As organisations accelerate their digital agenda, technology is increasingly becoming an integral part of day-to-day business operations. While rapid digital transformation brings exciting opportunities, novel risks must be managed carefully.

To manage these new risks, it is imperative that organisations review their technology-related controls to identify gaps for improvement and ensure regulatory compliance. A strong controls and security posture will allow organisations to build trust with their stakeholders at every stage of the value chain.

PwC Singapore’s digital audit team consists of highly experienced and knowledgeable professionals dedicated to helping organisations make the most of their investments in technology. Our team is well-versed in the relevant frameworks and has collaborated with a wide range of clients across industries, allowing them to bring invaluable insight into every engagement.

By managing technology-related risks, organisations can ensure a smoother digital transformation journey, and maintain stakeholder trust and organisational reputation.

Our services

Evidence Act

Third party trust

Technology audit

Controls advisory

Evidence Act

As organisations pursue digital transformation, business and financial records are increasingly being stored in electronic formats rather than hardcopies. The shift from analogue to digital carries legal risks, and organisations should think about the admissibility of electronic records as evidence for use in Singapore courts.

- How can electronic records be used as evidence in courts?

- What does Evidence Act certification involve?

- How will my organisation benefit from Evidence Act certification?

- Is it mandatory to obtain Evidence Act certification?

- What is the frequency of certification?

How can electronic records be used as evidence in courts?

The admissibility of electronic records as evidence in Singapore courts is governed by the Evidence Act (Cap 97) (‘the Act’). Section 116A of the Act contains certain presumptions, which a party seeking to use electronic records as evidence in court may rely on. In particular, the court will presume the authenticity of electronic records if certain conditions are met and there is no conflicting evidence to the contrary.

What does Evidence Act certification involve?

One of the conditions necessary for proving the authenticity of electronic records is obtaining Evidence Act certification, which involves using an imaging system that has been certified by a Certifying Authority appointed by the Ministry of Law, known as an “approved process”, to ensure the accurate conversion of physical documents to electronic images.

How will my organisation benefit from Evidence Act certification?

Electronic documents that were produced using an approved process will be presumed by the Court to be accurate representations of the original copies. Furthermore, the certification will help your organisation save storage space and costs, and support your business continuity plan.

Is it mandatory to obtain Evidence Act certification?

No, it is not mandatory for electronic record-keeping systems to be certified as an “approved process” by a Certifying Authority. However, such certificates may be helpful and relevant if your organisation intends to use electronic records as evidence in Singapore courts by relying on the presumptions in Section 116A(6) of the Act.

What is the frequency of certification?

For the first three years, you will need to be certified once annually. Thereafter, Evidence Act certification needs to be renewed once every two years.

Third party trust

In today’s business landscape, outsourcing remains a prevalent practice among organisations, which rely on third party service providers for cost-efficient access to various services and forms of support, including cloud and financial technology services, and human resource management.

Despite the benefits of outsourcing, it also exposes organisations to special risks, such as the potential loss of sensitive data, and possible disruptions to critical business services and financial reporting. Hence, organisations must ensure that third party service providers meet a certain level of governance, rigour and consistency in order to build trust and be able to make outsourcing decisions with confidence.

Technology audit

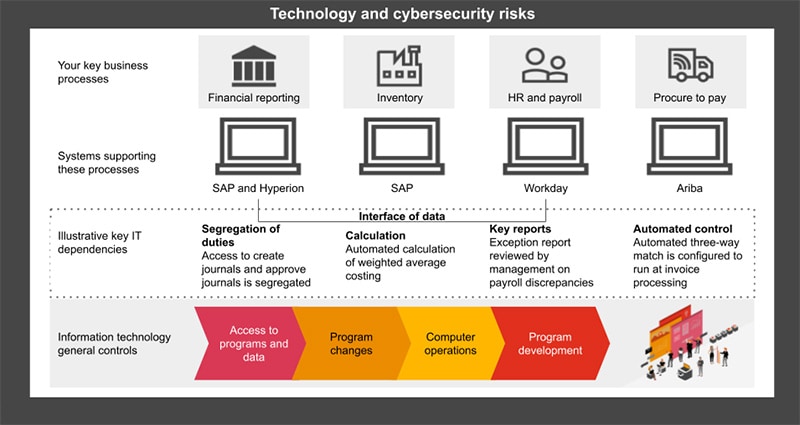

As your organisation pushes forward with its automation and digitisation agenda, technology and cybersecurity risks will increasingly become significant concerns. Therefore, the impact of these risks on financial reporting must be considered during the audit process.

Our integrated audit approach is tech-enabled, people-powered and scalable, allowing key risks to be thoroughly and accurately identified. At PwC, our digital audit professionals:

- Develop a deep understanding of the key IT systems supporting your organisation’s financial operations and reporting needs, facilitating adaptation to your technology transformation journey.

- Collaborate with you to discuss entity-level controls relating to IT and high-level cybersecurity governance.

Where applicable, we will perform procedures over the controls you have implemented in your organisation’s support systems, followed by a review of the IT General Controls (ITGCs) over these support systems, including a consideration of whether they are hosted on-premise or on cloud.

Controls advisory

Technology is fundamentally and rapidly changing the way businesses operate. PwC’s digital audit professionals are here to help you optimise your technology investments, while proactively managing your business risks.

How PwC’s digital audit stands out

Evidence Act

PwC is a Certifying Authority appointed by the Ministry of Law. This allows us to certify that an electronic record-keeping system is an “approved process” for the purposes of relying on the presumptions in Section 116A(6) of the Act. We have extensive experience in helping organisations across various industries to prepare for and obtain Evidence Act certifications, equipping us with the expertise to guide you through a smooth certification journey.

Third party trust

We have a team of dedicated professionals who are experienced and knowledgeable about third party risks, the relevant frameworks and assurance standards, controls identification and reporting. By identifying and managing key risks related to security, technology and third party relationships, we help your organisation maintain stakeholder trust and its reputation.

Technology audit and controls advisory

Our deep understanding of Information Technology (IT) risks in business contexts allows us to strengthen their controls and security posture to optimise their technology investment. In identifying threats, we consider the client’s business landscape to provide holistic recommendations. We have worked with companies across industries, including the top 50 listed companies in Singapore as well as start-ups, allowing us to bring rich insights to the table.