Adopting a proactive approach to tackle revenue leakage

Revenue is the pulse of every business, driving profitability, fueling growth, and empowering organisations to meet their financial commitments to stakeholders. Whether an organisation is a startup or a global enterprise, its ability to generate and protect revenue is essential for fulfilling financial obligations to shareholders, employees, and partners. The revenue cycle, from product development to invoicing and final collection, is central to value creation and, ultimately, the viability of the organisation.

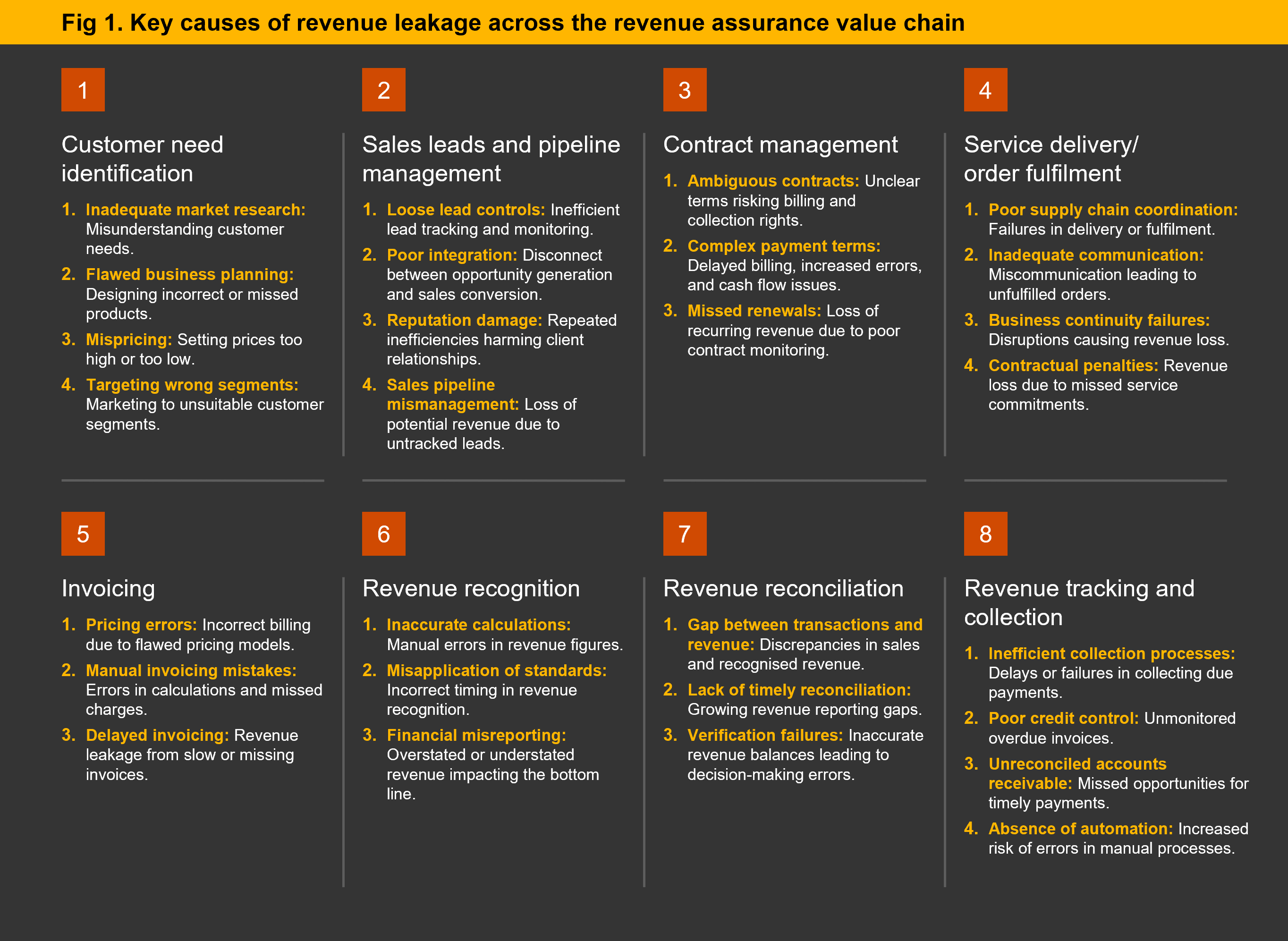

However, as business environments become more complex, this cycle is increasingly vulnerable to revenue leakage – a challenge that impacts all industries. Leakage, including through missed billing, contract mismanagement, or errors in revenue recognition, can silently erode profitability and – in severe cases – threaten a company’s future feasibility.

The critical importance of revenue assurance can be demonstrated through the journey of a single transaction through the revenue cycle. It begins with understanding customer needs and pricing a product or service accordingly. The journey continues through sales pipeline management, contract negotiation, service delivery, invoicing, and final collection. Each stage presents risks for revenue leakage. In today’s competitive landscape, waiting for month-end reconciliations or quarterly audits to identify discrepancies is no longer viable. Organisations must adopt a proactive, real-time approach to address revenue leakage, or risk losing significant value over time.

The evolution of revenue assurance: From traditional approaches to data-driven strategies

Traditionally, revenue assurance has been approached reactively, often relying on periodic audits and manual reviews. This method, while effective to some extent, has clear limitations. By the time discrepancies are identified, the financial impact has already been felt, affecting the bottom line. Traditional methods are also labour-intensive, relying on sample-based monitoring, which can overlook hidden issues, especially in businesses with high transaction volumes.

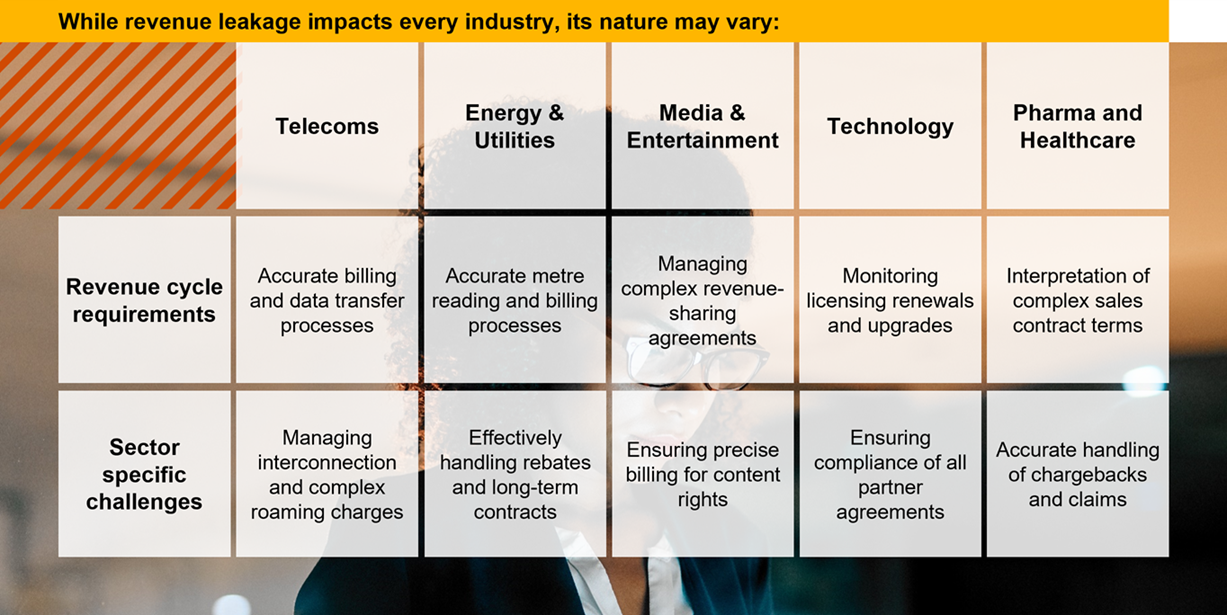

The need for more robust revenue assurance is expanding alongside the evolution of business models. In sectors with diverse revenue streams such as telecommunications, retail, and media, the multiple pricing structures, discount arrangements, and partner agreements create complex revenue paths. In these environments, data accuracy and process integrity are essential for tracking every dollar through the revenue cycle. Today’s advancements in data analytics and Artificial Intelligence (AI) have transformed revenue assurance. AI can monitor transactions at speed and in volume, flagging unusual patterns and pinpointing anomalies at source and in real time. Unlike traditional systems, AI offers proactive insights that allow organisations to immediately address revenue leakage.

Revenue leakage: The hidden threat across all industries

Revenue leakage is a significant risk across all sectors, manifesting differently depending on business models and industry-specific challenges. In financial services, it can arise from inaccuracies in bank and card fee calculations or issues in handling partner commissions. While payment partners play a critical role, any discrepancies in their transactions may result in lost revenue or unearned fees. Stringent regulatory requirements in the financial sector add another layer of complexity, making it vital for firms to meticulously track every transaction and adhere to compliance standards.

Key questions for revenue assurance

Effective revenue assurance relies on a combination of robust processes, clear policies and advanced technology to safeguard revenue by addressing leakage at each stage of the cycle. This includes refining internal processes, automating repetitive tasks, designing comprehensive controls and forming specialist teams to monitor revenue consistently. The most successful programmes are adaptive, leveraging technology to provide ongoing oversight and integrating improvements as business needs evolve.

When striving to build a resilient revenue assurance framework, the following questions

will help to identify and address revenue leakage:

- Is your organisation experiencing revenue leakage? Even for the most well-established enterprises, identifying potential leakage risks is critical.

- Where are the potential revenue leakage points in your cycle? Understanding these points allows you to target improvements and develop a proactive approach.

- Can you quantify potential revenue losses? Without understanding the financial impact, it’s challenging to prioritise and address the leakage points.

- How accurate are your reported revenue figures? Regular reconciliations and accuracy checks are essential to ensure your financial statements reflect true revenue.

- Do you have advanced systems and controls in place to prevent and monitor leakage? This includes the latest technologies, such as AI, which can automate systems that track and flag irregularities across the revenue cycle.

Data analytics and AI: The future of revenue assurance

Advanced data analytics and AI have redefined what revenue assurance can achieve, enabling organisations to analyse vast amounts of data instantaneously, identifying patterns that would otherwise go unnoticed. By applying machine learning models, these systems can detect anomalies, predict risk areas, and provide actionable insights.

AI’s power lies in learning from historical data and recognising emerging trends – crucial for identifying the subtle indicators of revenue leakage. For example, an AI system can detect unusual patterns in customer billing cycles or identify inconsistencies in partner commission structures. When coupled with real-time data, these insights enable organisations to respond quickly, minimising financial impact.

GenAI: Unlocking revenue growth and profitability

Business leaders in the Middle East are optimistic about the financial impact of GenAI, with 63% of CEOs expecting GenAI to increase their organisations revenue, and 62% anticipating it will increase profitability, according to PwC’s 27th Annual CEO Survey. As more organisations embrace these tools, the ability to safeguard revenue will become more robust, further enhancing financial performance.

Building a revenue assurance culture

A robust revenue assurance framework requires more than just technology alone. It demands a cultural shift within the organisation, prioritising revenue integrity across all teams and functions. Revenue assurance is everybody’s responsibility, involving collaboration across finance, operations, sales, and IT. By fostering a culture of accountability, companies can ensure that each function understands its role in safeguarding revenue.

Organisations should also invest in training employees on the importance of revenue assurance and its supporting technologies. Staff well-versed in revenue management processes and the potential impact of leakage are better equipped to identify issues and raise concerns proactively. Additionally, clear policies and performance metrics aligned with revenue assurance goals ensure that teams work towards the shared objective of revenue protection.

Looking ahead:

In a rapidly evolving business landscape, revenue assurance is now a proactive, strategic pillar essential for organisational resilience and growth. It requires a transition from a passive approach to a predictive, responsive strategy that includes: