PwC Canada's cannabis series

Chapter 5 – M&A: High yields drive a surge in transactions

Every week leading up to legalization seemed to bring the announcement of another transformational deal in the cannabis industry. With each new press release, the purchase price multiple crept ever higher with companies paying increasing premiums for targets that had not yet proven their value in the adult-use industry. However, often lost among this deal mania is the underpinning rationale for the transaction and a concrete plan to increase the deal’s value for shareholders over the long-term.

In chapter 1 we discussed how shifting shareholder expectations upon adult-use legalization will drive change in the industry. With large transformational deals likely to continue during this phase of the cannabis boom, companies must now demonstrate to shareholders that their capital was spent wisely towards securing a competitive advantage.

What’s the big deal?

Given the current fragmentation in the cannabis industry, it’s not surprising that cannabis companies who are flush with cash and have access to relatively cheap capital (due to strong valuations) are on a buying spree. These companies are seeking economies of scale, expanding their patient base, securing consumer-centric products and brands, entering new markets or acquiring protected distribution channels.

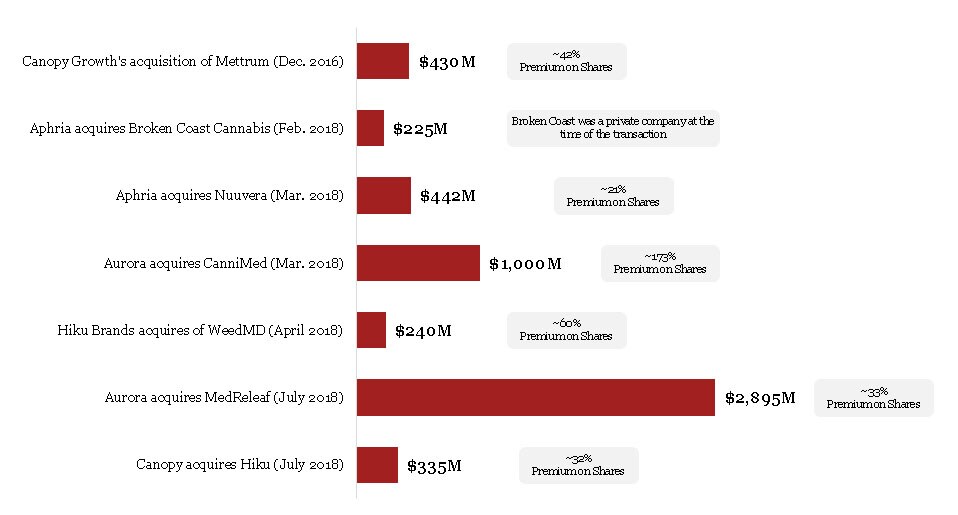

Source: Bloomberg - Based on announced / amended values.

As legalization drew closer, the size of deals appeared to grow as well. Just considering some of the marquee licensed producer (LP) acquisition deals over the past three years, it’s easy to see the rising valuations. As was the case in the deals mentioned above, LPs have primarily leveraged their strong market valuations to complete their acquisitions using stock. And while transformational deals are on the rise across all industries, every one of these deals was billed as transformational to both the buyer and the cannabis industry.

Regardless of deal objectives, the scope and scale of a transformational deal makes it very difficult to realize the original deal thesis. Cannabis companies should make sure these transactions support the overarching corporate strategy (as we discussed in chapter 2); supplement and reinforce capability systems (chapter 3); and, ultimately drive shareholder value.

More than half of Fortune 1000 executives described the largest transaction they completed in the last three years as transformational, up from 44% in 2013 and just 29% in 2010.(1)

Source: (1) PwC M&A Integration Survey Report. https://www.pwc.com/us/en/deals/ma-integration-survey/pwc-m-and-a-integration-survey.pdf (file size: 0.67 MB)

The risks can be high

While mergers and acquisitions (M&A) is an important tactic in the execution of a company’s strategy, it’s essential for executives to remember that it’s just that: a tactic. It allows companies to rapidly gain ground in new markets or outpace competition in profitability or productivity. Business leaders need to recognize that in the absence of a broader strategy to successfully integrate the target, deal-making may destroy shareholder value through squandered capital, distracted management and failure to retain key talent and relationships.

Some common post-transaction issues companies face include:

- Not capturing revenue synergies;

- Partial cost synergy realization; and,

- An inefficient or incomplete integration plan.

Each of these issues may result in lost shareholder value, making it vital to first understand the factors that contribute to these outcomes.

First, define the integration strategy

The standard expectation from M&A activity is that the combined entity will drive greater top-line revenue growth than either entity could generate independently.

Specifically, executives should be sure that the deal brings together complementary product portfolios and capability systems so that there isn’t a cannibalization effect on either. Absent of this, companies risk losing market share to competitors, and more importantly, impairing their brand and public confidence in their company. For cannabis companies in the freshly legalized market, this could be devastating.

Without a coherent strategy the expected growth synergies may never be realized.

Next, focus on priority value drivers

Aside from revenue growth, investment theses for M&A often include realizing significant cost synergies in the combined entity, specifically in back-office areas (e.g., procurement, finance, human resources, information technology) and assets. Hard assets, such as property, plant and equipment, can be rationalized through combination or closure, whereas soft asset synergies may be captured through better management of working capital, cost of capital and optimizing debt-to-equity levels.

To realize these synergies and have a sustainable operating model for the combined entity, the buyer should use due diligence findings to continuously validate synergy opportunities, understand any potential risks to the combined entity, and from there, deploy a structured process and dedicated team in achieving synergy goals. In an environment with disparate, licensed assets across Canada, creating a plan to bolster synergies without destroying the target’s value is paramount.

Manage the integration as a business process

Despite the importance of integration, companies often overlook the value of an effective integration plan. As the size and complexity of these transactions increase, so too does the importance of a detailed plan. With cannabis companies pursuing increasingly transformational deals, executives must recognize the complexity of integrating cross-functional organizations and assets in a fluid regulatory environment. Compounding this is the growing internationalization of the cannabis industry with cross-border deals increasing in frequency.

Executives should address the ‘soft’ issues surrounding transformational deals (e.g., employee uncertainty post-deal), which often arise due to a lack of alignment amongst stakeholders and a proper workforce transition plan. Employees are a company’s most valuable assets. Arguably, in no industry is this truer than with cannabis companies where they’re currently building technology infrastructure to institutionalize knowledge, so people hold the keys to their success.

Failure to address these operational and people constraints to support business continuity and overall strategy may result in a target operating model that is neither agile nor capable of reacting to environmental changes that could put the combined entity at risk.

Mistakes can be costly

It’s rare for an integration to go flawlessly—there are generally some hiccups along the way. The role of executives is to mitigate risk and augment overall shareholder value. Without a plan, the risk significantly increases for margin deterioration, business continuity disruption and, potentially, bankruptcy. Aside from the obvious implications to the operations of the target and buyer, in the fast paced cannabis industry these mistakes also allow competitors to gain market share and entrench their position with patients and consumers, liquor boards and potential partners.

There is a solution

One solution to these issues is for companies to establish a tailored M&A playbook to serve as a resource, and guide M&A activities in support of the corporate strategy while reducing disruption to the core business. An M&A playbook provides a shared point of reference for structure, planning, cooperation and discipline throughout the transaction lifecycle. It should reflect a company’s strategy, goals, risk appetite, operating structure, corporate culture, capability system and stakeholder network.

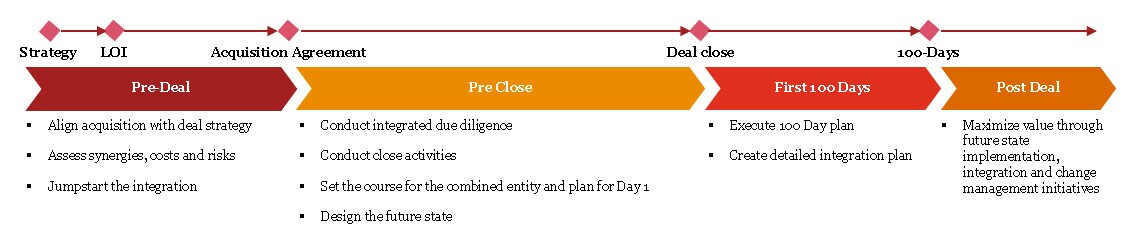

M&A playbooks span the deal continuum from pre-deal strategy through to post-deal implementation and integration as shown in our approach outlined below.

Deal strategy

All deals start with strategy. It’s critical that the deal strategy aligns with all other levels of a business’ strategy—corporate, growth and M&A—to reinforce the overall corporate direction. This allows companies to better source and approach M&A targets to achieve their growth objectives.

Integrated due diligence

Next, an integrated approach to due diligence will provide consistent insights into potential risks, issues and opportunities facing the buyer prior to deal close. Findings from commercial, financial, operational, IT (including cybersecurity) and HR due diligence streams should be discussed with all appropriate stakeholders to allow both parties to develop appropriate business cases to increase deal value upon close.

Target operating model and integration plan

To design an effective target operating model, the buyer and the target must first examine all elements of the individual strategies and identify key opportunities for consolidation and synergies. It’s critical that both the buyer and target emphasize an open discovery process to truly appreciate how each company differs and complements the other.

Upon the final design of the target operating model, an integration work plan should be designed for each functional workstream to prepare for Day 1. There is no value in delay. Accelerating the transition plan to quickly obtain bottom-line results will increase total shareholder value creation.

Integration management

The more complex a transaction, the greater leadership and management interaction is required to realize its benefits. Early alignment on the integration governance structure, including roles and responsibilities across all workstreams and at all levels of the organization, will allow resources to mobilize and support a successful integration.

Managing integrations should be viewed as another business process within the organization. By using leading tools, practices templates and advisors, the functional teams can track and report to executives the progress of the integration and quickly course-correct should the need arise.

Communication and change management

Finally, the cultural aspect of integrations can’t be overstated. All integrations should be led with a cultural lens that informs the communication and change management plan. Early and comprehensive communication can increase customer focus, employee commitment and productivity. It can also create confidence in the overall process and expedite decision making. As the stabilizer to uncertainty, communication and change management initiatives can mitigate risk by proactively addressing the questions and concerns of all stakeholders.

The rewards can be considerable

Planning for successful integration of a target is critical to realize shareholder value. While the task may seem daunting, approaching it in a methodical manner supported by the right people and systems can make it much easier. Ultimately, the rewards for a successful integration can far exceed the costs and risks of deal-making.

With the sector in rapid transformation, distress is expected as market forces drive a separation of the winners and losers. In chapter 6 of our cannabis series, we discuss restructuring in the cannabis industry.

This publication is made available by PricewaterhouseCoopers LLP (PwC) for educational purposes only as well as to give you general information and a general understanding of the cannabis landscape, not to provide specific financial, investment or other advice. By using this publication you understand and agree that there is no client relationship between you and PwC, or any of its member firms. The publication should not be used as a substitute for competent financial, investment or other advice from a professional services firm.