About the firm

Find out about PwC Malaysia through these links:

- Locations and markets served here.

- Services we provide here

- Legal entities

- Awards and recognition for our work

Note: We are unable to report revenue numbers as this information is not publicly shared in Malaysia.

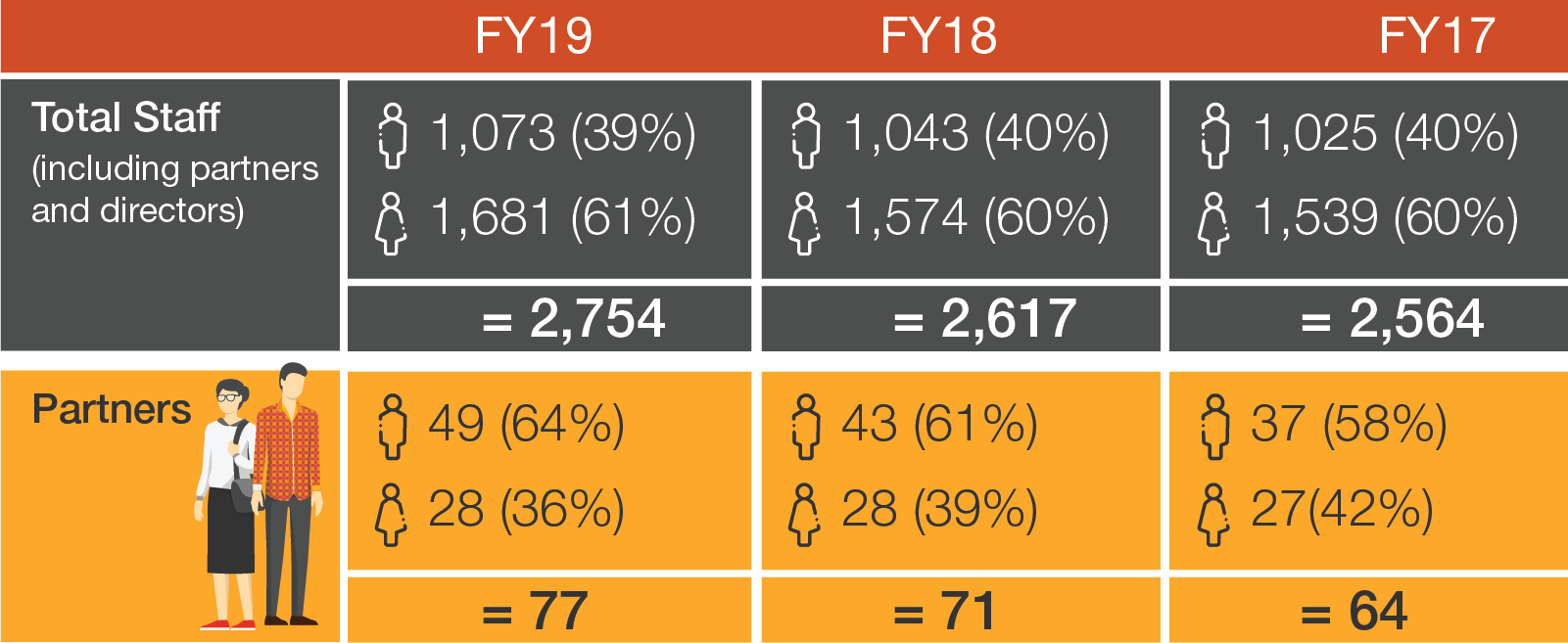

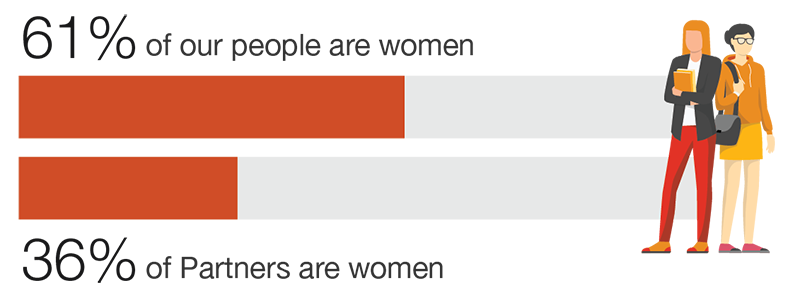

About our people

Our numbers have grown steadily over the past three years, as we broaden and diversify our services in line with client needs and global megatrends.

Overall attrition rate at PwC Malaysia decreased by 2% in the last three years and we have been consistently lower than the industry average of 25.7% (Audit Oversight Board report, 2016).

Helping to solve important problems

Many of our Partners and Directors serve as board/committee members in various professional bodies and industry organisations. In Malaysia, these include:

- 30% Club

- Financial Reporting Foundation

- Malaysian Accounting Standards Board (MASB)

- Malaysian Institute of Accountants (MIA)

- Malaysian Institute of Certified Public Accountants (MICPA)

- Islamic Finance for Labuan Offshore Financial Services Authority

- Association of Chartered Certified Accountants, Malaysia (ACCA)

- CPA Australia

- Institute of Chartered Accountants in England and Wales (ICAEW)

- American Malaysian Chamber of Commerce (AMCHAM)

- Association of Chartered Islamic Finance Professionals in Malaysia

- International Accounting Standards Board (IASB) Committee on Islamic Finance

Key appointments

- Executive Chairman, Dato’ Mohammad Faiz Azmi - present or past appointments held:

- Chair of Islamic Finance Consultative Group (IFCG), which is part of the International Accounting Standards Board (IASB).

- Appointed President of the Malaysian Institute of Accountants (MIA) in July 2015. He has previously served as a Council Member of MIA and was also the chair of the MIA Capital Market Advisory Committee. He was also the past Chairman for MASB from 2009 to 2012.

- Chairs the Asian-Oceanian Standard-Setters Group (AOSSG) on Islamic Finance.

- Elected to the Debt Management Committee by the Ministry of Finance in May 2019.

- Elected to the ICAEW UK Council in June 2019.

- Chairman of Malaysian Professional Accountancy Center (MYPAC)

- Managing Partner, Sridharan Nair is an Audit Committee member on the Financial Reporting Foundation starting from 1 October 2019.

- People Partner, Pauline Ho is a member of the Steering Committee of 30% Club, Malaysian Chapter, launched in May 2015 to increase the number of women in decision making positions. She is also a member of the Integrated Reporting Steering Committee and Practice Review Committee of the Malaysian Institute of Accountants.

- Chief Risk Officer, Lee Tuck Heng was appointed Chairman of the Auditing and Assurance Standards Board (AASB) (MIA) in July 2013.

- Irvin Menezes is Chairman of the ICAEW Members Society, Malaysia.

Our report covers PwC’s Purpose, where we want to be in 20201 and how we will reach it.

We have been reporting our Corporate Responsibility activities since 2009 and began reporting against the Global Reporting Initiative (GRI) framework since 2012, in accordance with the GRI Standards: 'Core option'. Starting from 2017, we have used Integrated Reporting <IR> principles to guide our content.

We have the support of our Sustainability & Climate Change Consulting Team in verifying the report in line with GRI guidelines; as well as our Integrated Reporting team’s advice on <IR>.

This full report and the summary highlights achievements during the firm’s 2018 and 2019 financial year, covering the operations of PricewaterhouseCoopers Malaysia (PwC Malaysia), from 1 July 2017 to 30 June 2019.

There is no re-statement of information from earlier reports, issued from 2009 to 2017.

It covers the operations for PwC Malaysia across all entities and lines of services outlined here.

There was a new entity formed in 2018 ie PricewaterhouseCoopers PLT (LLP0014401-LCA & AF 1146) was registered on 2 January and with effect from that date, PricewaterhouseCoopers (AF1146), a conventional partnership was converted to a limited liability partnership.

This entity was formed due to structural changes within the firm and does not affect overall reporting boundaries.

1 2020 has been a focus for our network. Given the pace of change in the world, we need to focus on the next few years in order to build our longer-term view. As we draw closer we will adapt our focus areas as a business accordingly.

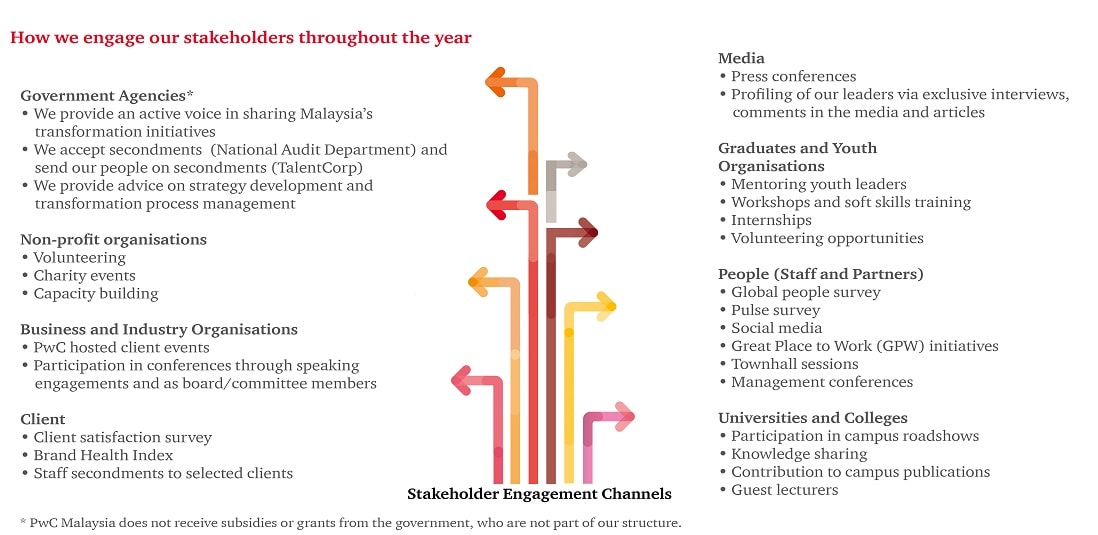

Our stakeholders are people or organisations who we have worked closely with or who have an interest in our business. We actively engage them to obtain feedback on issues that are of shared interest, from accounting development to corporate governance and talent attraction. We do this through the following channels:

- Our people through the annual Global People Survey, townhalls and focus groups

- Our people who volunteer for our Corporate Responsibility (CR) programmes via email and face-to-face interactions

throughout the volunteering programme - Our clients through client satisfaction surveys

- Regulators and professional associations through our participation as board or committee members

- Our potential recruits through social media, via their campus advisors and initiatives such as the Trust Builders Challenge

- Charity partners who benefit from our CR programmes through personal feedback and survey forms at the end of each volunteering programme

Not only does feedback from our stakeholders help determine topics of interest for the report; more importantly, it helps us improve our services and programmes to further add value to our stakeholders.

In 2015, we ran a survey to engage our biggest group of stakeholders, our people, on issues that are important to them. In September 2017, we ran four focus groups with 55 participants across all lines of service and levels.

We found the qualitative feedback valuable and insightful and will consider engaging our people more consistently. The issues and feedback raised were analysed and validated at our highest governing entity, the Country Management Board team and were used to guide our CR strategy.

Engaging other stakeholders

Media: We engage the media regularly, providing thought leadership publications that are relevant to the public and points of view on key business topics e.g. economics, audit and tax matters and governance.

Clients: Through our client feedback programme, our clients tell us that we do well in translating insights and technical knowledge into practical advice in helping them work more efficiently. A key area that they think we can do more of is to give an added dimension to the work we do - for example, in the form of sharing best practices, industry insights, out-of-the-box ideas and solutions.

What’s important to our stakeholders

We focus our Corporate Responsibility (CR) activities and reporting on the issues of importance to PwC and our stakeholders.

Feedback from regular engagement with our biggest stakeholders, our people, helps us identify the issues that are most significant – or ‘material’ – to PwC.

We use a ‘materiality matrix’ to map the issues that our stakeholders are most concerned about against those that have the biggest impact on our business.

You will read about topics that are significant to our stakeholders and to the business in this report.

We are cognisant that as we continue to engage our other stakeholders, the materiality matrix and reporting content may change.

Results of the survey helped us set directions, plan forward and make plans that would be meaningful and sustainable for our beneficiaries and our people. The strategy was validated with the Country Management Team and then shared with our people.

Please refer to the Corporate responsibility page for the CR strategy, flagship programmes, three-year plan and how they fit into the three CR buckets.

We’ll continue our focus on Education and Capacity Building (helping people build skills to meet their goals) and aim to be more strategic and focused in our efforts.

| No. | Global Standard Disclosures | Links | External assurance |

| 102 | GRI 102: General Disclosures: Organisational profile 102-1 Name of Organisation. 102-2 Activities, Brands, products and services. 102-3 Location of headquartes. 102-4 Location of operations. 102-5 Ownership and legal form. 102-6 Markets served. 102-7 Scale of organisation. 102-8 Information on employees. 102-9 Supply chain. 102-10 Changes to organisation and supply chain 102-11 Precautionary principle / approach 102-12 External initiatives. 102-13 Membership of associations |

About this report, About the firm & About our people | |

| 102 | 102-14 Strategy: Statement from senior decision maker. 102-15 Key Impacts, risks and opportunities |

Foreword, Main page | |

| 102 | 102-16 Values, principles, standards, and norms of behaviour | Leveraging on our foundations | |

| 102 | 102-18 Governance structure | About this report, Leadership team | |

| 102 | 102-40 List of stakeholder groups 102-41 Identifying and selecting stakeholders 102-42 Approach to stakeholder engagement 102-43 Key topics and concerns raised and approach to stakeholder engagement 102-44 Key topics and concerns raised |

About this report, Stakeholder engagement | |

| 102 | 102-45 Entities | About this report | |

| 102 | 102-46 Defining report content and topic boundaries. 102-48 Restatement of information 102-49 Changes in reporting 102-50 Reporting period 102-51 Date of most recent report 102-52 Reporting cycle 102-54 Claims of reporting in accordance with the GRI standards |

About this report, Reporting structure | |

| 102 | 102-47 List of material topics | About this report, Materiality assessment | |

| 102 | 102-53 Contact point | At the end of every webpage | |

| 102 | 102-55 GRI content index | About this report, GRI content index | |

| 203 | GRI 203 – indirect economic impact 203-1. Describe work undertaken to understand indirect economic impacts at the national, regional, or local level. 203-2. Explain whether it conducted a community needs assessment to determine the need for infrastructure and other services, and describe the results of the assessment.

|

Solving business issues and influencing societal agenda

|

|

| 305 | GRI 305 – Emissions 305-1 Direct (Scope 1) GHG emissions 305-2 Energy indirect (Scope 2) GHG emissions 305-3 Other indirect (Scope 3) GHG emissions 305-5 Reduction of GHG emissions list activities |

Corporate Responsibility, Planet

|

|

| 404 | GRI 404: Training and Education 404-1 Average hours of training per year per employee 404-2 Programs for upgrading employee skills and transition assistance program 404-3 Percentage of employees receiving regular performance and career development reviews |

Enhance flexible resourcing model Leveraging on our foundation, PwC Professional |

|

| 413 | GRI 413: Local Communities 413-1 Operations with local community engagement, impact assessments, and development programs CR programmes 413-2 Operations with significant actual and potential negative impacts on local communities |

Corporate Responsibility |

Contact us