1. I heard that my income from overseas is now taxable in Malaysia. Is this true?

Up till 1 January 2022, we did not have to worry about foreign-sourced income (“FSI”) when it comes to filing our tax returns. However, since 1 January 2022, the blanket exemption on FSI has been removed. Consequently, FSI received in Malaysia by a tax resident from outside Malaysia is now taxable in Malaysia, unless the specific conditions for exemptions are met.

This move by the government of Malaysia was also to meet international best practices Malaysia had committed to adhere to by 31 December 2022.

In response to the feedback received after the initial announcement, an exemption was granted for Malaysian resident individuals for FSI (other than partnership income) received in Malaysia from 1 January 2022 to 31 December 2026 (subject to meeting the conditions as per item 2 below).

2. Are there any conditions for resident individuals to qualify for the FSI exemption?

Qualifying FSI is exempt from tax provided the income has been subjected to tax in the country of origin. FSI received from individuals is regarded as having been subject to tax in the country of origin if:

a) Income tax or withholding tax on the FSI has been paid or is payable; or

b) Tax is not imposed in the country of origin because of:

i) The taxation system of the origin country

ii) The FSI of the individual falling below the taxable threshold in the country of origin

iii) Income that is given an exemption through a tax incentive

iv) In the case of foreign dividend income, it has been subject to underlying tax

v) Foreign dividend income that is paid from underlying profits arising from operating profits, which have not been subjected to tax due to:

- Unabsorbed losses or capital allowances

- Profit arising from capital gains

- Tax incentives that are in compliance with the country’s substance requirements; or

- Tax rules under a tax consolidation regime

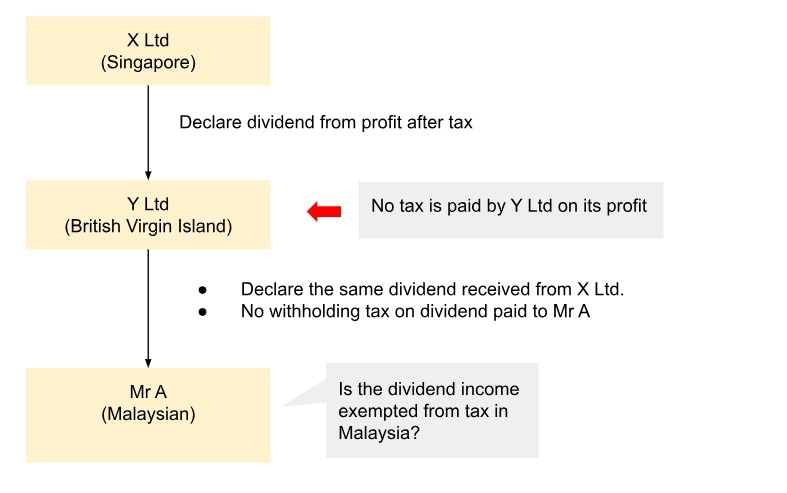

3. Any dividends I receive should be from the profits of an entity. Does this mean that the dividend income I have received has been subject to an underlying tax in the foreign country?

Unfortunately, this is not a straightforward issue.

Based on clarifications with the Malaysian Inland Revenue Board, the foreign dividend must be subject to withholding tax or an underlying tax at the company that is paying the dividend. If no tax is paid at the level of the dividend paying company, the FSI exemption may not be applicable.

Please refer to the illustration below: