We provide high quality tax services to organisations varying from top-tier multinationals to medium and smaller enterprises.

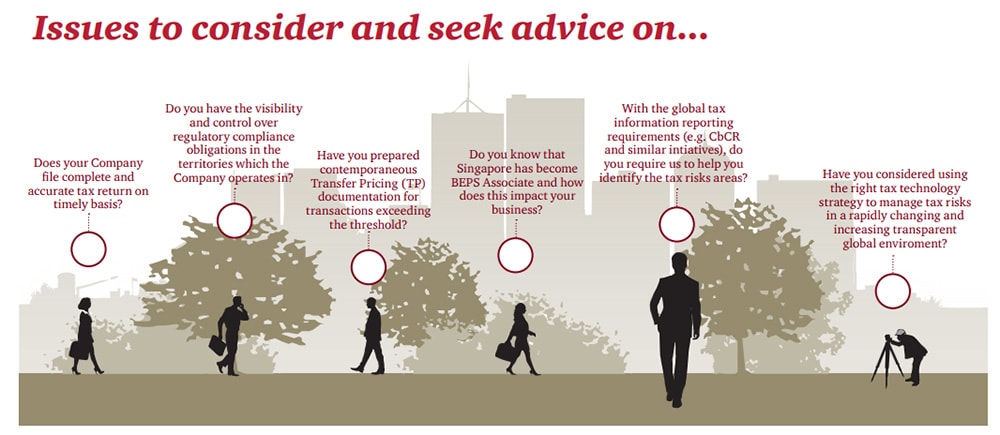

Why compliance is important?

- All companies must file their tax return by the statutory deadline.

- Penalties will be imposed for late filing and incorrect returns.

- Contemporaneous Transfer Pricing (TP) documentation needs to be prepared if transactions exceed certain thresholds.

- Singapore became a BEPS Associate on 16 June 2016.

- Singapore will implement Country-by Country Reporting (CbCR) for financial years beginning on or after 1 January 2017 for the ultimate parent entity of a Singapore multinational enterprise group

How PwC can help you

- Our experienced specialist team can help you meet the compliance needs today and provide knowledge of current and emerging regulatory requirements.

- We not only assist you to comply with the regulatory requirements, we also identify areas that require more focus.

- We can introduce you to a ‘Client Relationship Manager’ (CRM) to free up your resources in monitoring the compliance status. A CRM delivers centralised coordination and communicates with you on the status of the compliance obligations in the territories which you operate in.

- We can assist you to do a health check to address compliance and technical gaps.

Use of technology

We have various tax technology tools to help you with information collection and analysis, including but not limited to:

- CbCR template

- Engagement Center (EC)

- Tax Operations Manager (TOM)

- Tax Organiser (TO) Connect

We will help you to be more efficient in gathering information for tax computation by automating the retrieval of information.

Explore more

Corporate Tax Compliance Services

Corporate Tax Compliance in Singapore has become more complex under the regulatory scrutiny of the Inland Revenue Authority of Singapore.

You need to be confident that all returns are properly prepared and submitted to the regulatory authorities on time.

PwC Tax compliance specialist team is well versed in the latest tax law and practice. We offer you support to deliver more than a ‘classical tax return’, we deliver insight and value.

We offer thoroughly managed tax compliance services which may include:

- Keeping you up-to-date with Singapore tax regulations (including Budget updates) which may affect your company/ branch and compliance requirements

- Monitoring the statutory deadlines and working closely with your company/ branch to meet the compliance filing deadlines

- Preparation and filing of an estimated chargeable income which has to be filed within three months from the accounting year end

- Preparation/ reviewing monthly/quarterly tax provision calculations based on your information and highlight any tax issues identified in the course of our preparation/ review of the information provided

- Preparation/ reviewing the tax computation and Form C based on your information and highlight any tax issues identified in the course of our preparation/ review of the information provided

- Submitting the finalised tax computation and Form C to your company/ branch for your signature and agreement before filing with the IRAS

- Advising on the tax payments due dates upon receipt of the Notice of Assessment

Global Compliance Services

In today’s evolving regulatory environment, global compliance management has become an increasingly complex and risky area. Operating in numerous countries requires coordination of subsidiaries with diverse accounting practices, legislative environments and local business customs.

Our GCS network, part of our broader Tax Management & Accounting Services (TMAS) practice, comprises a network of local country compliance service teams, supported by proven process, technology and effective central coordination. Our GCS network offers coordinated compliance services spanning:

- Direct tax compliance

- Indirect tax compliance

- Tax accounting and reporting

Each of these services is overseen by central/regional Client Relationship Managers. Our services are also underpinned by our Encompass technology, helping us coordinate worldwide activities and giving you online oversight and access to the information you need.

Contact us