{{item.title}}

{{item.text}}

{{item.text}}

27/10/23

Since 2004, under the Self Assessment System (SAS), an individual taxpayer is required by law to self compute their chargeable income tax, submit the income tax return form and make tax payment on or before the stipulated due dates. No documentation is required at the point when the tax returns are submitted. Under the SAS, the tax authorities are expecting taxpayers to comply with the tax filing requirement diligently. However, based on the media release issued by the Inland Revenue Board of Malaysia (IRBM) in June 2022, it was reported that more than 31,000 entities, including individuals, businesses, companies and other entities, have yet to declare their income. This has resulted in tax losses estimated at RM665 million.

These statistics shed light on the importance of the IRBM’s role in conducting tax audits to ensure compliance. Over the decades, the IRBM has developed the procedures to conduct tax audits for both corporate and individual taxpayers. Tax audit should not come as a surprise anymore and it is important to be prepared for tax audit to avoid any hefty consequences of non-compliance. Here are some of the key observations and best practices in dealing with tax audit.

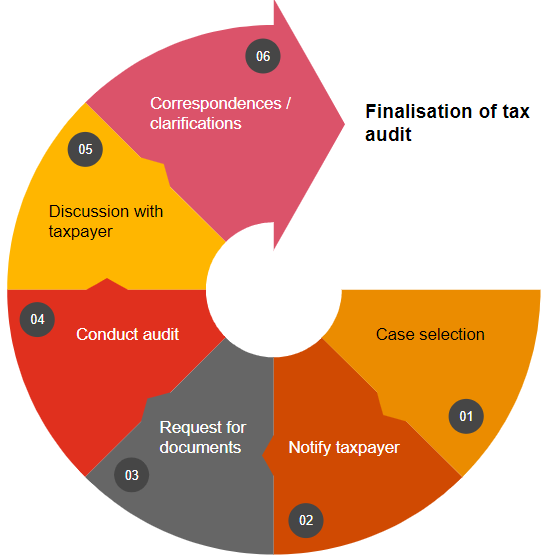

Typically the tax audit cycle starts with case selection. Once your file is selected, the IRBM will notify the taxpayer to request for documentation. The entire review process can take up to three months before finalisation. In complex cases where the tax audit cannot be resolved within 90 days, taxpayers will be notified by the IRBM. In a nutshell, the tax audit cycle can be summarised in the following diagram:

Case selection for tax audit purposes is done via the IRBM’s computerised system based on the risk profile analysis, third party information, specific category of industries, targeted group of taxpayers or locations.

These are some of the common triggering points for tax audit:

Significant fluctuation in income or expenditure

Businesses with constant losses

Spending not commensurate with the income reported

Failure to submit tax returns

Conflicting information

Full cooperation during the tax audit process will definitely increase the likelihood of resolving the case in an amicable manner. It is important to engage with the officer and to attend to the queries raised on a timely basis to avoid any surprises on the tax audit findings.

Typically you will need to keep a copy of invoices and receipts to support the claim of expenses and various personal reliefs. For example, life insurance cover notes, medical receipts and certification issued by registered medical practitioners, receipts for lifestyle reliefs, approved donation receipts, birth documents of the child, etc.

In a more extensive audit for individual taxpayers, the taxpayers are required to produce the capital statement to reconcile their income against expenditure, assets and liabilities, in order to prove that there is no understatement of taxable income.

In short, record retention is of utmost importance and do note that the record keeping requirement is seven years. Without good record retention and concrete supporting documentation, it is rather difficult, if not impossible, to defend a case during tax audit.

In most audit cases, the IRBM will conduct an audit for up to three years of assessments. However, under the legislation, the open tax year is up to five years and in the case of negligence, fraud or wilful default, the IRBM has the right to re-open the tax file beyond five years.

There are penalties for various non-compliance scenarios such as non-filing or late filing of tax return, late payment of tax, incorrect information etc. In the event of omission or understatement of income, penalties up to 100% can be imposed under Section 113(2) of the Income Tax Act, 1967. However, based on the latest Tax Audit Framework dated 1 May 2022, penalties will be imposed at the following rates:

First offence: 15%

Second offence: 30%

Third and subsequent offences: 45%

There are instances where the IRBM can consider a waiver of penalty if the taxpayer is able to prove that the understatement is due to technical adjustment. In practice, this is not a straightforward defence and requires technical expertise and robust documentation to support the position taken.

Do note that in the case of wilful evasion, a penalty of up to 300% can be imposed.

Yes, under the law, a person aggrieved by an assessment made may appeal against the assessment using the prescribed Form Q within 30 days after the service of the notice of assessment. However, despite the appeal, any additional tax liabilities together with the penalty imposed has to be settled within the stipulated time frame to avoid further penalty being imposed on late payment.

From our experience in handling various tax audits, it is in your best interest to keep your tax profile in order and manage the tax audit in a proactive manner, because the subsequent appeal process can be lengthy and costly.

With big data analytics and sophisticated information exchange mechanisms, tax information is getting more and more transparent.

Taxpayers should be diligent with their tax affairs and be prepared for tax audits because this is one of the measures for the IRBM to ensure compliance. Here are some indicators to examine your readiness for tax audit:

Do you have the documentation to support your claims?

Do you have income that is not taxed in any country?

Do you have regular income that is not reported as your taxable income?

Do you have fund remitted / kept outside Malaysia for work done in Malaysia (i.e. Malaysian sourced income)?

In the event that the IRB requests for a capital statement to assess if you have under-declared your taxable income, you will need to be prepared to produce the capital statement to tally to your lifestyle.

It may be timely to consider a tax health check to validate your tax profile. If there are tax issues that keep you awake at night, consider reaching out to us to explore the alternatives available to make good your tax position.

{{item.text}}

{{item.text}}