{{item.title}}

{{item.text}}

{{item.text}}

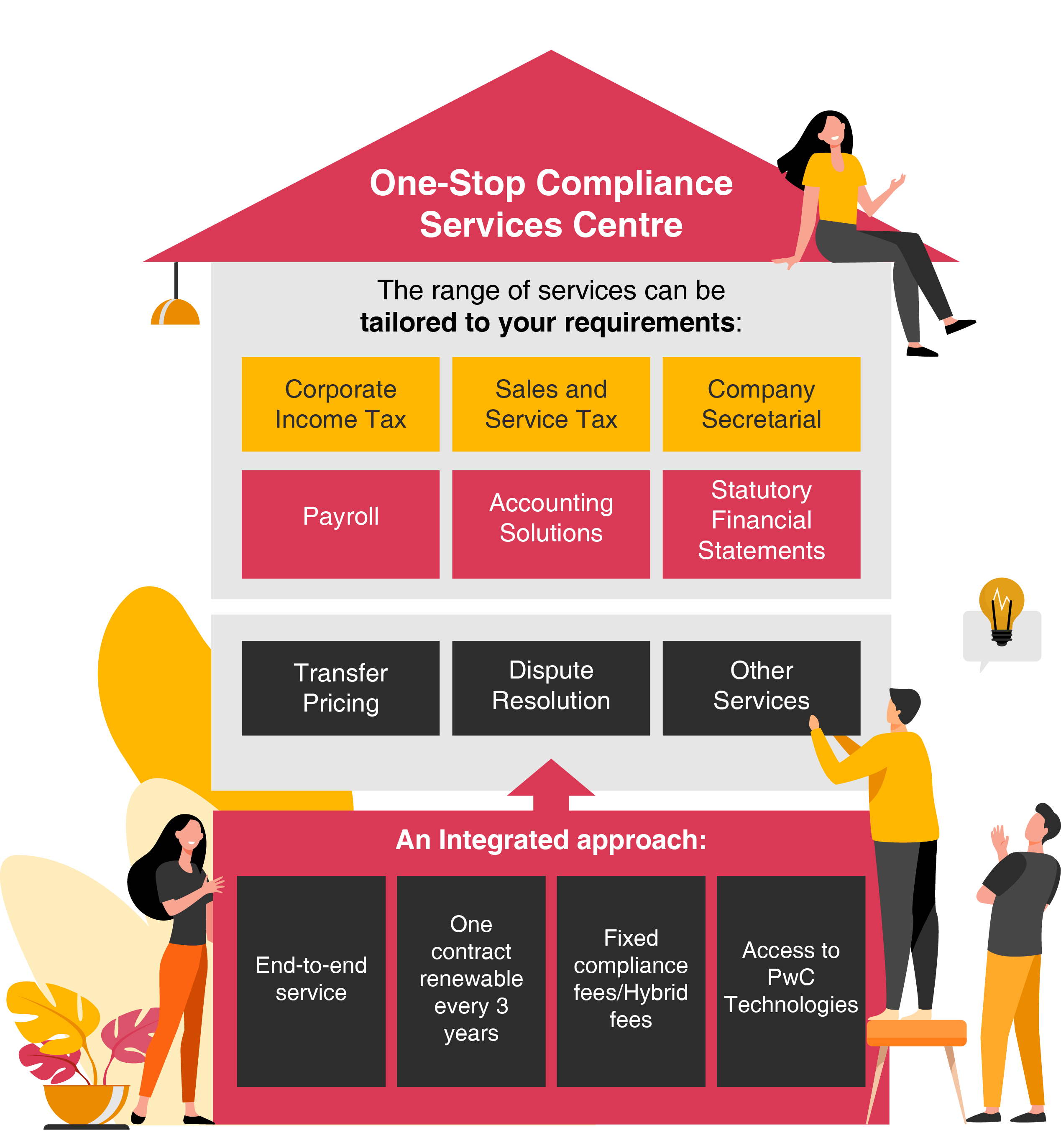

Meeting regulatory and compliance requirements is becoming increasingly complex. Through One-Stop Compliance Services Centre, our experienced professionals provide a comprehensive range of services to manage your compliance matters, so that you can focus on growing your business.

You will benefit from our long-term commitment, extensive experience in various industries (subject matter experts and technologies) and the flexibility in adapting to the changing needs of your business.

We can support you in the areas below:

| Company Secretarial |

|

|---|---|

Accounting Solutions |

|

Corporate Income Tax |

|

Sales & Service Tax |

|

Payroll |

|

Transfer Pricing |

|

Dispute Resolution |

|

* Other services can be provided based on requirements.

For further information and other customised services, get in touch with us below.

{{item.text}}

{{item.text}}