After years of unabated growth, Singapore saw a slide in tech start-up funding in 2019 as investors turned more cautious, resetting focus around business fundamentals and cash generation as opposed to growth potential or other less pragmatic business metrics like Gross Merchandise Value (“GMV”). This resulted in fewer deals, and lesser “mega deals”.

This publication explores the funding trends in Singapore’s tech start-up ecosystem over the past three years and first half of 2020, to analyse potential outlook scenarios, pockets of investment opportunities as well as key considerations for both start-ups and investors in the post COVID-19 new world.

Overview

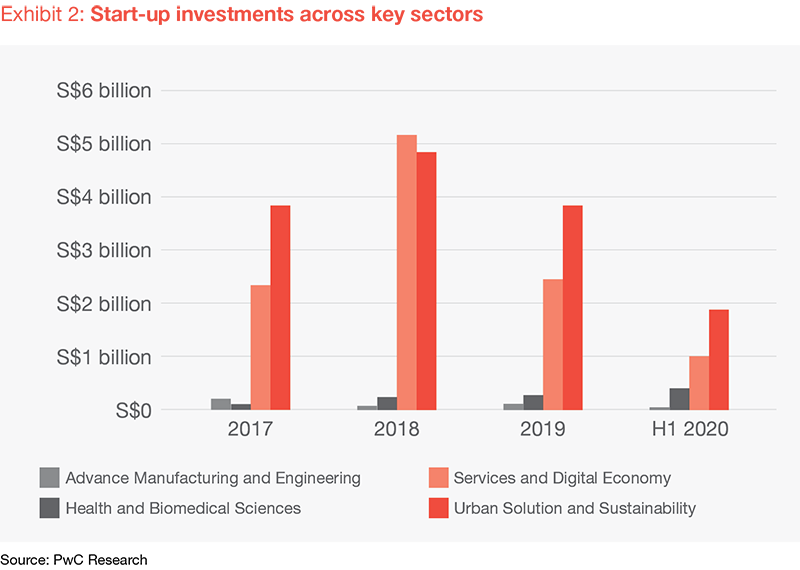

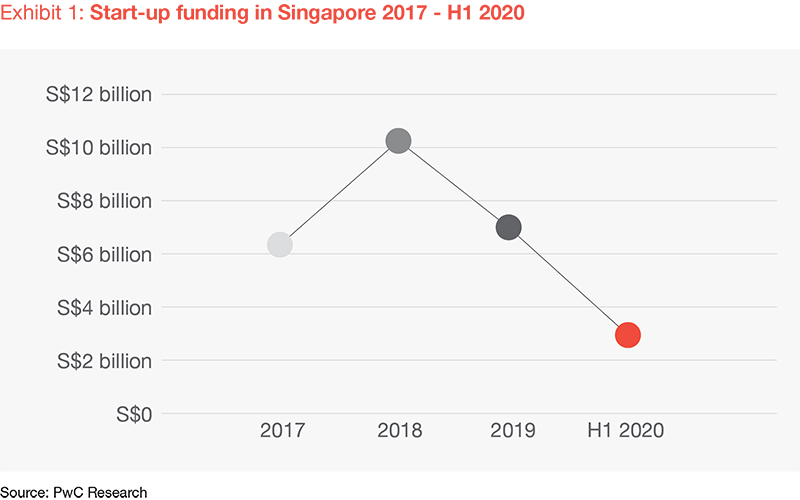

- Record high funding in 2018, a decline in 2019 and a surprisingly steady H1 2020

- Average value per deal fell from S$22.5 million in 2018 to S$16.3 million in 2019 with number of deals reduced from 449 in 2018 to 397 in 2019. The average value per deal in H1 2020 stood at S$17.3 million across 188 deals.

- H1 2020 saw growing interest among investors in AI driven DeepTech start-ups, aside from emerging start-ups in BioTech and AgriTech.

The first half of 2020 saw a steady flow of funding and it looks to be on track to reach 2019 funding numbers.

Large and successful startups are still able to access funding, with Grab raising its latest Series I round of S$1.2 billion in February 2020, and Ninjavan raising $390 million in April 2020. Others like Elara Technologies, Shopback and Moglix have also seen renewed interest and raised large amounts despite COVID-19.

The growth in funding in DeepTech start-ups continues to hold true. DeepTech start-ups funding increased from S$702 million in 2017 to S$980 million in 2018 and touched S$1.11 billion in 2019. Another S$571 million has already been injected in the first half of 2020.

Start-up funding slowed down in 2019 garnering only S$6.5billion against over S$10 billion in 2018 (Exhibit 1). This was however in line with similar declines that have been observed in other parts of the world.

Funding stages trend

There used to be a funding gap beyond Series A a few years ago, when Singapore was a much younger ecosystem. However we have seen a rapid increase in Series A funding in recent years. As of H1 2020, the amount invested in Series A is S$586 million, close to 70% of prior year numbers.

This rapid growth has impacted almost all stages of fundraising beyond Series A. We observe growth rates of over 45% to 55% per year in Series B and C between 2017 and 2019. However, Series B and C funding for H1 2020 stood at S$634 million indicating reduced investors’ focus across these stages of funding amid the COVID-19.

The seed stage however, has been roughly stable over the last 3 years, and this can be explained by the relative early development of seed stage funding in Singapore. It was the first stage to grow, and has now matured to a certain extent. Seed stage funding raised in H1 2020 is S$140 million against S$270m in 2019.

Key takeaways

For start-ups

Be prepared for a potential slowdown. Maintain a good cash visibility - start-ups should ideally have a 12-18 months cash runway. Embrace cash conservation initiatives while ensuring careful assessment of all options. For instance, consider pay cuts instead of lay-offs.

Choosing the right investor is a key success factor for start-ups. More often than not, investors don’t just bring money, but also bring valuable insights and market access among other benefits. Evaluate the non-cash benefits investors may potentially bring in to fast-track the start-ups’ success.

Leverage the advantages created by the new normal. Discuss these opportunities with the potential investors and together understand the ways in which COVID-19 crisis has impacted the business as well as the sector. Adaptability and agility are key attributes for successful start-ups and they must be able to realign strategic focus with changing business environments.

Tap on the support extended by the Government. To catalyse investment into DeepTech start-ups, Singapore’s Budget 2020 has set aside an additional S$300 million under start-up SG Equity. The Government intends to improve support for DeepTech start-ups — particularly those in emerging technology areas such as Pharmbio and MedTech, advanced manufacturing and Agri-foodTech.

For investors

Keep eyes set on proper due diligence. Against the backdrop of COVID-19, investors must focus on the sustainability of the business models as opposed to excessive emphasis on the growth potential. In today’s scenario, we expect investors to play around with businesses they know, and those they’ve been following, as opposed to experimenting with totally new start-ups.

Protect value in existing investments, and help portfolio companies navigate the current situation. Focus on stabilising portfolio businesses amid the COVID-19 crisis, with short term liquidity reviews, evaluation of new funding options and rapid cost reduction. Consider re-focusing and re-positioning the business models of your portfolio start-ups, including Online to Offline ("O2O") and direct to consumer, to ensure alignment with the post COVID-19 world.

“It’s now important for investors to lay greater emphasis on the fundamentals and resilience of the start-ups’ business models. On the flip side, outstanding start-ups should be able to clearly show how they have emerged much stronger and more relevant in the new post COVID-19 world.”

All in all, we believe Singapore’s tech-enabled start-up ecosystem is poised for further growth

- The prominence of Singapore’s ecosystem across key sectors is here to stay, although we expect some turbulence in the short term as investors become more careful and selective in their investment, potentially making fundraising more uncertain amid COVID-19.

- Good investment opportunities will arise from the new normal as businesses shift online and new business models emerge. To connect people and businesses digitally and across sectors, more data will be generated and will need to be analysed, creating needs for Analytics and AI solutions, as well as risk management solutions for issues such as cyber security.

- As key sub-sectors (e.g. FinTech, Analytics and AI) and emerging sub-sectors (e.g. BioTech, CleanTech, AgriTech) assume larger significance in the post COVID-19 world, funds will find a way to boost strong assets led by adaptive strategies, innovative business models and robust growth potential.