{{item.title}}

{{item.text}}

{{item.text}}

January 2019

By Jeannie Shee, Tax Managing Consultant, PwC Malaysia

Building a sustainable tax function requires a robust framework, supported by suitable building blocks which are managed and driven by an agile team. Our last blog focused on Data (bricks) and Process (cement), enhanced with tools such as Technology for automation. This blog will address People (bricks), Organisations (bricks) and Performance Metrics (cement), through two case studies.

Cash is the lifeblood of an organisation, and people are their assets. They are responsible for the culture and commercial successes of the organisation. Increasingly, more organisations are investing time and money to ensure their people are fully equipped to effectively execute their roles. However, lack of alignment, communication and awareness of user requirements across functions may result in duplication of tasks that sometimes lead to tax leakages. Hence, a conducive ecosystem (i.e. Organisation) must be in place to support the requirements of internal functions such as Tax.

In our first blog, we highlighted how heavily dependent tax functions are on their stakeholders (i.e. Accounts Payable, contract owners, Procurement) in relation to withholding tax (WHT) management. Each stakeholder manages their own processes to meet their respective reporting requirements and timelines. Here are two stories on how we helped Companies X and Y bridge their requirements across functions:

Story (1) - Slipping through the cracks

Company X suffered a significant cash outflow (i.e. RM10 million) due to WHT (i.e. late payment, non-compliance penalties, bore WHT on behalf of their non-resident vendors and was unable to claim a tax deduction for the fee due to non-compliance of WHT). This was for a single transaction and the new CFO had to explain the cause of the outflow to the Board of Directors, despite having processes in place.

Story (2) - Stitching data together

Company Y spent 940 man hours monthly to collate information for sales tax purposes and reporting. Multiple parties were involved with different business needs and understanding of tax reporting requirements, which resulted in significant amounts of time extracting data.

Tax practitioners have had to hone diverse skill sets (beyond tax technical), to effectively manage tax reporting requirements, with limited support from business processes and stakeholders, leading to a non-conducive ecosystem.

We worked with Company X and Y’s Tax teams to improve WHT management and data extraction for sales tax reporting, by carrying out the following:

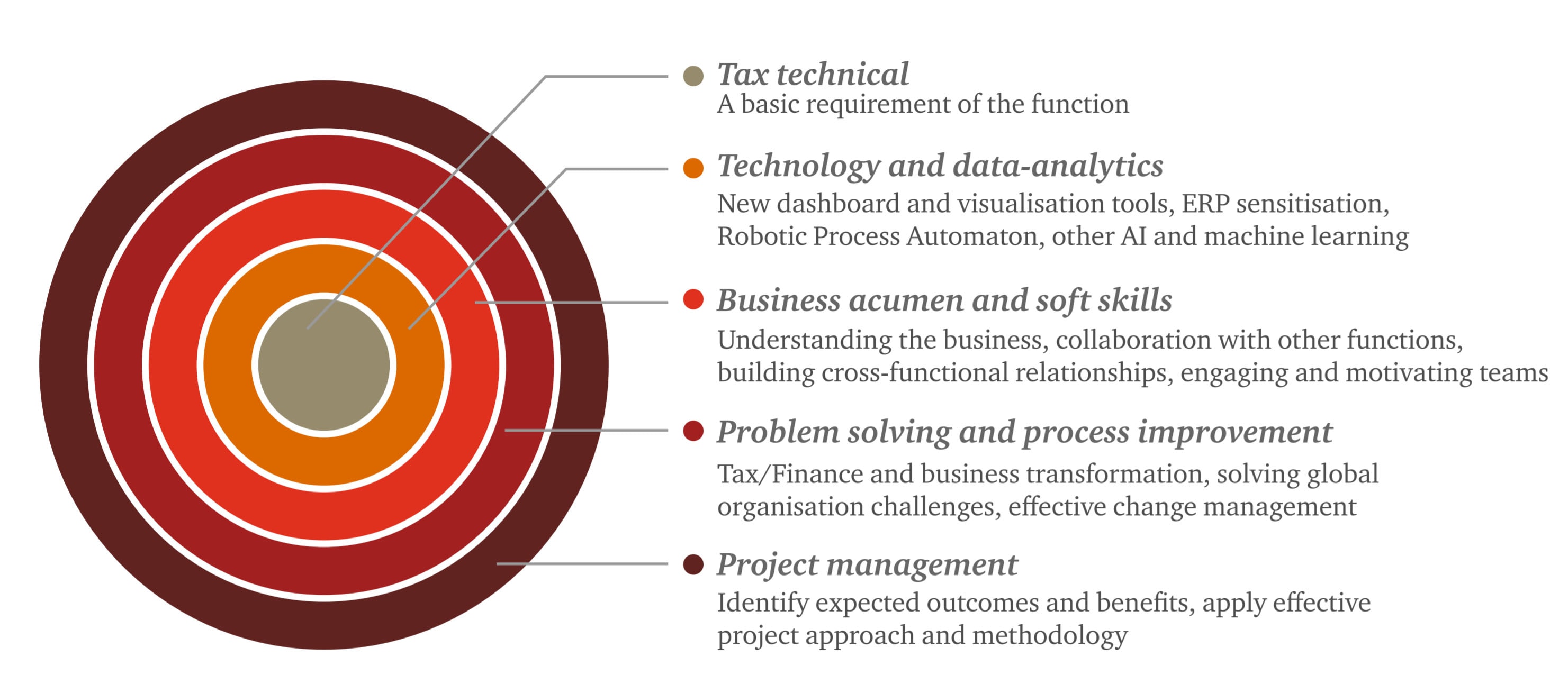

Managing today’s challenges require Tax practitioners to be agile and analytical (details on other qualities illustrated below), and be comfortable using enablers such as Technology to strategically support the business.

Source: The Tax Professional of the Future: Staying relevant in changing times, June 2017.

In our blog, we talk about how Tax should develop workforce and talent strategy together with Human Capital to ensure their people are equipped with the right skill sets to meet the demand of the future.

In order to drive change, most organisations use performance metrics. For instance, Tax practitioners may have performance metrics to effectively manage WHT, such as recording:

Tax reimagined - taking stock of your assets

Do these considerations and stories sound familiar? Ask yourself:

Taking the first step to dealing with your tax challenges of tomorrow, starts today - Let's chat.

{{item.text}}

{{item.text}}