OPEC+ extends producer action

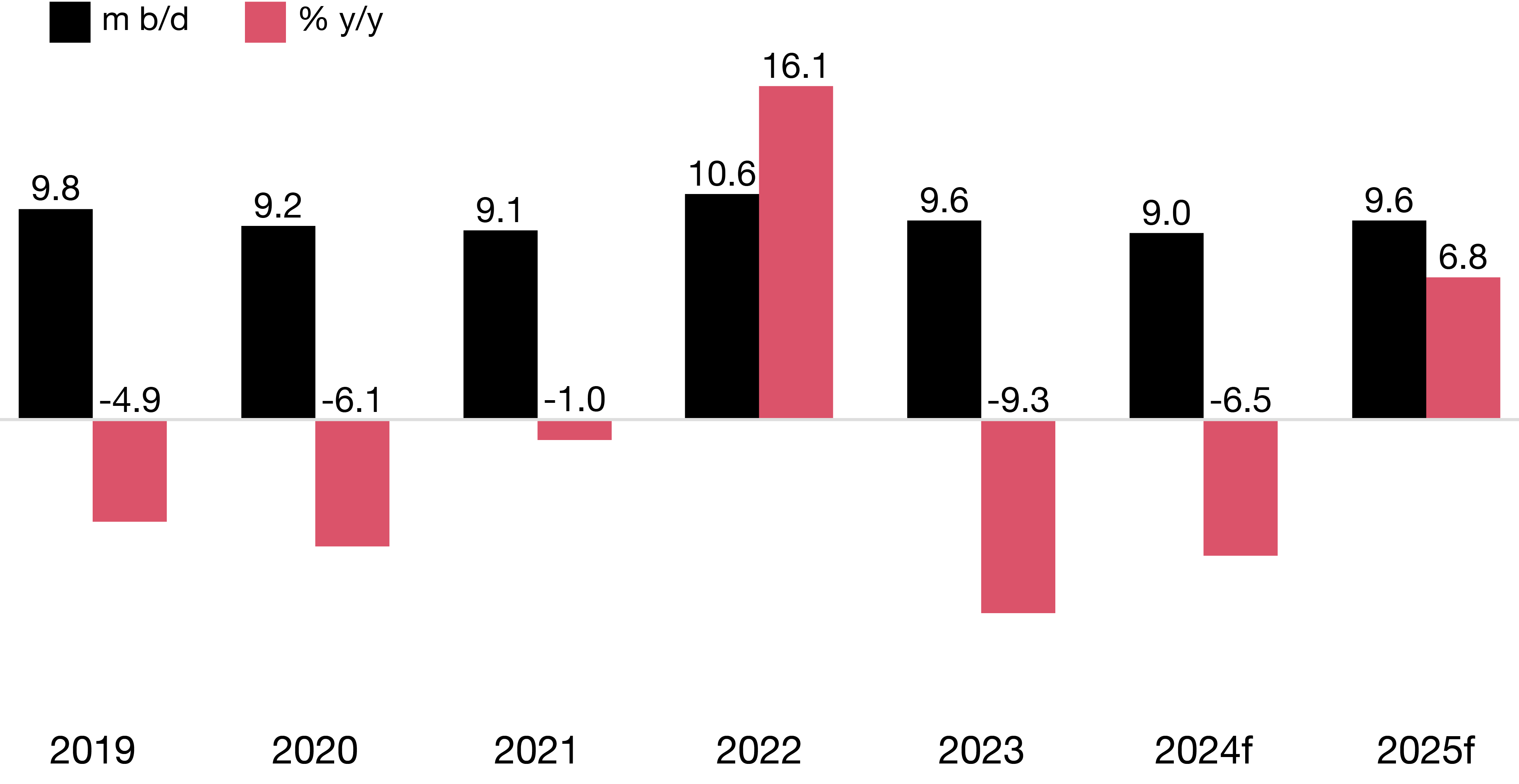

The oil sector, a key driver of the Saudi economy, remains constrained by demand and OPEC+ quotas, with production in 2024 set to average just under 9m b/d, the lowest level since 2010. The year began with a significant win for Saudi Arabia’s oil market strategy as seven other countries agreed to make a second round of voluntary cuts beyond their formal OPEC+ allocations, whereas previously Saudi Arabia had been bearing this burden alone, making a unilateral cut of 1m b/d from July 2023. Then in June, an agreement was reached to extend OPEC+ action through H2 2024 and 2025, maintaining headline quotas and gradually tapering voluntary cuts, which would bring Saudi output back to nearly 10m b/d in late 2025, the highest since June 2023. These efforts seemed to bear fruit as the oil price broadly stabilised, with Brent crude averaging $83/barrel from January to August, similar to 2023. However, concerns grew about the economic health of China and the US and hence the trajectory for oil demand growth, causing Brent to dip, which fell below $70 on 10th September for the first time since 2021. In response, Saudi Arabia and its peers postponed the taper of their voluntary cut by two months until December. Assuming the current schedule is followed, Saudi production in 2024 will be about -7% lower than in 2023 and will then rebound by 7% in 2025.

Saudi oil production and future allocations (annual average)

Source: OPEC

The oil sector remains the key driver of the fiscal balance. Although average oil prices in H1 2024 were up by about 5% y/y, production was down by -12% y/y, thereby reducing royalties and income tax receipts by -10%. However, this was more than offset by a 42% surge in dividends from Aramco, as it introduced a new performance-based dividend to distribute windfall profits, mainly dating from 2022, causing overall oil fiscal revenue to increase by 10%. Meanwhile, non-oil fiscal revenue continued to grow, rising by 6% to a new record. However, expenditure rose by 12%, led by a 43% increase in capex, much of it linked to infrastructure supporting Vision 2030 projects. As a result, there was a fiscal deficit of 1.3% of GDP in H1, down from a deficit of 3.6% of GDP in H2 2023. However, the Ministry of Finance’s Mid-Year Economic Review anticipates a deficit of 2.9% of GDP for 2024 as a whole, wider than budgeted.

Solid non-oil performance in H1

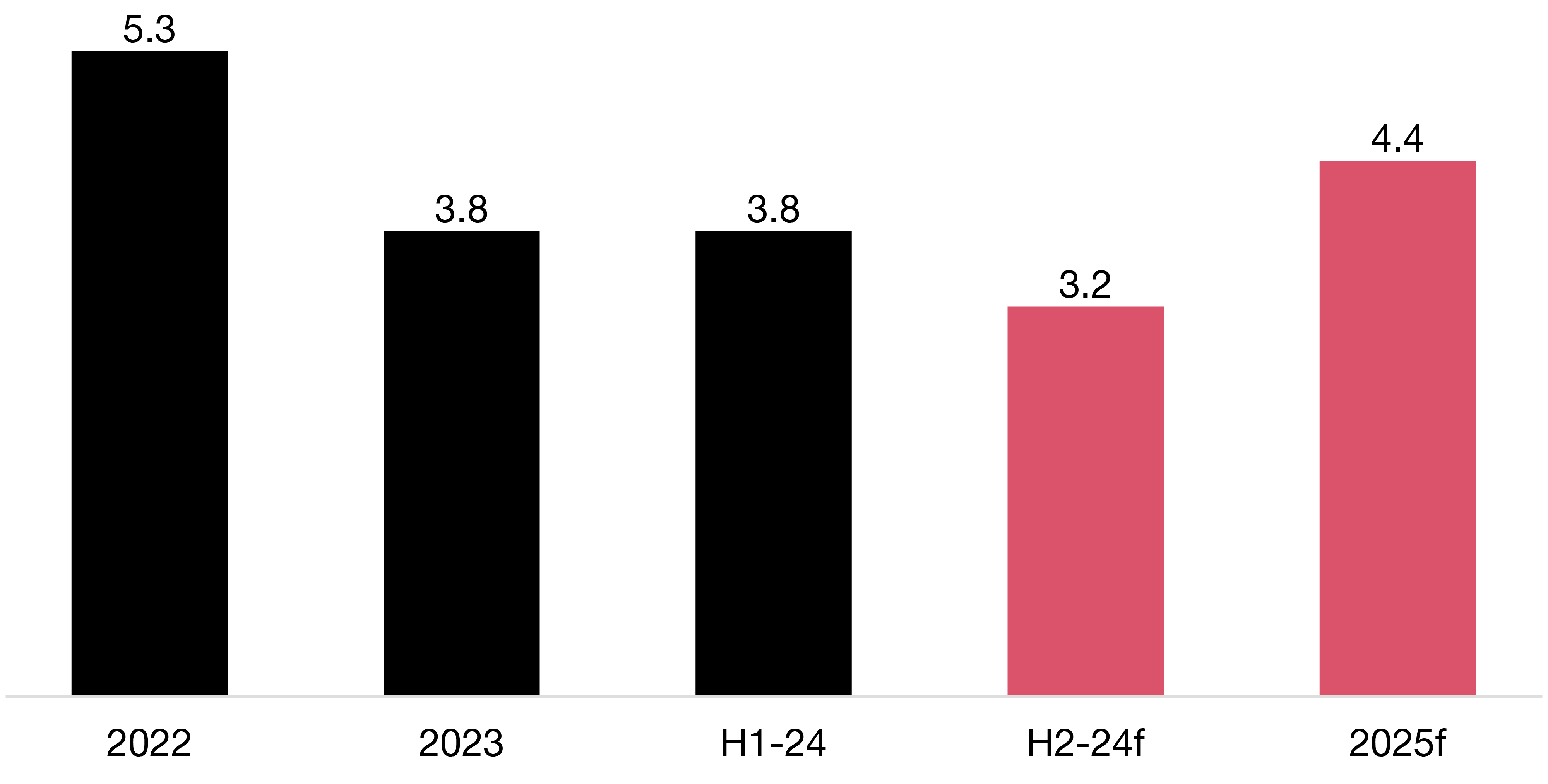

The non-oil economy continued to perform strongly in H1 2024, up by 3.8% year-on-year. This was led by the private sector, which grew by 4.2%, including by 4.9% in Q2, the strongest performance in a year. The biggest contribution came from the trade and hospitality sector, which grew by 6.4% in H1 and there was positive growth in all the other non-oil sectors including transport and communications (4.8%) and finance and business services (3.8%). Although manufacturing only grew by 1.7%, this was a notable rebound and came despite a further cut in crude production, which can affect feedstock for downstream industries and was part of the reason for the 3.5% decline in manufacturing in 2023.

Non-oil growth (%p.a.)

Source: General Authority for Statistics; IMF

There may have been a slight slowdown in Q3, indicated by a fall in the Purchasing Managers Index, which averaged 55.2 in Q3. Although this is still indicative of expansion (>50), it was down from an average of 56.3 in H1. This fits with the IMF’s forecast of 3.5% non-oil growth for 2024 as a whole, which is similar to the official estimate of 3.4% in the Ministry of Finance’s Mid-Year Economic Review. When combined with the H1 result, this implies a slowdown to around 3% growth in H2. However, the Fund expects non-oil growth to then pick up to 4.4% in 2025. This anticipated acceleration could be explained by the opening of several projects, ranging from the Riyadh Metro to Red Sea hotels, as well as many private projects initiated after the end of the COVID-19 lockdowns.

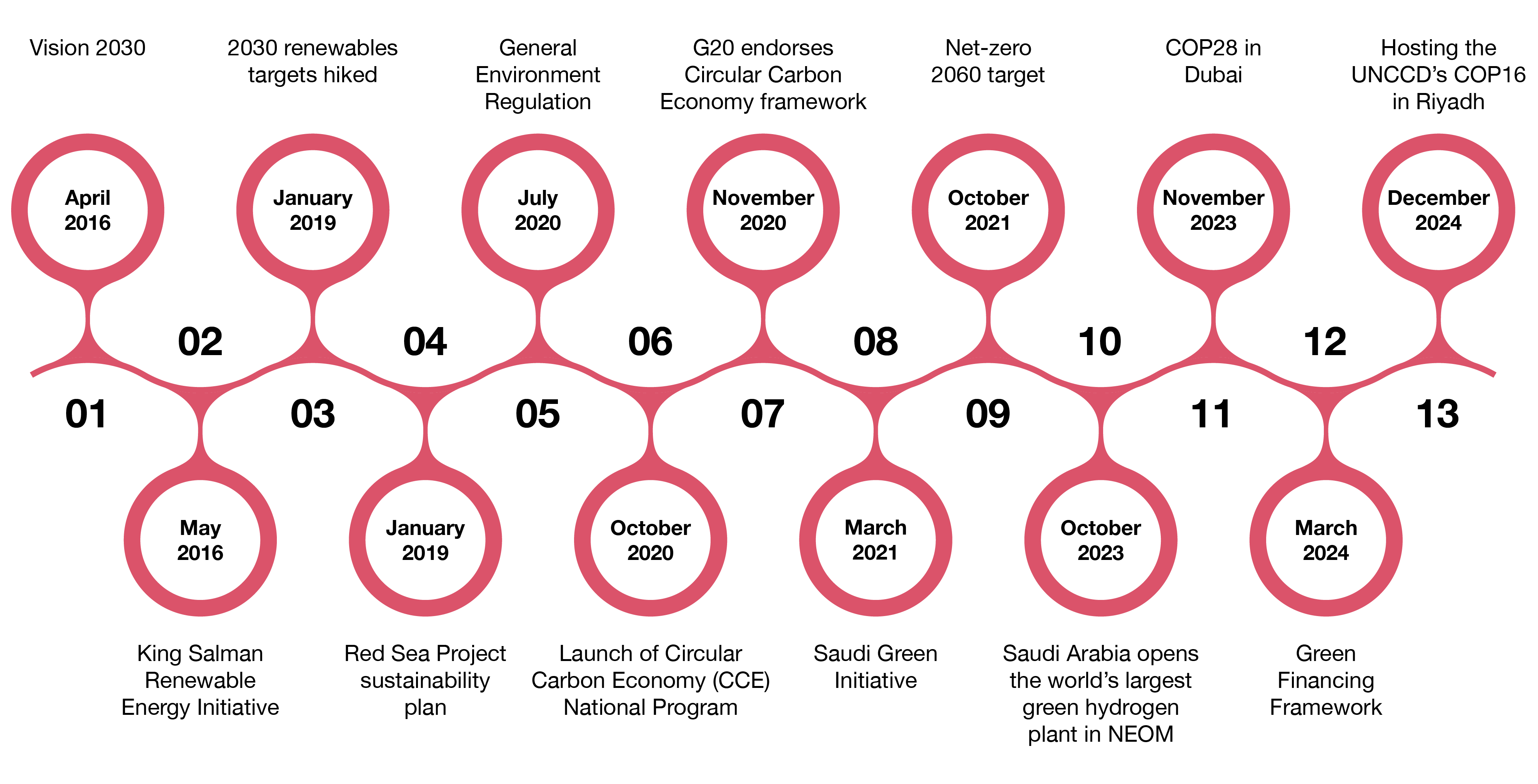

Sustainability milestones

Saudi Arabia's journey toward sustainability has been marked by a series of critical milestones that have laid the foundation for its long-term vision. Building on Vision 2030, the Kingdom has progressively set ambitious sustainability goals and implemented comprehensive programmes to facilitate their realisation. Milestones range from initial foundational steps, through the setting of increasingly ambitious targets and systematic programmes, to a focus on developing the right enablers to facilitate implementation.

Among the foundational steps was the King Salman Renewable Energy Initiative, which in 2016 introduced new capacity targets for power deployment that have, in turn, been successively increased; these are discussed in detail in the next section of this report. Meanwhile, legislative changes culminated in the General Environment Regulation issued in July 2020, updating a two-decades-old law to address current challenges. Then, the Kingdom’s presidency of the G20 in 2020 provided an opportunity to unveil its Circular Carbon Economy framework, which focuses on efforts to integrate into economic planning efforts to reduce, reuse, recycle and remove CO2 emissions.

Next came the launch of the Saudi Green Initiative (SGI) in 2021, a broad programme that cuts across governments and catalyses efforts to reduce emissions, protect the land and sea, and restore ecosystems. The SGI’s first summit was also the occasion for the announcement of a formal net-zero target, for the year 2060; Saudi Arabia was one of the first countries in the region to announce a net-zero target and it was a highly symbolic development for the world’s largest oil exporter that had in the past been accused of resisting global efforts to transition away from hydrocarbons. Saudi Arabia’s sustainability ambitions were on display at COP28 in Dubai in late 2023, both in the formal meetings and in the initiatives showcased in its national pavilion.

There have also been efforts to integrate sustainability into finance, including the Ministry of Finance’s Green Financing Framework, published in March 2024. Alongside these major developments, there have been dozens of smaller initiatives across government and also in the semi-public and private sectors, where ESG (Environment, Social and Governance) efforts have become widespread. Moreover, sustainability has become a major topic of discussion at conferences, such as the annual Future Investment Initiative, and it is an area that Saudi Arabia emphasises in its regional cooperation efforts, such as the Middle East Green Initiative.

These clear ambitions around sustainability have defied expectations of some sceptics and have become integral to the Kingdom’s vision for the future, well beyond 2030.

Timeline of major developments

Saudi Arabia's sustainability strategy addresses both the supply and demand sides of energy management to achieve its environmental goals. On the supply side, the Kingdom is investing in lower-carbon alternatives, including natural gas and renewable energy sources like solar, wind, and nuclear power. These efforts aim to reduce emissions while diversifying the energy mix. On the demand side, the focus is on enhancing energy efficiency and reducing overall consumption across sectors. The strategy also emphasises driving electrification in transportation and industry to further decrease carbon emissions, aligning with global sustainability trends and national targets for a greener future.

Bold expansion of gas production

Until recently, the energy sector in Saudi Arabia largely meant the production and export of oil, with domestic power generated from oil and associated gas. The future is going to be a more diversified and lower-carbon mix, both for domestic power generation and exports, including a significant increase in gas, renewables and possibly nuclear power.

In the hydrocarbons sector, Saudi Arabia anticipates that there will continue to be substantial global hydrocarbon demand for decades and that supplying it will remain the mainstay of the economy, even as it diversifies. There has been a push underway for several decades to scale up gas production to provide a cheaper and lower-carbon alternative to oil for electricity generation, while at the same time freeing up oil for export and providing ethane and natural gas liquids feedstock for downstream industries. Most of the Kingdom’s gas is produced as an associated by-product from oil fields. Back in the 1970s, most of this was flared or reinjected, but the Master Gas System was steadily rolled out across oil fields so that by the mid-1980s, the vast majority was harvested. Efforts continue to improve efficiency: only about 1% of gas is now flared and Aramco is committed to end all routine flaring by 2030.

Non-associated gas has now risen to around half of total gas production and has the advantage of not being curtailed by OPEC quotas on oil. The first plant to process onshore non-associated gas from a layer of Ghawar came into operation in 2001, followed by production from offshore fields including Karan, Arabiyah and Hasbah. There are ambitious plans in place to expand gas production, focused largely on Jafurah, a giant unconventional gas field east of Ghawar which is estimated to have around 229 trillion cubic feet of gas, similar in magnitude to all the Kingdom’s conventional gas reserves combined. Unconventional fields require more complex techniques to extract, such as horizontal drilling and fracking and the Kingdom is already producing 0.5bcf/day from two smaller unconventional fields, South Ghawar and North Arabia. Work on Jafurah began in 2021, with the first production targeted for Q3 2025, ramping up to 2bcf/day by 2030. In addition, new gas fields are still being discovered, most recently Al-Ladam and Al-Farouq in 2024.

The expanded gas production aims to end the use of oil in the power sector by 2030, which would free up about 0.4m b/d of oil for export. As well as producing more gas, the implementation of the Liquid Fuels Displacement Program requires expanding the Master Gas Network to deliver the gas where it is needed, including converting power and desalination plants to use gas. There may even be enough gas to export LNG or convert into “blue” hydrogen, which involves capturing and storing the waste carbon dioxide from the process.

Renewables rollout

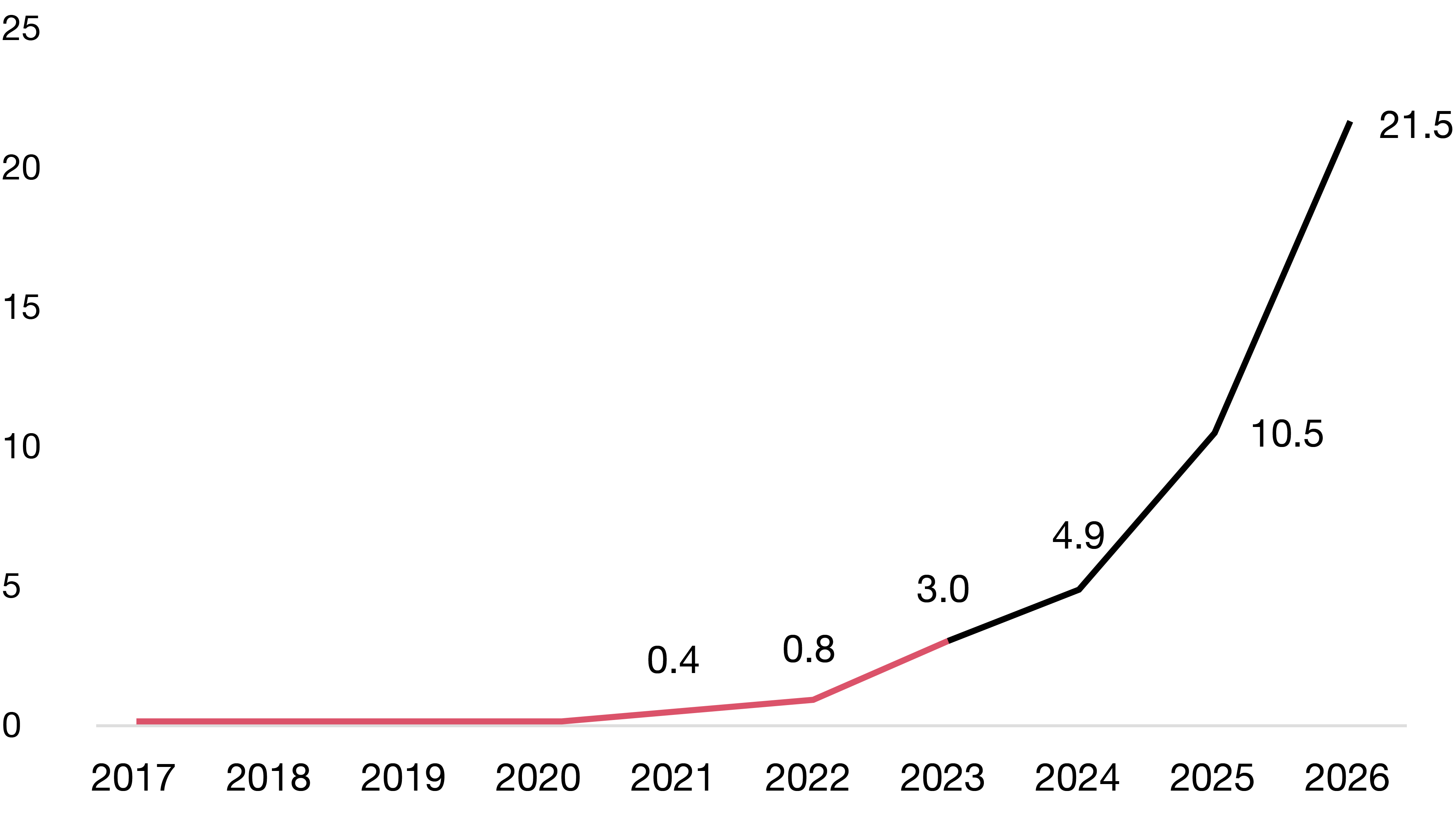

The Kingdom’s potential for renewables, particularly solar power, has been clear for some time, with ambitious capacity targets set as early as 2013. Some of the early targets have been missed, but there has been a dramatic increase in delivery capacity in recent years that provide more confidence for current plans. The official target for 2030 was hiked last year from an already ambitious 58.7GW to a range of 100-130GW, reflecting uncertainty about the rate of electricity demand, as the goal is to meet at least 50% of demand through renewables, with the remainder provided by gas.

Procedures and financing were put in place to work towards these targets, with the Ministry of Energy’s Renewable Energy Project Development Office (REPDO) and the Saudi Power Procurement Company (SPPC) awarding four projects. This includes, the first utility-scale solar plant PV, Sakaka, which came into operation in 2021, and the first wind plant, Dumat Al-Jandal, in 2022. Projects have also been tendered by PIF, which has been given the mandate to deliver 70% of the national renewables target, which it is doing through its Badeel subsidiary and in partnership with its associate ACWA Power and Aramco. The first to be operational, and the Kingdom’s largest, is the 1.5GW Sudair solar plant, which began production in September 2023. There are also other public and private companies developing renewables, including Saudi Electricity Company, Aramco and Alfanar.

The policies, capabilities and financing structures are now in place so that even if the targets are not met by 2030, they should be soon afterward. As of September 2024, a total of 21 projects had been contracted through REPDO and PIF, with a total planned capacity of 19GW. The most recent to become operational was the 700MW Al-Rass solar plant, in August and we estimate that close to 5 GW of capacity will be operational by the end of 2024, a more than five-fold increase in two years. Capacity should more than double in 2025 and double again in 2026, to around 21GW, based on the estimated timelines of announced projects.

Renewable power operational (GW)

Source: IRENA historic data until 2023, PwC forecasts for 2024-26 based on announced projects

The nuclear potential

Saudi Arabia has a longstanding interest in nuclear power. The King Abdullah City for Atomic and Renewable Energy (KA-CARE) proposed in 2013 to build 17GW of nuclear capacity by 2032, later postponing the target until 2040 (at the same time as it postponed the renewables target). Since then, no major projects have been contracted, with just a low-energy test reactor completed this year by Argentine firm Invap.

Given the rapid expansion of gas and renewable energy capacity, along with the cost and complexity of nuclear power, it is unlikely that nuclear energy will play a significant role in the Kingdom’s energy mix in the medium term. However, niche applications, particularly for new small-scale modular nuclear reactor designs, may still be explored.

Greening industry and infrastructure

Saudi Arabia has seen a significant opportunity to link its investment in renewables capacity with the development of upstream industrial activity locally, as part of broader localisation and diversification objectives. The first solar manufacturing in the Kingdom was by dt Industries in Jeddah, which had an annual capacity of 300MW of panels in 2023 and is aiming to boost that as high as 3GW by 2025. In a major development in July 2024, the Renewable Energy Localisation Company, a subsidiary of PIF, signed agreements with three Chinese companies, Jinko Solar, Lumetech and Envision Energy to develop solar and wind components.

Some of these locally produced components may be used in the Kingdom’s largest clean energy project, the NEOM Green Hydrogen Company in Oxagon. The plant achieved an $8.4bn financial close in 2023 on its first phase, which is due to come into production in 2026, when it will use 4GW of solar and wind power to produce 1.2m t/yr of ammonia, the preferred carrier molecule for hydrogen energy. The project is being developed by PIF in association with US firm Air Products, which has signed a 30-year off-take agreement, significantly derisking the project. It will be the world’s largest green hydrogen project and could be substantially expanded in the future.

An even more substantial area of investment in green technology is electric vehicles. Saudi Arabia is establishing a manufacturing hub in King Abdullah Economic City, with a goal of producing 150,000 vehicles by 2026 and half a million vehicles by 2030, along with localisation of much of the component supply chain. The objectives are being implemented through three companies. US firm Lucid Group, 60% owned by PIF, opened its first facility in the Kingdom in 2023, starting by reassembling cars sent in kits from its main Arizona factory, as it invests in developing a full production line. The other major player is Ceer, a joint venture between PIF and Taiwan’s Foxconn, which is developing its own EV models, utilising technology from BMW. Ceer has taken major steps forward in 2024, awarding a $1.3bn contract to Modern Building Leaders to construct its factory and a $2.2bn contract with Hyundai Transys for the supply of the EV drive systems for its vehicles. In addition, Hyundai Motors has partnered with PIF to develop a factory for both EVs and conventional cars, which is aiming to begin operations in 2026.

As well as building EVs, Saudi Arabia is procuring them for the public sector and developing a charging network. The Electric Vehicle Infrastructure Company, a JV between PIF and Saudi Electricity Company, plans to install 5,000 fast chargers by 2030. The government pledged in 2022 to buy up to 100,000 of the Lucid EVs produced during the first decade in which the factory is in operation. Another area of focus is the supply chain for batteries and their precursor minerals. Manara Minerals, a JV between Ma’aden and PIF, was launched in 2023 to procure key minerals abroad, including a major investment in 2030 in the Energy Transition Metals business of Brazilian giant Vale, and efforts are also underway to expand exploration and mining within the Kingdom. Projects have been announced to extract lithium from spodumene ore, including by EV Metals, which announced plans in 2021 to develop a plant in Yanbu, and more recently by European Lithium in 2023.

Saudi Arabia’s tourism sector presents a unique opportunity to integrate sustainability into development, as well as promoting environmental conservation. The Kingdom understands the importance of preserving its diverse landscapes and ecosystems, not only for their economic potential but for their ecological significance. For example, the Royal Nature Reserves initiative aims to protect and restore the country's natural landscapes and biodiversity, safeguarding iconic Arabian species like gazelles and Nubian ibexes, which have been threatened by urbanisation, habitat loss and illegal hunting. These reserves also provide sanctuary for migratory birds, red foxes and golden jackals, balancing both ecological preservation and cultural heritage. Attracting over 400,000 visitors annually, the reserves promote sustainable tourism and contribute to both conservation and economic growth, with infrastructure investments of approximately US$350 million planned by 2030.

Improving energy and resource efficiency

Efforts to expand renewable and gas production are also being complemented by initiatives to improve energy and resource efficiency. Since the launch of the Saudi Energy Efficiency Program in 2012, the programme is estimated to have resulted in energy savings equivalent to around 0.5m b/d of oil, by improving the efficiency of buildings, reducing the energy intensity of industry and developing public transportation. These efforts will advance further in late 2024 when the Riyadh Metro opens and shifts a sizable proportion of the city’s transportation off roads. The carbon intensity of industry is also being addressed through carbon capture, utilisation and storage (CCUS), a technology that Saudi Arabia is well placed to deploy given Saudi Arabia’s expertise in drilling and the availability of reservoirs suitable for storing captured CO2. SABIC currently captures 1.3m t/yr of CO2, already one of the world’s largest such projects, and is aiming to expand CCUS capacity to 11m t/yr by 2035.

Another pressing challenge is water sustainability. As one of the largest producers of desalinated water globally, Saudi Arabia depends on this energy-intensive process due to its arid climate and lack of perennial rivers. However, desalination's environmental impacts, including brine discharge that harms marine life, pose significant challenges. In response, the Kingdom is investing in sustainable desalination technologies, exploring alternative water sources like treated wastewater, and advancing water conservation measures. The country is also focusing on improving the efficiency of its water infrastructure and promoting water-saving practices among its population.

Vision 2050

As this report has outlined, Saudi Arabia has made significant advances in sustainability across various sectors, with plans to accelerate progress in the final years of Vision 2030, which would create hundreds of thousands of jobs in sectors ranging from manufacturing to tourism, and make a significant contribution to the non-oil economy. This then raises the question: What could come next?

It is likely that in the later part of this decade, the government will announce a successor plan, perhaps a Vision 2040 or 2050, outlining its goals for the next stage of development. Such a vision would likely look out much further into the energy transition. To meet UN climate goals, some assessments suggest that global oil consumption would need to fall by about two-thirds by 2050, whereas OPEC’s forecast sees demand continuing to increase, rising by about a sixth to 120 million b/d by 2050. Nevertheless, there is good reason for the Kingdom to press ahead with its sustainability efforts domestically.

The next vision could see more ambitious targets for renewable energy generation, moving from the 2030 target of 50% electricity generation from renewables towards 100%. This might involve halting the construction of new gas plants and phasing out existing ones, as well as expanding energy efficiency measures. There could also be a major push to expand utilisation of EVs, not least because of domestic production capacity that will be in place by 2030. The government could commit to utilising EVs for its fleets, investing in the charging infrastructure and providing subsidies for purchases - replacing the existing subsidies on fossil fuel consumption, estimated by the IMF at around 5% of GDP.

A successful shift toward clean energy domestically would also free up gas to be exported as LNG or blue ammonia to displace more polluting fuels like coal abroad. Carbon capture and storage in the chemicals sector is another way that the Kingdom could cleanly utilise its hydrocarbon reserves. Green energy exports could also be ramped up, including increasing production of hydrogen, which some forecasts expect to comprise up to 14% of the global energy mix in a net-zero scenario, and the Kingdom could also expand its direct exports of electricity to neighbours, building on its existing grid interconnections with Iraq, Egypt and other countries.

The Kingdom’s continued commitment to sustainability, paired with its bold vision for future development, positions Saudi Arabia to play a critical role in the global energy transition. By pursuing clean energy initiatives, expanding green technology, and building strategic partnerships, Saudi Arabia is poised not only for continued economic growth but also for leadership in the global green economy in the years ahead.

Contact us

Richard Boxshall

Global Economics Leader and Middle East Chief Economist, PwC Middle East

Tel: +971 (0)4 304 3100