Data capture and reporting

Understanding BEPS Pillar Two

Pillar Two implementation worldwide has been steadily gaining momentum since the model rules were published in December 2021. In Singapore, it has been more than a year since it was first announced that a domestic minimum tax was being considered, and this was followed in Budget 2023 with the announcement that Singapore plans to implement the Global Anti-Base Erosion rules and domestic minimum top-up tax for in-scope businesses from financial year beginning on or after 1 January 2025, subject to international developments.

Are businesses ready for Pillar Two?

Pillar Two would ensure that large multinational enterprises (MNEs) - those with consolidated annual revenues of EUR 750 million or more - pay tax at an effective rate of at least 15% on profits earned in countries in which they operate. This is primarily through a top-up tax regime.

In-scope MNEs are at varying stages of preparedness but few, if any, can likely claim to be ready for Pillar Two. This is due, in part, to the complexity and uncertainty of the rules at this point in time.

The real challenge is that the difficulty goes beyond the complexity of the rules. Pillar Two calculations are quite different from local tax calculations. This means that companies essentially have to keep records to meet three sets of reporting requirements - one for financial reporting, one for local tax reporting and the additional one for global minimum tax reporting. Each calls for different data sets, and the data do not reside with the tax team or finance department necessarily. So companies need to evaluate and invest to make sure that they have the manpower, system capability in order to handle all data extraction, calculations as well as reporting that they will need for Pillar Two compliance.

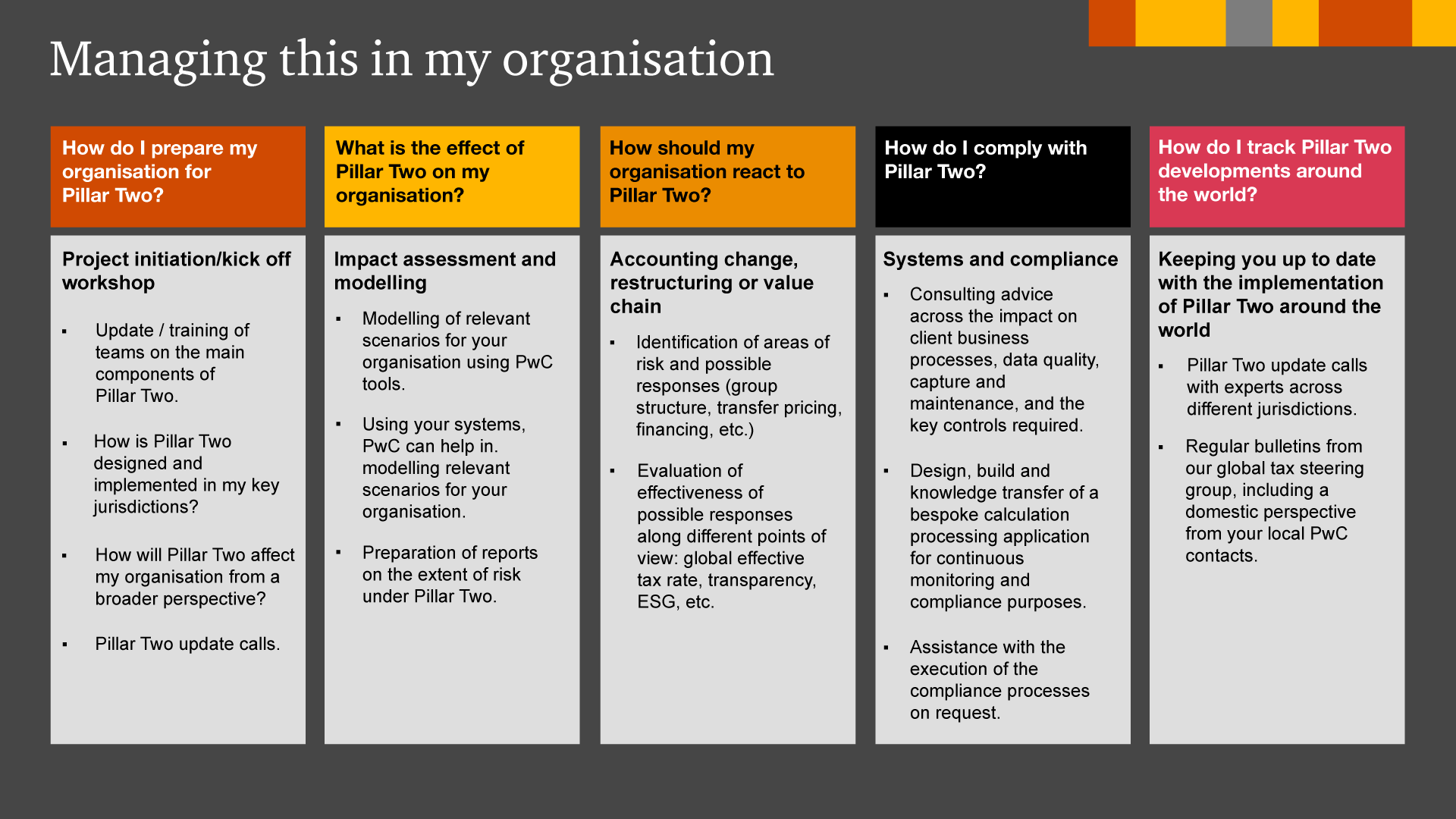

Five key questions for tax directors

Tax directors of in-scope MNEs need to develop a plan to manage Pillar Two in their organisations. These five questions will help them assess where they are on their Pillar 2 journey now, as well as what their next steps ought to be. The impact assessment results from these questions should also help them to engage the board and C-suite so that adequate resources are devoted to respond to this new tax.

Are businesses ready for Pillar Two?

Pillar Two would ensure that large multinational enterprises (MNEs) - those with consolidated annual revenues of EUR 750 million or more - pay tax at an effective rate of at least 15% on profits earned in countries in which they operate. This is primarily through a top-up tax regime.

In-scope MNEs are at varying stages of preparedness but few, if any, can likely claim to be ready for Pillar Two. This is due, in part, to the complexity and uncertainty of the rules at this point in time.

The real challenge is that the difficulty goes beyond the complexity of the rules. Pillar Two calculations are quite different from local tax calculations. This means that companies essentially have to keep records to meet three sets of reporting requirements - one for financial reporting, one for local tax reporting and the additional one for global minimum tax reporting. Each calls for different data sets, and the data do not reside with the tax team or finance department necessarily. So companies need to evaluate and invest to make sure that they have the manpower, system capability in order to handle all data extraction, calculations as well as reporting that they will need for Pillar Two compliance.

Pillar Two is a change of quite a massive scale and in-scope MNEs should start investing resources and preparing for it early notwithstanding the 2025 start date. The GloBE rules are extremely complex, and not identical to current tax laws nor do they follow accounting standards in all respects. The compliance with these rules requires a vast amount of data, not all of which are readily available in current financial systems. MNEs should take full advantage of the two-year lead time to prepare for this new tax regime.

Get more insights on data reporting and strategies

Data capture and reporting

Data capture and reporting

Strategies for moving forward

Strategies for moving forward

Contact us

Rose Sim