As they adapt to the wide-ranging impacts of the COVID-19 pandemic, Canadian banks have shown their agility by stepping up digitization efforts during this unprecedented period of uncertainty.

Remote working, virtual collaboration and cloud-based productivity tools and the need to think differently about ways to engage with customers have been catalysts for change across the banking workforce. For example, commercial bankers and wealth advisors have adopted digital capabilities like electronic signatures and are now engaging with clients via digital channels for relationship building, advice and sales.

COVID-19 and the workforce of the future

As the momentum for change takes hold, Canadian banks have an opportunity to build on these successes. A critical ingredient is to maximize their people’s potential to work and lead in bold new ways by bridging skills gaps and adapting strategies for the evolving world of work. Key aspects of this changing landscape include:

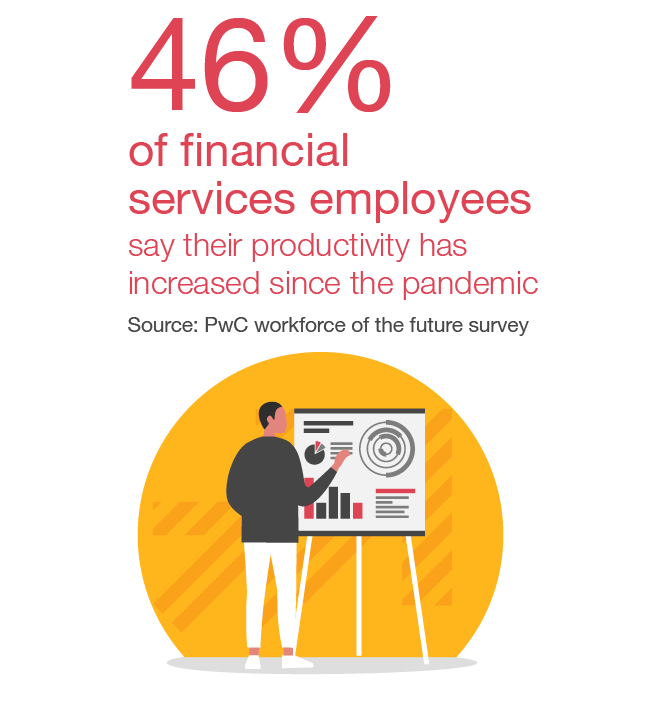

The rise of remote working: With more employees searching for remote work opportunities each year, coupled with advancements in digital tools and technologies, remote working has been on the rise for some time. Even after the pandemic is no longer a threat, many employees want to continue working remotely at least part of the time, including those in areas of the bank that have tended to be resistant to flexible work arrangements in the past. This also offers Canadian banks an opportunity to rethink the role of the office and the potential for significant real estate cost savings over the long term.

A hybrid model of remote and office-based work requires a thoughtful upskilling strategy focused on adopting digital tools and new ways of working to support productivity, collaboration and innovation in a virtual world. It’s also important to focus on the role of nurturing a culture of care, trust and resilience to help employees cope with the health crisis and embrace change. By showing empathy and emphasizing health and well-being, you can alleviate employees’ anxieties about the future and help them feel more engaged and confident in their ability to keep doing their jobs during uncertain times.

This sense of connection has been one of the silver linings of the pandemic as employees gained a better understanding of their colleagues’ personal lives through video calls and developed a greater sense of humanity and empathy for each other. By fostering these emotional connections among their employees, banks can sustain some of the standout behaviours they saw at the height of the pandemic that are breaking down barriers to change and instilling a greater sense of purpose among the workforce. While COVID-19 was a catalyst for digital upskilling and adopting new and more flexible ways of working, banks will continue to benefit from the ability to lead and innovate through uncertainty and having a more inclusive work environment after the pandemic to drive performance.

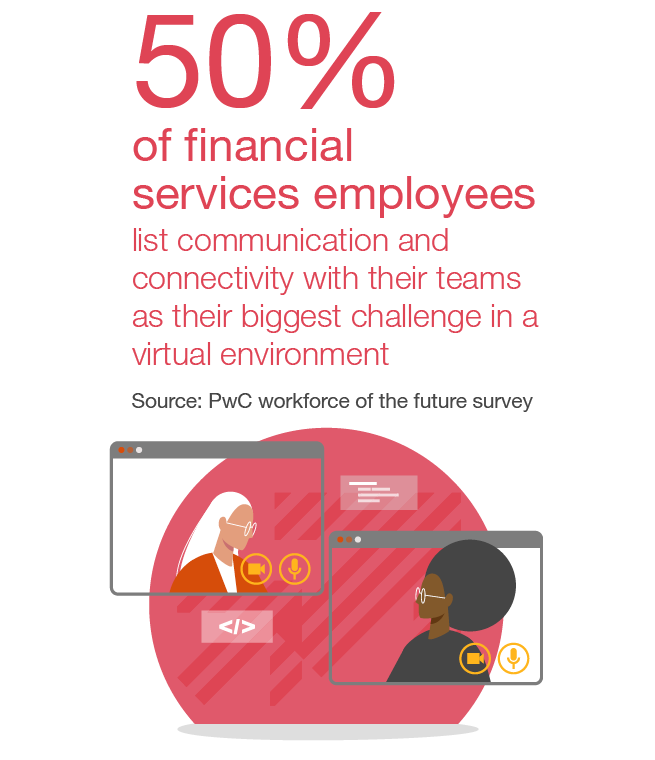

Leading virtual teams: Banks’ ability to reimagine the way they use technology to collaborate, innovate, deliver and solve new problems differently is only as good as the leaders who recognize the opportunities before them.

To unleash the potential of their workforces, leaders need to adopt good virtual practices that engage their teams daily, model healthy habits and behaviours, encourage adoption of digital tools, focus on outcomes and results (versus inputs), offer clear direction and support, facilitate problem solving and increase visibility of performance. People managers also need to be proactive and creative in finding new ways to foster informal interactions to maintain a sense of connection and community among their teams.

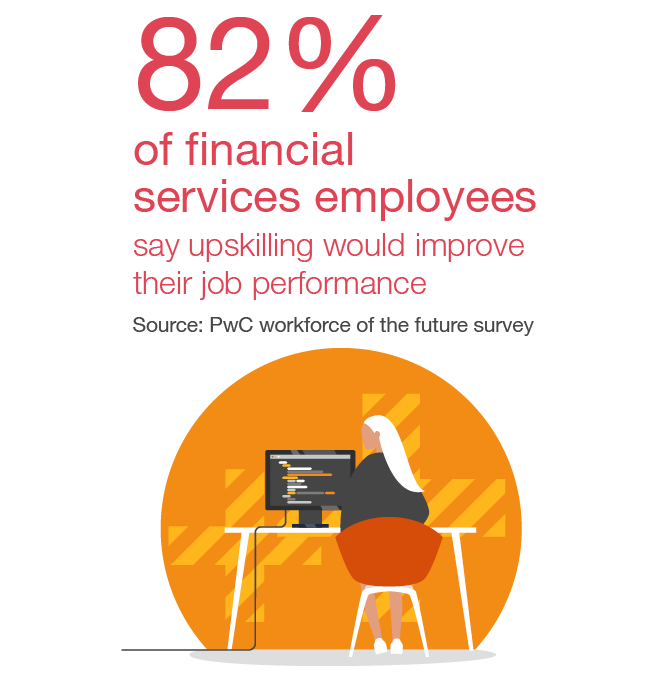

Evolving workforce strategies: Automation and enabling technologies rapidly evolved during COVID-19, increasing people’s comfort with having complex advice-based conversations virtually. This has opened the door for Canadian banks to deliver advice in new, more targeted ways and to a broader customer base. In this environment, banks are working to increase automation efforts in both the front and back office to improve efficiency and productivity and prioritize value-added work. They’re also focusing more on data and analytics, which will be critical to rethinking products, services and delivery models in this new environment and offering the personalization customers have come to expect. All of these trends require banks to help existing employees gain new skills to adopt new ways of working. In some cases, they’ll need to hire new talent.

Five principles to accelerate your people’s potential

To bring your people along on the next stage of your transformation journey, here are five principles to guide your approach to the new world of work:

Focus on new ways of working: In the longer term, banks will likely still be working in a mostly virtual or a hybrid work model. It hasn’t been enough to simply take practices that were effective in person and shift them to video or conference calls. It will now be essential to adapt these practices for a virtual world and adopt new ways of working that support virtual relationship building, effectively leading remote teams, cross-functional collaboration, creating connections and developing informal networks

Be agile: Plan for a dynamic rather than a static future. You’ll need to be ready for multiple scenarios. Make no-regrets moves that work in most scenarios. It’s also important to act now, test, learn and scale quickly. Research shows that organizations that invest in upskilling not only make progress in closing the skills gap, but they also see other benefits such as higher employee engagement and greater confidence, trust and productivity

Make a bigger leap: You may need to make more radical changes than the smaller steps you may have initially envisioned. Your upskilling strategy should start with a vision for the future and boldly build towards it. While training people on digital and collaboration tools to support remote work is a start, use this as a catalyst for upskilling and create capabilities across the entire organization to use new technologies, like robotic process automation, data visualization and manipulation tools.

Own the automation debate: Automation and artificial intelligence will affect every area of the bank and your people. They’re too important to leave to your technology and human resources teams alone. How automation is applied to the organization, and the upskilling required to enable it, should be led and owned by the business in order to drive impact, offer the right support to people and realize anticipated benefits. Automation and digitization have also been pivotal to shifting to remote working and meeting productivity targets, which will continue to be an important focus for banks.

Focus on people, not jobs: Banks can’t protect jobs made redundant by technology, but they do have a responsibility to their people. Support your people by offering them the opportunity to upskill and help them change with your organization. Outline the strategy for upskilling and the road ahead, and have your leaders reinforce and visibly support it by finding ways for people to use technology to solve new problems.

As you embark on this transformation, it’s equally important to build a clear narrative for your employees about your direction as an organization. With employees more anxious than ever about the future and their jobs, you need to maintain their momentum to innovate. How your employees feel affects the business today, so now is the time for a rich discussion about the future that helps them see their role in the bank’s success.

Contact us

Partner, Financial Services Workforce of the Future Consulting, PwC Canada

Tel: +1 416 814 5893