{{item.title}}

{{item.text}}

{{item.text}}

The impact of the COVID-19 pandemic on organisations and their people has been unprecedented and has caused many organisations to rethink and evolve their workforce, workplace and operating model.

More than ever, organisations are being challenged to meet the talent demands to support the return to sustainable growth, are under pressure to effectively manage reward and benefits costs, and maximise the return on the overall investment in human capital.

In this new world where people are motivated to work for companies who are purpose-led, yet facing a future that is less defined, organisations still need to ensure that their reward and performance framework supports this and remains aligned to strategy.

It is therefore critical for organisations to take a fresh look at their total reward and performance strategy to ensure it aligns with any new and evolving workforce strategies.

Organisations are finding their approaches to reward and benefits - and the behaviours they drive - under the microscope from stakeholders, regulators, the media and prospective recruits. Understanding the impact of these evolving forces on the competitiveness of reward is increasingly difficult.

And while reward may be one of the reasons why people work, it is not the only reason. That is why PwC’s approach considers reward as part of the broader management ecosystem – including: pensions, leadership, performance management and business strategy.

Businesses continue to face unprecedented structural change, where reward and employment considerations form critical issues.

We work with our clients to understand their people’s reward and benefits; supporting them from the design to implementation of cost-efficient compensation and benefit or incentive plans; that:

We work with organisations to make their programmes more effective through:

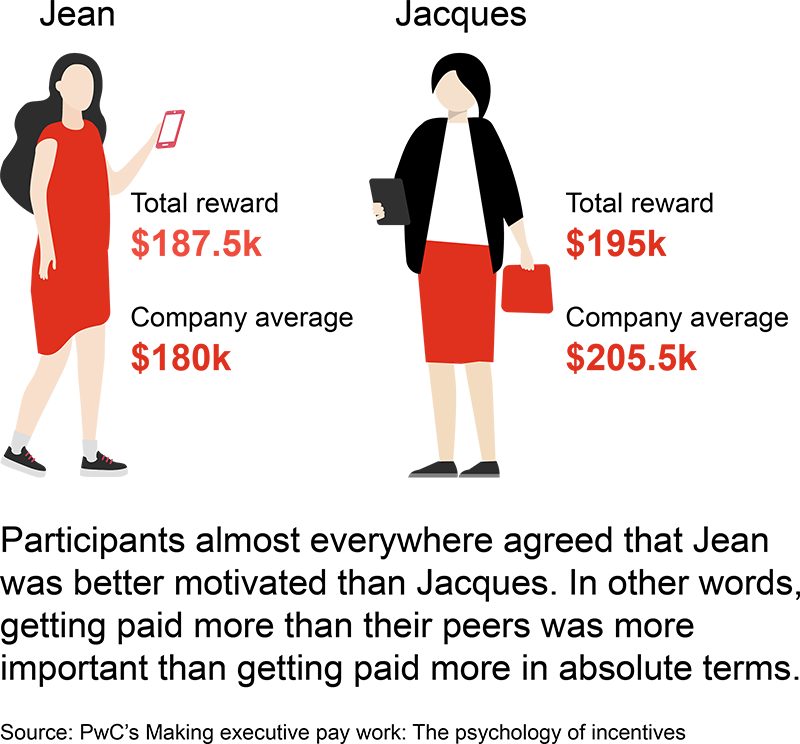

The motivation and retention of executives to implement corporate strategy is vital to an organisation's success. In this specialism, we aim to help companies build a credible executive remuneration policy to achieve this objective. We have considerable experience in helping our clients balance an appropriate remuneration policy companies with shareholder considerations whilst balancing the intricate governance considerations. In practice, our help involves understanding the company strategy and then designing and modelling remuneration policies and plans to drive a positive outcome for all stakeholders.

We support clients in designing their total reward strategy and creating future-fit reward structures for the wider workforce. Greater workforce diversity plus changes to ways of working and technology means that new models are increasingly required. In addition, the underpinning infrastructure of performance management is also evolving to support the development and progression required by today’s fluid and competitive talent marketplace.

We work with clients to develop sales compensation programs tailored to their business’s unique needs and culture. We help clients assess and identify gaps in their current sales plans, design effective incentive plans and facilitate plan roll-out with the right communication.

We provide a structured, analytical approach to:

A key way to drive success for many employers is facilitating shared ownership via employee equity schemes. However, using equity requires careful design, communication and ongoing management to deliver the desired alignment and incentive impact, as well as the tax, accounting and legal consequences. We support clients in creating new schemes, increasing their tax efficiency, managing cost and navigating the impact of organisational change on any type of employee equity arrangement.

Assess the reward and the related tax impact of deals, including pre and post deal, buy and sell side, initial public offerings (IPOs) and divestments.

For more information, visit our people in deals page.

We support clients across the full spectrum of employment tax obligations. The administration of these can be complicated and fraught with risks. Now, even “traditional” employer organisations are becoming increasingly complex and new business models are also on the rise, with an increasingly non-traditional workforce mix that includes ‘gig’ talent and other contingent workers. Our employment specialists help to guide clients every compliance requirements, helping them to seek out commercial and strategic advantages while doing so.

For more information, visit our employment taxes page.

We work with clients using technology based platforms and our market experience to determine what employees value, their preferences, expectations, and identify value gaps. We help clients design bespoke surveys based on their specific goals, perspective and constraints, interpret results, provide training on technology tools, extract actionable insights, and develop and implement action plans. This support delivers tangible results to our clients on:

{{item.text}}

{{item.text}}