{{item.title}}

{{item.text}}

{{item.text}}

25/07/22

In our previous blog, we shared some trigger points from global or domestic requirements on tax governance and how companies could plan ahead to meet multiple requirements with one action plan. In this blog, we will outline the components required to effectively manage tax risk (i.e. the "building blocks" of a Tax Corporate Governance Framework).

Some of you may be wondering what is the Tax Corporate Governance Framework (TCGF) and Tax Control Framework (TCF)? Are they one and the same and how do they correlate to each other?

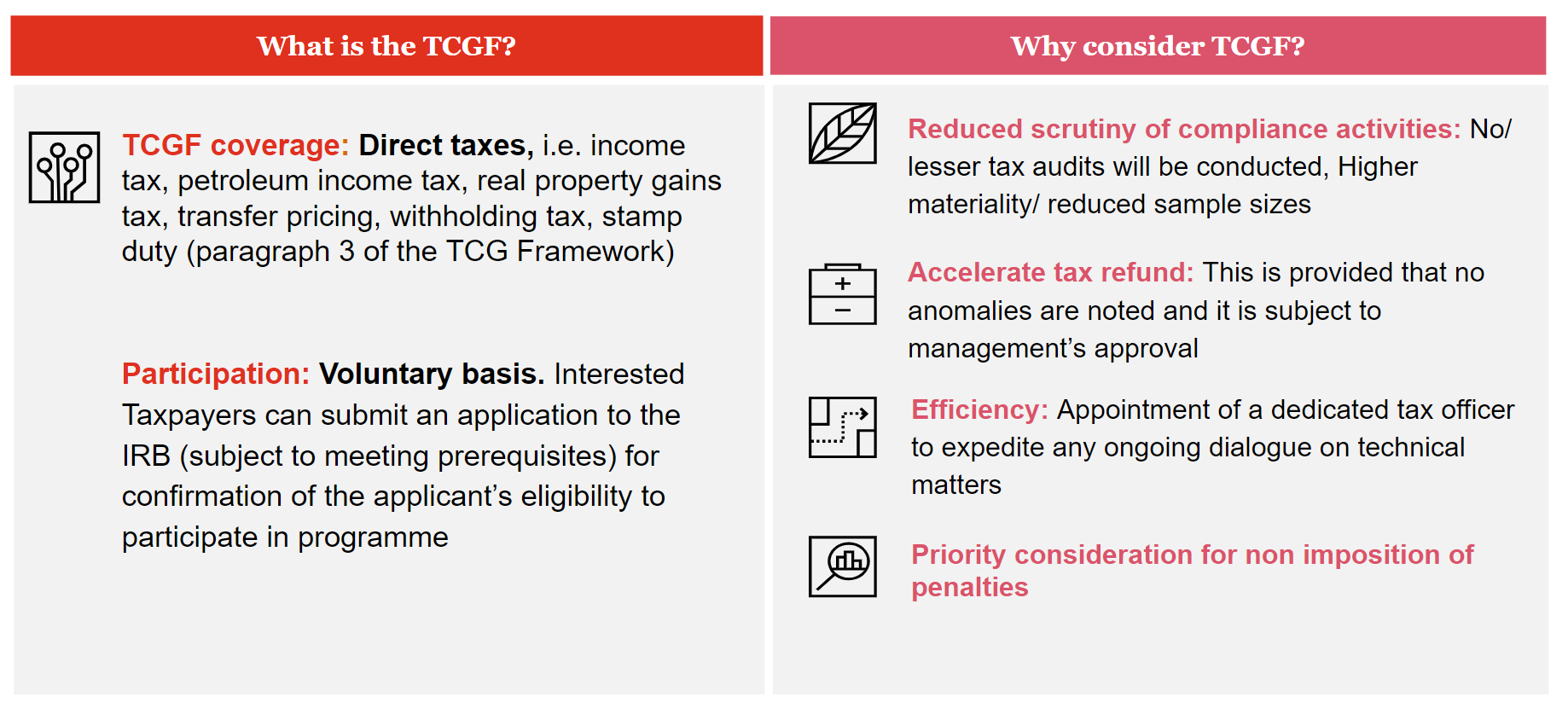

As per the Malaysian Inland Revenue Board’s (IRB) Guidelines to Tax Corporate Governance Framework released on 15 April 2022, Tax Corporate Governance encompasses the rules, relationships, systems, and processes under which authority is exercised and controlled within an organisation. The requirements and benefits for participation in the TCGF programme is summarised in the below diagram:

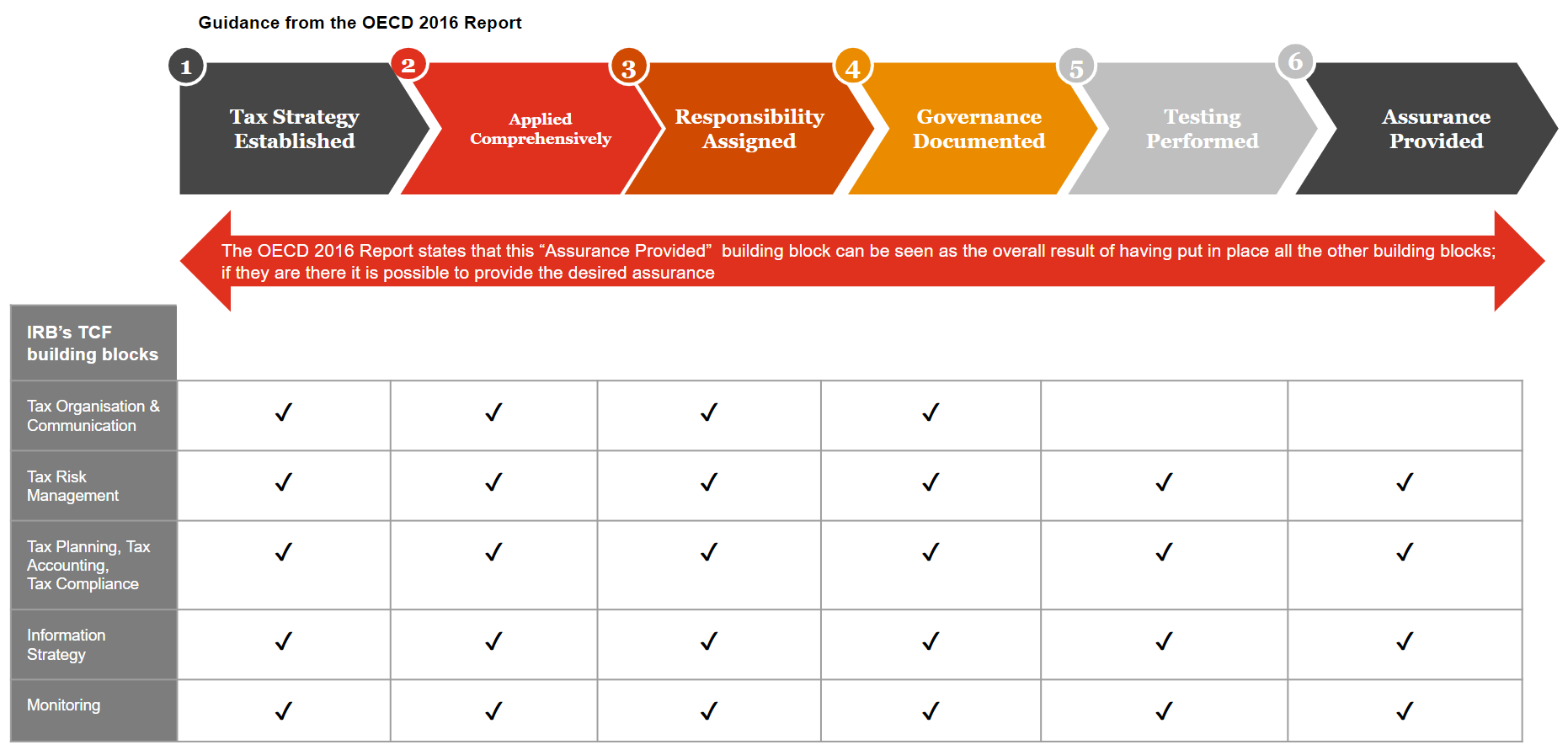

The Tax Control Framework (TCF) is a subset within the broader corporate governance framework - it comprises the mechanisms by which businesses, officeholders, and those in control are held to account. The Organisation for Economic Co-operation and Development (OECD)’s report on Co-operative Tax Compliance: Building Better Tax Control Frameworks 2016 defined a TCF as part of the system of internal control that assures the accuracy and completeness of the tax returns and disclosures made by an enterprise. The IRB aligned their definition of TCF closely with the OECD, which is summarised in the diagram below (please see further details shared in our newsletter Taxavvy Issue 7/2022 ).

These building blocks should be capable of providing assurance to stakeholders that the right amount of tax is paid when it is due. The effective management and adoption of a TCF is dependent on all key stakeholders in the organisation (Board of Directors, Finance, Legal, Procurement, etc.), i.e. there is adequate awareness of the role of the TCF, controls are in place and these are communicated accordingly to ensure risks are managed to facilitate compliance.

TCF originated as a modification or extension of a generic Internal Control Integrated Framework developed by the Committee of Sponsoring Organisations of the Treadway Commission (COSO) to reflect the specific requirements for tax. The table below maps out the building blocks to key five interrelated components defined in COSO’s Internal Control Integrated Framework, which is a leading model for internal control used globally:

No. |

COSO’s Internal Control Integrated Framework |

TCF building blocks based on IRB’s guidelines |

|---|---|---|

1 |

Control environment |

|

2 |

Risk assessment |

|

3 |

Control activities |

|

4 |

Information and communication |

|

5 |

Monitoring |

|

Is there a model of TCF that should be adopted by all companies? The OECD and COSO models offer guiding principles on what is expected to support effective tax risk management. However, companies also need to consider alignment of their TCF with their:

As an example, multinational companies which have diverse business models may potentially have higher risk from cross border transactions, compared to locally run businesses. Some companies may not have a separate tax function, which may mean that they have embedded tax controls into their finance processes. For companies offering financial services, it’s important to manage withholding tax risk while meeting various compliance/reporting requirements e.g. Fair and Accurate Credit Transactions Act (FACTA)/Common Reporting Standards (CRS). Therefore, one size does not fit all. This is consistent with statements issued in IRB’s guidelines - there is no specific format to follow as each business has different levels of need.

OECD further recommends TCF as an integral part of the Internal Control Framework, where “transparency in exchange for certainty” cannot exist without disclosure of tax risks and the underlying frameworks provide assurance that these risks are surfaced and managed. The obligation for taxpayers to be in control of their risks applies to all taxpayers, not only those who participate in co-operative compliance programmes.

Tax risks can be grouped into two categories; measurable tax risks and non-measurable risks. See below for details:

The decisions, activities and operations undertaken by the company give rise to various areas of uncertainty in tax. The effectiveness of TCF hinges on how well the company manages these uncertainties, from identifying, measuring, mitigating and monitoring tax risk. Companies need to assess their risk appetite and requirements to ensure a practical, agile approach can be taken to manage tax risk.

As of July 2022, the IRB's FAQs on how the guidelines will be implemented have not been released yet. Meanwhile, companies may want to start the process by assessing the effectiveness of their TCF’s baseline in managing tax risks. From the baseline assessment, companies could identify key risk areas and prioritise them. Some companies in the market have started the process by breaking down the improvement of TCF into smaller action steps, for example, by prioritising the risk areas for processes that impact a greater proportion of stakeholders. After all, Rome was not built in a day. Look out for further insights in our third blog.

Given what we’ve explored around the TCGF and TCF, taxpayers have an obligation to remain in control in managing their tax risks. Here are some questions that you may want to consider:

Does your company already practise key principles as laid out in OECD’s TCF building blocks?

Does your current TCF provide adequate assurance to your internal/external stakeholders that tax risks are effectively managed?

What is your game plan to manage the top 3 key risk areas in your industry?

How are you leveraging "best industry practices" to manage your tax risks?

Our ‘Tax Governance Framework’ blog series will help provide insights on:

Blog #1: Tax Corporate Governance Framework - Are you ready for greater transparency?

Blog #2: Tax Corporate Governance Framework - Does one size fit all?

Blog #3: Tax Corporate Governance Framework - How can you get started? (upcoming)

{{item.text}}

{{item.text}}

{{item.text}}

{{item.text}}