Executive summary

Saudi Arabia is making significant strides in its transition to eMobility as part of its broader Vision 2030 strategy, which aims to diversify the economy and achieve net-zero carbon emissions by 2060.

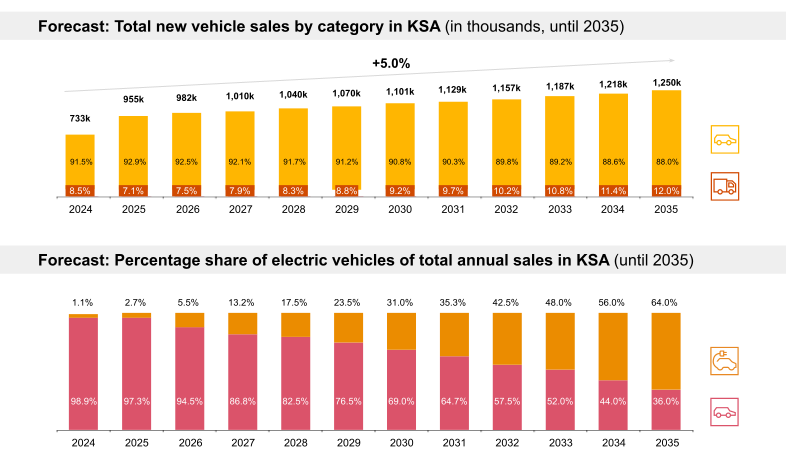

The Kingdom has set an ambitious goal to transition 30% of all vehicles in Riyadh to electric by 2030, as part of a larger strategy to reduce emissions in the capital city by 50%.1 This transformation is being driven by ambitious targets, substantial investments in local electric vehicle (EV) manufacturing, and rising consumer confidence. According to PwC Middle East consumer survey data, more than 40% of consumers in KSA are considering purchasing an EV in the next three years.

The Kingdom is also focused on building a domestic EV manufacturing sector that is expected to greatly boost its in-country value, attract talent, technology and foreign direct investment. Key players like CEER, Foxconn and Lucid Motors are central to Saudi Arabia’s EV manufacturing ambitions. These companies are contributing to the local economy and positioning Saudi Arabia as a regional hub for EV production. Moreover, the PIF and the Saudi Electricity Company have launched a new electric vehicle infrastructure company, Electric Vehicle Infrastructure Company (EVIQ), which plans to establish 5,000 fast chargers across the Kingdom by 2030.2

Despite these advancements, challenges remain in the context of affordability of EVs, limited charging infrastructure, the impact of high temperatures on EV performance and the need for advancements in the regulatory framework. Additionally, the Kingdom must secure a stable supply of critical EV battery minerals and transition to cleaner energy sources to power the growing number of EVs.

This report explores the successful uptake of EVs in KSA and focuses on several key areas, such as investing in domestic EV manufacturing to reduce costs and create significant investment opportunities; developing an efficient and accessible charging infrastructure, including fast-charging stations, to overcome range anxiety; establishing a robust aftermarket support system for EV maintenance and repair to boost consumer confidence and exploring innovative, sustainable, and cost-effective methods for EV battery production. Additionally, fostering public-private partnerships and government initiatives will create a conducive environment for EV infrastructure investment and development and finally, sourcing cleaner energy to power EVs will reinforce Saudi Arabia’s commitment to reducing carbon emissions.

Achieving ambitious EV targets

Accelerating the adoption of EVs and achieving these targets will depend on four crucial factors, such as overcoming affordability barriers for wider adoption, optimal temperature considerations, expanding the public charging infrastructure and assessing the need for sustainable energy generation to power EVs on Saudi roads.

Resources

Download the full report to discover more about :

eMobility Outlook 2024: KSA Edition

Contact us:

Heiko Seitz

Global & Middle East eMobility Leader, PwC Middle East

Shikhar Gupta

Global eMobility Subject Matter Expert, PwC AC India

Dr. Jonas Wussow

eMobility Manager, PwC Middle East

Sushovan Bej

eMobility Manager, PwC Middle East