 75%) and inventory coverage of ~100 days (industry average 60 days) leading to under / over stocking situations and hence impacting the top / bottom line.

Approach:

Our client approached PwC in late 2019 to help it identify process, technology, people and governance opportunities over a short 10 week engagement to help it increase forecast accuracy and process efficiency, while taking into consideration their global, regional, and local initiatives ongoing then.

Given the complexity of our client’s operations, we first had to formulate an accurate and comprehensive understanding of the processes, technologies, people and governance policies that were used at that point in time. To achieve this, our multi-national team of professionals with expertise in Supply Chain, Operations and Strategy conducted extensive interviews with key stakeholders and held a discovery workshop with select senior executives from different countries. To further strengthen our analysis, we supported these qualitative assessments with an extensive analysis of data pertaining to our client’s preliminary forecasts, reports, KPIs, etc. Through these targeted analysis and structured interactions, our team was able to reach an accurate understanding of our client’s APAC operations and uncover various underlying pain points that would only exacerbate as our client’s operations continued to grow.

We also conducted a comprehensive study of best practices across industry peers, and identified several up and coming trends in demand planning and supply chain management such as the need for an integrated real-time order management system and the adoption of demand sensing tools to augment traditional demand planning systems.

With these insights, we then crafted several potential operational structures for the 3 key tasks of forecasting, purchasing, and replenishment, and worked closely with our client to assess and test each of these options, as well as their implications on the client’s processes, technologies, people and governance. After several rounds of intensive discussions with the client, we were able to agree on a new vision for our client’s APAC operations which is supported by changes in various aspects of our client’s process, technology, people and governance.

Impact:

The client now has a new 5 year vision to position itself for high growth in APAC and a comprehensive roadmap that brings together various people, process and technology changes required to achieve the vision. All these are further supported by a set of clearly defined R&R and governance structure to enable improved collaboration, ownership and efficiency. This would ultimately help it to reduce inventory levels (by ~15%) and improve forecasting accuracy (by ~10-15%), leading to significant savings and revenue growth (USD 15-20m per year).